Gross Revenues grew 10% YoY

IT Services Segment Revenue in US Dollar

terms grew by 7.2% YoY in constant currency

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) today

announced financial results under International Financial Reporting

Standards (IFRS) for its second quarter ended September 30,

2016.

Highlights of the

Results

- Gross Revenues were Rs 137.7 billion

($2.1 billion1), an increase of 10% YoY.

- Net Income2 was Rs 20.7 billion ($312

million1), a decline of 8% YoY.

- Non-GAAP constant currency IT Services

Segment Revenue in dollar terms grew 0.9% sequentially and grew

7.2% YoY.

- IT Services Segment Revenue was

$1,916.3 million, a sequential decrease of 0.8% and YoY increase of

4.6%.

- IT Services Segment Revenue in Rupee

terms was Rs 131.4 billion ($2.0 billion1), an increase of 9%

YoY.

- IT Services Segment Profits3 was Rs

23.4 billion ($352 million1), a decrease of 5% YoY.

- IT Services Margins4 was 17.8% for the

quarter, as compared to 17.8% for the quarter ended June 30,

2016.

Performance for the quarter ended

September 30, 2016

“We delivered Revenues in constant currency at the top end of

our guidance range,” said Abidali Z. Neemuchwala, Chief

Executive Officer and Member of the Board. “I am very excited

about Wipro’s acquisition of Appirio, a leader in cloud

applications especially across Salesforce and Workday

implementation services. This acquisition will establish Wipro’s

dominance in cloud application services and further strengthen

Wipro’s brand as a Digital Partner of choice.”

“We maintained margins in Q2 despite the impact of salary

increase for an incremental two months due to strong operational

improvements in automation-led productivity, offshoring and

utilization,” said Jatin Dalal, Chief Financial Officer. “As

we look forward, the demand environment is mixed in a seasonally

weak quarter affected by furloughs and lower number of working

days.”

Outlook for the Quarter ending December

31, 2016

We expect Revenues from our IT Services business to be in the

range of $ 1,916 million to $ 1,955 million*.

* Guidance is based on the following exchange rates: GBP/USD at

1.26, Euro/USD at 1.11, AUD/USD at 0.76, USD/INR at 67.01 and

USD/CAD at 1.31.

IT Services

The IT Services segment had a headcount of 174,238 as of

September 30, 2016.

Wipro has won a multi-year network management product sustenance

deal from a Tier-1 network equipment provider. The company has been

working with the client to optimize the total cost of ownership,

and this end-to-end ownership engagement further strengthens

Wipro’s relationship with the customer.

A global consumer electronics and technology major headquartered

in Europe has awarded an IT application managed services deal to

Wipro. As part of the project, Wipro will consolidate and optimize

the client’s IT application managed services through

hyper-automation using the Wipro HOLMES Artificial Intelligence

Platform™. The engagement will further strengthen Wipro’s existing

relationship with the customer.

Wipro has been awarded a three-year IT infrastructure services

contract by a prominent Australian oil and gas company with a

global presence. The client has chosen Wipro as their strategic

partner due to its proven capabilities in the infrastructure

services space and expertise in automation. Wipro will also be a

partner for the digital transformation of the client’s upstream

operations.

Wipro has won a multi-year managed services engagement with a

large Australian utilities business. The scope of the contract

includes Applications, Networks, End User Computing, Service Desk

and Data Centre Services. This engagement will see Wipro helping

the customer transition to a more scalable and sustainable cost

based model, which improves services and functional capabilities

through digital initiatives.

Wipro has won a multi-year managed services engagement with a

top U.S. Department Store Retailer to transform their Quality

Centre of Excellence. This deal will enable the client to realize

significant savings and achieve quicker ‘Go to Market’ through

transformation initiatives involving quality engineering and Wipro

IP-enabled cognitive automation and robots.

Wipro has won a multi-year engagement with The Highland Council,

UK to transform their core IT infrastructure and provide tablet

devices to school children. This program will empower the Council

to provide robust IT services and transform education in schools in

the region.

