UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2015

________________________________________________

|

|

WOLVERINE WORLD WIDE, INC. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Delaware | | 001-06024 | | 38-1185150 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

9341 Courtland Drive N.E., Rockford, Michigan | | 49351 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (616) 866-5500

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| |

Item 2.02 | Results of Operations and Financial Condition. |

On July 21, 2015, Wolverine World Wide, Inc. (the “Company”) issued a press release announcing its financial results for the Company’s second quarter of 2015, attached as Exhibit 99.1 to this Form 8-K (the “8-K”), which is here incorporated by reference. This 8-K and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| |

Item 9.01 | Financial Statements and Exhibits. |

| |

99.1 | Press Release dated July 21, 2015. This Exhibit shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

Dated: July 21, 2015 | WOLVERINE WORLD WIDE, INC. (Registrant) |

| |

| |

| /s/ Brendan M. Gibbons |

| Brendan M. Gibbons |

| Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Document |

| | |

99.1 | | Wolverine World Wide, Inc. Press Release dated July 21, 2015. |

|

| |

| 9341 Courtland Drive NE, Rockford, MI 49351 Phone (616) 866-5500; Fax (616) 866-0257 |

FOR IMMEDIATE RELEASE

CONTACT: Michael D. Stornant

(616) 866-5728

WOLVERINE WORLDWIDE REPORTS RECORD SECOND-QUARTER 2015 REVENUE; REAFFIRMS FULL-YEAR ADJUSTED EARNINGS PER SHARE GUIDANCE

Rockford, Michigan, July 21, 2015 - Wolverine Worldwide (NYSE: WWW) today reported financial results for its second quarter ended June 20, 2015. Adjusted financial results exclude restructuring and impairment and acquisition-related integration costs.

“The global demand for our family of brands remains strong and I am pleased to report that our top-line growth accelerated in the quarter and exceeded our internal expectations,” commented Blake W. Krueger, Wolverine Worldwide’s Chairman, Chief Executive Officer and President. "As we move into the second half of the year, we remain intensly focused on our consumers and further investing in our key strategic initiatives – specifically our global brand-building efforts, omnichannel transformation and the continued expansion of our portfolio's international footprint."

SECOND-QUARTER 2015 REVIEW

| |

• | Consolidated revenue increased to a record $630.1 million, representing growth of 2.7% versus the prior year and 4.9% on a constant currency basis. Adjusting for the impact of foreign exchange, retail store closures and termination of the Patagonia license agreement, adjusted revenue grew 6.9% versus the prior year. Other highlights include: |

| |

▪ | Growth of 12.2% from the Heritage Group (14.6% in constant currency) and growth of 5.7% from the Performance Group (9.4% in constant currency). |

| |

▪ | U.S. wholesale revenue growth in the mid-single digits. |

| |

▪ | Planned retail store closures and termination of the Patagonia license agreement reduced revenue $11.6 million versus the prior year. |

| |

• | Gross margin was 39.1%, a decrease of 100 basis points versus the prior year's gross margin, in line with Company expectations. |

| |

• | Adjusted operating margin decreased 90 basis points versus the prior year to 8.1%, due primarily to higher pension expense and planned incremental brand investment. Reported operating margin declined 40 basis points versus the prior year to 7.6%. |

| |

• | Adjusted diluted earnings per share were $0.27, compared to an adjusted $0.31 per share in the prior year, and well ahead of Company expectations for the quarter. Reported diluted earnings per share were $0.24, compared to $0.27 per share in the prior year. |

| |

• | Cash and cash equivalents were $220.7 million and net debt was $612.4 million, a reduction of $286.5 million from the same period last year. |

| |

• | The Company repurchased $5.9 million of its common stock in the quarter at an average price of $29.93 per share. |

"The strong performance in the quarter was highlighted by mid-single digit revenue growth in our U.S. wholesale business, double-digit growth in EMEA and growth exceeding 50% in the Asia Pacific region, each on a constant currency basis," commented Mike Stornant, Senior Vice President and Chief Financial Officer. "Revenue for the quarter also benefited from higher than anticipated international shipments that were initially expected to deliver in Q3 2015. Operating margin was also positive relative to our projections heading into the quarter, aided by strong discipline around discretionary spending to protect our key brand investment initiatives. The Company's global diversity and reliable fiscal discipline helped deliver another very good financial performance in Q2 2015."

