UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of January 2016

Commission File Number 001-16139

Wipro Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Karnataka, India

(Jurisdiction of incorporation or organization)

Doddakannelli

Sarjapur

Road

Bangalore, Karnataka 560035, India +91-80-2844-0011

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ¨ No

x

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a

Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No

x

Note: Regulation S-T Rule 101(b)(7) only permits the submission in

paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not

been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DISCLOSURE OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

We hereby furnish the Commission with copies of the following information concerning our public disclosures regarding our results of

operations for the quarter ended December 31, 2015. The following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On January 18, 2016, we announced our results of operations for the three months and nine months ended December 31, 2015. We issued

a press release announcing our results under IFRS, copy of which is attached to this Form 6-K as Item 99.1.

On January 18,

2016, we held a press conference to announce our results. The presentation made by the registrant at the press conference is attached to this Form 6-K as Item 99.2.

We placed advertisements in certain Indian newspapers concerning our results of operations for the three months and nine months ended

December 31, 2015 under IFRS. A copy of the form of this advertisement is attached to this Form 6-K as Item 99.3.

We make

available on our website the Condensed Consolidated Interim Financial Statements as of and for the three months ended December 31, 2015 under IFRS. A copy of such financial statements are attached to this Form 6-K as Item 99.4.

We filed with stock exchanges in India a statement of statutorily audited consolidated financial results for the quarter and nine months ended

December 31, 2015 under IFRS. A copy of such financial statements are attached to this Form 6-K as Item 99.5.

We filed with

stock exchanges in India a datasheet containing operating metrics for the quarter ended December 31, 2015. A copy of such data sheet is attached to this Form 6-K as Item 99.6.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly organized.

|

| WIPRO LIMITED |

|

| /s/ Jatin Pravinchandra Dalal |

|

| Jatin Pravinchandra Dalal |

| Chief Financial Officer |

Dated: January 21, 2016

INDEX TO EXHIBITS

|

|

|

| Item |

|

|

|

|

| 99.1 |

|

IFRS Press Release |

|

|

| 99.2 |

|

Presentation made by the Company at the Press Conference on January 18, 2016 |

|

|

| 99.3 |

|

Form of Advertisement Placed in Indian Newspapers |

|

|

| 99.4 |

|

Consolidated Interim Financial Statements under IFRS |

|

|

| 99.5 |

|

Statutorily Audited Consolidated Financial Results filed with stock exchanges in India |

|

|

| 99.6 |

|

Data sheet containing operating metrics filed with stock exchanges in India |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Results for the quarter ended December 31, 2015 under IFRS

Gross Revenues grew 7% YoY

Bangalore,

India and East Brunswick, New Jersey, USA – January 18, 2016 — Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) today announced financial results under International Financial Reporting Standards (IFRS) for its third

quarter ended December 31, 2015.

Highlights of the Results:

| • |

|

Wipro Limited Gross Revenues were

128.6 billion ($1.9 billion1), an increase of 7% YoY.

128.6 billion ($1.9 billion1), an increase of 7% YoY. |

| • |

|

IT Services Segment Non-GAAP constant currency Revenue in dollar terms grew 1.4% sequentially and grew 6.3% YoY. IT Services Segment Revenue was $1,838.3 million, a sequential increase of 0.3%. |

| • |

|

IT Services Segment Revenue was

123.1 billion ($1,861 million1), an increase of 9% YoY.

123.1 billion ($1,861 million1), an increase of 9% YoY. |

| • |

|

Net Income2 was

22.3 billion ($338 million1), an increase of 2% YoY.

22.3 billion ($338 million1), an increase of 2% YoY. |

| • |

|

IT Services Segment Profit3 was

24.8 billion ($375 million1).

24.8 billion ($375 million1). |

| • |

|

IT Services Segment Margins was 20.2%. |

| • |

|

Headcount increased by 2,268 to 170,664. |

| • |

|

Wipro declared an interim dividend of

5 ($0.08) per share /ADS.

5 ($0.08) per share /ADS. |

Performance for the quarter ended December 31, 2015

T K Kurien, Member of the Board & Chief Executive Officer of Wipro, said – “We delivered Revenues in line with our guidance. We saw a

pick-up in large deal closures led by Global Infrastructure Services. It is becoming increasingly clear that customers want to simplify operations and optimize their IT spend while investing in Digital to transform their business. We are

well-positioned to take advantage of this trend.”

Abidali Z. Neemuchwala, Chief Executive Officer-Designate of Wipro, said –

“We are focused on driving market share growth in our core businesses through integrated domain and technology services, while investing for the future in building differentiated Digital capabilities. We will leverage our strong culture of

innovation and extremely talented employee pool to build compelling value propositions for our customers.”

Jatin Dalal, Chief Financial Officer

of Wipro, said – “During the quarter, we have built competitive differentiation through the acquisition of two high-potential companies – cellent and Viteos. The impact on revenues from the Chennai floods were minimized

significantly by strong execution of our robust Business Continuity Plans (BCP). The additional expenses incurred in deploying BCP impacted operating margins for the quarter.”

| 1. |

For the convenience of the reader, the amounts in Indian Rupees in this release have been translated into United States Dollars at the noon buying rate in New York City on December 31, 2015, for cable transfers in

Indian rupees, as certified by the Federal Reserve Board of New York, which was US $1=

66.19. However, the realized exchange rate in our IT Services business segment for the quarter ended December 31, 2015 was US$1=

66.19. However, the realized exchange rate in our IT Services business segment for the quarter ended December 31, 2015 was US$1=

66.99

66.99 |

| 2. |

Refers to ‘Profit for the period attributable to equity holders of the company’ |

| 3. |

Refers to Segment Results |

Outlook for the Quarter ending March 31, 2016

We expect Revenues from our IT Services business to be in the range of $ 1,875 million to $1,912 million*.

| * |

Guidance is based on the following exchange rates: GBP/USD at 1.50, Euro/USD at 1.07, AUD/USD at 0.72, USD/INR at 66.13 and USD/CAD at 1.37 |

IT Services

The IT Services segment had a

headcount of 170,664 as of December 31, 2015. We added 39 new customers during the quarter.

