|

|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

----------------------- |

|

FORM 8-K |

|

CURRENT REPORT |

|

Pursuant to Section 13 or 15(d) of |

The Securities Exchange Act of 1934 |

|

----------------------- |

|

Date of Report (Date of earliest event reported): |

November 4, 2015 |

|

|

United States Steel Corporation |

----------------------------------------------------------------------------------- |

(Exact name of registrant as specified in its charter) |

|

| | |

Delaware | 1-16811 | 25-1897152 |

--------------- | ------------------------ | ------------------- |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

600 Grant Street, Pittsburgh, PA | 15219-2800 |

--------------------------------------- | ---------- |

(Address of principal executive offices) | (Zip Code) |

|

|

412 433-1121 |

------------------------------ |

(Registrant's telephone number, |

including area code) |

-----------------------------------------------------------------------------------

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

<PAGE> 2

Item 8.01. Other Events.

On November 4, 2015, United States Steel Corporation conducted a conference call to discuss its results for the third quarter of 2015. The slides that were discussed during that call are attached hereto as Exhibit 99.1. Also, a question and answer document that was posted to the Company’s website on November 4, 2015 is attached as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1. Slides provided in connection with the third quarter 2015 earnings call of United States Steel Corporation.

99.2. Question and Answer document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

|

| |

By | /s/ Colleen M. Darragh |

| ----------------------------------- |

| Colleen M. Darragh |

| Vice President and Controller |

Dated: November 4, 2015

United States Steel Corporation Third Quarter 2015 Earnings Conference Call and Webcast November 4, 2015 © 2011 United States Steel Corporation Exhibit 99.1

2 Forward-looking Statements United States Steel Corporation This presentation contains information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward- looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” and “Supplementary Data - Disclosures About Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2014, and those described from time to time in our future reports filed with the Securities and Exchange Commission.

Segment EBIT $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 3Q 2015 1Q 2015 4Q 2014 4Q 2014 1Q 2015 2Q 2015 Note: For reconciliation of non-GAAP amounts see Appendix 1Q 2015 4Q 2014 2Q 2015 Third Quarter 2015 Results 3 United States Steel Corporation Adjusted Net Income $ Millions 4Q 2014 1Q 2015 3Q 2015 Improved results under more difficult market conditions 2Q 2015 LTM 3Q 2015 LTM 2Q 2015 LTM 3Q 2015 LTM Market headwinds worsened in the third quarter Note: LTM = latest twelve months Focused on improving the things we control

Cash from Operations $ Millions 2Q 2015 1Q 2015 4Q 2014 LTM 3Q 2015 Total Estimated Liquidity $ Millions 3Q 2014 3Q 2013 3Q 2012 3Q 2015 Strong Cash Position and Liquidity 4 United States Steel Corporation Cash and Cash Equivalents $ Millions Net Debt $ Millions Disciplined cash management and capital allocation strategies 3Q 2012 3Q 2013 3Q 2014 3Q 2015 3Q 2012 3Q 2013 3Q 2014 3Q 2015 Strong cash position and liquidity to weather tough market conditions Note: LTM = latest twelve months

EBIT $ Millions Average Realized Prices $ / Ton 4Q 2014 1Q 2015 2Q 2015 Third Quarter 2015 Flat-rolled Segment 4Q 2014 1Q 2015 2Q 2015 Shipments Net tons (Thousands) 4Q 2014 1Q 2015 3Q 2015 5 United States Steel Corporation EBITDA $ Millions 4Q 2014 1Q 2015 2Q 2015 3Q 2015 LTM 3Q 2015 LTM 3Q 2015 LTM 2Q 2015 LTM Note: LTM = latest twelve months Cost improvements continue to offset lower average realized prices Challenging spot market conditions continue to pressure shipment levels

EBIT $ Millions Average Realized Prices $ / Ton 4Q 2014 1Q 2015 2Q 2015 Third Quarter 2015 Tubular Segment 4Q 2014 1Q 2015 2Q 2015 Shipments Net tons (Thousands) 4Q 2014 1Q 2015 2Q 2015 6 United States Steel Corporation EBITDA $ Millions 4Q 2014 1Q 2015 2Q 2015 3Q 2015 LTM 3Q 2015 LTM 3Q 2015 LTM 3Q 2015 LTM Note: LTM = latest twelve months Significant increase in margins due to higher shipments and cost improvements High supply chain inventory levels continue to pressure prices and shipments