UPDATE ON KEY STRATEGIC INITIATIVES

Over the past year, the Company has initiated several key strategic initiatives to accelerate growth and improve profitability.

| |

• | In July 2014, the Company announced a Strategic Realignment Plan for its consumer-direct operations. As part of this effort, the Company announced plans to close approximately 140 stores by the end of fiscal 2015. Today, the Company is announcing that total closures by year end are expected to number approximately 120, and that approximately 55 additional under-performing stores are expected to be closed over the next five years at their natural lease expiration. |

| |

• | Also, as part of the Strategic Realignment Plan, the Company is consolidating offices and infrastructure in Canada to streamline operations, further realize synergies and drive growth in this important market. This initiative was launched this past quarter and is expected to conclude by mid 2016. |

| |

• | As part of the continuing evaluation of the performance of brands within its portfolio, the Company has decided to wind-down operations for its smallest brand - Cushe - and redeploy talent and resources to other higher-value opportunities. The Company expects to incur $3.5 million of restructuring and impairment costs in fiscal 2015, of which $2.9 million was recorded in Q2 2015. |

| |

• | The Company recently amended and extended its senior secured credit facilities. In addition to increasing the overall size of the Company’s borrowing capacity, the amended credit agreement extends the maturity date of the facilities, lowers the cost of the Company’s debt, and increases flexibility with respect to stock repurchases and other restricted uses of cash. |

FISCAL 2015 GUIDANCE

The Company is narrowing its full-year revenue guidance and reaffirming its adjusted earnings per share guidance, as follows:

| |

• | Consolidated reported revenue is expected in the range of $2.82 billion to $2.85 billion, representing growth in the range of approximately 2% to 3% versus the prior year. Constant currency revenue growth is expected in the range of approximately 5% to 6%. |

| |

• | Adjusted diluted earnings per share is expected in the range of $1.53 to $1.60. Constant currency adjusted diluted earnings per share is expected in the range of $1.68 to $1.75. |

The Company now expects to incur total pre-tax charges of approximately $48 million to $51 million related to the previously announced Strategic Realignment Plan, exit of the Cushe business and debt extinguishment costs from the debt refinancing. Of this amount, $26 million was recorded in fiscal 2014, and $23 million of the charges are expected to be incurred in fiscal 2015 with the balance recorded in fiscal 2016. As a result, reported diluted earnings per share in fiscal 2015 is expected in the range of $1.39 to $1.46.

EARNINGS CALL INFORMATION

The Company will host a conference call today at 8:30 a.m. Eastern Time to discuss these results and current business trends. The conference call will be broadcast live and accessible under the “Investor Relations” tab at wolverineworldwide.com. A replay of the conference call will be available at the Company's website for a period of approximately 30 days.

ABOUT WOLVERINE WORLDWIDE

With a commitment to service and product excellence, Wolverine World Wide, Inc. is one of the world’s leading marketers of branded casual, active lifestyle, work, outdoor sport, athletic, children’s and uniform footwear and apparel. The Company’s portfolio of highly recognized brands includes: Merrell®, Sperry®, Hush Puppies®, Saucony®, Wolverine®, Keds®, Stride Rite®, Sebago®, Cushe®, Chaco®, Bates®, and HYTEST®. The Company also is the global footwear licensee of the popular brands Cat® and Harley-Davidson®. The Company’s products are carried by leading retailers in the U.S. and globally in approximately 200 countries and territories. For additional information, please visit our website, wolverineworldwide.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, including statements regarding future benefits relating to the amended credit agreement, the possibility of future share repurchases or other uses of cash, expected 2015 financial performance, 2015 investment plans and benefits, future growth plans and future benefits resulting from strategic initiatives. In addition, words such as “guidance,” “estimates,” “anticipates,” “believes,” “forecasts,” “step,” “plans,” “predicts,” “projects,” “is likely,” “expects,” “intends,” “should,” “will,” “confident,” variations of such words, and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions (“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Risk Factors include, among others: the impact of financial and credit markets on the Company, its suppliers and customers; changes in interest rates, tax laws, duties, tariffs, quotas, or applicable assessments in countries of import and export; changes in consumer preferences, spending patterns, buying patterns, price sensitivity or demand for the Company’s products; changes in future pension funding requirements and pension expenses; the ability to secure and protect owned intellectual property or use licensed intellectual property; the risk of impairment to goodwill and other intangibles; cancellation of orders for future delivery; the failure of the U.S. Department of Defense to exercise future purchase options or award new contracts, or the cancellation or modification of existing contracts by the Department of Defense or other military purchasers; changes in relationships with, including the loss of, significant customers; the financial strength of the Company’s customers, distributors and licensees; risks related to the significant investment in, and performance of, the Company’s consumer-direct business; the impact of regulation, regulatory or legal proceedings and legal compliance risks; the cost, availability, and management of raw materials, inventories, services and labor for owned and contract manufacturers; currency fluctuations; currency restrictions; the risks of doing business in developing countries and politically or economically volatile areas; changes in national, regional or global economic and market conditions; the impact of seasonality and unpredictable weather conditions; problems affecting the Company’s distribution system, including service interruptions at shipping and receiving ports; the potential breach of the Company’s databases, or those of its vendors, which contain certain personal information or payment card data; the inability for any reason to effectively compete in global footwear, apparel and consumer-direct markets; strategic actions, including new initiatives and ventures, acquisitions and dispositions, and the Company’s success in integrating acquired businesses and implementing new initiatives and ventures; the success of the Company’s consumer-direct realignment initiatives; and additional factors discussed in the Company’s reports filed with the Securities and Exchange Commission and exhibits thereto. The foregoing Risk Factors, as well as other existing Risk Factors and new Risk Factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Furthermore, the Company undertakes no obligation to update, amend, or clarify forward-looking statements.