Effective January 1, 2016, Wipro completed the

transaction announced on December 2, 2015 to acquire cellent AG, a leading IT consulting and software services company in the DACH region of Germany, Austria and Switzerland.

On December 23, 2015, Wipro announced that it has signed a definitive agreement to acquire Viteos Group, a BPaaS provider for the Alternative Investment

Management Industry.

Wipro sustained its momentum in winning Large Deals globally as described below:

Wipro has entered into a multi-year global infrastructure support engagement with one of the largest medical devices companies in the world. Wipro will

standardize and simplify the customer’s IT infrastructure across multiple service lines and in over 90 countries.

A leading global nutrition, health

and wellness company has selected Wipro to enable the migration of a significant portion of its global IT applications estate to a hybrid cloud. As part of the engagement, Wipro will provide IaaS (Infrastructure as a Service), PaaS (Platform as a

Service), an integrated hardware-software-services stack, and billing-metering-chargeback in a completely outcome-based model.

A large global retailer

has selected Wipro as its quality engineering partner. Wipro will help develop a new operating and financial model that will allow the customer to accurately forecast its quality engineering spends and optimize costs, while driving continuous

improvements in the quality and time-to-market of its offerings.

Wipro has won a large contract from a European general insurance multinational for

provisioning and managing the company’s infrastructure.

A leading security solutions manufacturer, headquartered in the Nordic region, has selected

Wipro to transform its IT infrastructure. As part of the five-year agreement, Wipro will leverage its Boundaryless Datacenter offering and will consolidate the customer’s existing data centers and implement a cloud-based-services model,

including IaaS (Infrastructure as a Service) and PaaS (Platform as a Service).

An Australia-headquartered manufacturing sector customer has awarded a

five-year strategic, IT-as-a-service contract to Wipro. Wipro will have the end-to-end responsibility of running the customer’s IT operations and enabling the transformation of the existing IT estate to a next-generation digital-ready

landscape. The new consumption-based model will enable the customer to be more agile, reliable and competitive while launching new products and services.

Digital highlights

Our Digital capability

combining design, engineering and analytics is seeing traction in the marketplace. Unique capabilities of Designit combined with Wipro’s technological prowess is driving synergistic deal wins.

Wipro has been selected to help a global bank establish and operate its new digital platform, across 50 markets.

With global scale and a blend of strategy, design and engineering capabilities, Wipro’s agile teams will help support consistent customer experience, underpinned by continuous delivery across this new digital platform. Wipro will reinvent the

onboarding process for customers, help improve sales conversion rates and reduce operational costs.

Wipro has won a multi-year deal from a large bank to

enable omni-channel self-service by digitizing service processes and leveraging new age digital technologies. This will help the bank provide superior customer experience while reducing costs, in the form of lower call volumes.

Wipro will be augmenting the in-house team of a market leader in the automotive space, with telematics domain skills and advanced engineering expertise for

their telematics program.

Designit has been selected by a leading South American bank to work on designing an entirely new banking concept and

experience, targeted to create the next-generation banking experience for customers who are usually not attracted to traditional banking offerings anymore.

For a major German telecommunications brand, Designit has been assigned to create future smart Product-Service-Experiences using artificial intelligence and

similar emerging technologies.

For a leading European energy provider, Designit has been selected to design an innovation process to better facilitate

the company’s investments into technology start-ups and to effectively drive the integration of acquired start-ups into the client’s own organizational portfolio.

Cloud highlights

Our Cloud applications business

is seeing a good traction in the market. In the quarter ending December 31, 2015 we engaged with several clients to design and deploy their enterprise processes leveraging industry leading SaaS products. A few marquee engagements include Cloud

CRM processes rationalization for a UK-based gas and utility major, simplification of lead & opportunity management processes for a leading US based equipment rental company, modernization of a B2B order management system for a leading

chemicals supplier company, design and deployment of recruitment processes for a business process outsourcing enterprise, implementation of performance and goal management processes for an American satellite service provider and transforming the

source-to-pay process for an global pharmaceutical and consumer packaged goods major.

Wipro has also partnered with Apttus, the category-defining

Quote-to-Cash cloud solution provider, to deliver best-in-class Contract Lifecycle Management (CLM), Configure-Price-Quote (CPQ) & Revenue Management solutions to clients across industries.

Awards and accolades

Wipro continued to lead the

‘Global Engineering and R&D Service Providers (GSPR) Rating 2015’ by Zinnov Management Consulting for the sixth consecutive year. The Zinnov study evaluated more than 75 R&D service providers across the world in 15 major industry

segments across key parameters like product development capabilities & innovation, client relationships, human capital, financials, ecosystem linkages, infrastructure, and business sustainability.

Wipro has been positioned as a “Leader” by Forrester Research Inc, in its report ‘The Forrester Wave™: Global Workplace Services, Q4

2015’. The report cites Wipro’s relative strength in infrastructure services delivery, well-balanced staff distribution across EMEA, North America and Asia Pacific, highest overall customer reference scores of any supplier evaluated in the

analysis, strong customer value proposition, and compelling vision for workplace services.

Wipro has been positioned as a “Leader” by in the IDC MarketScape: Worldwide Life Science Manufacturing

and Supply Chain 2015 vendor assessment for services in all the 3 service categories of strategic consulting, ITO and BPO.

Wipro has been recognised as a

“Leader” by leading global analyst firm Everest Group, in the Healthcare Payer Digital IT Services PEAK Matrix Assessment 2015. This reaffirms our growing capabilities in the Healthcare Digital space.

Wipro has also been featured as a “Star Performer” in the Everest Group Healthcare Provider IT Services PEAK Matrix Assessment 2015. This reflects

Wipro’s large scale and deeper client relationships, technology capability and investments in tools, platforms, and a global delivery presence in the Healthcare Provider space.

Wipro has been recognised as a “Leader” in the Gartner Magic Quadrant for Application Testing Services, Worldwide for the second consecutive year.

Wipro has been positioned in the ‘Winner’s Circle’ of HfS Blueprint Report on Trust-as-a-Service 2015. The report covers the market view

of Digital Trust and Security Framework, the Digital Trust Maturity Scale, and the As-a-Service Economy.