EBIT $ Millions Average Realized Prices $ / Ton 4Q 2014 1Q 2015 2Q 2015 Third Quarter 2015 U. S. Steel Europe Segment 4Q 2014 1Q 2015 2Q 2015 Shipments Net tons (Thousands) 4Q 2014 1Q 2015 2Q 2015 7 United States Steel Corporation EBITDA $ Millions 4Q 2014 1Q 2015 2Q 2015 3Q 2015 LTM 3Q 2015 LTM 3Q 2015 LTM 3Q 2015 LTM Note: LTM = latest twelve months Cost improvements offset lower average realized prices and shipments Consistent profitability and cash generation

3Q 2009 vs. 3Q 2015 $ Millions Note: For reconciliation of non-GAAP amounts see Appendix Carnegie Way Transformation Improving Earnings Power 8 United States Steel Corporation ($255) $188 ($31) $195 $81 ($16) 3Q09 EBITDA Price Volume Cost 3Q15 EBITDA North American Flat-rolled EBITDA Bridge Other 2Q 2015 vs. 3Q 2015 $ Millions 2Q15 EBITDA Price Volume Cost 3Q15 EBITDA Significant EBITDA margin improvement reflecting favorable commercial impacts and lower total costs, including lower raw materials and pension costs. Favorable change in costs, excluding raw materials and pension costs, of approximately $40 per ton EBITDA margin improvement despite negative commercial impacts, reflecting lower total costs, including lower raw materials costs. Favorable change in costs, excluding raw materials costs, of approximately $35 per ton $35 ($57) ($24) $127 $0 $81 Other

Carnegie Way Benefits1 – FY 2015 Impact $ Millions 9 Carnegie Way Continuing to Deliver 55% 12% United States Steel Corporation 1 Carnegie Way benefits are based on the incremental impact in 2015 as compared to 2014 as the base year.

10 Carnegie Way transformation Phase 1: Earning the right to grow in search of: • Economic profits • Customer satisfaction and loyalty • Process improvements and focused investment Phase 2: Driving profitable growth with: • Innovation and Technology • Differentiated customer solutions • Focused M&A Strategic Approach United States Steel Corporation

11 United States Steel Corporation Business Update Short term actions taken are expected to reduce costs in the fourth quarter of 2015 by approximately $125 million Operating updates • Steelmaking facilities • Flat-rolled finishing facilities • Tubular facilities Trade Update Recent activity

12 United States Steel Corporation Flat-rolled September auto sales highest since 2005 at an 18.1 million SAAR Construction spend has increased 9 straight months to a SAAR of $1.09 trillion in August September major unit shipments up 21% m-o-m according to the Assc. of Home Appliance Manufacturers (AHAM) Service center carbon flat-rolled inventory at 2.8 months supply; 3rd consecutive monthly increase Imports remain a headwind for all of our flat-rolled markets U. S. Steel Europe V4* car production growth expected to outpace the EU average in 2015 Appliance growth in V4 expected to outperform EU average growth in 2015 Moderate EU construction growth is expected to continue in 4Q at a rate of 2.5% y-o-y Tubular During 3Q, import share of OCTG apparent market demand is projected to exceed 47% September 2015 OCTG inventory is approximately 8-9 months of supply WTI oil prices down19% from 2Q. EIA forecasts $49.16/barrel for 2015. Market Updates Major industry summary and market fundamentals * Visegrad Group – Czech Republic, Hungary, Poland and Slovakia

13 United States Steel Corporation 2015 Outlook 2015 Adjusted EBITDA Guidance Approximately $225 million • Steel selling prices reversed direction • Import levels remained higher than expected • Slower pace of supply chain inventory rebalance • Continued deterioration of the OCTG market Actual market performance versus prior expectations

United States Steel Corporation Turning Strategy Into Action 13

United States Steel Corporation Third Quarter 2015 Earnings Conference Call and Webcast Q & A November 4, 2015 © 2011 United States Steel Corporation United States Steel Corporation 15

© 2011 United States Steel Corporation Appendix 16 United States Steel Corporation