# # #

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except per share data)

|

| | | | | | | | | | | | | | | |

| 12 Weeks Ended | | 24 Weeks Ended |

| June 20,

2015 | | June 14,

2014 | | June 20,

2015 | | June 14,

2014 |

Revenue | $ | 630.1 |

| | $ | 613.5 |

| | $ | 1,261.5 |

| | $ | 1,241.1 |

|

Cost of goods sold | 383.7 |

| | 367.7 |

| | 753.7 |

| | 739.1 |

|

Restructuring costs | — |

| | 0.1 |

| | — |

| | 0.5 |

|

Gross profit | 246.4 |

| | 245.7 |

| | 507.8 |

| | 501.5 |

|

Gross margin | 39.1 | % | | 40.1 | % | | 40.3 | % | | 40.4 | % |

| | | | | | | |

Selling, general and administrative expenses | 195.1 |

| | 190.8 |

| | 393.9 |

| | 381.3 |

|

Acquisition-related integration costs | — |

| | 2.5 |

| | — |

| | 4.1 |

|

Restructuring and impairment costs | 3.7 |

| | 3.4 |

| | 2.7 |

| | 3.4 |

|

Operating expenses | 198.8 |

| | 196.7 |

| | 396.6 |

| | 388.8 |

|

Operating expenses as a % of revenue | 31.6 | % | | 32.1 | % | | 31.4 | % | | 31.3 | % |

| | | | | | | |

Operating profit | 47.6 |

| | 49.0 |

| | 111.2 |

| | 112.7 |

|

Operating margin | 7.6 | % | | 8.0 | % | | 8.8 | % | | 9.1 | % |

| | | | | | | |

Interest expense, net | 9.0 |

| | 10.5 |

| | 18.5 |

| | 21.4 |

|

Other expense, net | 1.8 |

| | — |

| | 0.8 |

| | 0.8 |

|

| 10.8 |

| | 10.5 |

| | 19.3 |

| | 22.2 |

|

Earnings before income taxes | 36.8 |

| | 38.5 |

| | 91.9 |

| | 90.5 |

|

| | | | | | | |

Income tax expense | 11.6 |

| | 10.9 |

| | 26.6 |

| | 25.7 |

|

Effective tax rate | 31.4 | % | | 28.2 | % | | 28.9 | % | | 28.4 | % |

| | | | | | | |

Net earnings | 25.2 |

| | 27.6 |

| | 65.3 |

| | 64.8 |

|

| | | | | | | |

Less: net (loss) earnings attributable to noncontrolling interest | (0.1 | ) | | 0.1 |

| | (0.1 | ) | | 0.2 |

|

Net earnings attributable to Wolverine World Wide, Inc. | $ | 25.3 |

| | $ | 27.5 |

| | $ | 65.4 |

| | $ | 64.6 |

|

Diluted earnings per share | $ | 0.24 |

| | $ | 0.27 |

| | $ | 0.63 |

| | $ | 0.64 |

|

| | | | | | | |

Supplemental information: | | | | | | | |

Net earnings used to calculate diluted earnings per share | $ | 24.9 |

| | $ | 27.1 |

| | $ | 64.3 |

| | $ | 63.5 |

|

Shares used to calculate earnings per share | 101.6 |

| | 100.0 |

| | 101.3 |

| | 99.9 |

|

Weighted average shares outstanding | 103.2 |

| | 101.4 |

| | 102.8 |

| | 101.2 |

|

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(Unaudited)

