By Taos Turner

NEUQUÉN, Argentina--From North Dakota to Texas and beyond, oil

and gas companies have sharply reined in drilling and thousands of

workers are being laid off.

But here, where the oil and gas industry operates inside a

government-made, subsidized bubble, taxpayers and drivers spend

billions of dollars to try to keep that from happening. A barrel of

oil fetches more than twice what it does in the U.S., and prices

for natural gas can be nearly four times higher.

That is helping shield producers and their workers developing

the vast shale oil-and-gas deposits buried under a desolate swath

of western Patagonia called Vaca Muerta, or Dead Cow, from the

vagaries of world markets.

Since taking office in December, Argentina's president, Mauricio

Macri, has been reversing the populist policies of his predecessor,

Cristina Kirchner, undoing everything from currency controls to

export taxes. But he is expanding the expensive programs she used

to decouple energy prices from global markets.

"This is so important, strategically," said Miguel Galuccio,

chief executive of Argentina's state-run oil company, YPF SA. With

the price of light crude set at $67 a barrel and natural gas at

$7.50 per million British Thermal Units--compared with less than $2

in the U.S.--the policy has made Argentina one of the few places on

Earth where energy companies are looking to expand their

operations.

Some energy analysts say the country's high production costs

make the system sustainable. But proponents here note that since

December, Dow Chemical Co. and American Energy Partners LP--which

had been run by Aubrey McClendon, the shale-drilling pioneer who

died earlier this month--have said they plan to invest in a

partnership with YPF to develop shale oil and gas. YPF also has

said it plans soon to form a joint venture with Russia's PAO

Gazprom.

"You've got to incentivize people to do exploration and

development, especially when prices are low," said Ali Moshiri,

president of Latin America and Africa for Chevron Corp., which has

an exploration-and-production joint venture with YPF. "If Argentina

carries on with these incentives, it will encourage others to come

to the country."

In this arid patch of Patagonia, YPF is running 350-ton drilling

rigs that dig 9,000 feet deep in search of gas. Far below red rocks

and desert scrub lie 27 billion barrels of technically recoverable

oil and 802 trillion cubic feet of gas trapped in a layer of shale

up to 1,200 feet thick, according to the U.S. Energy Information

Administration.

In one area of El Orejano, Argentina's flagship shale

gas-project, so many blue fracking-fluid pipelines crisscross the

ground that workers from YPF and Schlumberger Ltd., the

Houston-based oil service giant, have to take care not to stumble

over them. Tanks supply water that is mixed with chemicals and sand

and then blasted at high pressure into rock formations below,

fracturing and releasing gas.

"If we could tap just 7% of the resources we have in Vaca

Muerta, we could double Argentina's gas production," Pablo

Bizzotto, who runs YPF's regional unconventional operations, said

from inside a trailer where technicians used laptops to control a

drill snaking toward the shale.

World-wide, oil-and-gas companies cut capital spending by about

20% last year, with spending falling by as much as 40% in the U.S.,

according to Moody's Investors Service.

YPF increased spending by about 4%.

"It shows the government's strong desire to boost domestic oil

and gas production and maintain employment," said Matt Blomerth, an

analyst at energy consulting firm Wood Mackenzie.

This doesn't mean Argentina is immune to the global slowdown.

The number of working rigs was down 39% from a year earlier in

February, according to Baker Hughes Inc. Companies here have laid

off or furloughed workers, and YPF plans to cut spending by up to

25% this year. But the drop in rigs hasn't been as dramatic in the

U.S., where it fell 59% from a year earlier.

The government is also working to protect Argentina from the

kind of mass layoffs that have hit the industry world-wide. More

than 319,000 jobs have disappear since 2014, according to Graves

& Co., an energy-transaction-advisory firm.

"If you lower the price to a certain point, it's not like you

lose a rig or two, but you cause a pretty big shutdown and you lose

a lot of jobs," said Chris Boswell, chief executive of EcoStim

Energy Solutions Inc., a Houston oil-field-services company working

with YPF.

In January, Argentina's labor ministry agreed with unions and

Chubut, another oil-producing province, to artificially raise the

price of exportable heavy crude by $10 a barrel, to around $34, so

companies mining the tar-like oil don't lose more money. The

six-month deal could save 3,000 to 5,000 jobs, officials say.

"We are doing this to sustain activity and employment,"

Argentina's labor minister, Jorge Triaca, said last month.

Argentina spent $11 billion last year bolstering oil and gas

prices, according to an official estimate. Motorists here foot a

big part of that bill for the oil sector by paying about double

what U.S. drivers do for a gallon of gasoline. The government owes

almost $1.7 billion in back payments to companies for producing

natural gas.

For Fernando Navajas, who studies energy issues at FIEL, an

economic research firm, the data indicate the cost to produce a

barrel of oil is surpassing the subsidized rate. He said that is

"unsustainable, even in the best of cases," unless production costs

tumble and oil prices rebound.

Mr. Galuccio, however, says the prices keep YPF's shale

operations marginally profitable.

Argentine officials say they are banking on prices rising, so

they can eventually wean the country off price props.

"If you believe this price is going to stay at $20 for next 50

years, then what we're doing is wrong," said Mr. Galuccio, the YPF

CEO, who was appointed by Mrs. Kirchner in 2012 and will leave the

company in April, officials said Wednesday. "If prices rebound," he

said, "we are big winners."

Write to Taos Turner at taos.turner@wsj.com

(END) Dow Jones Newswires

March 09, 2016 18:52 ET (23:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

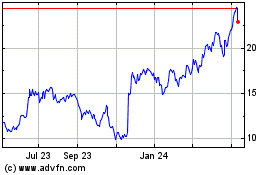

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024