Wipro has won 8 awards at the seventh Annual

Golden Bridge Business and Innovation Awards Ceremony including the Grand Trophy Award for being the overall winner with maximum impact. Wipro was recognized for its innovations in API Management and Solutions, Information Technology

(Software), Mobile Innovative Products or Services, Business Process Management and Application Development.

IT Products

| • |

|

Our IT Products Segment delivered Revenue of

6.5 billion ($98 million1) for the quarter ended December 31, 2015

6.5 billion ($98 million1) for the quarter ended December 31, 2015 |

Please refer to the table on page 7 for reconciliation between IFRS IT Services Revenue and IT Services Revenue on a non-GAAP constant currency basis.

About Non-GAAP financial measures

This press release

contains non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that are adjusted

to exclude or include amounts that are excluded or included, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The table on page 7 provides IT Services Revenue on a constant currency basis, which is a non-GAAP financial measure that is calculated by translating IT

Services Revenue from the current reporting period into U.S. dollars based on the currency conversion rate in effect for the prior reporting period. We refer to growth rates in constant currency so that business results may be viewed without the

impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance.

This non-GAAP

financial measure is not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, the most directly comparable financial measure calculated in accordance with IFRS, and may be

different from non-GAAP measures used by other companies. In addition to this non-GAAP measure, the financial statements prepared in accordance with IFRS and the reconciliation of these non-GAAP financial measures with the most directly comparable

IFRS financial measure should be carefully evaluated.

Results for the quarter ended December 31, 2015, prepared under IFRS, along with individual business

segment reports, are available in the Investors section of our website www.wipro.com.

Quarterly Conference Call

We will hold an earnings conference call today at 11:00 a.m. Indian Standard Time (12:30 a.m. US Eastern Time) to discuss our performance for the quarter. An

audio recording of the management discussions and the question and answer session will be available online and will be accessible in the Investor Relations section of our website at www.wipro.com.

About Wipro Limited (NYSE: WIT)

Wipro Ltd. (NYSE:WIT) is

a leading information technology, consulting and business process services company that delivers solutions to enable its clients do business better. Wipro delivers winning business outcomes through its deep industry experience and a 360 degree view

of “Business through Technology.” By combining digital strategy, customer centric design, advanced analytics and product engineering approach, Wipro helps its clients create successful and adaptive businesses. A company recognized globally

for its comprehensive portfolio of services, strong commitment to sustainability and good corporate citizenship, Wipro has a dedicated workforce of over 160,000, serving clients in 175+ cities across 6 continents.

For more information, please visit www.wipro.com

|

|

|

|

|

| Contact for Investor Relations |

|

Contact for Media & Press |

| Pavan N Rao |

|

Abhishek Kumar Jain |

|

Vipin Nair |

| Phone: +91-80-4672 6143 |

|

Phone: +1 978 826 4700 |

|

Phone: +91-98450 14036 |

| pavan.rao@wipro.com |

|

abhishekkumar.jain@wipro.com |

|

vipin.nair1@wipro.com |

Forward-looking statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain

and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, and its plans, expectations and intentions. Wipro cautions readers that

the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited

to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability

to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for

technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make

strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property, and general economic

conditions affecting our business and industry. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual

Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange

Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

# # #

(Tables to follow)

Wipro limited and subsidiaries

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION

(Rupees in millions, except share and per share data, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of March 31, |

|

|

As of December 31, |

|

| |

|

2015 |

|

|

2015 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

Convenience

translation into US

dollar in millions

(unaudited) - Refer

footnote 1 on Page 1 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

68,078 |

|

|

|

75,361 |

|

|

|

1,139 |

|

| Intangible assets |

|

|

7,931 |

|

|

|

8,274 |

|

|

|

125 |

|

| Property, plant and equipment |

|

|

54,206 |

|

|

|

57,360 |

|

|

|

867 |

|

| Derivative assets |

|

|

736 |

|

|

|

237 |

|

|

|

4 |

|

| Available for sale investments |

|

|

3,867 |

|

|

|

4,391 |

|

|

|

66 |

|

| Non-current tax assets |

|

|

11,409 |

|

|

|

11,551 |

|

|

|

175 |

|

| Deferred tax assets |

|

|

2,945 |

|

|

|

3,850 |

|

|

|

58 |

|

| Other non-current assets |

|

|

14,369 |

|

|

|

13,718 |

|

|

|

207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

163,541 |

|

|

|

174,742 |

|

|

|

2,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventories |

|

|

4,849 |

|

|

|

6,095 |

|

|

|

92 |

|

| Trade receivables |

|

|

91,531 |

|

|

|

99,959 |

|

|

|

1,510 |

|

| Other current assets |

|

|

73,359 |

|

|

|

97,751 |

|

|

|

1,477 |

|

| Unbilled revenues |

|

|

42,338 |

|

|

|

45,662 |

|

|

|

690 |

|

| Available for sale investments |

|

|

53,908 |

|

|

|

151,651 |

|

|

|

2,291 |

|

| Current tax assets |

|

|

6,490 |

|

|

|

8,371 |

|

|

|

126 |

|

| Derivative assets |

|

|

5,077 |

|

|

|

3,486 |

|

|

|

53 |

|

| Cash and cash equivalents |

|

|

158,940 |

|

|

|

89,973 |

|

|

|

1,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

436,492 |

|

|

|

502,948 |

|

|

|

7,598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

|

600,033 |

|

|

|

677,690 |

|

|

|

10,239 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

4,937 |

|

|

|

4,941 |

|

|

|

75 |

|

| Share premium |

|

|

14,031 |

|

|

|

14,532 |

|

|

|

220 |

|

| Retained earnings |

|

|

372,248 |

|

|

|

418,176 |

|

|

|

6,318 |

|

| Share based payment reserve |

|

|

1,312 |

|

|

|

1,950 |

|

|

|

29 |

|

| Other components of equity |

|

|

15,454 |

|

|

|

16,968 |

|

|

|

256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity attributable to the equity holders of the Company |

