Costco Same-Store Sales Rise After String of Declines -- Update

December 07 2016 - 8:10PM

Dow Jones News

By Sarah Nassauer and Ezequiel Minaya

Costco Wholesale Corp. said discounts and deflation erased much

of the sales gains the company logged in its latest quarter, as the

retail giant battles with Wal-Mart and Amazon.com for a bigger

slice of consumer spending.

Costco, the second largest retailer in the U.S. by revenue, said

more shoppers headed to its warehouses in the period, but lower

prices on everything from food to electronics left the company with

just a 1% increase in same-store sales.

For example, unit sales of TVs rose 17% in the busy November

holiday shopping period, but just 2% in dollar terms, said finance

chief Richard Galanti on a conference call Wednesday with

investors. Meat sales rose 16% in pounds and 6% in dollars. "We're

going to invest in loyalty and growth while it's raining on

everybody as it relates to higher levels of deflation," he

said.

Excluding the impact of the strong dollar and lower gas prices,

same-store sales rose 2% in the quarter ended Nov. 20. Traffic

increased 2.2%, but was "choppy," slowing the week of the

presidential election, said Mr. Galanti.

The latest results come amid the relatively upbeat outlook for

the holiday season among some of the biggest players in the

challenged retail sector. Macy's Inc. and Kohl's Corp. have posted

optimistic outlooks for the crucial holiday season, despite more

long-term struggles with changing shopping habits and competition

from discounters. Last month, Wal-Mart Stores Inc. also chimed in

with the expectation that consumer spending would remain solid

during the holidays.

Much of the sector has struggled to keep pace with Amazon.com

Inc. which has e-commerce sales greater than the combined

e-commerce sales of the next 20 U.S. retailers, Costco among them.

At the same time, deflation is taking a bite out of many retailers'

sales. Last week, Kroger Co. cut its profit guidance for the full

year, saying lower prices on eggs, meat and other food are

tempering sales.

Costco's online sales in the fiscal first quarter rose 8%, a

slower rate than the overall e-commerce market. The Seattle-based

retailer has been more blunt than competitors that it prefers

shoppers to come to stores where impulse purchases are more likely.

Still, it's working to be stronger online, say executives. "We

think we could and should do a lot more online," said Mr.

Galanti.

Asked how much of the company's sales are imported and thus

potentially subject to import tariffs under a Donald Trump

administration, Mr. Galanti estimated about 25% of sales come from

imported goods. But it's "tenuous to come up with an exact number,"

he said. For example "most electronics are purchased in U.S.

dollars by U.S. trading companies that are arms of the overseas

manufacturer," he said.

For the quarter, Costco reported a profit of $545 million, or

$1.24 a share, up from $480 million, or $1.09 a share, a year

earlier. Total revenue rose 3.2% to $28.1 billion, while membership

fees climbed 6.2% to $630 million.

The latest period benefited from a $51 million legal settlement

that contributed 7 cents a share to earnings, the company said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Ezequiel

Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

December 07, 2016 19:55 ET (00:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

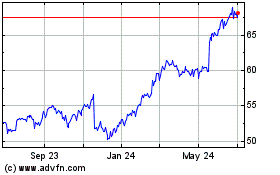

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

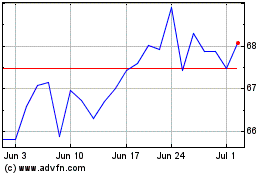

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024