Report of Foreign Issuer (6-k)

January 14 2016 - 4:02PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of January, 2016

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

YPF Sociedad Anónima

TABLE OF CONTENTS

ITEM

1 Translation of letter to the Buenos Aires Stock Exchange dated January 14, 2016

TRANSLATION

Autonomous City of Buenos Aires, January 14, 2016

To the

Bolsa de Comercio de Buenos Aires

(Buenos Aires Stock Exchange)

|

|

Re: YPF S.A. executes an agreement with American Energy – Acquisitions, LLC

|

Dear Sirs:

The purpose of this letter is to comply with the requirements of Article 23 of Chapter VII of the Buenos Aires Stock Exchange Rules.

In that regard, please be informed that YPF S.A. ("YPF") executed as of the date of this letter two agreements (the "Agreements") with American Energy - Acquisitions, LLC ("AEAQ"), an affiliate of American Energy Partners, LP ("AELP"), pursuant to which YPF and AEAQ agreed to the key terms and conditions for the (i) joint development of a shale oil and gas pilot program in the Bajada de Añelo block and (ii) joint exploration and delineation] of the southern part of the Cerro Arena block, both of which are located in the Province of Neuquén (see attached maps). The execution of the projects will begin once definitive agreements have been signed and certain conditions precedent have been met.

For the pilot program in the Bajada de Añelo area, the joint investment commitment for the pilot program is US$447 million, to be deployed by June 30, 2018. A local subsidiary affiliated with AEAQ will initially acquire a 25% stake in the Bajada de Añelo exploitation concession covering 204 square kilometers, while YPF and its affiliates will retain the remaining 75%. Upon completing the planned investments for the first phase of the pilot program in 2016, the AEAQ affiliate will have the right to increase its stake by an additional 25% for a total stake of 50%. During the pilot program, the AEAQ affiliate will contribute 72.6% of the joint investment commitment if it increases its stake to 50% or 39.4% of the joint investment commitment if it maintains its initial 25% stake. Once the pilot program has been completed, each party will contribute funds for the development of the block according to its respective stake. The AEAQ affiliate will initially be the operator of the block, the operation of which should be returned to YPF in 2017 if the AEAQ affiliate does not increase its stake.

With respect to Cerro Arena, a local subsidiary affiliated with AEAQ would acquire a 45% stake in contractual exploration rights in the southern part of the block, covering 375 square kilometers. YPF and Pluspetrol S.A. would each hold a 22.5% stake, and Gas y Petróleo del Neuquén S.A. would hold a 10% stake. During the exploratory phase, YPF would remain the operator of the block, and an affiliate of AEAQ would provide technical leadership. Before the end of the exploratory phase and subject to the results thereof, an exploitation concession would be requested. If obtained, the AEAQ affiliate would operate the block. The AEAQ affiliate investment commitment is US$60 million (with no co-investments by the current partners) and would be disbursed by February 28, 2017.

The Agreements provide an exclusivity period to negotiate and execute a series of definitive agreements, which will come into full force and effect upon certain conditions precedent being met, primarily relating to: approval by the Province of Neuquén of the initial assignment to the AEAQ affiliate of the 25% stake in the Bajada de Añelo concession, approval by Gas y Petróleo del Neuquén S.A. and the Province of Neuquén of the transfer of a 45% stake in contractual rights in the southern part of Cerro Arena block to the AEAQ affiliate, receipt by the AEAQ affiliate of an operator's license under the Registry of Operating Oil Companies of Argentina, and other approvals required by relevant governmental authorities and internal bodies of the companies.

Yours faithfully,

Diego Celaá

Market Relations Officer

YPF S.A.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

YPF Sociedad Anónima

|

|

| |

|

|

|

|

Date: January 14, 2016

|

By:

|

/s/ Diego Celaá

|

|

| |

Name:

Title:

|

Diego Celaá

Market Relations Officer

|

|

Schedule I (Area Maps)

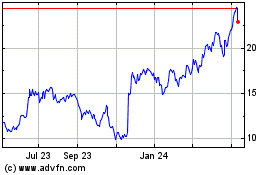

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024