Digital highlights

“Service providers in the digital transformation space need to

develop a comprehensive set of capabilities to meet the new client

demand effectively. In this context, through strategic acquisitions

including Designit, investments in Wipro Digital and studios in key

client hubs, and a strong partner ecosystem, Wipro has developed

unique competencies that integrate technology and domain to

establish industry leading digital delivery capabilities,” said

Peter Bendor-Samuel, CEO, Everest Group.

Wipro will enable a global contract manufacturing company in its

journey of implementing the “SmartFactory” model through advanced

automation, machine learning, IoT and data analytics.

A leading provider for electricity distribution, automation and

energy management has engaged Wipro to help them develop new

business models through the intelligent application of their

software and entitlement management systems.

Wipro will enable a biopharmaceutical company transform the

online digital experience for its customers. Leveraging expertise

from its Digital, Designit, Digital Engineering and Connected

Enterprise Services teams, Wipro will deliver a consistent and

relevant experience across multiple websites for the company’s

customers.

A leader in the DIY (Do It Yourself) home space has chosen Wipro

and Designit as its partners to help the company define the vision,

a new value proposition, product road-map and design products for

its Connected Home segment.

Designit was asked by one of the world’s leading ICT solution

providers to define and design the next innovative application for

smart watches. The goal is to assist with developing realizable

next-generation functionalities for the product line management at

the client’s headquarters in Asia. The client seeks an innovative

state-of-the-art customization of Android Wear in regards to

application interfaces and the necessary programming.

Wipro has secured a Data Discovery Platform win at a western

Australian state government-owned corporation. This program will

help the organization understand where their predictive asset

maintenance capabilities currently lie, and provide a roadmap to

develop their analytics capabilities. Wipro’s Data Discovery

Platform will use the best of breed open source technologies and

leverage cognitive capabilities from Wipro HOLMES Artificial

Intelligence Platform™ to bring to life the hidden insights in

large and diverse data sets.

We have had more than 10 cloud application wins this quarter and

a few of the notable ones are as follows:

- Wipro was selected to implement a cloud

based Procure-to-Pay solution for a global leader in branded

lifestyle apparel, footwear and accessories.

- An American Chemicals Conglomerate

selected Wipro to define their CRM modernization roadmap using a

leading cloud CRM platform.

- A global marketing services firm has

chosen Wipro to manage and execute the campaigns of their customers

using leading marketing cloud platforms.

Delivery Excellence

“We wanted a partner who can think global and act local. Wipro

has displayed a deep understanding of our business priorities,

organization culture and the ability to challenge and innovate the

way of executing the business. Wipro is our trusted partner in this

journey and our journey will continue with Wipro in the future as

well,” said Serhan Ozhan, CIO, CLK Enerji.

“It is key for us in IT to provide consistent and reliable

services and we look to Wipro to help us do that. They bring best

in class practices to IT that we think we’ll be able to leverage

over the coming years. Our experience in dealing with Wipro is that

they have always been responsive. We trust them as a partner. They

are honest and a very high integrity company,” said Christopher

Krebs, Senior Vice President & CIO, Fruit of the Loom.

Wipro deployed an integrated retail solution across 550 stores

for a global retail major enabling central visibility of inventory,

price differentials, cash and sales forecast. The retail solution

led to the decommissioning of 10 legacy applications and helped

reduce stock outage situations by almost 90%, resulting in an

increased in-store customer satisfaction.

Awards and accolades

Gartner has identified Wipro Digital as a Representative

Provider of all five services - Business Model Innovation,

Cybersecurity and Digital Trust, Internet of Things,

Industry-Specific Disruptive Technologies and Organizational

Culture and Change Management in its Market Guide for Digital

Business Consulting Services.*

Wipro has been included in the Dow Jones Sustainability Index

(DJSI) – World and Emerging Markets for the seventh time in

succession.

Wipro has been cited as a "Leader" by technology global research

and advisory firm Forrester Research Inc. in its report, "The

Forrester WaveTM: Services Providers for Next-Generation Oracle

Application Projects, Q3 2016.

Wipro won the Teradata Epic Award for ICP Collaborative Revenue

category at Teradata Partners Conference & Expo 2016. The

Collaborative Revenue award recognizes the Integration and

Consulting Partners (ICP) who worked with Teradata to influence the

largest year-over-year order revenue growth for Teradata technology

and services.

