Wal-Mart Cheers Investors With Revenue Growth, Upbeat Outlook--Update

May 19 2016 - 8:50AM

Dow Jones News

By Joshua Jamerson

Wal-Mart Stores Inc. on Thursday posted surprise revenue growth

in the first quarter and offered an upbeat view for the second,

bolstered by strength in its health and wellness segment.

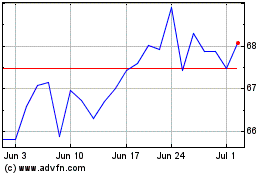

Shares of Wal-Mart jumped 8.1% to $68.25 in premarket trading,

as results were in contrast with several retailers that have

reported weaker results recently.

Wal-Mart said its sales were helped by strength in U.S. segments

such as health and wellness, apparel, and home and seasonal. More

scripts at its pharmacies, along with branded drug inflation, led

to mid-single digit comparable sales growth in the health and

wellness unit.

More than half of Wal-Mart's sales come from its grocery

business, which led analysts to believe the company could be

insulated from the difficult apparel environment. But its grocery

operations are also vulnerable to food deflation and pricing

competition; grocery sales declined by low single-digits during the

first quarter, as strong traffic in grocery was offset by

deflation.

Wal-Mart said its general merchandise sales rose by low-single

digits thanks to a "focus on basics."

The Bentonville, Ark., company has been spending heavily to get

customers back into its stores. It has worked to better stock

stores, improve efficiency and increase pay for its employees. But

Wal-Mart has warned that those efforts would dent profits this

fiscal year.

Indeed, profit slipped 7.8% in the first quarter, but it still

topped the company's expectations.

Wal-Mart's results stand out from a list of retailers with

disappointing starts to the year. On Wednesday, Target Corp.

reported that consumers pulled back on spending, with its chief

executive citing "an increasingly volatile consumer environment."

Soft results from department stores like Macy's Inc. and Nordstrom

Inc. illustrated shoppers' shift away from brick-and-mortar stores

and sparked declines across the retail sector.

Retailers have been closing weaker locations and investing in

e-commerce as consumers shift online shopping and fast-fashion

chains. But the moves haven't been enough to counter weak

demand.

Wal-Mart's operating, selling, general and administrative

expenses climbed 6.3% to $24.09 billion in the quarter, in part due

to efforts to beef up its online business.

"We are focused on building the e-commerce capabilities we need

to drive growth to a higher level and deliver the seamless shopping

experience for customers they desire," said Doug McMillon,

Wal-Mart's chief executive.

Off-price chain TJX Cos. and home-improvement stores like Home

Depot Inc. have reported healthy traffic and spending at their

locations, suggesting that consumers are willing to spend but are

being more selective about where.

In the first quarter, sales at Wal-Mart's existing U.S. stores

ticked up 1%, marking the seventh straight quarterly gain after a

long stretch of declines. Analysts polled by Consensus Metrix

expected 0.5% growth in the metric.

The number of people visiting Wal-Mart's stores rose 1.5%.

Over all, Wal-Mart reported a first-quarter profit of $3.08

billion, or 98 cents a share, down from $3.34 billion, or $1.03 a

share, a year earlier. Wal-Mart had forecast earnings of 80 cents

to 95 cents a share. Analysts anticipated 88 cents.

Revenue rose 0.9% to $115.9 billion, above the $113.2 billion

analysts polled by Thomson Reuters had forecast. Excluding currency

impacts, revenue rose 4%.

For the second quarter, the company said it expects earnings

between 95 cents and $1.08 a share. Analysts were expecting

second-quarter profit of 98 cents.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

May 19, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

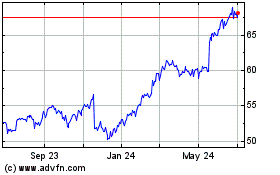

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024