ArcelorMittal Loss Worse Than Expected -- 2nd Update

November 06 2015 - 2:48PM

Dow Jones News

By John W. Miller and Alex MacDonald

LONDON--Steelmaking giant ArcelorMittal reported a hefty

quarterly loss on Friday, blaming in part Chinese steel imports,

and said prices might not recover next year without new U.S.

steel-import tariffs and curbs in Chinese production.

Luxembourg-based ArcelorMittal, the world's biggest steelmaker

by volume, was forced to take a $500 million charge on inventories

in its latest quarter. Like peer U.S. Steel Corp., ArcelorMittal

said Chinese exports were responsible.

"This is not an economic crisis, it is not a volume crisis, it

is an import crisis," ArcelorMittal Chief Financial Officer Aditya

Mittal told reporters on Friday.

Chinese steel exports rose 27% to 83 million tons in the first

nine months of 2015, compared with 65 million tons in the same

period the year before. But that excessive production has been

unprofitable. Chinese steel producers lost $8 billion in the first

nine months of 2015, the CFO said, citing figures from China's

steel association.

ArcelorMittal, which accounts for more than 6% of global

production, swung to a loss of $711 million in its third quarter

from a profit of $22 million a year earlier. It was expected to

lose $184 million, according to a FactSet poll of six analysts.

Revenue fell 22% to $15.6 billion.

The pain in the steel industry has been sharp and widespread.

U.S. Steel has reported $509 million over three quarters so far

this year.

The catalyst is steel prices, which were expected to recover in

the second half of this year, but instead have continued to slide.

The benchmark hot-rolled coil price in the U.S. is now $393 per

ton, down by more than a third since the start of the year.

ArcelorMittal said operating conditions have deteriorated

significantly, both in terms of international steel prices, driven

by unsustainably low export prices from China, and order volumes as

customers adopt a "wait and see" mind-set in case steel prices fall

further.

The industry headwinds led ArcelorMittal to suspend its dividend

and cut its earnings guidance for the year on Friday. Despite

losing money, it still plans to lower its net debt by $1 billion by

year-end and said it expects to remain free cash-flow positive this

year.

Increased Chinese exports are also having run-on effects, such

as depressing the price of scrap metal in the U.S. Chinese steel is

so cheap that countries like Turkey are buying it instead of

continuing to use American scrap, the company said.

Chinese steel officials say they aren't doing anything improper

and that their companies will become profitable when demand

recovers.

But demand in the U.S. and Europe, ArcelorMittal's main markets,

is already relatively strong, and the company expects improved

demand next year, said Chief Executive Lakshmi Mittal. The

difference will be supply, and how much China continues to

export.

This week, the U.S. Department of Commerce levied preliminary

duties on imports of corrosion-resistant steel from China. If more

duties are imposed, that will support prices, the chief executive

said.

The U.S. is doing a better job of protecting its steel markets.

Investment bank Jefferies estimates the U.S. has launched steel

trade cases representing 34% of its total steel imports so far this

year, while the EU has launched steel trade cases for just 15% of

its total steel imports.

"A lot of the trade actions that could be launched could create

some value," said Lakshmi Mittal. "The overproduction in China is

unsustainable," he added.

Davy Research said the continuing drop in steel prices doesn't

bode well for next year's earnings. "Pressure on global pricing,

from China in particular, is more than canceling out significant

cost-cutting initiatives," said Davy analyst Colin Sheridan, adding

he expects downgrades to full-year 2015 and 2016 consensus

estimates.

Write to John W. Miller at john.miller@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

November 06, 2015 14:33 ET (19:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

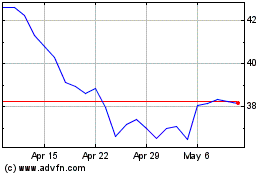

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

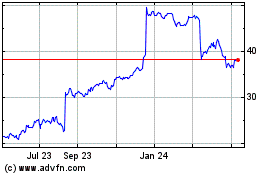

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024