Wipro has been named as a "Leader" in the report “IDC

MarketScape: Worldwide Oracle Implementation Services 2016 Vendor

Assessment”.

Wipro has been featured in the “Winner’s Circle” by HfS Research

in its 2016 blueprint report on Mortgage As-a-Service. HfS said

Wipro has one of the most progressive strategies for moving toward

Mortgage As-a-Service and is expanding market lead and vision by

integrating and building on valuable mortgage industry assets.

Wipro is rated as a “Leader" in the Everest Group PEAK Matrix

reports for Capital Markets BPO, Application Outsourcing and FAO

Service providers in 2016.

Wipro has been positioned in the "Winner's Circle" by HfS

Research in its 2016 blueprint report on Energy Operations. HfS

said Wipro is enabling new business models across the value chain

with strong capabilities in Digital, automation and domain

expertise.

*Gartner does not endorse any vendor, product or service

depicted in its research publications, and does not advise

technology users to select only those vendors with the highest

ratings or other designation. Gartner research publications consist

of the opinions of Gartner’s research organization and should not

be construed as statements of fact. Gartner disclaims all

warranties, expressed or implied, with respect to this research,

including any warranties of merchantability or fitness for a

particular purpose.

IT Products

- Revenue for the quarter ended September

30, 2016 was Rs 7.7 billion ($115 million1).

Please refer to the table at the end for reconciliation between

IFRS IT Services Revenue and IT Services Revenue on a non-GAAP

constant currency basis.

About Non-GAAP financial measures

This press release contains non-GAAP financial measures within

the meaning of Regulation G and Item 10(e) of Regulation S-K. Such

non-GAAP financial measures are measures of our historical or

future performance, financial position or cash flows that are

adjusted to exclude or include amounts that are excluded or

included, as the case may be, from the most directly comparable

financial measure calculated and presented in accordance with

IFRS.

The table at the end provides IT Services Revenue on a constant

currency basis, which is a non-GAAP financial measure that is

calculated by translating IT Services Revenue from the current

reporting period into U.S. dollars based on the currency conversion

rate in effect for the prior reporting period. We refer to growth

rates in constant currency so that business results may be viewed

without the impact of fluctuations in foreign currency exchange

rates, thereby facilitating period-to-period comparisons of our

business performance.

This non-GAAP financial measure is not based on any

comprehensive set of accounting rules or principles and should not

be considered a substitute for, or superior to, the most directly

comparable financial measure calculated in accordance with IFRS,

and may be different from non-GAAP measures used by other

companies. In addition to this non-GAAP measure, the financial

statements prepared in accordance with IFRS and the reconciliation

of these non-GAAP financial measures with the most directly

comparable IFRS financial measure should be carefully

evaluated.

Results for the quarter ended September 30, 2016, prepared

under IFRS, along with individual business segment reports, are

available in the Investors section of our website

www.wipro.com.

Quarterly Conference Call

We will hold an earnings conference call today at 07:15 p.m.

Indian Standard Time (09:45 a.m. U.S. Eastern Time) to discuss our

performance for the quarter. The audio from the conference call

will be available online through a web-cast and can be accessed at

the following link -

http://services.choruscall.eu/links/wipro161021.html

An audio recording of the management discussions and the

question and answer session will be available online and will be

accessible in the Investor Relations section of our website at

www.wipro.com.

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading

information technology, consulting and business process services

company that delivers solutions to enable its clients do business

better. Wipro delivers winning business outcomes through its deep

industry experience and a 360-degree view of “Business through

Technology.” By combining digital strategy, customer centric

design, advanced analytics and product engineering approach, Wipro

helps its clients create successful and adaptive businesses. A

company recognized globally for its comprehensive portfolio of

services, strong commitment to sustainability and good corporate

citizenship, Wipro has a dedicated workforce of over 170,000,

serving clients across 6 continents. For more information, please

visit www.wipro.com.