|

|

407,982 |

|

|

|

456,567 |

|

|

|

6,898 |

|

| Non-controlling interest |

|

|

1,646 |

|

|

|

2,035 |

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

409,628 |

|

|

|

458,602 |

|

|

|

6,929 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Long - term loans and borrowings |

|

|

12,707 |

|

|

|

16,427 |

|

|

|

248 |

|

| Deferred tax liabilities |

|

|

3,240 |

|

|

|

3,379 |

|

|

|

51 |

|

| Derivative liabilities |

|

|

71 |

|

|

|

50 |

|

|

|

1 |

|

| Non-current tax liabilities |

|

|

6,695 |

|

|

|

7,397 |

|

|

|

112 |

|

| Other non-current liabilities |

|

|

3,658 |

|

|

|

7,296 |

|

|

|

110 |

|

| Provisions |

|

|

5 |

|

|

|

15 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

26,376 |

|

|

|

34,564 |

|

|

|

522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans and borrowings and bank overdrafts |

|

|

66,206 |

|

|

|

81,501 |

|

|

|

1,231 |

|

| Trade payables and accrued expenses |

|

|

58,745 |

|

|

|

61,918 |

|

|

|

935 |

|

| Unearned revenues |

|

|

16,549 |

|

|

|

19,122 |

|

|

|

289 |

|

| Current tax liabilities |

|

|

8,036 |

|

|

|

7,209 |

|

|

|

109 |

|

| Derivative liabilities |

|

|

753 |

|

|

|

908 |

|

|

|

14 |

|

| Other current liabilities |

|

|

12,223 |

|

|

|

12,622 |

|

|

|

191 |

|

| Provisions |

|

|

1,517 |

|

|

|

1,244 |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

164,029 |

|

|

|

184,524 |

|

|

|

2,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

190,405 |

|

|

|

219,088 |

|

|

|

3,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

|

600,033 |

|

|

|

677,690 |

|

|

|

10,239 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wipro limited and subsidiaries

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF INCOME

(Rupees in millions, except share and per share data, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months ended December 31, |

|

|

Nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

Convenience

translation into US

dollar in millions

(unaudited)- Refer

footnote 1 on Page 1 |

|

|

|

|

|

|

|

|

Convenience

translation into US

dollar in millions

(unaudited) - Refer

footnote 1 on Page 1 |

|

| Gross revenues |

|

|

119,929 |

|

|

|

128,605 |

|

|

|

1,943 |

|

|

|

348,125 |

|

|

|

376,116 |

|

|

|

5,682 |

|

| Cost of revenues |

|

|

(82,867 |

) |

|

|

(90,270 |

) |

|

|

(1,364 |

) |

|

|

(238,675 |

) |

|

|

(260,881 |

) |

|

|

(3,941 |

) |

| Gross profit |

|

|

37,062 |

|

|

|

38,335 |

|

|

|

579 |

|

|

|

109,450 |

|

|

|

115,235 |

|

|

|

1,741 |

|

| Selling and marketing expenses |

|

|

(7,524 |

) |

|

|

(8,362 |

) |

|

|

(126 |

) |

|

|

(22,709 |

) |

|

|

(25,114 |

) |

|

|

(379 |

) |

| General and administrative expenses |

|

|

(6,426 |

) |

|

|

(7,010 |

) |

|

|

(106 |

) |

|

|

(19,217 |

) |

|

|

(20,710 |

) |

|

|

(313 |

) |

| Foreign exchange gains/(losses), net |

|

|

922 |

|

|

|

911 |

|

|

|

14 |

|

|

|

3,343 |

|

|

|

2,774 |

|

|

|

42 |

|

| Results from operating activities |

|

|

24,034 |

|

|

|

23,874 |

|

|

|

361 |

|

|

|

70,867 |

|

|

|

72,185 |

|

|

|

1,091 |

|

| Finance expenses |

|

|

(810 |

) |

|

|

(1,423 |

) |

|

|

(21 |

) |

|

|

(2,687 |

) |

|

|

(4,298 |

) |

|

|

(65 |

) |

| Finance and other income |

|

|

5,035 |

|

|

|

6,227 |

|

|

|

94 |

|

|

|

14,383 |

|

|

|

17,663 |

|

|

|

267 |

|

| Profit before tax |

|

|

28,259 |

|

|

|

28,678 |

|

|

|

434 |

|

|

|

82,563 |

|

|

|

85,550 |

|

|

|

1,293 |

|

| Income tax expense |

|

|

(6,228 |

) |

|

|

(6,248 |

) |

|

|

(95 |

) |

|

|

(18,369 |

) |

|

|

(18,679 |

) |

|

|

(282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

22,031 |

|

|

|

22,430 |

|

|

|

339 |

|

|

|

64,194 |

|

|

|

66,871 |

|

|

|

1,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the company |

|

|

21,928 |

|

|

|

22,341 |

|

|

|

338 |

|

|

|

63,808 |

|

|

|

66,572 |

|

|

|

1,006 |

|

| Non-controlling interest |

|

|

103 |

|

|

|

89 |

|

|

|

1 |

|

|

|

386 |

|

|

|

299 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

22,031 |

|

|

|

22,430 |

|

|

|

339 |

|

|

|

64,194 |

|

|

|

66,871 |

|

|

|

1,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per equity share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to equity share holders of the company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

8.92 |

|

|

|

9.09 |

|

|

|

0.14 |

|

|

|

25.97 |

|

|

|

27.10 |

|

|

|

0.41 |

|

| Diluted |

|

|

8.88 |

|

|

|

9.07 |

|

|

|

0.14 |

|

|

|

25.85 |

|

|

|

27.05 |

|

|

|

0.41 |

|

| Weighted average number of equity shares used in computing earnings per equity share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