17 Major end-markets summary North American Flat-rolled Segment United States Steel Corporation Automotive September auto sales were the highest since 2005 at an 18.1 million SAAR. October 1st inventories increased modestly by 4 days up to a still normal 59 days. 4Q build forecast is projected to be on par with 1Q 2015, and slightly higher than 4Q 2014. Industrial Equipment Mining remains very slow, with facility rationalization underway. Construction equipment demand slightly improving with construction market. 2015 railcar demand & backlogs remain steady, but not increasing. Tin Plate AISI reports that apparent consumption through July is down 4.2% on tin mill products (excl Black Plate); however domestic mill shipments are off -12% YTD. Net imports up 13.7% through August preliminary statistics. Appliance September major unit shipments were up over 21% m-o-m, according to the Association of Home Appliance Manufacturers (AHAM); YTD unit shipments are up 7.4%. Pipe and Tube Structural tubing demand reasonable due to construction market; prices under pressure. Line pipe project activity is stable. Welded OCTG producers have essentially written off 2015 in hope of better markets in 2016. Construction US Housing Starts up 6.5% in September led by multi-family units (+18.3%); permits fell 5%. The Dodge Momentum Index increased 5.8% in September; up 14% y-o-y. Construction spend has increased 9 straight months to a SAAR of $1.09 trillion in August. September Housing Market Index score of 62 the highest since October 2005. Service Center MSCI Sept Carbon Flat Rolled shipments are down 9.7% y-o-y; down 6.2% YTD. Inventory increases for the 3rd consecutive month to almost 5.93 million tons, a 2.8 months supply. Cold Rolled and Coated inventories stable and months supply reasonable; Hot Rolled is sluggish. Only positive is that it appears as though customers are keeping open order exposure small. Sources: Wards / McGrawHill / Customer Financial Reports / MSCI / NAHB US Dept of Commerce / AHAM / AISI / Railway Age / AIA

18 Market industry summary Tubular Segment United States Steel Corporation Sources: Baker Hughes, US Energy Information Administration, Preston Publishing, Internal Oil Directed Rig Count The oil directed rig count averaged 657during 3Q, a decrease of 4% q-o-q. There are currently 578 active oil rigs. Gas Directed Rig Count The natural gas directed rig count averaged 209 during 3Q, a decrease of 6% q-o-q. There are currently 197 active natural gas rigs. Natural Gas Storage Level Currently 3.9 Tcf, 12% above year-ago levels and 4% above the five year average. Oil Price The West Texas Intermediate oil price averaged $46.69 per barrel during 3Q, down $10 or 19% from 2Q. U.S. Energy Information Administration forecasts an average 2015 price of $49.16 per barrel. Natural Gas Price The Henry Hub natural gas price averaged $2.76 per million Btu during 3Q, up $0.01 q-o-q. The U.S. Energy Information Administration forecasts an average 2015 natural gas price of $2.81 per million Btu. Imports During 3Q, import share of OCTG apparent market demand is projected to exceed 47%. OCTG Inventory September 2015 OCTG inventory is estimated to be between 8 - 9 months of supply.

19 Major end-markets summary United States Steel Corporation U. S. Steel Europe Segment Sources: Eurofer, USSK Marketing, EASSC, IHS, Euroconstruct, ESTA, ACEA Automotive In 4Q, the EU car production is expected to amount to 4.3 million units, an increase of 4.2% y-o-y. In 2015, EU car production is forecasted to grow by 6.2% to roughly 17.9 million units. V4 car production is anticipated to increase by 9.9% y-o-y in 4Q and for the full year 2015 we expect 10% growth y-o-y to 3.3 million units. In 1Q 2016, the EU car production is expected to grow 2.4% y-o-y to 4.78 million units; in V4 countries by 0.3% y-o-y to 0.87 million units. Appliance In 4Q, the EU appliance sector is projected to grow by 2% y-o-y. Prospects for the EU domestic appliances market in 2015 are for the continuation of slight growth across the sector. Positive demand trends are expected in Germany, France and Austria spurred by improvement in economic conditions, consumer confidence and a better outlook for the residential property sector. Stagnation in other EU markets is mainly due to prolonged weakness of the residential construction market. In 1Q 2016, the EU appliance sector estimates growth of 1.2% y-o-y. Central Europe will continue to achieve slightly higher performance compared to the EU average. Tin Plate 4Q demand is expected to decline due to seasonal impacts by 23% q-o-q; the seasonal adjustment is typical for 4Q. Aggressively priced imports from Asia in 4Q are expected to continue across Europe with Southern Europe seeing the biggest impact. Construction Construction activity in 3Q continued to improve moderately as the recovery of the residential sector gradually gains more traction. This trend is expected to continue through the final quarter of the year; 4Q is forecast to grow y-o-y by 2.5% and 1Q 2016 by 0.4% y-o-y. Service Centers Cautious inventory management continues to define the service center segment. Fairly steady demand through 3Q has been balanced by pricing pressure brought on by imports. This trend is likely to continue through the balance of the year.