Forward-looking statements

The forward-looking statements contained herein represent

Wipro’s beliefs regarding future events, many of which are by their

nature, inherently uncertain and outside Wipro’s control. Such

statements include, but are not limited to, statements regarding

Wipro’s growth prospects, its future financial operating results,

and its plans, expectations and intentions. Wipro cautions readers

that the forward-looking statements contained herein are subject to

risks and uncertainties that could cause actual results to differ

materially from the results anticipated by such statements. Such

risks and uncertainties include, but are not limited to, risks and

uncertainties regarding fluctuations in our earnings, revenue and

profits, our ability to generate and manage growth, intense

competition in IT services, our ability to maintain our cost

advantage, wage increases in India, our ability to attract and

retain highly skilled professionals, time and cost overruns on

fixed-price, fixed-time frame contracts, client concentration,

restrictions on immigration, our ability to manage our

international operations, reduced demand for technology in our key

focus areas, disruptions in telecommunication networks, our ability

to successfully complete and integrate potential acquisitions,

liability for damages on our service contracts, the success of the

companies in which we make strategic investments, withdrawal of

fiscal governmental incentives, political instability, war, legal

restrictions on raising capital or acquiring companies outside

India, unauthorized use of our intellectual property, and general

economic conditions affecting our business and industry. Additional

risks that could affect our future operating results are more fully

described in our filings with the United States Securities and

Exchange Commission, including, but not limited to, Annual Reports

on Form 20-F. These filings are available at www.sec.gov. We may,

from time to time, make additional written and oral forward-looking

statements, including statements contained in the company’s filings

with the Securities and Exchange Commission and our reports to

shareholders. We do not undertake to update any forward-looking

statement that may be made from time to time by us or on our

behalf.

Wipro Limited and subsidiaries

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION

(Rupees in millions, except share and per share data, unless

otherwise stated)

As of March 31, As

of September 30, 2016 2016 2016

Convenience translation

into US dollar in millions (unaudited) - Refer

footnote 1

ASSETS

Goodwill 101,991 101,864 1,530 Intangible assets 15,841 14,479 217

Property, plant and equipment 64,952 69,103 1,038 Derivative assets

260 100 2 Investments 4,907 5,092 76 Non-current tax assets 11,751

11,938 179 Deferred tax assets 4,286 3,530 53 Other non-current

assets 15,828 16,773 252

Total non-current assets 219,816

222,879 3,347 Inventories 5,390 5,215 78 Trade receivables

100,976 101,170 1,520 Other current assets 32,894 32,245 484

Unbilled revenues 48,273 48,691 731 Investments 204,244 258,499

3,883 Current tax assets 7,812 8,131 122 Derivative assets 5,549

6,746 101 Cash and cash equivalents 99,049 55,167 829

Total

current assets 504,187 515,864 7,748

TOTAL ASSETS

724,003 738,743 11,095

EQUITY

Share capital 4,941 4,861 73 Share premium 14,642 427 6 Retained

earnings 425,106 452,925 6,803 Share based payment reserve 2,229

2,761 41 Other components of equity 18,242 22,353 335 Equity

attributable to the equity holders of the Company 465,160 483,327

7,258 Non-controlling interest 2,224 2,363 35

Total equity

467,384 485,690 7,293

LIABILITIES

Long - term loans and borrowings 17,361 18,004 270 Deferred tax

liabilities 5,108 4,436 67 Derivative liabilities 119 26 -

Non-current tax liabilities 8,231 7,795 117 Other non-current

liabilities 7,225 7,269 109 Provisions 14 14 -

Total non-current

liabilities 38,058 37,544 563 Loans, borrowings and bank

overdrafts 107,860 106,600 1,601 Trade payables and accrued

expenses 68,187 68,487 1,031 Unearned revenues 18,076 15,053 226

Current tax liabilities 7,015 8,810 132 Derivative liabilities

2,340 2,553 38 Other current liabilities 13,821 12,820 193

Provisions 1,262 1,186 18

Total current liabilities 218,561

215,509 3,239

TOTAL LIABILITIES 256,619 253,053 3,802

TOTAL EQUITY AND LIABILITIES 724,003 738,743

11,095

Wipro Limited and subsidiaries

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF INCOME (Rupees in

millions, except share and per share data, unless otherwise stated)