2,457,766,859 |

|

|

|

2,457,022,905 |

|

|

|

2,457,022,905 |

|

|

|

2,457,491,867 |

|

|

|

2,456,551,992 |

|

|

|

2,456,551,992 |

|

| Diluted |

|

|

2,469,323,243 |

|

|

|

2,462,220,926 |

|

|

|

2,462,220,926 |

|

|

|

2,468,262,835 |

|

|

|

2,461,282,411 |

|

|

|

2,461,282,411 |

|

| Additional Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IT Services Business Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BFSI |

|

|

29,177 |

|

|

|

32,322 |

|

|

|

489 |

|

|

|

85,653 |

|

|

|

95,595 |

|

|

|

1,444 |

|

| HLS |

|

|

13,247 |

|

|

|

14,719 |

|

|

|

222 |

|

|

|

36,713 |

|

|

|

41,453 |

|

|

|

626 |

|

| RCTG |

|

|

16,005 |

|

|

|

19,158 |

|

|

|

289 |

|

|

|

45,951 |

|

|

|

54,650 |

|

|

|

826 |

|

| ENU |

|

|

18,637 |

|

|

|

17,708 |

|

|

|

268 |

|

|

|

53,792 |

|

|

|

52,949 |

|

|

|

800 |

|

| MFG |

|

|

20,718 |

|

|

|

22,683 |

|

|

|

343 |

|

|

|

59,721 |

|

|

|

66,769 |

|

|

|

1,009 |

|

| GMT |

|

|

15,661 |

|

|

|

16,557 |

|

|

|

250 |

|

|

|

45,933 |

|

|

|

47,932 |

|

|

|

724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IT SERVICES TOTAL |

|

|

113,445 |

|

|

|

123,147 |

|

|

|

1,861 |

|

|

|

327,763 |

|

|

|

359,348 |

|

|

|

5,429 |

|

| IT PRODUCTS |

|

|

7,740 |

|

|

|

6,503 |

|

|

|

98 |

|

|

|

24,552 |

|

|

|

20,119 |

|

|

|

304 |

|

| RECONCILING ITEMS |

|

|

(334 |

) |

|

|

(134 |

) |

|

|

(2 |

) |

|

|

(847 |

) |

|

|

(577 |

) |

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

|

120,851 |

|

|

|

129,516 |

|

|

|

1,957 |

|

|

|

351,468 |

|

|

|

378,890 |

|

|

|

5,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment Result |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IT Services Business Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BFSI |

|

|

7,035 |

|

|

|

7,199 |

|

|

|

109 |

|

|

|

19,904 |

|

|

|

21,147 |

|

|

|

320 |

|

| HLS |

|

|

2,981 |

|

|

|

3,188 |

|

|

|

48 |

|

|

|

7,534 |

|

|

|

8,991 |

|

|

|

136 |

|

| RCTG |

|

|

3,255 |

|

|

|

3,809 |

|

|

|

57 |

|

|

|

9,648 |

|

|

|

10,211 |

|

|

|

154 |

|

| ENU |

|

|

4,262 |

|

|

|

3,436 |

|

|

|

52 |

|

|

|

13,483 |

|

|

|

10,745 |

|

|

|

162 |

|

| MFG |

|

|

4,228 |

|

|

|

4,142 |

|

|

|

63 |

|

|

|

12,630 |

|

|

|

13,270 |

|

|

|

201 |

|

| GMT |

|

|

3,438 |

|

|

|

3,093 |

|

|

|

47 |

|

|

|

10,696 |

|

|

|

8,928 |

|

|

|

135 |

|

| OTHERS |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

583 |

|

|

|

— |

|

|

|

— |

|

| UNALLOCATED |

|

|

(458 |

) |

|

|

(47 |

) |

|

|

(1 |

) |

|

|

(1,606 |

) |

|

|

759 |

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL IT SERVICES |

|

|

24,741 |

|

|

|

24,820 |

|

|

|

375 |

|

|

|

72,872 |

|

|

|

74,051 |

|

|

|

1,119 |

|

| IT PRODUCTS |

|

|

89 |

|

|

|

(505 |

) |

|

|

(7 |

) |

|

|

316 |

|

|

|

(574 |

) |

|

|

(9 |

) |

| RECONCILING ITEMS |

|

|

(796 |

) |

|

|

(441 |

) |

|

|

(7 |

) |

|

|

(2,321 |

) |

|

|

(1,292 |

) |

|

|

(19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

|

24,034 |

|

|

|

23,874 |

|

|

|

361 |

|

|

|

70,867 |

|

|

|

72,185 |

|

|

|

1,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCE EXPENSE |

|

|

(810 |

) |

|

|

(1,423 |

) |

|

|

(22 |

) |

|

|

(2,687 |

) |

|

|

(4,298 |

) |

|

|

(65 |

) |

| FINANCE AND OTHER INCOME |

|

|

5,035 |

|

|

|

6,227 |

|

|

|

94 |

|

|

|

14,383 |

|

|

|

17,663 |

|

|

|

267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROFIT BEFORE TAX |

|

|

28,259 |

|

|

|

28,678 |

|

|

|

433 |

|

|

|

82,563 |

|

|

|

85,550 |

|

|

|

1,293 |

|

| INCOME TAX EXPENSE |

|

|

(6,228 |

) |

|

|

(6,248 |

) |

|

|

(94 |

) |

|

|

(18,369 |

) |

|

|

(18,679 |

) |

|

|

(282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROFIT FOR THE PERIOD |

|

|

22,031 |

|

|

|

22,430 |

|

|

|

339 |

|

|

|

64,194 |

|

|

|

66,871 |

|

|

|

1,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment result represents operating profits of the segments and dividend income and gains or losses (net) relating to

strategic investments, which are presented within “Finance and other income” in the statement of Income.

The Company is organized by the

following operating segments; IT Services and IT Products.

The IT Services segment primarily consists of IT Service offerings to our customers organized

by industry verticals as follows: Banking, Financial Services and Insurance (BFSI), Healthcare and Life Sciences (HLS), Retail, Consumer, Transport and Government (RCTG), Energy, Natural Resources and Utilities (ENU), Manufacturing (MFG), Global

Media and Telecom (GMT). Starting with quarter ended September 30, 2014, it also includes Others which comprises dividend income and gains or losses (net) relating to strategic investments, which are presented within “Finance and other

income” in the statement of Income. Key service offering to customers includes software application development and maintenance, research and development services for hardware and software design, business application services, analytics,

consulting, infrastructure outsourcing services and business process services.

