YPF, American Energy Partners to Develop Argentina Oil, Gas Projects

January 14 2016 - 5:00PM

Dow Jones News

BUENOS AIRES—Argentina's YPF SA and American Energy Partners LP,

run by energy industry veteran Aubrey McClendon, signed a deal

Thursday to jointly explore and develop unconventional oil and gas

projects in the South American nation, the chief executive of the

Argentine state-run oil firm said.

The deal, the latest in a series of international joint ventures

by YPF, underscores growing global interest in Argentina's Vaca

Muerta—or "dead cow"—shale formation, located in the Patagonian

Province of Neuqué n.

Drilling in Vaca Muerta has already turned Argentina into the

world's top shale producer outside of North America.

YPF expects Mr. McClendon and his engineers to introduce a new,

more competitive approach to producing unconventional energy in

Argentina.

"We are adding someone with experience that will speed up our

learning curve," Miguel Galuccio, YPF's chief executive, said in an

interview. "This will introduce a kind of healthy competition that

all players will benefit from, as early wildcatters and smaller

companies did early on in the development of the U.S. shale

industry."

American Energy Partners couldn't immediately be reached for

comment.

YPF and American Energy Partners plan to drill more than 20

wells, most of them to horizontally fracture ancient shale rock,

according to people familiar with the agreement. They will also

build gas-treatment facilities, these people said.

One project entails launching a pilot program in the "Bajada de

Añ elo" block, a roughly 55,000-acre area in Vaca Muerta. Another

project involves a partnership between YPF, American Energy and two

other companies to development shale gas in "Cerro Arena," a nearly

92,000-acre block.

Mr. McClendon formed American Energy in Oklahoma City in 2013

after being ousted as chief executive of Chesapeake Energy Corp., a

company he co-founded. Mr. McClendon helped turn Chesapeake into an

unconventional oil-and-gas powerhouse. But during his tenure,

Chesapeake took on debt that is now threatening the company due to

extremely low oil and gas prices.

YPF has already signed multibillion-dollar deals with companies

including Chevron Corp. and Malaysia's Petroliam Nasional Bhd, or

Petronas. Last month, it reached a $500 million shale-gas deal with

Dow Chemical Co.

YPF plans turn over operations to American Energy, representing

a departure from YPF's ventures with Chevron, Dow Chemical and

Petronas. The thinking is that this would make it easier for Mr.

McClendon's team to tap its vast experience in developing shale

basins.

American Energy's plans come after it bought more than 55

million acres of land in Australia in hopes of developing

oil-and-gas projects there.

YPF and its partners have invested more than $3 billion to

develop unconventional oil and gas in Argentina. Agreements are

already in place with Chevron and Petronas that could lift that

amount to more than $25 billion over the next 15 years.

Write to Taos Turner at taos.turner@wsj.com

(END) Dow Jones Newswires

January 14, 2016 16:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

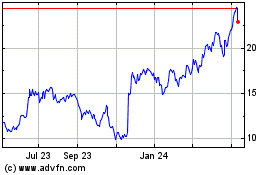

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024