Reiterates Guidance for Full-Year 2016

Operating Profit Growth in Constant Currency of 10%

Yum! Brands, Inc. (NYSE: YUM) today reported results for the

fourth quarter ended December 26, 2015. Fourth-quarter EPS

excluding Special Items was $0.68, an increase of 11%. Reported EPS

was $0.63 for the quarter and $2.92 for the year.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160203006508/en/

FOURTH-QUARTER

HIGHLIGHTS

- Worldwide system sales grew 6%.

Worldwide restaurant margin increased 3.4 percentage points to

13.6%. Worldwide operating profit increased 17%.

- New global restaurants totaled 1,160,

including 384 in China, 374 at KFC, 270 at Pizza Hut, 109 at Taco

Bell and 23 in India; 83% of international development occurred in

emerging markets.

- China Division system sales increased

7%, driven by 7% unit growth and 2% same-store sales growth.

Restaurant margin increased 4.3 percentage points to 11.4%.

Operating profit increased 207%.

- KFC Division system sales increased 6%,

driven by 3% unit growth and 3% same-store sales growth. Operating

margin increased 0.4 percentage points to 22.4%. Operating profit

increased 7%.

- Pizza Hut Division system sales

increased 2%, driven by 1% unit growth and 1% same-store sales

growth. Operating margin increased 1.0 percentage point to 23.4%.

Operating profit increased 6%.

- Taco Bell Division system sales

increased 7%, driven by 3% unit growth and 4% same-store sales

growth. Operating margin decreased 2.7 percentage points to 25.0%.

Operating profit decreased 7%.

- India Division system sales decreased

9%, driven by a 13% same-store sales decline.

- Worldwide effective tax rate decreased

to 29.4% from 30.0%.

- Foreign currency translation negatively

impacted operating profit by $37 million.

FULL-YEAR HIGHLIGHTS

- Worldwide system sales grew 5%.

Worldwide restaurant margin increased 1.5 percentage points to

16.0%. Worldwide operating profit increased 7%.

- New global restaurants totaled 2,365,

including 743 in China, 715 at KFC, 577 at Pizza Hut, 276 at Taco

Bell and 54 in India; 80% of international development occurred in

emerging markets.

- China Division system sales increased

2%, driven by 7% unit growth and partially offset by a 4%

same-store sales decline. Restaurant margin increased 1.1

percentage points to 15.9%. Operating profit increased 8%.

- KFC Division system sales increased 7%,

driven by 3% unit growth and 3% same-store sales growth. Operating

margin increased 0.8 percentage points to 23.0%. Operating profit

increased 8%.

- Pizza Hut Division system sales

increased 2%, driven by 1% unit growth and 1% same-store sales

growth. Operating margin decreased 0.4 percentage points to 25.2%.

Operating profit increased 1%.

- Taco Bell Division system sales

increased 8%, driven by 3% unit growth and 5% same-store sales

growth. Operating margin increased 1.3 percentage points to 27.1%.

Operating profit increased 12%.

- India Division system sales decreased

5%, driven by a 13% same-store sales decline.

- Worldwide effective tax rate increased

to 25.6% from 25.5%.

- Foreign currency translation negatively

impacted operating profit by $107 million.

Note: All comparisons are versus the same period a year ago and

exclude Special Items unless noted. System sales and operating

profit figures on this page exclude foreign currency translation;

restaurant margin and operating margin figures are as reported.

SUMMARY FINANCIAL TABLE

Fourth

Quarter

Full

Year

2015 2014

% Change 2015

2014 %

Change EPS Excluding Special Items $0.68 $0.61 11% $3.18

$3.09 3% Special Items Gain/(Loss)1 $(0.05) $(0.81) NM $(0.26)

$(0.77) NM EPS $0.63 $(0.20)

NM $2.92 $2.32 26%

1 See Reconciliation of Non-GAAP

Measurements to GAAP Results for further detail of Special Items.

Special Items for 2015 are primarily related to charges for the

refranchising of certain international markets, U.S. refranchising

gains and charges associated with the agreement reached with KFC

U.S. franchisees. Special Items for 2014 are primarily related to

the impairment of Little Sheep and U.S. refranchising gains.

GREG CREED COMMENTS

Greg Creed, CEO, said, “I’m pleased with the positive sales

momentum we generated across the majority of Yum! in the fourth

quarter. KFC China, for example, grew same-store sales 6% in the

last quarter of 2015. Outside of China, each of our brand divisions

grew same-store sales on a one-year and a two-year basis. Our U.S.

results were particularly strong on a two-year basis, with growth

of 2% at Pizza Hut, 8% at KFC and 10% at Taco Bell.

Fourth-quarter EPS grew 11%, with full-year EPS growth of 3%

despite a 7% decline in the first half and six percentage points of

foreign currency headwinds. For the full year, our brand divisions

collectively grew operating profit 8% in constant currency, led by

12% operating profit growth at Taco Bell. Operating profit grew 8%

in constant currency in China with impressive cost management

partially offsetting weaker than originally anticipated sales

results.

New-unit development continues to be a bright spot for our

company. We added more than 2,300 new units globally in 2015. This

year we expect to open nearly 2,400 new restaurants, which means

we’re opening over six new restaurants a day, laying the groundwork

for future growth. With all of this in mind, we are reiterating the

guidance we initially gave in December. Given the results we have

seen year-to-date and the plans we have laid out for each of the

brands, we're confident in our ability to deliver 10% operating

profit growth in constant currency in 2016.

2016 will be a transformational year for Yum! as we are on track

to complete the spin-off of our China Division, ultimately creating

two powerful, independent, focused growth companies. The

fundamental goal of Yum!, however, is unchanged. We are 100%

dedicated to building and strengthening KFC, Pizza Hut and Taco

Bell all around the world, as strong brands are critical to

delivering sustained growth and creating shareholder value over the

long term."