In the IT Products segment, the Company is a value added reseller of

desktops, servers, notebooks, storage products, networking solutions and packaged software for leading international brands. In certain total outsourcing contracts of the IT Services segment, the Company delivers hardware products, software licenses

and other related deliverables.

Reconciliation of Non-GAAP Constant Currency IT Services Revenue to IT Services Revenue as per IFRS

($MN)

|

|

|

|

|

|

|

|

|

|

|

| Three Months ended December 31, 2015 |

|

|

Three Months ended December 31, 2015 |

|

| IT Services Revenue as per IFRS |

|

$ |

1,838.3 |

|

|

IT Services Revenue as per IFRS |

|

$ |

1,838.3 |

|

| Effect of Foreign currency exchange movement |

|

$ |

19.8 |

|

|

Effect of Foreign currency exchange movement |

|

$ |

69.9 |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Constant Currency IT Services |

|

|

|

|

|

Non-GAAP Constant Currency IT Services |

|

|

|

|

| Revenue based on exchange rates of previous quarter |

|

$ |

1,858.1 |

|

|

Revenue based on exchange rates of comparable quarter in the previous year |

|

$ |

1,908.2 |

|

Exhibit 99.2

Performance for Quarter ended December

31, 2015 Jatin Dalal Senior Vice President and Chief Financial Officer January 18, 2016

Financial Summary for the Quarter Ended

December 31, 2015 (IFRS) Wipro Limited Q3 16 (Rs crores) YoY Growth Revenues 12,861 7% Net Income 2,234 2% Free Cash Flow 2,102 31% Operating Profit refers to Results from Operating Activities Net Income refers to ‘Profit for the period

attributable to equity shareholders of the company’ Operating Cash Flow refers to ‘Net Cash generated from Operating Activities as presented in consolidated interim statements of Cash Flows Gross Cash is the sum of (i) cash and cash

equivalents plus (ii) Available for Sale Investments – current, and (iii) Interest bearing deposits with corporates - current. Free Cash Flow is defined as Net cash generated from operating activities plus (i) Cash outflows on Purchase of

property, plant and equipment and (ii) Proceeds from Sale of property, plant and equipment as presented in consolidated interim statements of Cash Flows. For detailed reconciliations, please refer slide 11 in appendix 1 crores=10 million

Strong cash conversion with Free Cash Flow being 94% of Net Income Gross Cash position was Rs. 30,624 crores or $ 4.63 Billion Declared Interim Dividend of Rs 5 per share

Highlights for the quarter IT Services

Segment USD Revenue grew by 0.3% sequentially and 2.4% on a YoY basis. Net Headcount addition of 2,268 in the quarter. Headcount now stands at 170,664. For reconciliation of non-GAAP constant currency IT Services USD revenues please refer to slide

11 Segment Profit refers to Segment Results 1 crores= 10 million Addition of 39 new customers in quarter to take the total number of active customers to 1,105. IT Services Segment Margins was 20.2% for the quarter, impacted by the Chennai floods.

Non-GAAP constant currency IT Services Segment USD Revenue grew 1.4% QoQ and grew 6.3% YoY. During the quarter, Wipro acquired two high-potential companies - cellent AG and Viteos IT Services Segment Revenue was Rs. 12,315 crores, an increase of 9%

YoY.

IT Services - Revenue Dynamics for

Quarter Ended December 31, 2015 Retail, Consumer Goods and Transportation grew 16.7% on a constant currency YoY basis Financial Services grew 7.8% on a constant currency YoY basis Healthcare, Life Sciences & Services grew 7.2% on a constant

currency YoY basis Americas grew 6.8% on a constant currency YoY basis India and Middle East grew 20.9% on a constant currency YoY basis APAC and Other Emerging Markets grew 12.3% on a constant currency YoY basis Geographies Product Engineering

Services grew 16.2% on a YoY reported basis Wipro Analytics grew 8.4% on a YoY reported basis Business Process Service grew 5.9% on a YoY reported basis Business units Service Lines The growth percentages have been calculated based on USD revenues

for the Business Unit/ Service line/ Geography

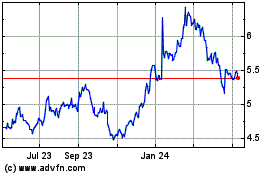

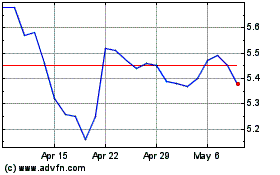

Looking ahead * Guidance is based on

the following exchange rates: GBP/USD at 1.50, Euro/USD at 1.07, AUD/USD at 0.72, USD/INR at 66.13 and USD/CAD at 1.37 Looking ahead for the quarter ending March 31, 2016 We expect the Revenue from our IT Services business to be in the range of $

1,875 million to $ 1,912 million* Jan Feb Apr May Jun Jul Aug Sep Oct Nov Dec 2015-16 Mar

Supplemental Data Key Operating Metrics

of IT Services

Key Operating Metrics in IT Services

for the Quarter ended December 31, 2015 Particulars Q3’16 Q2’16 Q3’15 Revenue Composition Global Media & Telecom 13.4% 13.4% 13.8% Finance Solutions 26.2% 26.7% 25.7% Manufacturing & Hitech 18.4% 18.7% 18.3% Healthcare,

Life Sciences & Services 12.0% 11.4% 11.7% Retail, Consumer Goods & Transportation 15.6% 15.1% 14.1% Energy, Natural Resources & Utilities 14.4% 14.7% 16.4% Geography Composition Americas 52.8% 53.0% 51.4% Europe 24.8% 25.2% 27.6% India

& Middle East Business 11.0% 10.6% 9.6% APAC & Other Emerging Markets 11.4% 11.2% 11.4% People related Number of employees 170,664 168,396 156,866

Thank You Jatin.Dalal@wipro.com Jatin

Dalal Senior Vice President & Chief Financial Officer

Appendix

Reconciliation of Selected GAAP

measures to Non-GAAP measures Reconciliation of Gross Cash WIPRO LIMITED AND SUBSIDIARIES (Amounts in INR crores) As of Dec 31, 2015 Computation of Gross cash position Cash and cash equivalents 8,997 Available for sale

investments - current 15,165 Interest bearing deposits with corporates - current 6,462 Total 30,624 WIPRO LIMITED AND SUBSIDIARIES (Amounts in INR crores) Three months ended Dec 31, 2015 Profit for the period [A] 2,234

