Maxus Bankruptcy Deal Faces Opposition From OxyChem

June 21 2016 - 12:57PM

Dow Jones News

By Patrick Fitzgerald

Maxus Energy Corp.'s deal with its corporate parent, YPF SA,

over who is on the hook for the cleanup of New Jersey's

contaminated Passaic River hit a hurdle Monday in bankruptcy

court.

Occidental Chemical Corp., Occidental Petroleum Corp.'s chemical

subsidiary also known as OxyChem, is balking at Maxus's proposed

environmental settlement with YPF and the subsequent bankruptcy

filing.

"This isn't a fair settlement," said Jerry Roth, OxyChem's

bankruptcy lawyer, at a hearing Monday in U.S. Bankruptcy Court in

Wilmington, Del. Mr. Roth, a lawyer in the San Francisco office of

the law firm Munger, Tolles & Olson, told Judge Christopher

Sontchi that OxyChem has questions over whether the settlement

talks between Maxus and its parent were conducted at "arms

length."

At issue is a deal that calls for YPF to provide Maxus with $130

million in return for Maxus dropping any "alter ego" claims it may

have against its parent for cleaning up the river.

Maxus filed for bankruptcy Friday evening, days before OxyChem

was slated to head to court in New Jersey over litigation seeking

to put YPF on the hook for Maxus's environmental obligations.

OxyChem purchased part of Maxus's business in 1986.

YPF, which is Argentina's state-run oil company, bought Maxus

Energy Corp. in 1995. A New Jersey state court has ruled that Maxus

and an affiliate were responsible for dumping dioxin, a highly

toxic chemical and suspected carcinogen, into the river in the

1950s and 1960s.

YPF and Maxus agreed to pay New Jersey $130 million to settle

most of the pollution claims in 2013. The following year, OxyChem

agreed to pay $190 million to resolve its liability for

contamination of the river.

Maxus is responsible for compensating OxyChem for that amount.

In the litigation that was slated to begin this week, OxyChem is

seeking to extend that responsibility to YPF. The Environmental

Protection Agency has put the cleanup cost of an eight-mile area of

the river at $1 billion to $3.4 billion.

At Monday's hearing, Maxus bankruptcy lawyer James Peck of the

law firm Morrison & Foerster said Maxus is "hopelessly

insolvent" and that an adequately funded bankruptcy represents the

most desirable way to resolve the claims between the company and

its parent.

Argentina's YPF was privatized in 1993 and bought by Spain's

Respol SA in 1999. The company was re-nationalized in 2012 by

Argentina's then-president, Cristina Kirchner.

YPF is providing Maxus, whose oil and gas holding include

thousands of wells in the Gulf of Mexico and half a dozen states,

with $63.1 million in bankruptcy funding.

Monday, Judge Sontchi approved the loan on an interim basis,

along with a number of the company's other routine requests. He

scheduled a July 13 hearing to consider a final approval of the

loan.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

June 21, 2016 12:42 ET (16:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

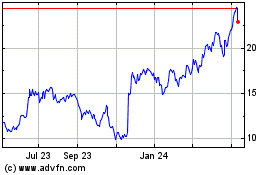

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024