Exxon, Saudi Firm Seek to Build Petrochemical Plant on U.S. Gulf Coast

July 25 2016 - 1:10PM

Dow Jones News

By Bradley Olson and Ahmed Al Omran

Exxon Mobil Corp. is considering a major new petrochemical

complex on the U.S. Gulf Coast that would be developed as a joint

venture with Saudi Basic Industries Corp., one of the biggest

chemical companies in the world.

Monday's announcement is another signal that energy companies

continue to find potential investment opportunities even as oil and

natural gas prices remain depressed.

The project, if developed, would be located in Texas or

Louisiana near abundant supplies of cheap natural gas, the

companies said. It would also include a stream cracker, which is

capable of producing the chemicals used to make plastic products

from football helmets to bulletproof vests.

No final investment decision has been made yet. The companies

plan to carry out further studies and consult with state and local

officials to help identify a potential site. Neither company

disclosed how much such a complex would cost.

A Gulf Coast chemical plant on this size and scale could compete

internationally with other similar projects around the world, said

Neil Chapman, president of ExxonMobil Chemical Co.

"That is vitally important as most of the chemical demand growth

in the next several decades is anticipated to come from developing

economies," he said.

Major energy and chemical companies have completed or are

planning about 250 such projects around the U.S. valued at a

collective $160 billon, according to the American Chemistry

Council.

Hydraulic fracturing of wells around the U.S. has unleashed new

natural gas reserves, making the country an ideal location for

petrochemical operations that use gas as a feedstock to make

plastics. U.S. oil and gas drilling has revitalized the American

chemical industry in recent years.

Royal Dutch Shell PLC last month said it would move forward with

a multibillion petrochemical complex near Pittsburgh, close to the

Marcellus and Utica shale gas fields. That plant is projected to

cost $6 billion.

Sabic is the state-run chemical company is Saudi Arabia. Exxon

and Sabic have worked together for 35 years in other chemical joint

ventures in the Middle East.

"We are focused on geographic diversification to supply new

markets," said Yousef Abdullah Al-Benyan, SABIC vice chairman and

chief executive officer.

Saudi Arabia is seeking to diversify its economy away from oil

and plans to hold an initial public offering for a portion of its

state-run oil-production company, Saudi Arabian Oil Co., also known

as Aramco. Over the last decade, that company has made significant

investments in refining as well as chemical operations around the

world.

Write to Bradley Olson at Bradley.Olson@wsj.com and Ahmed Al

Omran at Ahmed.AlOmran@wsj.com

(END) Dow Jones Newswires

July 25, 2016 12:55 ET (16:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

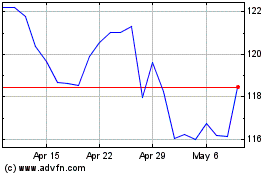

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

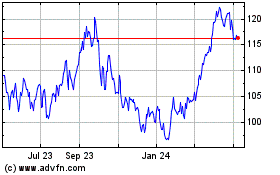

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024