Computation of Free cash flow Net cash generated from operating activities 2,183 Add/(deduct) cash inflow/(outflow) on : Purchase of Property,plant and equipment (118) Proceeds from sale of Property,plant and equipment 37

Free cash flow attributable to equity holders of the company [B] 2,102 Free cash flow as a percentage of Net income [B/A] 94% Reconciliation of Non-GAAP Constant Currency IT Services Revenue to IT Services Revenue as per IFRS ($MN)

Three months ended December 31, 2015 Three months ended December 31, 2015 IT Services Revenue as per IFRS $1,838.3 IT Services Revenue as per IFRS $1,838.3 Effect of Foreign currency exchange movement $ 19.8 Effect of Foreign currency exchange

movement $ 69.9 Non-GAAP Constant Currency IT Services Revenue based on previous quarter exchange rates $ 1,858.1 Non-GAAP Constant Currency IT Services Revenue based on exchange rates of comparable period in previous year $1,908.2

Reconciliation of Free Cash Flow Reconciliation of Non-GAAP constant currency Revenue 1 crores=10 million

Exhibit 99.3

Exhibit 99.3 Wipro Limited CIN: L32102KA1945PLC020800 Registered Office: Wipro Limited, Doddakanneli, Sarjapur Road, Bangalore-560035,

India. Website: www.wipro.com Email id - info@wipro.com Tel: +91-80-2844 0011 Fax: +91-80-2844 0054 Extract of statutorily audited consolidated financial results of Wipro Limited and its Subsidiaries for the Quarter and Nine months ended December

31, 2015 prepared in compliance with the International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. in millions, except share and per share data, unless otherwise stated) Particulars Quarter ended

Nine months ended Quarter ended December 31, 2015 December 31, 2015 December 31,2014 Total income from operations (net) 129,516 378,890 120,851 Net Profit / (Loss) from ordinary activities after tax 22,430 66,871 22,031 Net Profit / (Loss) for the

period after tax (after Extraordinary items) 22,430 66,871 22,031 Equity Share Capital 4,941 4,941 4,937 Reserves (excluding Revaluation Reserve as shown in the Balance Sheet of previous year ended 31st March, 2015 and 31st March, 2014 respectively)

403,045 403,045 338,567 Earnings Per Share (before extraordinary items) (of Rupee2/- each) Basic: 9.09 27.10 8.92 Diluted: 9.07 27.05 8.88 Earnings Per Share (after extraordinary items) (of Rupee2/- each) Basic: 9.09 27.10 8.92 Diluted: 9.07 27.05

8.88 The consolidated interim financial results of the Company for the quarter and nine months ended December 31, 2015 have been approved by the Board of Directors of the Company at its meeting held on January 18, 2016. The statutory auditors have

expressed an unqualified audit opinion. Standalone Audited Financial Results of Wipro Limited Particulars Quarter ended December 31, 2015 Nine months ended December 31, 2015 Quarter ended December 31,2014 Total income from operations (net) 112,727

333,058 105,212 Net Profit / (Loss) from ordinary activities after tax 20,045 61,346 19,923 Net Profit / (Loss) for the period after tax (after Extraordinary items) 20,045 61,346 19,923 Equity Share Capital 4,941 4,941 4,937 Reserves (excluding

Revaluation Reserve as shown in the Balance Sheet of previous year ended 31st March, 2015 and 31st March, 2014 respectively) 341,279 341,279 288,627 Earnings Per Share (before extraordinary items) (of Rupee2/- each) Basic: 8.16 24.97 8.11 Diluted:

8.14 24.93 8.07 Earnings Per Share (after extraordinary items) (of Rupee2/- each) Basic: 8.16 24.97 8.11 Diluted: 8.14 24.93 8.07 The audited interim financial results of the Company for the quarter and nine months ended December 31, 2015 have been

approved by the Board of Directors of the Company at its meeting held on January 18, 2016. The statutory auditors have expressed an unqualified audit opinion. Notes: 1. The above is an extract of the detailed format of Quarterly Financial Results

filed with the Stock Exchanges under Regulation 33 of the SEBI (Listing and Other Disclosure Requirements) Regulations, 2015. The full format of the Quarterly Financial Results are available on the Bombay Stock Exchange website (URL:

www.bseindia.com/corporates), the National Stock Exchange website (URL: www.nseindia.com /corporates) and on the Company’s website (URL: www.wipro.com). 2. On January 18, 2016, the Board of Directors of the Company declared an interim dividend

of 5 ($0.08) per equity share and ADR (250% on an equity share of par value of 2). Place: Bangalore Date: January 18, 2016 By Order of the Board For Wipro Ltd. T K Kurien Executive Director & Chief Executive Officer

Exhibit 99.4

WIPRO LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED

INTERIM

FINANCIAL STATEMENTS UNDER IFRS

AS OF

AND FOR THE THREE AND NINE MONTHS ENDED DECEMBER 31, 2015

1

WIPRO LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(

in millions, except share and per share data, unless otherwise stated)

in millions, except share and per share data, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