U. S. Steel Commercial – Contract vs. Spot Contract vs. spot mix by segment – twelve months ended September 30, 2015 Firm 33% Market Based Quarterly * 18% Flat-rolled Market Based Monthly * 13% Tubular U. S. Steel Europe Spot 26% Cost Based 9% Contract: 74% Spot: 26% Firm 37% Market Based Quarterly* 1% Spot 41% Cost Based 9% Program 53% Contract: 59% Spot: 41% Market Based Monthly* 12% Spot 47% Program: 53% Spot: 47% United States Steel Corporation 20 Market Based Semi-annual * 1% *Annual contract volume commitments with price adjustments in stated time frame

21 United States Steel Corporation Other Items Capital Spending Third quarter actual $133 million, 2015 estimate $500 million Depreciation, Depletion and Amortization Third quarter actual $136 million, 2015 estimate $550 million Pension and Other Benefits Costs Third quarter actual $74 million, 2015 estimate $245 million Pension and Other Benefits Cash Payments (excluding any VEBA contributions and voluntary pension contributions) Third quarter actual $85 million, 2015 estimate $300 million

22 Global OSHA Recordable Incidence Rates January 2010 through September 2015 United States Steel Corporation Safety Performance Rates Frequency of Injuries (per 200,000 manhours) Data for 2010 forward includes Lone Star Tubular Operations, Bellville Tubular Operations, Rig Site Services, Tubular Processing Houston, Offshore Operations Houston, and Wheeling Machine Products. Data for 2011 forward includes Transtar. Data for 2010 through 2011 includes U. S. Steel Serbia. 16% Improvement 2010 to 2015 Global Days Away From Work Incidence Rates January 2010 through September 2015 29% Improvement 2010 to 2015

NAFR Segment - EBITDA Bridge $ Millions Tubular Segment - EBITDA Bridge $ Millions Note: For reconciliation of non-GAAP amounts see Appendix Carnegie Way Transformation Improving Earnings Power 23 United States Steel Corporation ($255) $188 ($31) $195 $81 ($16) 3Q09 EBITDA Price Volume Cost 3Q15 EBITDA 3Q09 EBITDA Price Volume Cost 3Q15 EBITDA 3Q 2009 vs. 3Q 2015 Other ($9) ($32) $3 $0 ($36) $2 Other USSE Segment - EBITDA Bridge $ Millions $44 ($127) ($137) $275 $39 ($16) 3Q09 EBITDA Price Volume Cost Other 3Q15 EBITDA

NAFR Segment - EBITDA Bridge $ Millions Tubular Segment - EBITDA Bridge $ Millions Note: For reconciliation of non-GAAP amounts see Appendix Carnegie Way Transformation Improving Earnings Power 24 United States Steel Corporation $35 ($57) ($24) $127 $81 $0 2Q15 EBITDA Price Volume Cost 3Q15 EBITDA 2Q15 EBITDA Price Volume Cost 3Q15 EBITDA 2Q 2015 vs. 3Q 2015 Other ($49) ($36) $78 ($26) ($36) ($3) Other USSE Segment - EBITDA Bridge $ Millions $40 ($19) ($37) $53 $39 $2 2Q15 EBITDA Price Volume Cost Other 3Q15 EBITDA

25 United States Steel Corporation Adjusted Results ($ millions) LTM 3Q 2015 2Q 2015 1Q 2015 4Q 2014 Reported net earnings (loss) ($234) ($173) ($261) ($75) $275 Loss on shutdown of coke production facilities 65 ─ ─ 65 ─ Loss on shutdown of Fairfield Works Flat-Rolled Operations (a) 53 53 ─ ─ ─ Losses associated with U. S. Steel Canada Inc. 147 10 136 ─ 1 Impairment of carbon alloy facilities at Gary Works (2) ─ ─ ─ (2) Restructuring and other charges (b) 17 7 10 ─ ─ Adjusted net earnings (loss) $46 ($103) ($115) ($10) $274 Reconciliation of reported and adjusted net earnings (b) Consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. (a) Includes the shutdown of the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works, and does not include the slab and rounds caster and #5 coating line.