CHINA DIVISION

Fourth

Quarter

Full

Year

% Change %

Change 2015

2014 Reported

Ex F/X 2015

2014 Reported

Ex F/X System Sales Growth +3 +7 Even +2

Same-Store Sales Growth (%) +2 (16) NM NM (4) (5) NM NM Franchise

& License Fees ($MM) 37 33 +12 +16 120 113 +7 +9 Restaurant

Margin (%) 11.4 7.1 4.3 4.3 15.9 14.8 1.1 1.0 Operating Profit

($MM) 96 32 +195

+207 757 713 +6

+8

- China Division system sales

increased 7% for the quarter and 2% for the year, excluding foreign

currency translation.

- KFC same-store sales increased 6% for

the quarter and declined 4% for the year.

- Pizza Hut Casual Dining same-store

sales declined 8% for the quarter and 5% for the year.

- China Division opened 384 new

restaurants in the quarter. For the year, China Division opened 743

new restaurants, including 351 at KFC, 280 at Pizza Hut Casual

Dining and 75 at Pizza Hut Home Service.

China Units Q4 2015

% Change2

Restaurants1 7,176 +7 KFC 5,003 +4

Pizza Hut Casual Dining 1,572 +20 Home Service 331

+28

1 Total includes East Dawning and Little

Sheep units.

2 Represents year-over-year change.

- Restaurant margin increased 4.3

percentage points to 11.4% for the quarter driven by productivity

initiatives and KFC sales leverage. Restaurant margin increased 1.1

percentage points to 15.9% for the year driven by productivity

initiatives, partially offset by sales deleverage.

- Foreign currency translation negatively

impacted operating profit by $4 million for the quarter and $15

million for the year.

KFC DIVISION

Fourth

Quarter

Full

Year

% Change

% Change 2015

2014 Reported

Ex F/X 2015

2014 Reported

Ex F/X Restaurants 14,577 14,197 +3 NA 14,577

14,197 +3 NA System Sales Growth (5) +6 (4) +7 Same-Store Sales

Growth (%) +3 +4 NM NM +3 +3 NM NM Franchise & License Fees

($MM) 263 277 (5) +7 842 873 (4) +7 Restaurant Margin (%) 14.7 13.8

0.9 0.8 14.8 13.3 1.5 1.4 Operating Profit ($MM) 206 221 (7) +7 677

708 (4) +8 Operating Margin (%) 22.4

22.0 0.4 0.3 23.0

22.2 0.8 0.4

- KFC Division system sales

increased 6% for the quarter and 7% for the year, excluding foreign

currency translation.

% Change Int'l Emerging

Markets Int'l Developed Markets

U.S.

FourthQuarter

Full Year

FourthQuarter

Full Year

FourthQuarter

Full Year System Sales Growth (Ex F/X) +10

+11 +6 +6

+1 +2 Same-Store Sales Growth +2

+3 +3 +3 +3

+4

- KFC Division opened 370 new

international restaurants during the quarter.

- For the year, KFC Division opened 705

new international restaurants in 85 countries, including 524 units

in emerging markets. 85% of these new units were opened by

franchisees.

- Operating margin increased 0.4

percentage points for the quarter and 0.8 percentage points for the

year driven by same-store sales growth and new-unit

development.

- Foreign currency translation negatively

impacted operating profit by $31 million for the quarter and $85

million for the year, as approximately 90% of division profits are

generated outside the U.S.

KFC MARKETS1

Percent of KFCSystem Sales

2

SYSTEM Sales Growth Ex F/X

Fourth Quarter (%) Full Year

(%) Emerging Markets Asia (e.g. Malaysia,

Indonesia, Philippines) 8% +8 +6 Africa 6% +4 +9 Latin America

(e.g. Mexico, Peru) 6% +7 +8 Middle East / North Africa 6% +3 +3

Russia 5% +35 +42 Thailand 3% +6 +6 Continental Europe (e.g.

Poland) 3% +12 +13

Developed Markets U.S. 24% +1 +2

Australia 10% +7 +9 Asia (e.g. Japan, Korea, Taiwan) 9% +7 +5 U.K.

9% +2 +3 Continental Europe (e.g. France, Germany) 7% +11 +9 Canada

3% +4 +2 Latin America (e.g. Puerto Rico) 1%

+3 +3

1 See website www.yum.com

under tab "Investors" for a list of the countries within each of

the markets.

2 Reflects Full Year 2015.

PIZZA HUT DIVISION

Fourth

Quarter

Full

Year

% Change

% Change 2015

2014 Reported

Ex F/X 2015

2014 Reported

Ex F/X Restaurants 13,728 13,602 +1 NA 13,728

13,602 +1 NA System Sales Growth (2) +2 (2) +2 Same-Store Sales

Growth (%) +1 Even NM NM +1 (1) NM NM Franchise & License Fees

($MM) 169 167 Even +5 536 541 (1) +3 Restaurant Margin (%) 9.6 6.4

3.2 2.4 9.7 8.2 1.5 1.0 Operating Profit ($MM) 81 80 +3 +6 289 295

(2) +1 Operating Margin (%) 23.4 22.4

1.0 0.6 25.2

25.6 (0.4) (0.6)

- Pizza Hut Division system sales

increased 2% for both the quarter and the year, excluding foreign

currency translation.

% Change Int'l Emerging

Markets Int'l Developed Markets

U.S.

FourthQuarter

Full Year

FourthQuarter

Full Year

FourthQuarter

Full Year System Sales Growth (Ex F/X) +7

+7 Even +1

+2 +1 Same-Store Sales Growth +3

+3 (1) (1) +2

+1

- Pizza Hut Division opened 223 new

international restaurants during the quarter.