As of March 31, |

|

|

As of December 31, |

|

| |

|

Notes |

|

2015 |

|

|

2015 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

Convenience

translation into US

dollar in millions

(unaudited) Refer

Note 2(iv) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

5 |

|

|

68,078 |

|

|

|

75,361 |

|

|

|

1,139 |

|

| Intangible assets |

|

5 |

|

|

7,931 |

|

|

|

8,274 |

|

|

|

125 |

|

| Property, plant and equipment |

|

4 |

|

|

54,206 |

|

|

|

57,360 |

|

|

|

867 |

|

| Derivative assets |

|

13,14 |

|

|

736 |

|

|

|

237 |

|

|

|

4 |

|

| Available for sale investments |

|

7 |

|

|

3,867 |

|

|

|

4,391 |

|

|

|

66 |

|

| Non-current tax assets |

|

|

|

|

11,409 |

|

|

|

11,551 |

|

|

|

175 |

|

| Deferred tax assets |

|

|

|

|

2,945 |

|

|

|

3,850 |

|

|

|

58 |

|

| Other non-current assets |

|

10 |

|

|

14,369 |

|

|

|

13,718 |

|

|

|

207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

|

|

163,541 |

|

|

|

174,742 |

|

|

|

2,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventories |

|

8 |

|

|

4,849 |

|

|

|

6,095 |

|

|

|

92 |

|

| Trade receivables |

|

|

|

|

91,531 |

|

|

|

99,959 |

|

|

|

1,510 |

|

| Other current assets |

|

10 |

|

|

73,359 |

|

|

|

97,751 |

|

|

|

1,477 |

|

| Unbilled revenues |

|

|

|

|

42,338 |

|

|

|

45,662 |

|

|

|

690 |

|

| Available for sale investments |

|

7 |

|

|

53,908 |

|

|

|

151,651 |

|

|

|

2291 |

|

| Current tax assets |

|

|

|

|

6,490 |

|

|

|

8,371 |

|

|

|

126 |

|

| Derivative assets |

|

13,14 |

|

|

5,077 |

|

|

|

3.486 |

|

|

|

53 |

|

| Cash and cash equivalents |

|

9 |

|

|

158,940 |

|

|

|

89,973 |

|

|

|

1,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

|

|

436,492 |

|

|

|

502,948 |

|

|

|

7,598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

|

|

|

600,033 |

|

|

|

677,690 |

|

|

|

10,239 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

|

|

4,937 |

|

|

|

4,941 |

|

|

|

75 |

|

| Share premium |

|

|

|

|

14,031 |

|

|

|

14,532 |

|

|

|

220 |

|

| Retained earnings |

|

|

|

|

372,248 |

|

|

|

418,176 |

|

|

|

6,318 |

|

| Share based payment reserve |

|

|

|

|

1,312 |

|

|

|

1,950 |

|

|

|

29 |

|

| Other components of equity |

|

|

|

|

15,454 |

|

|

|

16,968 |

|

|

|

256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity attributable to the equity holders of the Company |

|

|

|

|

407,982 |

|

|

|

456,567 |

|

|

|

6,898 |

|

| Non-controlling interest |

|

|

|

|

1,646 |

|

|

|

2,035 |

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

|

|

409,628 |

|

|

|

458,602 |

|

|

|

6,929 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long - term loans and borrowings |

|

11 |

|

|

12,707 |

|

|

|

16,427 |

|

|

|

248 |

|

| Deferred tax liabilities |

|

|

|

|

3,240 |

|

|

|

3,379 |

|

|

|

51 |

|

| Derivative liabilities |

|

13,14 |

|

|

71 |

|

|

|

50 |

|

|

|

1 |

|

| Non-current tax liabilities |

|

|

|

|

6,695 |

|

|

|

7,397 |

|

|

|

112 |

|

| Other non-current liabilities |

|

12 |

|

|

3,658 |

|

|

|

7,296 |

|

|

|

110 |

|

| Provisions |

|

12 |

|

|

5 |

|

|

|

15 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

|

|

26,376 |

|

|

|

34,564 |

|

|

|

522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, borrowings and bank overdrafts |

|

11 |

|

|

66,206 |

|

|

|

81,501 |

|

|

|

1,231 |

|

| Trade payables and accrued expenses |

|

|

|

|

58,745 |

|

|

|

61,918 |

|

|

|

935 |

|

| Unearned revenues |

|

|

|

|

16,549 |

|

|

|

19,122 |

|

|

|

289 |

|

| Current tax liabilities |

|

|

|

|

8,036 |

|

|

|

7,209 |

|

|

|

109 |

|

| Derivative liabilities |

|

13,14 |

|

|

753 |

|

|

|

908 |

|

|

|

14 |

|

| Other current liabilities |

|

12 |

|

|

12,223 |

|

|

|

12,622 |

|

|

|

191 |

|

| Provisions |

|

12 |

|

|

1,517 |

|

|

|

1,244 |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

|

|

164,029 |

|

|

|

184,524 |

|

|

|

2,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

|

|

190,405 |

|

|

|

219,088 |

|

|

|

3,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

|

|

|

600,033 |

|

|

|

677,690 |

|

|

|

10,239 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes form an integral part of these condensed consolidated interim financial statements

|

|

|

|

|

|

|

| As per our report of even date attached |

|

For and on behalf of the Board of Directors |

|

|

|

|

| for B S R & Co. LLP

Chartered Accountants Firm’s Registration No:

101248W/W- 100022 |

|

T K Kurien Executive Director

& Chief Executive Officer |

|

N Vaghul Director |

|

|

|

|

|

|

| Vijay Mathur Partner

Membership No. 046476 |

|

Jatin Pravinchandra Dalal

Chief Financial Officer |

|

Rishad Premji Chief Strategy Officer

& Executive Director |

|

M Sanaulla Khan Company

Secretary |

|

|

|

|

| Mumbai |

|

Bangalore |

|

|

|

|

| January 18, 2016 |

|

January 18, 2016 |

|

|

|

|

2

WIPRO LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF INCOME

(

in millions, except share and per share data, unless otherwise stated)

in millions, except share and per share data, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three months ended December 31, |

|

|

Nine months ended December 31, |

|

| |

|

Notes |

|

2014 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

Convenience

translation into

US dollar in

millions

(unaudited)

Refer Note 2(iv) |

|

|

|

|

|

|

|

|

Convenience

translation into

US dollar in

millions

(unaudited)

Refer Note 2(iv) |

|

| Gross revenues |

|

17 |

|

|

119,929 |

|

|

|

128,605 |

|

|

|

1,943 |

|

|

|

348,125 |

|

|

|

376,116 |

|

|

|

5,682 |

|

| Cost of revenues |

|

18 |

|

|

(82,867 |

) |

|

|

(90,270 |

) |

|

|

(1,364 |

) |

|

|

(238,675 |

) |

|

|

(260,881 |

) |

|

|

(3,941 |

) |

| Gross profit |

|

|

|

|

37,062 |

|

|

|

38,335 |

|

|

|

579 |

|

|

|