26 United States Steel Corporation Adjusted Results ($ per share) LTM 3Q 2015 2Q 2015 1Q 2015 4Q 2014 Reported diluted EPS (LPS) ($1.66) ($1.18) ($1.79) ($0.52) $1.83 Loss on shutdown of coke production facilities 0.45 ─ ─ 0.45 ─ Loss on shutdown of Fairfield Works Flat-Rolled Operations (a) 0.36 0.36 ─ ─ ─ Losses associated with U. S. Steel Canada Inc. 1.01 0.07 0.93 ─ 0.01 Impairment of carbon alloy facilities at Gary Works (0.02) ─ ─ ─ (0.02) Restructuring and other charges (b) 0.12 0.05 0.07 ─ ─ Adjusted diluted EPS (LPS) $0.26 ($0.70) ($0.79) ($0.07) $1.82 Reconciliation of reported and adjusted diluted EPS (b) Consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. (a) Includes the shutdown of the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works, and does not include the slab and rounds caster and #5 coating line.

27 United States Steel Corporation Adjusted Results ($ millions) LTM 3Q 2015 2Q 2015 1Q 2015 4Q 2014 Reported (loss) earnings before interest and income taxes (EBIT) ($352) ($170) ($392) ($187) $397 Depreciation expense 556 136 138 144 138 EBITDA 204 (34) (254) (43) 535 Loss on shutdown of coke production facilities 153 ─ ─ 153 ─ Loss on shutdown of Fairfield Works Flat-Rolled Operations (a) 91 91 ─ ─ ─ Losses associated with U. S. Steel Canada Inc. 274 16 255 ─ 3 Impairment of carbon alloy facilities at Gary Works (4) ─ ─ ─ (4) Restructuring and other charges (b) 31 12 19 ─ ─ Adjusted EBITDA $749 $85 $20 $110 $534 Reconciliation of adjusted EBITDA (b) Consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. (a) Includes the shutdown of the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works, and does not include the slab and rounds caster and #5 coating line.

28 United States Steel Corporation Adjusted Results Net Debt ($ millions) 3Q 2015 2Q 2015 1Q 2015 4Q 2014 Short-term debt and current maturities of long-term debt $362 $362 $378 $378 Long-term debt, less unamortized discount 3,127 3,124 3,124 3,120 Total Debt $3,489 $3,486 $3,502 $3,498 Less: Cash and cash equivalents 1,165 1,210 1,266 1,354 Net Debt $2,324 $2,276 $2,236 $2,144 Reconciliation of net debt

29 United States Steel Corporation Adjusted Results Segment EBITDA – North America Flat-rolled ($ millions) 3Q 2015 2Q 2015 1Q 2015 4Q 2014 3Q 2009 Segment EBIT ($18) ($64) ($67) $247 ($370) Depreciation 99 99 104 96 115 Segment EBITDA $81 $35 $37 $343 ($255) Reconciliation of segment EBITDA Segment EBITDA – Tubular ($ millions) 3Q 2015 2Q 2015 1Q 2015 4Q 2014 3Q 2009 Segment EBIT ($50) ($66) $1 $121 ($21) Depreciation 14 17 17 17 12 Segment EBITDA ($36) ($49) $18 $138 ($9) Segment EBITDA – U. S. Steel Europe ($ millions) 3Q 2015 2Q 2015 1Q 2015 4Q 2014 3Q 2009 Segment EBIT $18 $20 $37 $34 $7 Depreciation 21 20 20 23 37 Segment EBITDA $39 $40 $57 $57 $44

Exhibit 99.2

Third Quarter 2015

Questions and Answers

Cautionary Note Regarding Forward-Looking Statements

This document contains information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” and “Supplementary Data - Disclosures About Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2014, and those described from time to time in our future reports filed with the Securities and Exchange Commission.

1. U. S. Steel's stock has been very volatile. Why is this so and what is U. S. Steel doing to reduce the impact of cyclicality on its results?

