Wal-Mart Lifts Profit Outlook as Sales Grow--2nd Update

August 18 2016 - 11:12AM

Dow Jones News

By Joshua Jamerson and Sarah Nassauer

Wal-Mart Stores Inc. reported stronger-than-expected same-store

sales growth in the latest period, with slightly more shoppers

heading to its stores at a time when many retailers are struggling

to attract foot traffic.

The retailer also lifted its profit outlook for the year. Shares

rose 3.1% to $75.18 in premarket trading, which would be the

highest level in a year for the stock.

Same-store sales at Walmart's U.S. stores rose 1.6%%, compared

with its guidance for a 1% increase. Meanwhile, traffic rose 1.2%.

Wal-Mart executives attributed sales gains in the U.S. to

improvements they have made to stores, as well lower gas prices and

warm weather. Still, sales were hurt by deflationary food prices,

they said.

Many traditional retailers have struggled recently to grow sales

and adjust to customer's changing online shopping habits. Target

Corp. said Wednesday that same-store sales fell for the first time

in more than two years as fewer shoppers visited its locations,

while Macy's Inc. last week said it would shut 100 more stores, or

14% of its physical base, as shoppers increasingly opt to make

purchases online and spend more on services than on goods.

Demand for clothing and household items in recent years has been

markedly softer than during past economic recoveries. What demand

there is has been shifting online away from traditional retailers

such as Macy's, Kohl's Corp. and Nordstrom Inc., which all reported

lower quarterly sales last week.

Bentonville, Ark.-based Wal-Mart has been spending heavily to

get customers back into its stores. It has worked to better stock

its stores, improve efficiency and boost the pay for its employees.

"Comp store inventory was down 6.5% and in-stock levels are up,"

said Wal-Mart chief executive Doug McMillon on a conference call.

Operating, selling, general and administrative expenses climbed

4.6% in the latest period.

The company has also invested in its lackluster online

operations as Amazon.com Inc. continues to grow sales quickly.

Earlier this month, the company announced plans to purchase

discount e-commerce retailer Jet.com Inc. for $3.3 billion, the

largest purchase to date of an e-commerce startup. Wal-Mart also

tapped Jet's founder Marc Lore to lead its e-commerce efforts once

the deal is complete.

In the second quarter, Wal-Mart reported global e-commerce sale

rose 11.8%, the first time in nine quarters the retailer's online

sales growth has increased quarter-over-quarter.

During the quarter Wal-Mart offered a free monthlong trial of a

$49 two-day shipping membership similar to Amazon's popular Prime

program and rapidly ramped up the number of items available on

Walmart.com. Until May, the technology behind Wal-Mart's website

capped the number of products it could display to shoppers at

around 8 million. "We made advancements in the U.S. on our key

priorities to build digital relationships with customers, scale the

assortment and expand online grocery," said Mr. McMillon.

Walmart.com now sells 15 million items, he said.

Wal-Mart is also trying to make its produce, meat and grocery

business more prominent for shoppers, an effort at the heart of its

plan to fend off Amazon as consumers still tend to shop offline for

fresh food. During the quarter, the company reported strong traffic

in food and consumables, such as beauty and cosmetics, in its

grocery segment. The company also reported stronger pharmacy sales,

helped by drug price inflation and more prescriptions filled.

Meanwhile, apparel sales were helped by a focus on basics,

though entertainment sales were soft. Target also reported weakness

in electronics sales.

Over all, Wal-Mart reported earnings of $3.77 billion, or $1.21

a share, compared with a year-earlier profit of $3.48 billion, or

$1.08 a share. Excluding the gain from the sale of its Yihaodian

website in China, the company earned $1.07 a share. The company had

said earnings would land between 95 cents and $1.08 a share.

Revenue edged up 0.5% to $120.85 billion. In constant currency,

revenue rose 2.8%. Analysts estimated $120.16 billion in

revenue.

The company now sees full-year earnings in a range of $4.15 to

$4.35 a share. Analysts were expecting $4.27. The company

previously guided for earnings between $4.00 and $4.30. For the

current quarter, the company is projecting 90 cents to $1 in

per-share earnings, in line with the consensus estimate for 94

cents a share.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 18, 2016 10:57 ET (14:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

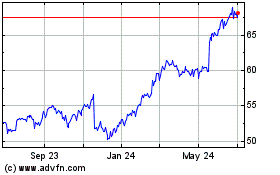

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

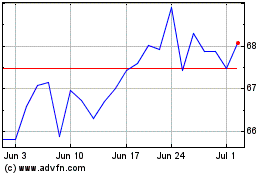

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024