- For the year, Pizza Hut Division opened

429 new international restaurants in 64 countries, including 243

units in emerging markets. 92% of these new units were opened by

franchisees.

- Operating margin increased 1.0

percentage point for the quarter led by an increase of 3.2

percentage points in restaurant margin. For the year, operating

margin decreased 0.4 percentage points driven by strategic

investments in international G&A.

- Foreign currency translation negatively

impacted operating profit by $2 million for the quarter and $8

million for the year.

PIZZA HUT MARKETS1

Percent of PizzaHut System

Sales2

SYSTEM Sales Growth Ex F/X Fourth Quarter

(%) Full Year (%) Emerging Markets

Latin America (e.g. Mexico, Peru) 7% +9 +9 Asia (e.g. Malaysia,

Indonesia, Philippines) 5% +5 +4 Middle East / North Africa 5% +5

+6 Continental Europe (e.g. Poland) 1% +14 +11

Developed

Markets U.S. 55% +2 +1 Asia (e.g. Japan, Korea, Taiwan) 9% (2)

(1) U.K. 7% +4 +4 Continental Europe (e.g. France, Germany) 5% +4

+3 Canada 3% +7 +5 Australia 2% (12) (8) Latin America (e.g. Puerto

Rico) 1% (12) (4)

1 See website www.yum.com

under tab "Investors" for a list of the countries within each of

the markets.

2 Reflects Full Year 2015.

TACO BELL DIVISION

Fourth

Quarter

Full

Year

% Change

% Change 2015

2014 Reported

Ex F/X 2015

2014 Reported

Ex F/X Restaurants 6,400 6,199 +3 NA 6,400

6,199 +3 NA System Sales Growth +7 +7 +8 +8 Same-Store Sales Growth

(%) +4 +6 NM NM +5 +3 NM NM Franchise & License Fees ($MM) 138

130 +7 +7 447 411 +9 +9 Restaurant Margin (%) 23.7 20.6 3.1 3.1

22.3 18.9 3.4 3.4 Operating Profit ($MM) 152 163 (7) (7) 539 480

+12 +12 Operating Margin (%) 25.0 27.7

(2.7) (2.7) 27.1

25.8 1.3 1.3

- Taco Bell Division system sales

increased 7% for the quarter and 8% for the year.

- Taco Bell Division opened 109 new

restaurants in the fourth quarter. For the year, Taco Bell Division

opened 276 new restaurants; 87% of these new units were opened by

franchisees.

- Restaurant margin increased 3.1

percentage points to 23.7% for the quarter driven by favorable U.S.

commodities and same-store sales growth. Restaurant margin

increased 3.4 percentage points to 22.3% for the year driven by

same-store sales growth.

- Operating margin decreased 2.7

percentage points for the quarter driven by an expected increase in

G&A related to incentive compensation, investment spending on

strategic growth and technology initiatives, legal costs and

creation of the Live Más scholarship program. The majority of the

increase is either nonrecurring in nature or represents investments

to sustain positive brand momentum. This was partially offset by

same-store sales growth. For the year, operating margin increased

1.3 percentage points driven by same-store sales growth, partially

offset by an increase in G&A primarily attributable to

incentive compensation, pension and previously mentioned

investments.

INDIA DIVISION

- India Division system sales

decreased 9% for the quarter and 5% for the year, excluding foreign

currency translation.

- Operating loss was $4 million for the

quarter and $19 million for the year.

- During the quarter, we refranchised 86

KFC units, reducing equity ownership in India from 25% to 15%.

India Units

Q4 2015 % Change2

Restaurants1 811 (3) KFC 372 (6) Pizza

Hut Casual Dining 170 (8) Home Service 262

+7

1 Total includes 7 Taco Bell units.

2 Represents year-over-year change.

SPECIAL ITEMS / SHARE REPURCHASE

UPDATE

- For the fourth quarter in the U.S., we

refranchised 36 Taco Bell units and sold real estate related to 19

previously refranchised KFC units, resulting in total proceeds of

$75 million. We recorded pre-tax U.S. refranchising gains of $51

million in Special Items. At the end of the fourth quarter, our

company ownership in the U.S. across our three branded divisions

was 9%.

- During the first quarter of 2015, we

reached an agreement with our KFC U.S. franchisees that will give

us brand marketing control, as well as an accelerated path to

expanded menu offerings, improved assets and an enhanced customer

experience. In connection with this agreement, we recognized a

Special Items charge of $41 million during the fourth quarter,

primarily related to the funding of investments for new

back-of-house equipment for franchisees.

- In the fourth quarter, we repurchased

11.4 million shares totaling $830 million at an average price of

$73. For the year, we repurchased 15.9 million shares totaling $1.2

billion at an average price of $75, with 420 million shares

outstanding as of year end. During 2015, we reduced our outstanding

share count by 14 million. For fiscal year 2016 through February 2,

2016, we repurchased 10.8 million shares totaling $749 million at

an average price of $70.

CONFERENCE CALL

Yum! Brands, Inc. will host a conference call to review the

company's financial performance and strategies at 9:15 a.m. Eastern

Time Thursday, February 4, 2016. The number is 877/815-2029 for

U.S. callers and 706/645-9271 for international callers.

The call will be available for playback beginning at 12:30 p.m.

Eastern Time Thursday, February 4, through midnight Thursday, March

3, 2016. To access the playback, dial 855/859-2056 in the United

States and 404/537-3406 internationally. The playback passcode is

19873670.

The webcast and the playback can be accessed via the internet by

visiting Yum! Brands' website, www.yum.com/investors and selecting “Q4 2015

Earnings Conference Call” under “Events & Presentations.”