(In millions)

|

| | | | | | | |

| June 20,

2015 | | June 14,

2014 |

ASSETS | | | |

Cash and cash equivalents | $ | 220.7 |

| | $ | 232.4 |

|

Accounts receivables, net | 355.3 |

| | 434.3 |

|

Inventories, net | 452.2 |

| | 459.8 |

|

Other current assets | 79.8 |

| | 66.5 |

|

Total current assets | 1,108.0 |

| | 1,193.0 |

|

Property, plant and equipment, net | 137.3 |

| | 146.0 |

|

Goodwill and other indefinite-lived intangibles | 1,124.4 |

| | 1,135.3 |

|

Other non-current assets | 184.9 |

| | 206.9 |

|

Total assets | $ | 2,554.6 |

| | $ | 2,681.2 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Accounts payable and other accrued liabilities | $ | 345.8 |

| | $ | 286.7 |

|

Current maturities of long-term debt | 45.2 |

| | 48.4 |

|

Total current liabilities | 391.0 |

| | 335.1 |

|

Long-term debt | 787.9 |

| | 1,082.9 |

|

Other non-current liabilities | 376.9 |

| | 355.3 |

|

Stockholders' equity | 998.8 |

| | 907.9 |

|

Total liabilities and stockholders' equity | $ | 2,554.6 |

| | $ | 2,681.2 |

|

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

|

| | | | | | | |

| 24 Weeks Ended |

| June 20,

2015 | | June 14,

2014 |

OPERATING ACTIVITIES: | | | |

Net earnings | $ | 65.3 |

| | $ | 64.8 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

Depreciation and amortization | 21.7 |

| | 25.0 |

|

Stock-based compensation expense | 14.1 |

| | 11.2 |

|

Excess tax benefits from stock-based compensation | (3.8 | ) | | (3.7 | ) |

Pension expense | 12.9 |

| | 5.9 |

|

Restructuring and impairment costs | 2.7 |

| | 3.9 |

|

Other | (7.0 | ) | | 1.1 |

|

Changes in operating assets and liabilities | (11.0 | ) | | (42.6 | ) |

Net cash provided by operating activities | 94.9 |

| | 65.6 |

|

| | | |

INVESTING ACTIVITIES: | | | |

Additions to property, plant and equipment | (15.8 | ) | | (12.5 | ) |

Investment in joint venture | — |

| | (0.7 | ) |

Other | 3.2 |

| | (1.6 | ) |

Net cash used in investing activities | (12.6 | ) | | (14.8 | ) |

| | | |

FINANCING ACTIVITIES: | | | |

Payments on long-term debt | (67.7 | ) | | (19.4 | ) |

Cash dividends paid | (12.3 | ) | | (12.0 | ) |

Purchase of common stock for treasury | (5.9 | ) | | — |

|

Purchases of shares under employee stock plans | (7.5 | ) | | (9.4 | ) |

Proceeds from the exercise of stock options | 8.5 |

| | 3.8 |

|

Excess tax benefits from stock-based compensation | 3.8 |

| | 3.7 |

|

Net cash used in financing activities | (81.1 | ) | | (33.3 | ) |

| | | |

Effect of foreign exchange rate changes | (4.3 | ) | | 0.7 |

|

(Decrease) increase in cash and cash equivalents | (3.1 | ) | | 18.2 |

|

| | | |

Cash and cash equivalents at beginning of the year | 223.8 |

| | 214.2 |

|

Cash and cash equivalents at end of the period | $ | 220.7 |

| | $ | 232.4 |

|

The following tables contain information regarding the non-GAAP adjustments used by the Company in the presentation of its financial results:

WOLVERINE WORLD WIDE, INC.