Three Months ended September 30, Six

Months ended September 30, 2015 2016 2016

2015 2016 2016

Conveniencetranslation

into US dollar in millions(unaudited) Refer

footnote 1

Conveniencetranslation

into US dollar in millions(unaudited) Refer

footnote 1

Gross revenues 125,135 137,657 2,068 247,511 273,649 4,111 Cost of

revenues (85,824 ) (97,808 ) (1,469 ) (170,611 ) (194,197 ) (2,917

)

Gross profit 39,311 39,849 599

76,900 79,452 1,194 Selling and

marketing expenses (8,708 ) (9,614 ) (144 ) (16,752 ) (19,755 )

(297 ) General and administrative expenses (6,887 ) (8,545 ) (128 )

(13,780 ) (16,144 ) (242 ) Foreign exchange gains/(losses), net 533

1,281 19 1,863 2,265 34

Results from operating

activities 24,249 22,971 346 48,231

45,818 689 Finance expenses (1,589 ) (1,428 )

(21 ) (2,875 ) (2,764 ) (42 ) Finance and other income 6,318 5,105

77 11,653 10,305 155

Profit before tax 28,978

26,648 402 57,009 53,359 802

Income tax expense (6,515 ) (5,909 ) (89 ) (12,473 )

(12,031 ) (181 )

Profit for the period

22,463 20,739 313

44,536 41,328 621

Attributable to: Equity holders of the company 22,409 20,672

312 44,326 41,190 619 Non-controlling interest 54 67

1 210 138 2

Profit for the period 22,463 20,739

313 44,536 41,328 621

Earnings per equity share:

Attributable to equity share holders of

the company

Basic 9.12 8.54 0.13 18.05 16.89 0.25 Diluted 9.10 8.52 0.13 18.01

16.84 0.25

Weighted average number of equity shares

used in computing earnings per equity share

Basic 2,456,285,585 2,420,621,137 2,420,621,137 2,456,223,408

2,439,012,817 2,439,012,817 Diluted 2,461,507,934 2,426,812,644

2,426,812,644 2,460,985,436 2,445,466,651 2,445,466,651

Additional Information Segment Revenue IT Services

Business Units BFSI 32,252 33,583 503 63,273 67,213 1,011 HLS

13,746 20,883 314 26,734 40,814 613 CBU 19,510 20,708 311 38,210

41,433 622 ENU 17,664 16,881 254 35,240 34,237 514 MNT 28,146

29,463 443 55,109 59,001 886 COMM 9,110 9,848

148 17,635 19,760 297

IT SERVICES TOTAL 120,428 131,366 1,973 236,201 262,458

3,943 IT PRODUCTS 5,442 7,666 115 13,616 13,596 204 RECONCILING

ITEMS (202 ) (94 ) (1 ) (443 ) (140 ) (2 )

TOTAL 125,668 138,938 2,087

249,374 275,914 4,145

Segment

Result IT Services Business Units BFSI 6,882 6,379 96

13,829 13,373 201 HLS 3,023 3,234 49 5,777 6,090 91 CBU 3,238 3,584

54 6,320 7,359 111 ENU 3,272 3,443 52 6,859 6,468 97 MNT 6,370

6,175 93 12,203 12,129 182 COMM 1,554 1,594 24 2,801 3,096 47

OTHERS - - - - UNALLOCATED 277 (1,037 ) (16 )

808 (1,874 ) (28 )

TOTAL IT SERVICES 24,616

23,372 352 48,597 46,641 701 IT PRODUCTS (244 ) (298 ) (4 ) (141 )

(666 ) (10 ) RECONCILING ITEMS (123 ) (103 ) (2 )

(225 )

(157

) (2 ) TOTAL 24,249 22,971 346

48,231 45,818 689 FINANCE

EXPENSE (1,589 ) (1,428 ) (21 ) (2,875 ) (2,764 ) (42 ) FINANCE AND

OTHER INCOME 6,318 5,105 77

11,653 10,305 155 PROFIT BEFORE TAX

28,978 26,648 402 57,009 53,359 802 INCOME TAX EXPENSE

(6,515 ) (5,909 ) (89 ) (12,473 ) (12,031 ) (181 )

PROFIT FOR THE PERIOD 22,463

20,739 313

44,536

41,328 621 Segment result

represents operating profits of the segments and dividend income

and gains or losses (net) relating to strategic investments, which

are presented within “Finance and other income” in the statement of

Income.

