ExxonMobil’s Integration, Diverse Portfolio of Investments to Drive Growth

March 01 2017 - 8:30AM

Business Wire

- Five major upstream startups over next

two years to contribute 340,000 oil-equivalent barrels of working

interest capacity

- 2017 capital and exploration expenses

of $22 billion

- Integrated investments in the U.S. Gulf

Coast to benefit from advantaged feed stock

Exxon Mobil Corporation (NYSE:XOM) is positioned to succeed in

any price environment by maximizing the competitive advantages of

its integrated businesses and by investing in projects that

generate high-value products across the commodity cycle, Chairman

and Chief Executive Officer Darren W. Woods said Wednesday.

“Our job is to compete and succeed in any market, regardless of

conditions or price,” Woods said during a presentation at the

company’s annual analyst meeting at the New York Stock Exchange.

“To do this, we must produce and deliver the highest-value products

at the lowest-possible cost through the most-attractive channels in

all operating environments.”

ExxonMobil anticipates capital spending of $22 billion in 2017,

an increase of 16 percent from 2016. Capital and exploration

expenses through the end of the decade will average $25 billion

annually.

More than one quarter of the planned spending this year will be

made in high-value, short-cycle opportunities, including in the

Permian and Bakken basins. Short-cycle investments are those

expected to generate positive cash flow in less than three years

after initial investment. The company has an inventory of more than

5,500 wells in the Permian and the Bakken with a rate of return

greater than 10 percent at $40 a barrel, with nearly one-third

generating significantly higher returns. Total annual net

production growth from these basins through 2025 could be as high

as 750,000 oil-equivalent barrels per day at a compound annual

growth rate of about 20 percent.

At the same time, the company will advance longer-term projects

focused on growing higher-value production in locations including

Canada, Guyana and the United Arab Emirates. In Guyana, for

example, two wells last year confirmed a world-class discovery with

recoverable resources in excess of 1 billion oil-equivalent

barrels. Guyana startup is expected by 2020, less than five years

after the initial discovery well – a rare occurrence in the

industry in terms of development time.

ExxonMobil expects the startup of five major upstream projects

in 2017 and 2018, which will contribute an additional 340,000

oil-equivalent barrels per day of working-interest production

capacity. Odoptu Stage 2 in Far East Russia and the Hebron project

in Eastern Canada are expected to start up by year-end. Other

projects planned for startup in the period are the Upper Zakum

expansion in the United Arab Emirates, Barzan in Qatar and Kaombo

in Angola. Since 2012, the company has started up 27 projects,

adding 1.2 million oil-equivalent barrels per day of installed

capacity. The company has an upstream portfolio of nearly 100

projects that are in various stages of planning, concept selection

and construction.

These investments will support upstream volumes that are

projected to be in the range of 4 million to 4.4 million

oil-equivalent barrels per day through 2020.

In the downstream, the company is investing across the value

chain to continue building on the strength of its portfolio of

refining and other advantaged manufacturing assets. At its

Rotterdam refinery, for example, the company is reconfiguring a

hydrocracker unit to manufacture higher-value products, including

premium lube base stocks and ultra-low sulfur diesel, by upgrading

lower-value vacuum gas oil.

The chemical segment is investing to capture advantaged feed

stocks and produce high-performance products in the U.S. Gulf Coast

region and at its Singapore complex in Asia.

“Our integrated investments along the Gulf Coast will capture

the full value of the unconventional resource molecule, from the

wellhead to market,” Woods said.

During the meeting, ExxonMobil reviewed the following

performance highlights.

- ExxonMobil has increased its dividend

for 34 consecutive years through 2016, with an annual increase of

almost 9 percent per year over the past 10 years, exceeding the

S&P 500 and industry competitors during the same period.

- ExxonMobil was the only major

integrated oil company to significantly increase its dividend last

year by 3.5 percent.

- ExxonMobil recently completed its

acquisition of InterOil to expand its acreage in Papua New Guinea

and doubled its resource base in the Permian basin through another

purchase.

- Since the Exxon and Mobil merger in

1999, the company has returned nearly $370 billion to shareholders

in the form of dividends and share repurchases, more than the

individual market values for nearly all of the S&P 500

companies.

- The company’s return on average capital

employed over the past decade averaged 5 percentage points above

its nearest competitor.

- ExxonMobil generated more than $26

billion of cash flow from operations and asset sales in 2016

including $4.3 billion from asset sales.

About ExxonMobil

ExxonMobil, the largest publicly traded international oil and

gas company, uses technology and innovation to help meet the

world’s growing energy needs. ExxonMobil holds an industry-leading

inventory of resources, is one of the largest refiners and

marketers of petroleum products and its chemical company is one of

the largest in the world. For more information, visit

www.exxonmobil.com or follow us on Twitter

www.twitter.com/exxonmobil.

CAUTIONARY NOTE: Statements of future events or conditions in

this release are forward-looking statements. Actual future results,

including financial and operating performance, production capacity

growth, capital expenditures, rates of return, cash flow, operating

costs, and project plans, capacities and schedules, could differ

materially due to changes in long-term oil and gas price levels and

other market conditions affecting the oil, gas, and petrochemical

industries; political or regulatory developments; changes in

economic growth rates around the world; reservoir performance;

timely completion of development projects; the outcome of

commercial negotiations; the actions of competitors; technical or

operating factors; and other factors discussed under the heading

"Factors Affecting Future Results" in the Investors section of the

company’s website, www.exxonmobil.com, and in Item 1A of its most

recent Form 10-K filed with the Securities and Exchange Commission.

The Investors page of our website also contains definitions and

additional information regarding return on capital employed.

References to oil-equivalent barrels include amounts that are not

yet classified as proved reserves under SEC definitions but that we

believe will ultimately be produced.

For definitions and additional information concerning the

calculation of return on average capital employed, cash from

operations and asset sales, other terms, including information

required by SEC Regulation G, see “frequently used terms” on the

Investors section of the company’s website, www.exxonmobil.com.

“Rate of return” as used in this release means discounted cash flow

returns based on current company estimates.

The term “project” as used in this release does not necessarily

have the same meaning as in any government payment transparency

reports.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170301005128/en/

ExxonMobilMedia Relations, 972-444-1107

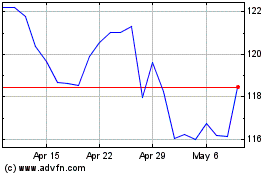

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

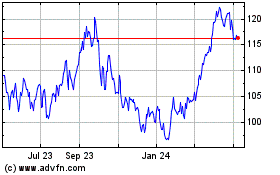

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024