ADDITIONAL INFORMATION

ONLINE

Quarter end dates for each division, restaurant-count details

and definitions of terms are available online at www.yum.com under

“Investors.”

This announcement may contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. We intend all

forward-looking statements to be covered by the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by the fact

that they do not relate strictly to historical or current facts and

by the use of forward-looking words such as “expect,”

“expectation,” “believe,” “anticipate,” “may,” “could,” “intend,”

“belief,” “plan,” “estimate,” “target,” “predict,” “likely,”

“will,” “should,” “forecast,” “outlook” or similar terminology.

These statements are based on current estimates and assumptions

made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as

well as other factors that we believe are appropriate and

reasonable under the circumstances, but there can be no assurance

that such estimates and assumptions will prove to be correct.

Forward-looking statements reflect our current expectations,

estimates or projections concerning future results or events,

including, without limitation, statements regarding the intended

capital return to shareholders as well as the related borrowing

required to fund such capital return, the planned separation of the

Yum! Brands and Yum! China businesses, the timing of any such

separation, the future earnings and performance as well as capital

structure of Yum! Brands, Inc. or any of its businesses, including

the Yum! Brands and Yum! China businesses on a standalone basis if

the separation is completed. Forward-looking statements are not

guarantees of performance and are inherently subject to known and

unknown risks, uncertainties and assumptions that are difficult to

predict and could cause our actual results to differ materially

from those indicated by those statements. We cannot assure you that

any of our expectations, estimates or projections will be achieved.

The forward-looking statements included in this announcement are

only made as of the date of this announcement and we disclaim any

obligation to publicly update any forward-looking statement to

reflect subsequent events or circumstances. Numerous factors could

cause our actual results and events to differ materially from those

expressed or implied by forward-looking statements, including,

without limitation: whether we are able to return capital to

shareholders at the times and in the amounts currently anticipated,

if at all, as well as the corresponding costs of borrowing to fund

such capital return as well as other costs; whether the separation

of the Yum! Brands and Yum! China businesses is completed, as

expected or at all, and the timing of any such separation; whether

the operational and strategic benefits of the separation can be

achieved; whether the costs and expenses of the separation can be

controlled within expectations, including potential tax costs; as

well as other risks. In addition, other risks and uncertainties not

presently known to us or that we currently believe to be immaterial

could affect the accuracy of any such forward-looking statements.

All forward-looking statements should be evaluated with the

understanding of their inherent uncertainty. You should consult our

filings with the Securities and Exchange Commission (including the

information set forth under the captions “Risk Factors” and

“Forward-Looking Statements” in our Annual Report on Form 10-K) for

additional detail about factors that could affect our financial and

other results. Reconciliation of non-GAAP financial measures to the

most directly comparable GAAP measures are included on our website

at www.yum.com/investors.

Yum! Brands, Inc., based in Louisville, Kentucky, has over

42,500 restaurants in more than 130 countries and territories. Yum!

is ranked #228 on the Fortune 500 List with revenues of over $13

billion in 2015 and is one of the Aon Hewitt Top Companies for

Leaders in North America. The Company's restaurant brands - KFC,

Pizza Hut and Taco Bell - are the global leaders of the chicken,

pizza and Mexican-style food categories. Outside the United States,

the Yum! Brands system opens over five new restaurants per day on

average, making it a leader in international retail

development.

YUM! Brands, Inc.

Consolidated Summary of Results

(amounts in millions, except per share

amounts)

(unaudited)

Quarter ended % Change Year ended % Change 12/26/15

12/27/14 B/(W) 12/26/15 12/27/14 B/(W)

Company sales $ 3,339 $ 3,383 (1) $ 11,145 $ 11,324 (2) Franchise

and license fees and income 612 614 — 1,960

1,955 — Total revenues 3,951 3,997 (1) 13,105

13,279 (1) Company restaurant expenses Food

and paper 1,045 1,116 6 3,507 3,678 5 Payroll and employee benefits

797 824 3 2,517 2,579 2 Occupancy and other operating expenses

1,043 1,099 5 3,335 3,425 3 Company

restaurant expenses 2,885 3,039 5 9,359 9,682 3 General and

administrative expenses 528 473 (11) 1,504 1,419 (6) Franchise and

license expenses 96 51 (88) 242 160 (51) Closures and impairment

(income) expenses 49 505 90 79 535 85 Refranchising (gain) loss (50

) (6 ) NM 10 (33 ) NM Other (income) expense 2 (22 ) NM (10

) (41 ) (75) Total costs and expenses, net 3,510 4,040

13 11,184 11,722 5 Operating Profit

(loss) 441 (43 ) NM 1,921 1,557 23 Interest expense, net 35

40 8 134 130 (4) Income (loss) before income

taxes 406 (83 ) NM 1,787 1,427 25 Income tax provision 131

36 NM 489 406 (20) Net income (loss) -

including noncontrolling interests 275 (119 ) NM 1,298 1,021 27 Net

income (loss) - noncontrolling interests — (33 ) (98) 5

(30 ) NM Net income (loss) - YUM! Brands, Inc. $ 275

$ (86 ) NM $ 1,293 $ 1,051 23

Effective tax

rate

32.2 % (44.1 )% NM 27.3 % 28.5 % 1.2 ppts.