The Company is organized by the following

operating segments; IT Services and IT Products.

The IT Services segment primarily consists

of IT Service offerings to customers organized by industry

verticals. Effective April 1, 2016, we realigned our industry

verticals. The Communication Service Provider business unit was

regrouped from the former GMT industry vertical into a new industry

vertical named “Communications”. The Media business unit from the

former GMT industry vertical has been realigned with the former

RCTG industry vertical which has been renamed as “Consumer Business

Unit” industry vertical. Further, the Network Equipment Provider

business unit of the former GMT industry vertical has been

realigned with the Manufacturing industry vertical to form the

“Manufacturing and Technology” industry vertical. The revised

industry verticals are as follows: Finance Solutions (BFSI),

Healthcare, Lifesciences & Services (HLS), Consumer (CBU),

Energy, Natural Resources & Utilities (ENU), Manufacturing

& Technology (MNT), Communications (COMM). IT Services segment

also includes Others which comprises dividend income and gains or

losses (net) relating to strategic investments, which are presented

within “Finance and other income” in the statement of Income. Key

service offerings to customers includes software application

development and maintenance, research and development services for

hardware and software design, business application services,

analytics, consulting, infrastructure outsourcing services and

business process services. In the IT Products segment, the Company

is a value added reseller of desktops, servers, notebooks, storage

products, networking solutions and packaged software for leading

international brands. In certain total outsourcing contracts of the

IT Services segment, the Company delivers hardware products,

software licenses and other related deliverables.

Reconciliation of

Non-GAAP Constant Currency IT Services Revenue to IT Services

Revenue as per IFRS ($MN)

Three Months ended September 30,

2016 Three Months ended September 30, 2016 IT Services

Revenue as per IFRS $ 1,916.3 IT Services Revenue as per IFRS $

1,916.3 Effect of Foreign currency exchange movement $ 32.3

Effect of Foreign currency exchange movement $ 47.2 Non-GAAP

Constant Currency IT Services Revenue based on previous quarter

exchange rates $ 1,948.6 Non-GAAP Constant Currency IT Services

Revenue based on previous year exchange rates $ 1,963.5

- For the convenience of the reader, the

amounts in Indian Rupees in this release have been translated into

United States Dollars at the noon buying rate in New York City on

September 30, 2016, for cable transfers in Indian rupees, as

certified by the Federal Reserve Board of New York, which was US

$1= Rs 66.58. However, the realized exchange rate in our IT

Services business segment for the quarter ended September 30, 2016

was US$1= Rs 68.55

- Net Income refers to ‘Profit for the

period attributable to equity holders of the Company’

- Segment Profit refers to segment

results. Effective April 1, 2016, the segment results is measured

after including the amortization charge for acquired intangibles to

the respective segments. Such costs were classified under

reconciling items until the fiscal year ended March 31, 2016.

Comparative information has been restated to give effect to the

same.

- Margins have been computed based on the

change as listed in footnote 3. above

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161021005601/en/

Wipro LimitedContact for Investor RelationsPavan N

RaoPhone: +91-80-4672 6143pavan.rao@wipro.comorAbhishek Kumar

JainPhone: +1 978 826 4700abhishekkumar.jain@wipro.comorContact

for Media & PressVipin NairPhone: +91-80-3991

6450vipin.nair1@wipro.com

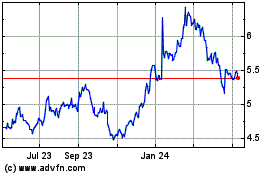

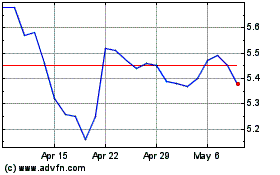

Wipro (NYSE:WIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wipro (NYSE:WIT)

Historical Stock Chart

From Apr 2023 to Apr 2024