Total Trims Loss, To Reduce Capital Spending -- Update

February 11 2016 - 7:01AM

Dow Jones News

By Inti Landauro

LONDON--French oil giant Total SA reported a $1.63 billion

fourth-quarter loss on Thursday and said it would cut billions more

in spending, rocked by low oil prices which forced it to devalue

projects.

Total joined other big international peers like BP PLC and

Chevron Corp. in turning in fourth-quarter losses. Exxon Mobil

Corp. said its net income for the quarter was the lowest in more

than a decade, as oil prices fell 70% in 20 months.

Oil prices have fallen so low that Total had to reassess the

value of its assets, writing them down by $3.7 billion. Much of the

blow came from impairments at its LNG Gladstone project in

Australia that started operating in 2015 and on the Usan project in

Nigeria which it was unable to sell.

Total said it would cut capital spending to around $19 billion

in 2016, lower than previously expected and down from $23 billion

last year. The company also said it would cut its operating costs

by $2.4 billion this year by squeezing contractors and cutting

spending at all levels.

The company is trying to make its operations profitable at $45 a

barrel, compared with $52 a barrel in 2015.

The company's revenues fell 28% to $37.75 billion in the three

months to end-December from $52.51 billion in the same period a

year earlier

As dismal as the results look, they were better than some

analysts expected. On an adjusted basis, stripping out one-time

charges such as write-downs and oil-price effects on inventories,

the company notched up profit of $2.08 billion in the quarter. That

is down 26% from the same period last year, but Total executives

said they were happy with it.

"Honestly, this is the best performance among all oil and gas

majors," the company's Chief Financial Officer Patrick de la

Chevardière told reporters Thursday morning.

Total's share price fell 3% in early trading on Thursday, in

line with the sector.

Oil prices were also down again, with the U.S. benchmark falling

below $27 a barrel.

Total is an integrated oil company, meaning it explores and

produces oil while also refining its into products and selling that

onto consumers.

The group leaned on refining and retail in the fourth quarter.

Operating profit for its gas stations and lubricants more than

doubled, while operating profit from refineries and petrochemicals

rose 5%. Those units do well when oil prices are low.

Total managed to sell assets worth $2.1 billion in the quarter

and $6 billion in the full year. The company expects to sell assets

worth $4 billion this year.

"This isn't a garage sale," Mr. de la Chevardiere said. "If we

cannot get a reasonable price, we don't sell."

The company also wrote down a number of projects that it won't

develop, though Mr. de la Chevardiére decline to detail any of

them.

For the full year, Total has written down $5.43 billion on its

assets, notably in Libya and Yemen, where output was suspended

because of civil wars in these countries, and on the oil-sands

project Fort Hills in Canada.

Total will keep its dividend this year at the same level as last

year at EUR2.44 a share. Like last year, it will offer to pay part

of it in shares instead of cash.

Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

February 11, 2016 06:46 ET (11:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

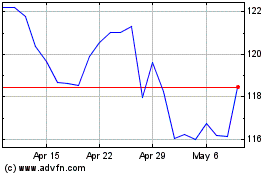

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

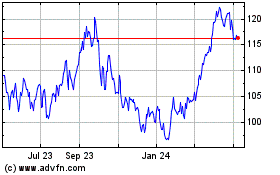

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024