Basic EPS

Data

EPS $ 0.64 $ (0.20 ) NM $ 2.97 $ 2.37 25

Weighted average shares used in computation 433 441 2

436 444 2

Diluted EPS

Data

EPS $ 0.63 $ (0.20 ) NM $ 2.92 $ 2.32 26

Weighted average shares used in computation 439 441 —

443 453 2 Dividends declared per common share

$ 0.92 $ 0.82 $ 1.74 $ 1.56

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

CHINA DIVISION Operating

Results

(amounts in millions)

(unaudited)

Quarter ended % Change Year ended % Change 12/26/15

12/27/14 B/(W) 12/26/15 12/27/14 B/(W)

Company sales $ 2,011 $ 1,973 2 $ 6,789 $ 6,821 — Franchise and

license fees and income 37 33 12 120 113

7 Total revenues 2,048 2,006 2 6,909

6,934 — Company restaurant expenses Food and paper

641 660 3 2,159 2,207 2 Payroll and employee benefits 453 463 2

1,386 1,407 2 Occupancy and other operating expenses 686 710

3 2,167 2,198 1 Company restaurant expenses

1,780 1,833 3 5,712 5,812 2 General and administrative expenses 139

132 (5) 397 391 (2) Franchise and license expenses 5 5 (4) 20 16

(25) Closures and impairment (income) expenses 42 31 (37) 64 54

(19) Other (income) expense (14 ) (27 ) (46) (41 ) (52 ) (22) Total

costs and expenses, net 1,952 1,974 1 6,152

6,221 1 Operating Profit $ 96 $ 32 NM $ 757

$ 713 6 Company sales 100.0 % 100.0 % 100.0 %

100.0 % Food and paper 31.8 33.4 1.6 ppts. 31.8 32.4 0.6 ppts.

Payroll and employee benefits 22.6 23.5 0.9 ppts. 20.4 20.6 0.2

ppts. Occupancy and other operating expenses 34.2 36.0

1.8 ppts. 31.9 32.2 0.3 ppts. Restaurant

margin 11.4 % 7.1 % 4.3 ppts. 15.9 % 14.8 % 1.1 ppts.

Operating margin 4.7 % 1.6 % 3.1 ppts. 11.0 % 10.3 % 0.7 ppts.

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

KFC DIVISION Operating Results

(amounts in millions)

(unaudited)

Quarter ended % Change Year ended % Change 12/26/15

12/27/14 B/(W) 12/26/15 12/27/14 B/(W)

Company sales $ 655 $ 727 (10) $ 2,106 $ 2,320 (9) Franchise and

license fees and income 263 277 (5) 842 873

(4) Total revenues 918 1,004 (9) 2,948

3,193 (8) Company restaurant expenses Food and paper

222 254 12 717 809 11 Payroll and employee benefits 155 168 8 497

552 10 Occupancy and other operating expenses 182 206

12 580 651 11 Company restaurant expenses 559 628 11

1,794 2,012 11 General and administrative expenses 122 122 — 386

383 (1) Franchise and license expenses 26 26 (3) 85 80 (7) Closures

and impairment (income) expenses 6 7 18 8 9 15 Other (income)

expense (1 ) — NM (2 ) 1 NM Total costs and expenses,

net 712 783 9 2,271 2,485 9 Operating

Profit $ 206 $ 221 (7) $ 677 $ 708 (4)

Company sales 100.0 % 100.0 % 100.0 % 100.0 % Food and paper

33.8 34.8 1.0 ppts. 34.0 34.8 0.8 ppts. Payroll and employee

benefits 23.7 23.0 (0.7 ppts.) 23.6 23.8 0.2 ppts. Occupancy and

other operating expenses 27.8 28.4 0.6 ppts. 27.6

28.1 0.5 ppts. Restaurant margin 14.7 % 13.8 % 0.9

ppts. 14.8 % 13.3 % 1.5 ppts. Operating margin 22.4 % 22.0 %

0.4 ppts. 23.0 % 22.2 % 0.8 ppts.

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

PIZZA HUT DIVISION Operating

Results

(amounts in millions)

(unaudited)

Quarter ended % Change Year ended % Change 12/26/15

12/27/14 B/(W) 12/26/15 12/27/14 B/(W)

Company sales $ 179 $ 185 (3) $ 609 $ 607 — Franchise and license

fees and income 169 167 — 536 541 (1)

Total revenues 348 352 (1) 1,145 1,148

— Company restaurant expenses Food and paper 49 54 9 169 180

6 Payroll and employee benefits 57 59 4 190 188 (1) Occupancy and

other operating expenses 56 60 7 191 189

(1) Company restaurant expenses 162 173 6 550 557 1 General

and administrative expenses 90 81 (9) 266 246 (8) Franchise and

license expenses 14 15 15 39 44 14 Closures and impairment (income)

expenses 1 3 48 3 5 29 Other (income) expense — — 17

(2 ) 1 NM Total costs and expenses, net 267 272

3 856 853 — Operating Profit $ 81 $ 80

3 $ 289 $ 295 (2) Company sales 100.0 %

100.0 % 100.0 % 100.0 % Food and paper 27.9 29.6 1.7 ppts. 27.8

29.7 1.9 ppts. Payroll and employee benefits 31.3 31.6 0.3 ppts.

31.1 30.9 (0.2 ppts.) Occupancy and other operating expenses 31.2

32.4 1.2 ppts. 31.4 31.2 (0.2 ppts.)

9.6 % 6.4 % 3.2 ppts. 9.7 % 8.2 % 1.5 ppts. Operating margin

23.4 % 22.4 % 1.0 ppts. 25.2 % 25.6 % (0.4 ppts.)