The global steel industry is a cyclical industry and steel selling prices can change fairly quickly. Our current cost structure is more fixed than many of our competitors. Additionally, our operating configuration has significant leverage to steel selling price and volume changes to both the upside and the downside resulting in significant earnings volatility on a quarter to quarter basis. The volatility of our earnings is also affected by the consistency and reliability of our operations. One objective of our Carnegie Way transformation is to create a lower and more flexible cost structure as well as more flexible and reliable operations in order to mitigate the financial impact of this volatility. While we cannot control, or reduce, the cyclicality of the global steel industry, we can control our costs and create a more flexible business model that will produce stronger and more consistent results across industry cycles.

2. Is the Carnegie Way just a cost cutting initiative?

No - it is much more than a cost cutting initiative. Carnegie Way is our new culture and the way we run the business. We focus on our strengths and where we can create the most value for our stockholders and best serve our customers.

We have achieved sustainable cost improvements through process efficiencies and investments in reliability centered maintenance (RCM), and we will continue to find more cost improvements. Additionally, if we find that changes cannot be implemented and value cannot be created for our customers and stockholders, we exit those underperforming areas. Opportunities are greatest where we make money for our stockholders and our customers. When we deliver value, we can provide good jobs and benefits to our employees and help support the communities in which we do business.

3. How can investors see the Carnegie Way benefits in U. S. Steel’s financial results?

We first realized Carnegie Way benefits in 2014. When we performed an internal analysis of our 2014 results compared to our 2013 results, we concluded that we are performing better than we would have in prior periods. This improved performance level is driven by the progress from our Carnegie Way transformation

Our methodology included:

| |

• | Removing the price and volume impacts to isolate the cost piece. |

| |

• | Deducting major raw materials costs including iron ore, coal, coke, scrap, and natural gas (or in the case of our Tubular segment, substrate costs), which we believe are costs observable to investors. |

| |

• | Excluding depreciation and pension and other post-employment benefits (OPEB), which we disclose. |

We have more direct control over the majority of the remaining costs. Thus comparing 2014 costs to 2013’s, on a per ton basis, yields a result that is consistent with the Carnegie Way benefits disclosed in 2014.

4. U. S. Steel has mentioned that there is increased focus on earning economic profit. What is the definition of economic profit?

The term profit typically refers to any positive income for a business enterprise. Economic profit has a higher threshold and refers to income in excess of an enterprise’s weighted average cost of capital, which includes the cost of equity as well as the cost of debt. Economic profit is true value creation as it provides stockholder returns above and beyond the weighted average cost of capital.

5. What is U. S. Steel’s approach to trade cases and how do you determine if one should be filed?

The process by which we consider whether to file a potential trade case is complex, constant and lengthy, informed by the requirements set forth in the Tariff Act of 1930, which provides for the right of American industries to petition for relief from imports that are sold in the United States at less than fair value ("dumped") or which benefit from subsidies provided through foreign government programs (Countervailing Duties, or “CVDs”). Under the law, the U.S. Department of Commerce (DOC) determines whether the dumping or subsidizing exists and, if so, the margin of dumping or amount of the subsidy; the U.S. International Trade Commission (ITC) determines whether there is material injury or threat of material injury to the domestic industry by reason of the dumped or subsidized imports.

The law also requires that the petitioners must represent at least 25% of domestic production and 50% of the domestic production produced by that portion of the industry expressing support for the petition. The petition itself requires the disclosure of all relevant economic factors, including the domestic industry's output, sales, market share, employment, and profits.

Continuously managed by our internal international trade lawyers, a multifaceted

U. S. Steel team: Surveys the relevant markets; Triangulates market intelligence; Assesses market trends and data; and Integrates and interprets prevailing legal and political concerns. Then, based on a comprehensive review of all factors and considerations, the team renders an informed, sanguine recommendation whether to proceed, at which time other industry participants are engaged through external counsel to determine if the legal requirements can be met to progress a case.

6. What is the current status of the recently filed flat-rolled trade cases?

In an effort to stem the increased flow of unfairly traded corrosion-resistant (CORE), cold-rolled, and hot-rolled products into the U.S. market, U. S. Steel, along with other steel producers, filed a series of three petitions with the Department of Commerce (DOC) and the International Trade Commission (ITC).

