U.S. Steel Files Trade Complaint Against China -- Update

April 26 2016 - 6:50PM

Dow Jones News

By John W. Miller

PITTSBURGH -- U.S. Steel Corp. on Tuesday filed a tough new

trade complaint against China as it reported another quarter of

disappointing results.

The company posted a net loss for the first quarter of $340

million, or $2.32 per share, down from $75 million, or $0.52 per

share, in the same quarter a year ago. U.S. Steel now lost money in

seven of the past eight quarters.

Net sales declined 30% to $2.3 billion from $3.3 billion.

Chief executive Mario Longhi said in a statement that the

company would "remain focused on reducing our costs, improving the

quality and reliability of our operations," and selling

"differentiated," or higher quality, steel. That steel includes

lighter-weight steel for auto manufacturing, at a time when car

makers are looking for lighter materials and aluminum is

increasingly competing with steel.

Mr. Longhi said the company is positioned to benefit in the

second quarter from rising steel prices, which are being helped by

falling inventories, and a pickup in demand, especially in the

automotive market. The benchmark hot-rolled coil index has risen to

$520 per ton, up 37% since Jan. 1., after falling 33% last

year.

In addition, steel imports into the U.S., which had been

increasing, declined 35% to 5.1 million tons in January and

February of 2016 compared with the same period a year ago. Imports

from China fell 70% to 119,895 tons.

But U.S. Steel is still seeking more trade protection. In a

complaint filed Tuesday with the International Trade Commission it

demanded penalties on Chinese steel imports which could include a

total ban on imports into the U.S. In particular, U.S. Steel said

that Chinese steelmakers conspired to fix prices, stole trade

secrets and circumvented duties with false labeling.

"We have said that we will use every tool available to fight for

fair trade," said Mr. Longhi. "With today's filing, we continue the

work we have pursued through countervailing and anti-dumping cases

and pushing for increased enforcement of existing laws."

The move by U.S. Steel comes amid rising tension between

American metal makers and China, which has dramatically ramped up

production and exports of steel and aluminum this decade. Chinese

steel exports rose 22% last year to 100.4 million tons, while

aluminum shipments increased 9% to 6.7 million tons.

This year already, the U.S. has slapped tariffs on imports of

several categories of Chinese steel, partly as a result of

complaints made last year by U.S. Steel. This month, the ITC

announced an investigation into overproduction in global aluminum,

a move that could pave the way for new tariffs on Chinese

imports.

U.S. Steel made the announcement about the complaint shortly

before reporting first quarter earnings. A spokesman for

ArcelorMittal, which operates steel mills in the same regions as

U.S. Steel, said the company hadn't been asked to support the

petition.

A spokeswoman for the ITC said the complaint was being processed

but it doesn't comment on the content of complaints.

The ITC held hearings in Washington earlier this month on damage

suffered by the American steel sector.

The ITC now has 30 days to evaluate the petition and decide

whether to initiate a case. After that, such a case can take up to

18 month to prosecute, according to trade experts.

Write to John W. Miller at john.miller@wsj.com

(END) Dow Jones Newswires

April 26, 2016 18:35 ET (22:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

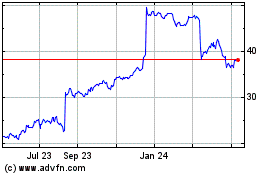

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

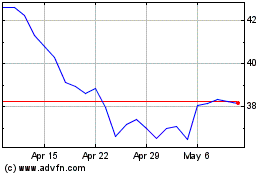

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024