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

TACO BELL DIVISION Operating

Results

(amounts in millions)

(unaudited)

Quarter ended % Change Year ended % Change 12/26/15

12/27/14 B/(W) 12/26/15 12/27/14 B/(W)

Company sales $ 470 $ 460 2 $ 1,541 $ 1,452 6 Franchise and license

fees and income 138 130 7 447 411 9

Total revenues 608 590 3 1,988 1,863 7

Company restaurant expenses Food and paper 124 134 8 421 431

2 Payroll and employee benefits 128 127 — 427 414 (3) Occupancy and

other operating expenses 107 104 (3) 350 333

(5) Company restaurant expenses 359 365 2 1,198 1,178 (2)

General and administrative expenses 88 57 (56) 228 185 (23)

Franchise and license expenses 10 5 NM 22 18 (24) Closures and

impairment (income) expenses — 1 NM 3 3 (35) Other (income) expense

(1 ) (1 ) (11) (2 ) (1 ) NM Total costs and expenses, net 456

427 (7) 1,449 1,383 (5) Operating

Profit $ 152 $ 163 (7) $ 539 $ 480 12

Company sales 100.0 % 100.0 % 100.0 % 100.0 % Food and paper

26.4 29.2 2.8 ppts. 27.3 29.7 2.4 ppts. Payroll and employee

benefits 27.2 27.7 0.5 ppts. 27.7 28.5 0.8 ppts. Occupancy and

other operating expenses 22.7 22.5 (0.2 ppts.) 22.7

22.9 0.2 ppts. 23.7 % 20.6 % 3.1 ppts. 22.3 % 18.9 %

3.4 ppts. Operating margin 25.0 % 27.7 % (2.7 ppts.) 27.1 %

25.8 % 1.3 ppts.

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

Consolidated Balance Sheets

(amounts in millions)

(unaudited) 12/26/2015

12/27/2014

ASSETS Current Assets Cash and cash

equivalents $ 737 $ 578 Accounts and notes receivable, less

allowance: $16 in 2015 and $12 in 2014 377 325 Inventories 229 301

Prepaid expenses and other current assets 242 254 Advertising

cooperative assets, restricted 103 95

Total

Current Assets 1,688 1,553

Property, plant and equipment, net of

accumulated depreciation and amortization of $3,643 in 2015 and

$3,584 in 2014

4,189 4,498 Goodwill 656 700 Intangible assets, net 271 318

Investments in unconsolidated affiliates 61 52 Other assets 534 560

Deferred income taxes 676 653

Total Assets $

8,075 $ 8,334

LIABILITIES AND SHAREHOLDERS'

EQUITY Current Liabilities Accounts payable and other

current liabilities $ 1,985 $ 1,970 Income taxes payable 77 77

Short-term borrowings 923 267 Advertising cooperative liabilities

103 95

Total Current Liabilities 3,088

2,409 Long-term debt 3,054 3,077 Other liabilities

and deferred credits 958 1,235

Total

Liabilities 7,100 6,721 Redeemable

noncontrolling interest 6 9

Shareholders'

Equity Common stock, no par value, 750 shares authorized; 420

shares and 434 shares issued in 2015 and 2014, respectively — —

Retained earnings 1,150 1,737 Accumulated other comprehensive

income (loss) (239 ) (190 )

Total Shareholders' Equity - YUM!

Brands, Inc. 911 1,547 Noncontrolling interests 58 57

Total Shareholders' Equity 969 1,604

Total Liabilities, Redeemable Noncontrolling Interest and

Shareholders' Equity $ 8,075 $ 8,334

See accompanying notes.

YUM! Brands, Inc.

Consolidated Statements of Cash

Flows

(amounts in millions)

Year ended (unaudited) 12/26/15 12/27/14

Cash Flows - Operating Activities Net income - including

noncontrolling interests $ 1,298 $ 1,021 Depreciation and

amortization 747 739 Closures and impairment (income) expenses 79

535 Refranchising (gain) loss 10 (33 ) Contributions to defined

benefit pension plans (98 ) (18 ) Losses and other costs related to

the extinguishment of debt — — Deferred income taxes (89 ) (172 )

Equity income from investments in unconsolidated affiliates (41 )

(30 ) Distribution of income received from unconsolidated

affiliates 21 28 Excess tax benefit from share-based compensation

(50 ) (42 ) Share-based compensation expense 57 55 Changes in

accounts and notes receivable

(54

) (21 ) Changes in inventories 58 (22 ) Changes in prepaid expenses

and other current assets (22 ) 12 Changes in accounts payable and

other current liabilities

128

60 Changes in income taxes payable 20 (143 ) Other, net

75

80

Net Cash Provided by Operating Activities

2,139 2,049

Cash Flows - Investing

Activities Capital spending (973 ) (1,033 ) Proceeds from

refranchising of restaurants 246 114 Acquisitions (9 ) (28 ) Other,

net 54 11

Net Cash Used in Investing

Activities (682 ) (936 )

Cash Flows - Financing

Activities Proceeds from long-term debt — — Repayments of

long-term debt (263 ) (66 ) Revolving credit facilities, three

months or less, net 285 416 Short-term borrowings, by original

maturity More than three months - proceeds 609 2 More than three

months - payments — (2 ) Three months or less, net — — Repurchase

shares of Common Stock (1,200 ) (820 ) Excess tax benefit from

share-based compensation 50 42 Employee stock option proceeds 12 29

Dividends paid on Common Stock (730 ) (669 ) Other, net (55 ) (46 )

Net Cash Used in Financing Activities (1,292 ) (1,114 )

Effect of Exchange Rate on Cash and Cash Equivalents (6 ) 6

Net Increase in Cash and Cash Equivalents 159 5

Cash and Cash Equivalents - Beginning of Period 578

573

Cash and Cash Equivalents - End of Period $ 737

$ 578

See accompanying notes.

Reconciliation of Non-GAAP Measurements to

GAAP Results(amounts in millions, except per share

amounts)(unaudited)

In addition to the results provided in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP") throughout this

document, the Company has provided non-GAAP measurements which

present operating results in 2015 and 2014 on a basis before

Special Items. Included in Special Items are gains/(losses)

associated with the refranchising of equity markets outside the

U.S., costs associated with the KFC U.S. Acceleration Agreement, a

loss associated with the planned sale of an aircraft in China,

costs associated with the planned spin-off of the China business

and YUM! recapitalization, U.S. refranchising gains and the

impairment of certain Little Sheep assets in 2014. These amounts

are described in (c), (d), (e), (f), (g) and (h) in the

accompanying notes.

