Inventory Pullback a Drag on Logistics Spending

June 21 2016 - 9:29AM

Dow Jones News

By Paul Page

A year-long pullback in U.S. business inventories will likely

continue through the rest of 2016 as retailers and manufacturers

remain cautious amid uncertain demand and the prospects for higher

interest rates, according to a report on U.S. logistics.

The tight lid on inventories, a drag on U.S. economic growth in

the first quarter, comes as companies are paring back after

overstocking in recent years while they tried to adjust to changes

in consumer buying patterns, said the authors of the annual State

of Logistics report released Tuesday. The report was produced by

A.T. Kearney for the Council of Supply Chain Management

Professionals.

Inventories in previous years grew faster than the economy as a

whole, a trend that halted in 2015 as growth slowed and big

retailers like Wal-Mart Stores Inc. and Target Corp. scaled back,

said Sean Monahan, a partner at A.T. Kearney and the main author of

the report.

"We would expect to see inventories through the rest of the year

increase in line with GDP growth," Mr. Monahan said. "We won't see

a return to a 5% growth rate [for inventories] that we had been

seeing."

The inventory pullback has roiled the logistics sector.

It has hit transportation companies hard since they are holding

expensive assets that they added between 2011 and 2014. Lighter

volumes have led ship operators and trucking companies to slash

their prices, eating into profit margins. The trucking industry has

75,000 to 80,000 more trucks than companies need to move goods,

said Marc Althen, president of Penske Logistics, a sponsor of the

CSCMP report.

"As a carrier, you're either parking it or lowering your rate to

keep the trucks spinning," said Mr. Althen.

Logistics services companies -- which do not own transportation

equipment -- have fared better, and taken advantage of the lower

rates. And the move to get goods closer to cities and consumers in

response to the growth of online sales has fueled stronger earnings

at industrial real estate companies that manage warehouses.

Retailers began slowing down their inventory replenishment

around the middle of 2015 as consumer sales faltered. A rush of

goods following the resolution of labor strife at West Coast ports,

where enormous stacks of imports had piled up early in 2015, added

to a big mismatch between supply and demand.

A big correction last fall meant businesses ended up adding

barely more inventory overall last year than they had in 2014. The

CSCMP report showed total business inventories expanded by $60

billion, or just 0.2%, to $2.515 trillion in 2015 while nominal

gross domestic product grew by nearly $600 billion from the year

before.

Total business inventory as a percentage of GDP fell to 14% from

14.5% in each of the previous three years, and the lowest share of

GDP since 2010.

"When things slow down it takes time to adjust, and at the same

time when the economy picks up companies still try to be efficient

and burn off inventories," said Rick Camacho, vice president of

global supply chain operations at Hershey Co. "The supply chain is

a big ship and it takes a long time to slow it down and a long time

to get it moving again."

Mr. Monahan said a rising cost of capital has dampened

investment, with the inventory-carrying rate -- or the cost of

holding goods -- rising 5.1% last year.

One cloud on the horizon is a potential a Federal Reserve

interest rate increase later this year, which Mr. Monahan said

would further temper business investment.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

June 21, 2016 09:14 ET (13:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

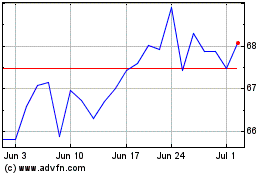

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

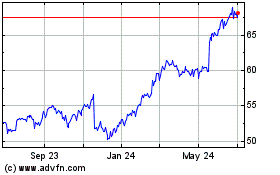

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024