On June 3, 2015, U. S. Steel launched a series of cases, the first against China, India, Italy, South Korea and Taiwan. The petitions allege that unfairly traded imports of CORE from the subject countries are causing material injury to the domestic industry and that significant subsidies have been provided to producers by the governments of those countries. The petitions also allege that foreign producers benefit from numerous countervailable subsidies. On July 16, 2015, the ITC determined that there is a reasonable indication that the U.S. industry is threatened with material injury by reason of imports of certain CORE products from the subject countries. All six ITC Commissioners voted in the affirmative. On November 3, 2015, the DOC announced its preliminary determinations in the CVD investigation of imports of CORE products from China, India, Italy, South Korea, and Taiwan. The DOC is expected to issue its preliminary AD duty determinations in late 2015.

On July 28, 2015, U. S. Steel, joined by other major U.S. steel companies, filed a second case. The petitions charged that unfairly-traded imports of cold-rolled steel products from Brazil, China, India, Japan, South Korea, Netherlands, Russia and the United Kingdom are causing material injury to the domestic industry. The petitions allege that producers in each of the eight countries are dumping cold-rolled steel in the U.S. market and that the foreign producers in Brazil, China, India, South Korea, and Russia benefit from numerous countervailable subsidies. On August 18, 2015, the DOC initiated AD and CVD investigations of imports of cold-rolled steel products from Brazil, China, India, Korea, and Russia and AD investigations of imports of the same merchandise from Japan, the Netherlands, and the United Kingdom. On September 10, the ITC determined that there is a reasonable indication that a U.S. industry is materially injured or threatened with material injury by reason of imports of cold-rolled steel flat products from Brazil, China, India, Japan, Korea, Russia, and the United Kingdom that are being sold in the United States at less than fair value and subsidized by the governments of Brazil, China, India, Korea, and Russia. The ITC further determined that imports of these products from the Netherlands were negligible. The DOC is expected to make its preliminary CVD determinations in December 2015 and its preliminary AD determination in early 2016.

Finally, on August 11, 2015, U. S. Steel and five other domestic steel producers filed petitions for the imposition of duties on hot-rolled coil imports from Australia, Brazil, Japan, Korea, the Netherlands, Turkey and the United Kingdom. On September 1, 2015, the DOC initiated AD and CVD investigations of imports of certain hot-rolled steel flat products from Brazil, Korea, and Turkey and antidumping duty investigations of imports of the same merchandise from Australia, Japan, the Netherlands, and the United Kingdom. On September 24, 2015, the ITC determined that there is a reasonable indication that the U.S. industry is materially injured by reason of imports of certain hot-rolled steel flat products from Australia, Brazil, Japan, Korea, the Netherlands, Turkey, and the United Kingdom that are sold in the United States at less than fair value and subsidized by the governments of Brazil, Korea, and Turkey. As a result of the Commission's affirmative determinations, the DOC will continue to conduct its investigations on imports

of these products from Australia, Brazil, Japan, Korea, the Netherlands, Turkey, and the United Kingdom, with its preliminary AD and CVD determinations due in 2016.

7. How is U. S. Steel responding to the threat from aluminum in the auto industry?

The continued development of advanced high strength steels (AHSS), particularly Generation 1 Plus and Generation 3 AHSS, enables us to provide our automotive customers with a steel intensive total vehicle solution. These solutions will help our customers meet the increased CAFÉ and safety standards of future vehicles at a very attractive and competitive value proposition compared with potential alternative materials.

We have increased our capabilities in people and equipment, namely at our Research and Technology Center in Munhall, Pennsylvania, and at our Automotive Technical Center in Troy, Michigan. We have made progress developing AHSS for automotive applications up to and including Generation 3 steels that possess unique properties in terms of strength, formability and toughness for light weighting and crash worthiness. We are working closely with customers on specific applications for their use using advanced analytic techniques for geometry, grade and gauge redesign.

8. What is the current status of Fairfield Works and how will the permanent shutdown of the Fairfield Flat-Rolled Operations impact your ability to serve your flat-rolled customers?

We announced on August 17 the shutdown of the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works, which does not include the slab and rounds casters and the #5 coating line (Fairfield Flat-Rolled Operations). The blast furnace is currently off-line and the identified finishing facilities are in the process of being idled in an orderly fashion. Both the #5 coating line and the Double G joint venture will continue to operate.

We are working closely with our flat-rolled customers and have the necessary product capabilities and capacity across our integrated network of facilities to meet our customer’s needs.