The Company uses earnings before Special Items as a key

performance measure of results of the operations for the purpose of

evaluating performance internally and Special Items are not

included in any of our segment results. This non-GAAP measurement

is not intended to replace the presentation of our financial

results in accordance with GAAP. Rather, the Company believes that

the presentation of earnings before Special Items provides

additional information to investors to facilitate the comparison of

past and present operations, excluding items in the quarters and

years to date ended December 26, 2015 and December 27, 2014 that

the Company does not believe are indicative of our ongoing

operations due to their size and/or nature.

Quarter ended Year ended 12/26/15

12/27/14 12/26/15 12/27/14

Detail of

Special Items

Gains (Losses) associated with the

refranchising of equity markets outside the U.S.(c)

$ (3 ) $ — $ (96 ) $ 7

Costs associated with KFC U.S.

Acceleration Agreement(d)

(41 ) — (72 ) — Loss associated with planned sale of China

aircraft(e) (15 ) — (15 ) — Costs associated with the planned

spin-off of the China business and YUM recapitalization(f) (9 ) —

(9 ) — U.S. Refranchising gain (loss)(g) 51 (5 ) 75 6 Little Sheep

impairment(h) — (463 ) — (463 ) Other Special Items Income

(Expense) — 3 1 3 Special Items Income

(Expense) before income taxes (17 ) (465 ) (116 ) (447 ) Tax

Benefit (Expense) on Special Items (6 ) 78 (1 ) 72

Special Items Income (Expense), net of tax - including

noncontrollng interests (23 ) (387 ) (117 ) (375 ) Special Items

Income (Expense), net of tax - noncontrolling interests — 26

— 26 Special Items Income (Expense), net of

tax - Yum Brands, Inc. $ (23 ) $ (361 ) $ (117 ) $ (349 ) Weighted

average shares used in computation 439 441 443

453 Special Items diluted EPS $ (0.05 ) $ (0.81 ) $ (0.26 )

$ (0.77 )

Reconciliation of Operating Profit Before

Special Items to Reported Operating Profit Operating Profit

Before Special Items $ 458 $ 422 $ 2,037 $ 2,004 Special Items

Income (Expense) - Operating Profit (17 ) (465 ) (116 ) (447 )

Reported Operating Profit (loss) $ 441 $ (43 ) $ 1,921

$ 1,557

Reconciliation of EPS Before

Special Items to Reported EPS Diluted EPS Before Special Items

$ 0.68 $ 0.61 $ 3.18 $ 3.09 Special Items EPS (0.05 ) (0.81 ) (0.26

) (0.77 ) Reported EPS $ 0.63 $ (0.20 ) $ 2.92 $ 2.32

Reconciliation of Effective Tax Rate Before

Special Items to Reported Effective Tax Rate Effective Tax Rate

Before Special Items 29.4 % 30.0 % 25.6 % 25.5 % Impact on Tax Rate

as a result of Special Items 2.8 % (74.1 )% 1.7 % 3.0 % Reported

Effective Tax Rate 32.2 % (44.1 )% 27.3 % 28.5 %

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

Quarter Ended 12/26/15 China KFC Pizza Hut Taco Bell

India

Corporate

and

Unallocated

Consolidated Total revenues $ 2,048 $ 918 $ 348

$ 608 $ 29 $ — $ 3,951

Company restaurant expenses 1,780 559 162 359 25 — 2,885 General

and administrative expenses 139 122 90 88 7 82 528 Franchise and

license expenses 5 26 14 10 1 40 96 Closures and impairment

(income) expenses 42 6 1 — — — 49 Refranchising (gain) loss — — — —

— (50 ) (50 ) Other (income) expense (14 ) (1 ) — (1 ) —

18 2 1,952 712 267 456

33 90 3,510 Operating Profit (loss) $

96 $ 206 $ 81 $ 152 $ (4 ) $ (90 ) $

441

Quarter Ended 12/27/14 China KFC

Pizza Hut Taco Bell India

Corporate

and

Unallocated

Consolidated Total revenues $ 2,006 $ 1,004 $ 352

$ 590 $ 45 $ — $ 3,997

Company restaurant expenses 1,833 628 173 365 39 1 3,039 General

and administrative expenses 132 122 81 57 8 73 473 Franchise and

license expenses 5 26 15 5 — — 51 Closures and impairment (income)

expenses 31 7 3 1 — 463 505 Refranchising (gain) loss — — — — — (6

) (6 ) Other (income) expense (27 ) — — (1 ) —

6 (22 ) 1,974 783 272 427 47

537 4,040 Operating Profit (loss) $ 32

$ 221 $ 80 $ 163 $ (2 ) $ (537 ) $ (43 )

The above tables reconcile segment information, which is based

on management responsibility, with our Consolidated Summary of

Results. Corporate and unallocated expenses comprise items that are

not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables

includes, among other amounts, all amounts that we have deemed

Special Items. See Reconciliation of Non-GAAP Measurements to GAAP

Results.

