Exxon's $2.5 Billion Bid For InterOil Tops Rival's -- WSJ

July 19 2016 - 3:03AM

Dow Jones News

By Lynn Cook, Robb M. Stewart and David Winning

Exxon Mobil Corp. has made a higher bid for InterOil Corp., a

U.S.-listed company with natural-gas assets in Papua New Guinea

that local partner Oil Search Ltd. has been trying to buy.

Exxon's all-stock proposal of $2.5 billion is roughly 10% higher

than Oil Search's $2.2 billion proposal for the company, which was

made in May. Oil Search has until Thursday to meet or beat Exxon's

bid.

The corporate tussle over InterOil pits two business partners

against one another. Exxon and Oil Search, which is based in Port

Moresby, the capital of Papua New Guinea, jointly own the country's

only natural-gas export plant. InterOil controls different gas

reserves and has proposed a second liquefied-natural-gas facility

there, which would compete for customers with the $19 billion

Exxon-Oil Search PNG LNG plant.

Oil Search, with financial backing from French oil company Total

SA, set its sights on InterOil's gas assets so it could find ways

to generate savings. But analysts say that even if Oil Search loses

InterOil to Exxon, the company will benefit: If Exxon buys InterOil

it would likely invest in expanding the existing LNG infrastructure

it co-owned with Oil Search, so that natural gas produced in Papua

New Guinea could funnel through one cost-effective project rather

than a competing plant.

If Exxon succeeds in buying InterOil, it will be the first

company the Irving, Texas-based oil giant has purchased in several

years.

Exxon's last large acquisition was the $31 billion takeover of

XTO Energy Inc. in 2009, which gave the big oil company massive new

oil-and-gas reserves in U.S. shale fields. In 2013, Exxon paid $2.6

billion for Celtic Exploration Ltd., based in Calgary, bulking up

the company's shale holdings in Canada.

For the past few years, Exxon has largely shunned corporate

deals in favor of land acquisitions. Much of the oil-and-gas

acreage that Exxon has purchased is in the Permian Basin of west

Texas, which is considered one of the most prolific American basins

with some of the lowest costs to produce in the U.S.

Papua New Guinea is a relatively new energy frontier. The small

Pacific nation only recently joined the ranks of global energy

exporters, in competition for a cluster of large untapped gas

deposits that could be developed to feed Asia's demand for cleaner

fuels.

If Oil Search walks away from its bid for InterOil this week, it

is entitled to a $60 million breakup fee, 20% of which would go to

French oil major Total SA, which partially backed Oil Search's

offer.

Write to Lynn Cook at lynn.cook@wsj.com, Robb M. Stewart at

robb.stewart@wsj.com and David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

July 19, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

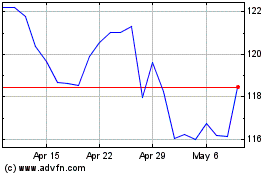

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

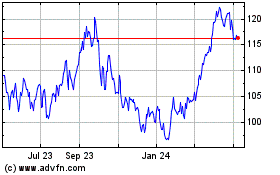

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024