9. How would the potential idling of Granite City Works impact your ability to serve your flat-rolled customers?

On October 6, we announced that we were examining the possibility of temporarily idling our Granite City Works steelmaking operations and most finishing operations. This potential decision is part of our on-going adjustment of steelmaking operations throughout North America to match customer demands. A

temporary idling of Granite City Works would not impact our ability to serve our customers. We work closely with our customers any time we have to make operating adjustments. We have the necessary product capabilities and capacity across our other flat-rolled facilities and will continue to provide them with the high quality products, technical support and other services as we always have.

10. How is a stronger dollar impacting U. S. Steel’s results?

A stronger U.S. dollar is one of the factors that contribute to the extremely high level of direct and indirect steel imports into the U.S. market, threatening domestic prices and volumes. In addition, a stronger dollar versus the euro negatively impacts our reported earnings attributable to our European segment.

11. Has the downturn in the domestic steel market altered the Carnegie Way transformation?

No – while the downturn in the domestic steel market has had a direct impact on our Company, it has not altered the Carnegie Way transformation. Our financial results have decreased in 2015 as compared to 2014. Steel prices and shipment levels continue to be negatively impacted by high levels of unfairly traded imports, weak energy markets reducing demand for Oil Country Tubular Goods (OCTG) and high levels of inventory in both the flat-rolled and tubular supply chains. Despite these difficult conditions, we are focusing on what we can control. Benefits from our Carnegie Way transformation efforts continue to grow and include cost reductions, improving the flexibility and reliability of our operations and working more closely with our customers to create differentiated and value enhancing solutions.

12. How are the Commercial Entities improving the Company?

The formation of our Commercial Entities was announced in November 2014. The Commercial Entities were created to specifically address the following markets: automotive, consumer, industrial, service centers, and mining. The Commercial Entities are working to create differentiated steel solutions that will better meet the needs of our existing customers and provide increased opportunities to establish new customer relationships. These efforts are still in the early stages but ultimately should improve our position in the markets we serve by creating value for both our customers and stockholders.

13. How did the hard freeze of the defined benefit pension plan for non-union participants and the permanent shutdown of the Fairfield Flat-Rolled Operations improve the Company’s overall pension exposure?

The hard-freeze of the defined benefit pension plan for non-union participants triggered a pension curtailment which required a remeasurement of the defined benefit pension plan's obligations and associated assets during the third quarter of 2015. The permanent shutdown of the Fairfield Flat-Rolled Operations triggered a remeasurement of both the defined benefit pension and OPEB plans' (the Plans)

obligations and associated assets during the third quarter of 2015. The remeasurement of the Plans' projected benefit obligations and assets resulted in a decrease in benefit obligations of approximately $305 million from benefit and plan changes and a higher discount rate, which were more than offset by a decrease in the fair value of plan assets of approximately $600 million resulting in a net decrease of the Plan's funded status of approximately $295 million as of September 30, 2015.

The discount rate used for the third quarter of 2015 remeasurements was 4.0 percent, as compared to 3.75 percent at December 31, 2014. The assumed rate of return on assets used for the remeasurements was 7.5 percent which is consistent with the rate used at December 31, 2014. Excluding impacts from potential changes in the assumptions to be used to measure our defined benefit pension obligation at December 31, 2015, we expect 2016 net periodic benefit cost for defined benefit pension to decrease by approximately $125 million to $150 million as compared to 2015 net periodic benefit cost for defined benefit pension.

14. What is the current status of your relationship with U. S. Steel Canada (USSC)?

As part of the USSC CCAA restructuring process, U. S. Steel and USSC, entered into a mutually agreed upon, court approved, transition arrangement (the transition plan) that provides for certain services to be provided by the Company to support USSC's continued operations as part of an orderly severance of the parties’ relationship. Additionally, the Court approved USSC's business preservation plan designed to conserve its liquidity.

The transition plan requires U. S. Steel to continue to provide shared services to USSC for up to 24 months, transitions U. S. Steel away from providing any technical and engineering services associated with product development or sales with USSC and in addition, U. S. Steel will not be supporting any quality claims made against USSC. Further, U. S. Steel will not be generating any sales orders on behalf of USSC and will fulfill its production orders with its U.S. based operating facilities.

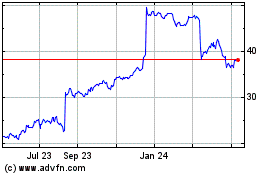

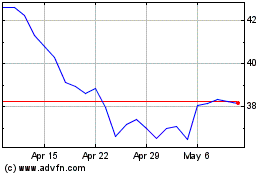

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024