RECONCILIATION OF FISCAL 2015 Q2 REPORTED REVENUE TO

ADJUSTED REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

|

| | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis

Fiscal 2015 Q2 | | Foreign Exchange Impact | | Fiscal 2015 Q2 Constant Currency Basis | | GAAP Basis

Fiscal 2014 Q2 | | Constant Currency Growth | | Reported Growth |

| | | | | | | | | | | |

Revenue | $ | 630.1 |

| | $ | 13.5 |

| | $ | 643.6 |

| | $ | 613.5 |

| | 4.9 | % | | 2.7 | % |

RECONCILIATION OF FISCAL 2015 Q2 REPORTED REVENUE

GROWTH TO ADJUSTED REVENUE GROWTH*

(Unaudited)

(In millions)

|

| | | | | | | | | | | | | | | |

| GAAP Basis

Revenue | | Foreign Exchange Impact | | Adjustments (1) | | As Adjusted

Revenue |

| | | | | | | |

Fiscal 2015 Q2 | $ | 630.1 |

| | $ | 13.5 |

| |

| | $ | 643.6 |

|

| | | | | | | |

Fiscal 2014 Q2 | $ | 613.5 |

| | | | $ | (11.6 | ) | | $ | 601.9 |

|

| | | | | | | |

Revenue Growth | 2.7 | % | | | | | | 6.9 | % |

| |

(1) | Fiscal 2014 Q2 Adjustments include the impact from planned retail store closures associated with the Strategic Realignment Plan and the termination of the Patagonia license agreement. |

RECONCILIATION OF FISCAL 2015 Q2 REPORTED REVENUE TO

ADJUSTED REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

|

| | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis

Fiscal 2015 Q2 | | Foreign Exchange Impact | | Fiscal 2015 Q2 Constant Currency Basis | | GAAP Basis

Fiscal 2014 Q2 | | Constant Currency Growth | | Reported Growth |

| | | | | | | | | | | |

Revenue: | | | | | | | | | | | |

Lifestyle Group | $ | 253.4 |

| | $ | 2.6 |

| | $ | 256.0 |

| | $ | 264.1 |

| | (3.1 | )% | | (4.1 | )% |

Performance Group | 223.3 |

| | 7.8 |

| | 231.1 |

| | 211.2 |

| | 9.4 |

| | 5.7 |

|

Heritage Group | 127.4 |

| | 2.7 |

| | 130.1 |

| | 113.5 |

| | 14.6 |

| | 12.2 |

|

Other | 26.0 |

| | 0.4 |

| | 26.4 |

| | 24.7 |

| | 6.9 |

| | 5.3 |

|

Total | $ | 630.1 |

| | $ | 13.5 |

| | $ | 643.6 |

| | $ | 613.5 |

| | 4.9 | % | | 2.7 | % |

RECONCILIATION OF REPORTED OPERATING

PROFIT TO ADJUSTED OPERATING PROFIT*

(Unaudited)

(In millions)

|

| | | | | | | | | | | |

| GAAP Basis

Operating Profit | | Adjustments (1) | | As Adjusted

Operating Profit |

| | | | | |

Fiscal 2015 Q2 | $ | 47.6 |

| | $ | 3.7 |

| | $ | 51.3 |

|

| | | | | |

Operating margin | 7.6 | % | | | | 8.1 | % |

| | | | | |

Fiscal 2014 Q2 | $ | 49.0 |

| | $ | 6.0 |

| | $ | 55.0 |

|

| | | | | |

Operating margin | 8.0 | % | | | | 9.0 | % |

| |

(1) | Fiscal 2015 Q2 Adjustments include Restructuring and Impairment Costs. Fiscal 2014 Q2 Adjustments include Acquisition-Related Integration and Restructuring Costs. |

RECONCILIATION OF REPORTED DILUTED EPS TO ADJUSTED DILUTED EPS*

(Unaudited)

|

| | | | | | | | | | | |

| GAAP Basis

EPS | | Adjustments (1) | | As Adjusted

EPS |

| | | | | |

Fiscal 2015 Q2 | $ | 0.24 |

| | $ | 0.03 |

| | $ | 0.27 |

|

| | | | | |

Fiscal 2014 Q2 | $ | 0.27 |

| | $ | 0.04 |

| | $ | 0.31 |

|

| |

(1) | Fiscal 2015 Q2 Adjustments include Restructuring and Impairment Costs. Fiscal 2014 Q2 Adjustments include Acquisition-Related Integration and Restructuring Costs. |

RECONCILIATION OF REPORTED DEBT TO NET DEBT*

(Unaudited)