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

Year Ended 12/26/15 China KFC Pizza Hut Taco Bell

India

Corporate

and

Unallocated

Consolidated Total revenues $ 6,909 $ 2,948 $ 1,145

$ 1,988 $ 115 $ — $ 13,105

Company restaurant expenses 5,712 1,794 550 1,198 105 —

9,359 General and administrative expenses 397 386 266 228 23 204

1,504 Franchise and license expenses 20 85 39 22 5 71 242 Closures

and impairment (income) expenses 64 8 3 3 1 — 79 Refranchising

(gain) loss — — — — — 10 10 Other (income) expense (41 ) (2 ) (2 )

(2 ) — 37 (10 ) 6,152 2,271 856

1,449 134 322 11,184 Operating Profit

(loss) $ 757 $ 677 $ 289 $ 539 $ (19 )

$ (322 ) $ 1,921

Year Ended 12/27/14

China KFC Pizza Hut Taco Bell India

Corporate

and

Unallocated

Consolidated Total revenues $ 6,934 $ 3,193 $ 1,148

$ 1,863 $ 141 $ — $ 13,279

Company restaurant expenses 5,812 2,012 557 1,178 122 1

9,682 General and administrative expenses 391 383 246 185 25 189

1,419 Franchise and license expenses 16 80 44 18 2 — 160 Closures

and impairment (income) expenses 54 9 5 3 1 463 535 Refranchising

(gain) loss — — — — — (33 ) (33 ) Other (income) expense (52 ) 1

1 (1 ) — 10 (41 ) 6,221 2,485

853 1,383 150 630 11,722

Operating Profit (loss) $ 713 $ 708 $ 295 $

480 $ (9 ) $ (630 ) $ 1,557

The above tables reconcile segment information, which is based

on management responsibility, with our Consolidated Summary of

Results. Corporate and unallocated expenses comprise items that are

not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables

includes, among other amounts, all amounts that we have deemed

Special Items. See Reconciliation of Non-GAAP Measurements to GAAP

Results.

Notes to the Consolidated Summary of

Results, Consolidated Balance Sheets

and Consolidated Statements of Cash

Flows

(amounts in millions, except per share

amounts)

(unaudited)

(a) Amounts presented as of and for the quarter and year

ended December 26, 2015 are preliminary. (b) Other (income)

expense for the China Division primarily consists of equity income

(loss) from investments in unconsolidated affiliates. The quarters

ended December 26, 2015 and December 27, 2014 also include

insurance recoveries of $5 million and $25 million, respectively,

related to the 2012 poultry supply incident. (c) In 2010 we

refranchised our then remaining Company-operated restaurants in

Mexico. To the extent we owned it, we did not sell the real estate

related to certain of these restaurants, instead leasing it to the

franchisee. During the quarter ended June 13, 2015 we initiated

plans to sell this real estate and determined it was held for sale

in accordance with GAAP. During the quarter ended December 26,

2015, we sold the real estate for approximately $58 million. While

these proceeds exceeded the book value of the real estate, the sale

represented a substantial liquidation of our Mexican operations

under U.S. GAAP. Accordingly, we were required to write-off

accumulated translation losses associated with our Mexican

business. As such, during the year to date ended December 26, 2015

we recorded charges of $80 million, representing the excess of the

sum of the book value of the real estate and other related assets

and our accumulated translation losses over the sales price.

Consistent with the classification of the original market

refranchising transaction, these charges were classified as

Refranchising Loss within Special Items. Additionally, during the

quarter and year to date ended December 26, 2015 we recognized

Special Items charges of $3 million and $16 million, respectively,

associated with the refranchising of our Pizza Hut Korea

restaurants. The carrying value of the remaining restaurants not

yet sold as of year end is not significant. While additional

charges may occur as the refranchising plans move forward, such

charges are not expected to be material at this time. (d)

During the first quarter of 2015, we reached an agreement with our

KFC U.S. franchisees that gave us brand marketing control as well

as an accelerated path to improved assets and customer experience.

In connection with this agreement we recognized Special Item

charges for the quarter and year to date ended December 26, 2015 of

$41 million and $72 million, respectively, primarily related to the

funding of investments for new back-of-house equipment for

franchisees. (e) During the quarter ended December 26, 2015,

we initiated plans to sell an aircraft used in our China Division

and determined it was held for sale, resulting in a write down of

$15 million. (f)

In October 2015 we announced our intent to

spin off YUM!’s China Division from YUM! Brands into a separate

independent, publicly-traded company by the end of 2016. A part of

this plan is to optimize the capital structure of YUM! Brands

through the issuance of new debt that will allow us to return

significant capital to shareholders. During the quarter ended

December 26, 2015 we incurred costs of $9 million related to these

initiatives.

(g) During the quarters ended December 26, 2015 and December

27, 2014, we recorded Special Item gains of $51 million and losses

of $5 million, respectively, related to refranchising in the U.S.

During the years to date ended December 26, 2015 and December 27,

2014, we recorded Special Item gains of $75 million and $6 million,

respectively, related to refranchising in the U.S. Refranchising

gains and losses in the U.S. have been reflected as Special Items

due to the scope of our U.S. refranchising program in recent years

and the volatility in associated gains and losses. (h)

During the quarter ended December 27, 2014, we recorded an

impairment charge related to Little Sheep totaling $361 million

(net of income tax benefit of $76 million and amounts allocated to

noncontrolling interests of $26 million). This charge was driven by

a write down in trademark from $342 million to $58 million and a

write off of all remaining goodwill of $160 million.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160203006508/en/

Yum! Brands, Inc.Analysts:Steve Schmitt, 888-298-6986Vice

President, Investor Relations & Corporate StrategyorElizabeth

Grenfell, 888-298-6986Director, Investor RelationsorMedia:Virginia

Ferguson, 502-874-8200Director, Public Relations

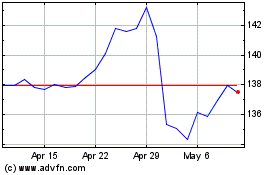

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

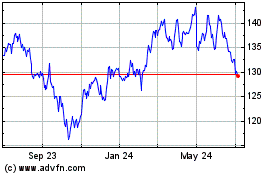

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024