MARKET SNAPSHOT: U.S. Stocks Open Lower As Oil Tumbles On OPEC Stalemate

June 02 2016 - 10:09AM

Dow Jones News

By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

ADP misses impact of Verizon strike; ECB leaves interest rates

unchanged

U.S. stocks opened lower Thursday, weighed down by falling oil

prices after the Organization of the Petroleum Exporting Countries

failed to reach an agreement on a production ceiling.

Meanwhile, fresh U.S. private-sector employment data

(http://www.marketwatch.com/story/adp-reports-173000-private-sector-jobs-added-in-may-2016-06-02-8103345)came

roughly within expectations, while first-time unemployment benefits

declined somewhat, increasing the likelihood of an interest-rate

increase this summer.

The S&P 500 index fell 5 points, or 0.3%, to 2,093, led by a

1% drop in energy shares, which were dragged down by tumbling oil

prices . The technology sector was the second-worst performer on

the index, down 0.5%.

The Dow Jones Industrial Average fell 45 points, or 0.3%, to

17,747, led by a 1.6% drop in energy giant Exxon Mobil Corp.(X)

followed by a 1.4% drop in shares of Apple Inc.(AAPL).

Meanwhile, the Nasdaq Composite began the day down 11 points, or

0.2%, to 4,941.

Earlier in the day, the European Central Bank left key interest

rates unchanged, in line with investors' expectations. But ECB

President Mario Draghi said the central bank remains ready to use

all the tools within its mandate

(http://blogs.marketwatch.com/thetell/2016/06/02/ecb-live-blog-draghi-faces-questions-on-inflation-greece-and-corporate-bonds/)

to makes sure that the low inflation environment doesn't become

"entrenched."

(END) Dow Jones Newswires

June 02, 2016 09:54 ET (13:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

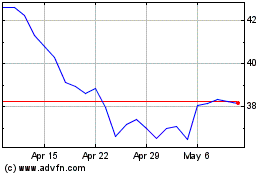

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

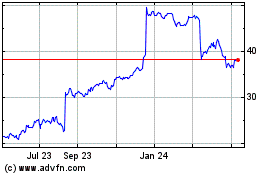

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024