(In millions)

|

| | | | | | | |

| Fiscal 2015 Q2 | | Fiscal 2014 Q2 |

| | | |

GAAP reported debt | $ | 833.1 |

| | $ | 1,131.3 |

|

Cash and cash equivalents | (220.7 | ) | | (232.4 | ) |

Net debt | $ | 612.4 |

| | $ | 898.9 |

|

RECONCILIATION OF FISCAL 2015 Q2 REPORTED REVENUE GROWTH BY GEOGRAPHY TO

ADJUSTED REVENUE GROWTH BY GEOGRAPHY ON A CONSTANT CURRENCY BASIS*

(Unaudited)

|

| | | | | | | | |

| Constant Currency Growth | | Foreign Exchange Impact | | GAAP Basis Reported Growth |

| | | | | |

Revenue growth: | | | | | |

North America | 1.3 | % | | (0.7 | )% | | 0.6 | % |

EMEA | 10.0 |

| | (11.4 | ) | | (1.4 | ) |

Asia Pacific | 56.9 |

| | (1.6 | ) | | 55.3 |

|

Latin America | 5.1 |

| | (6.5 | ) | | (1.4 | ) |

RECONCILIATION OF FISCAL 2015 FULL-YEAR REPORTED REVENUE GUIDANCE

TO ADJUSTED REVENUE GUIDANCE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

|

| | | | | | | |

| GAAP Basis Full-Year 2015 Guidance | | Foreign Exchange Impact | | Full-Year 2015 Guidance Constant Currency Basis |

| | | | | |

Revenue | $ 2,820 - 2,850 | | $ | 70.0 |

| | $ 2,890 - 2,920 |

Percentage growth | 2.0 - 3.0% | | | | 5.0 - 6.0% |

RECONCILIATION OF FISCAL 2015 FULL-YEAR REPORTED DILUTED

EPS GUIDANCE TO ADJUSTED DILUTED EPS GUIDANCE*

(Unaudited)

|

| | | | | | | |

| GAAP Basis Full-Year 2015 Guidance | | Adjustments (1) | | As Adjusted Full-Year 2015 Guidance |

| | | | | |

Diluted earnings per share | $ 1.39 - 1.46 | | $ | 0.14 |

| | $ 1.53 - 1.60 |

| |

(1) | Fiscal 2015 Full-Year Guidance Adjustments include estimated Restructuring and Impairment Costs and estimated Debt Extinguishment Costs. |

RECONCILIATION OF FISCAL 2015 FULL-YEAR ADJUSTED DILUTED EPS GUIDANCE

TO ADJUSTED DILUTED EPS GUIDANCE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

|

| | | | | | | |

| As Adjusted Full-Year 2015 Guidance | | Foreign Exchange Impact | | As Adjusted Full-Year 2015 Guidance Constant Currency Basis |

| | | | | |

Diluted earnings per share | $ 1.53 - 1.60 | | $ | 0.15 |

| | $ 1.68 - 1.75 |

| |

* | To supplement the consolidated financial statements presented in accordance with Generally Accepted Accounting Principles ("GAAP"), the Company describes what certain financial measures would have been if acquisition-related integration costs, restructuring and impairment costs and debt extinguishment costs were excluded. The Company also describes the revenue impact from planned retail store closures associated with the Strategic Realignment Plan and the termination of the Patagonia license agreement. The Company believes these non-GAAP measures provide useful information to both management and investors to increase comparability to the prior period by adjusting for certain items that may not be indicative of core operating measures and to better identify trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis. The Company has defined net debt as debt less cash and cash equivalents. The Company believes that netting these sources of cash against debt provides a clearer picture of the future demands on cash to repay debt. The Company evaluates results of operations on both a reported and a constant currency basis. The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. The Company believes providing constant currency information provides valuable supplemental information regarding results of operations, consistent with how the Company evaluates performance. The Company calculates constant currency by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to our current period reported results. Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitution for, financial information prepared in accordance with GAAP. A reconciliation of all non-GAAP measures included in this press release, to the most directly comparable GAAP measures, are found in the financial tables above. |

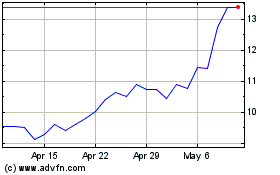

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

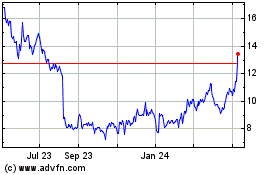

Wolverine World Wide (NYSE:WWW)

Historical Stock Chart

From Apr 2023 to Apr 2024