By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Mattress Firm bounces higher on deal news; oil gains boost

energy shares

U.S. stocks were trading moderately lower Monday as Wall Street

caught its breath after Friday's record-setting rally fueled by

jobs data that helped revive investors' confidence in the U.S.

economy. A sharp rise in oil prices boosted energy companies'

shares but didn't manage to nudge the broader stock market

higher.

The market looks like a "a reluctant bull," said Thomas Wilson,

senior investment manager at Brinker Capital, referring to Monday's

muted trading Monday, after Fridays' rally.

The S&P 500 index pulled back from an intraday all-time high

reached shortly after the opening bell to trade down less than a

point at 2,181, as a sharp drop in health-care stocks, outweighed a

rise in energy shares, which benefited from a rally in crude-oil

futures.

The Dow Jones Industrial Average was down 22 points, or 0.1%, to

18,522. A 2.2% decline in shares of Merck & Co.(MRK) dragged

the blue-chip gauge down. Oil giants Exxon Mobil Corp.(XOM) and

Chevron Corp.(CVX) were leading the gains.

The Nasdaq Composite Index fell 11 points, or 0.2%, at 5,210,

after logging its first closing record in more than a year,

(http://www.marketwatch.com/story/us-stocks-set-for-gains-as-traders-brace-for-upbeat-jobs-report-2016-08-05)

on Friday, following the employment report.

The U.S. economy added 255,000 jobs in July

(http://www.marketwatch.com/story/us-gains-292000-jobs-in-july-2016-08-05).

The reading blasted past analyst expectations, and may nudge the

Federal Reserve toward a near-term interest-rate hike.

Wilson said for the job-fueled rally to be sustainable, the

market needs an improvement in earnings expectations and a clear

indication that the quarterly results show that the so-called

earnings recession has bottomed out, he added.

As of Friday, aggregate earnings for the S&P 500 showed a

decline of 2.3% year-over-year--still better than the 5.2% fall

expected at the beginning of the earnings season, according to

S&P Global Market Intelligence.

But the "bull case" for U.S. stocks at this stage appeared

pretty simple, said Ian Winer, director of equity trading at

Wedbush Securities, namely that "as long as central banks are

flooding the market with liquidity and yields are so low, how can

you not be in U.S. stocks?"

Still, that masks the fundamental problem that U.S. corporations

haven't been spending on their businesses but rather on buying back

their own stocks, Winer said.

Meanwhile, even as economic fundamentals show signs of slow

improvement, an interest-rate hike by the Fed could come later this

year.

"Equity investors [on Friday] appeared comfortable with the idea

of a tightening in the U.S.'s monetary conditions," said Ipek

Ozkardeskaya, senior market analyst with London Capital Group, in a

note.

Read:Sell everything? This stock market dares you

(http://www.marketwatch.com/story/sell-everything-this-stock-market-rally-dares-you-2016-08-06)

Ozkardeskaya said if the U.S. economy continues to improve, the

markets could give their blessing to an additional 25-basis-point

hike by the end of the year. But she says the major challenge for

the Fed is that major central banks around the world are

easing.

"Hence, by simply maintaining the status quo, the Fed's policy

path diverges from the rest of the world," she said.

(http://www.marketwatch.com/story/sell-everything-this-stock-market-rally-dares-you-2016-08-06)There

is no major economic data on the calendar for Monday.

(http://www.marketwatch.com/story/sell-everything-this-stock-market-rally-dares-you-2016-08-06)Oil

futures

(http://www.marketwatch.com/story/oil-futures-steady-near-42-following-volatile-week-2016-08-08)

rose alongside stock futures on Monday, with September crude up 76

cents, or 1.8%, to $42.55 a barrel, boosted by a report that the

Organization of the Petroleum Exporting Countries will hold

informal talks at an energy conference in September

(http://www.marketwatch.com/story/opec-plans-informal-production-talks-for-september-2016-08-08).

Stocks to watch: Mattress Firm Holding Corp.(MFRM) soared over

114% after South African furniture retailer Steinhoff International

Holdings NVsaid it planned to buy the company

(http://www.marketwatch.com/story/mattress-firm-bought-by-south-africas-steinhoff-for-24-billion-2016-08-07)

for around $2.4 billion in cash. The bid, worth $64 per share in

cash, represents a huge premium over Mattress Firm's Friday closing

price of $29.74.

Vail Resorts Inc

(http://www.marketwatch.com/story/vail-resorts-to-acquire-whistler-blackcomb-in-c139-billion-deal-2016-08-08).(MTN)

shares gained 6.1% after the company said it has agreed to buy

rival ski-mountain operator Whistler Blackcomb Holdings Inc. (WB.T)

in a C$1.39 billion cash and share deal.

EverBank Financial

(http://www.marketwatch.com/story/everbanks-stock-surges-after-buyout-deal-with-tiaa-2016-08-08)(EVER)

rose 2.8% after the bank agreed to be acquired by financial

services company TIAA in a deal valued at around $2.5 billion.

Wal-Mart Stores Inc.(WMT) officially announced its acquisition

of Jet.com

(http://www.marketwatch.com/story/wal-mart-announces-3-billion-jetcom-acquisition-2016-08-08)

for $3 billion in cash, a portion of which will be paid over time.

Shares were down 0.4%.

Shares of Delta Air Lines Inc.(DAL) reversed premarket losses to

trade up 0.2% despite news the airline has grounded all flights

globally due to a computer glitch

(http://www.marketwatch.com/story/delta-air-lines-grounds-all-flights-worldwide-after-tech-glitch-everywhere-2016-08-08)

that's leaving passengers unable to check in.

Allergan PLC

(http://www.marketwatch.com/story/allergan-beats-profit-expectations-but-sales-miss-2016-08-08)(AGN)

lost 4.4%, after the company beat profit expectations but sales

missed forecasts. Tyson Foods Inc

(http://www.marketwatch.com/story/tyson-shares-jump-after-raised-outlook-2016-08-08).(TSN)

inched lower by 0.2% despite raising its outlook and beat earnings

forecasts. News Corp.(NWS.AU) (the owner of the publisher of this

report, MarketWatch) is expected to report earnings after the

market's close.

Other markets: European stocks traded moderately lower. The

Nikkei 225 index soared 2.4%, leading strong gains across Asia, on

positive reverberations from strong U.S. jobs data.

The Shanghai Composite Index rose 0.9%. Data released Monday

showed Chinese exports

(http://www.marketwatch.com/story/chinas-july-exports-slip-worse-than-expected-2016-08-07)

continued to fall in dollar terms in July.

The dollar

(http://www.marketwatch.com/story/dollar-moderately-higher-as-strong-us-jobs-data-linger-2016-08-08)

rose against its major rivals, drawing continued support from last

week's strong U.S. jobs report. Gold futures moved lower, dropping

0.2% to $1,341.30 an ounce on the heels of the sharpest drop in 10

weeks after that jobs data.

(END) Dow Jones Newswires

August 08, 2016 11:44 ET (15:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

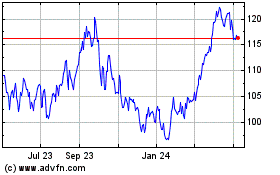

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

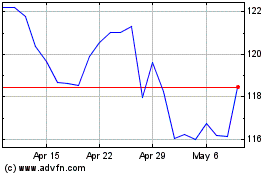

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024