Yum Brands' China Business Gaining Strength Ahead of Spinoff

April 21 2016 - 11:15AM

Dow Jones News

By Julie Jargon and Maria Armental

Yum Brands Inc.'s China business is gaining strength just as the

company is planning to spin it off.

The China business, which accounts for about half of the

company's revenue, has been a volatile part of the Yum portfolio,

which also includes the KFC, Pizza Hut and Taco Bell brands in the

U.S. and internationally. It had been hurt by food-safety scares,

stiffer competition and some missteps in its Pizza Hut brand

there.

The KFC China business has largely bounced back, posting 12%

same-store sales growth in the quarter thanks, in part, to chicken

bucket promotions related to Lunar New Year celebrations. Overall,

the China business posted a 6% same-store sales increase, beating

analyst's expectations for a 2% increase. It was the China

division's third consecutive quarterly increase in that metric.

As a result, the Louisville, Ky., company raised its projections

for core operating profit growth to 12%, adjusted for currency

conversions, from its previous target of 10% growth.

In addition to plans to spin off the once fast-growing China

business, which the company said is on track to be completed by

year-end, Yum is considering selling a stake in the business, The

Wall Street Journal reported last month, citing people familiar

with the situation.

Yum Chief Executive Greg Creed declined to comment on the

possibility of selling a stake in the China business.

"We are fully committed to maximizing the value of the China

business for all of our shareholders," Mr. Creed said during the

company's earnings call on Thursday. "We will carefully consider

all options to achieve that goal."

As part of the planned spinoff, Yum has pledged to return $6.2

billion to shareholders before the separation is complete.

Taco Bell, normally the bright spot of the Yum portfolio, posted

just 1% same-store sales growth, below expectations for 3% growth.

The company Thursday said Taco Bell was hurt by hamburger chains'

value promotions in the quarter.

"One percent same-store sales growth is not what we're used to

seeing at Taco Bell," Mr. Creed told investors.

For the period ended March 19, Yum reported a profit of $391

million, or 93 cents a share, compared with $362 million, or 81

cents a share a year earlier. Excluding certain items, including

costs tied to the planned separation of the China business, profit

rose to 95 cents a share from 80 cents a year earlier. Revenue was

relatively flat at $2.62 billion.

Yum shares were up 0.7% in Thursday morning trading.

Write to Julie Jargon at julie.jargon@wsj.com and Maria Armental

at maria.armental@wsj.com

(END) Dow Jones Newswires

April 21, 2016 11:00 ET (15:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

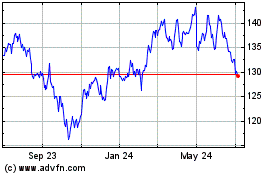

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

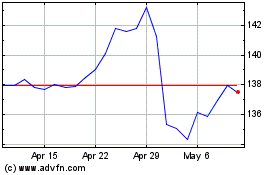

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024