Gross Revenues grew 7% YoY

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) today

announced financial results under International Financial Reporting

Standards (IFRS) for its third quarter ended December 31, 2015.

Highlights of the

Results:

- Wipro Limited Gross Revenues were Rs

128.6 billion ($1.9 billion1), an increase of 7% YoY.

- IT Services Segment Non-GAAP constant

currency Revenue in dollar terms grew 1.4% sequentially and grew

6.3% YoY. IT Services Segment Revenue was $1,838.3 million, a

sequential increase of 0.3%.

- IT Services Segment Revenue was Rs

123.1 billion ($1,861 million1), an increase of 9% YoY.

- Net Income2 was Rs 22.3 billion ($338

million1), an increase of 2% YoY.

- IT Services Segment Profit3 was Rs 24.8

billion ($375 million1).

- IT Services Segment Margins was

20.2%.

- Headcount increased by 2,268 to

170,664.

- Wipro declared an interim dividend of

Rs 5 ($0.08) per share /ADS.

Performance for the quarter ended

December 31, 2015T K Kurien, Member of the Board

& Chief Executive Officer of Wipro, said – “We delivered

Revenues in line with our guidance. We saw a pick-up in large deal

closures led by Global Infrastructure Services. It is becoming

increasingly clear that customers want to simplify operations and

optimize their IT spend while investing in Digital to transform

their business. We are well-positioned to take advantage of this

trend.”

Abidali Z. Neemuchwala, Chief Executive Officer-Designate of

Wipro, said – “We are focused on driving market share growth in

our core businesses through integrated domain and technology

services, while investing for the future in building differentiated

Digital capabilities. We will leverage our strong culture of

innovation and extremely talented employee pool to build compelling

value propositions for our customers.”

Jatin Dalal, Chief Financial Officer of Wipro, said –

“During the quarter, we have built competitive differentiation

through the acquisition of two high-potential companies – cellent

and Viteos. The impact on revenues from the Chennai floods were

minimized significantly by strong execution of our robust Business

Continuity Plans (BCP). The additional expenses incurred in

deploying BCP impacted operating margins for the quarter.”

Outlook for the Quarter ending March

31, 2016We expect Revenues from our IT Services

business to be in the range of $ 1,875 million to $1,912

million*.

* Guidance is based on the following exchange rates: GBP/USD at

1.50, Euro/USD at 1.07, AUD/USD at 0.72, USD/INR at 66.13 and

USD/CAD at 1.37

IT ServicesThe IT Services

segment had a headcount of 170,664 as of December 31, 2015. We

added 39 new customers during the quarter.

Effective January 1, 2016, Wipro completed the transaction

announced on December 2, 2015 to acquire cellent AG, a leading IT

consulting and software services company in the DACH region of

Germany, Austria and Switzerland.

On December 23, 2015, Wipro announced that it has signed a

definitive agreement to acquire Viteos Group, a BPaaS provider for

the Alternative Investment Management Industry.

Wipro sustained its momentum in winning Large Deals globally as

described below:

Wipro has entered into a multi-year global infrastructure

support engagement with one of the largest medical devices

companies in the world. Wipro will standardize and simplify the

customer’s IT infrastructure across multiple service lines and in

over 90 countries.

A leading global nutrition, health and wellness company has

selected Wipro to enable the migration of a significant portion of

its global IT applications estate to a hybrid cloud. As part of the

engagement, Wipro will provide IaaS (Infrastructure as a Service),

PaaS (Platform as a Service), an integrated

hardware-software-services stack, and billing-metering-chargeback

in a completely outcome-based model.

A large global retailer has selected Wipro as its quality

engineering partner. Wipro will help develop a new operating and

financial model that will allow the customer to accurately forecast

its quality engineering spends and optimize costs, while driving

continuous improvements in the quality and time-to-market of its

offerings.

Wipro has won a large contract from a European general insurance

multinational for provisioning and managing the company’s

infrastructure.

A leading security solutions manufacturer, headquartered in the

Nordic region, has selected Wipro to transform its IT

infrastructure. As part of the five-year agreement, Wipro will

leverage its Boundaryless Datacenter offering and will consolidate

the customer’s existing data centers and implement a

cloud-based-services model, including IaaS (Infrastructure as a

Service) and PaaS (Platform as a Service).

An Australia-headquartered manufacturing sector customer has

awarded a five-year strategic, IT-as-a-service contract to Wipro.

Wipro will have the end-to-end responsibility of running the

customer’s IT operations and enabling the transformation of the

existing IT estate to a next-generation digital-ready landscape.

The new consumption-based model will enable the customer to be more

agile, reliable and competitive while launching new products and

services.

Digital highlightsOur

Digital capability combining design, engineering and analytics is

seeing traction in the marketplace. Unique capabilities of Designit

combined with Wipro’s technological prowess is driving synergistic

deal wins.

Wipro has been selected to help a global bank establish and

operate its new digital platform, across 50 markets. With global

scale and a blend of strategy, design and engineering capabilities,

Wipro’s agile teams will help support consistent customer

experience, underpinned by continuous delivery across this new

digital platform. Wipro will reinvent the onboarding process for

customers, help improve sales conversion rates and reduce

operational costs.

Wipro has won a multi-year deal from a large bank to enable

omni-channel self-service by digitizing service processes and

leveraging new age digital technologies. This will help the bank

provide superior customer experience while reducing costs, in the

form of lower call volumes.

Wipro will be augmenting the in-house team of a market leader in

the automotive space, with telematics domain skills and advanced

engineering expertise for their telematics program.

Designit has been selected by a leading South American bank to

work on designing an entirely new banking concept and experience,

targeted to create the next-generation banking experience for

customers who are usually not attracted to traditional banking

offerings anymore.

For a major German telecommunications brand, Designit has been

assigned to create future smart Product-Service-Experiences using

artificial intelligence and similar emerging technologies.

For a leading European energy provider, Designit has been

selected to design an innovation process to better facilitate the

company’s investments into technology start-ups and to effectively

drive the integration of acquired start-ups into the client’s own

organizational portfolio.

Cloud highlightsOur Cloud

applications business is seeing a good traction in the market. In

the quarter ending December 31, 2015 we engaged with several

clients to design and deploy their enterprise processes leveraging

industry leading SaaS products. A few marquee engagements include

Cloud CRM processes rationalization for a UK-based gas and utility

major, simplification of lead & opportunity management

processes for a leading US based equipment rental company,

modernization of a B2B order management system for a leading

chemicals supplier company, design and deployment of recruitment

processes for a business process outsourcing enterprise,

implementation of performance and goal management processes for an

American satellite service provider and transforming the

source-to-pay process for an global pharmaceutical and consumer

packaged goods major.

Wipro has also partnered with Apttus, the category-defining

Quote-to-Cash cloud solution provider, to deliver best-in-class

Contract Lifecycle Management (CLM), Configure-Price-Quote (CPQ)

& Revenue Management solutions to clients across

industries.

Awards and accoladesWipro

continued to lead the ‘Global Engineering and R&D Service

Providers (GSPR) Rating 2015’ by Zinnov Management Consulting for

the sixth consecutive year. The Zinnov study evaluated more than 75

R&D service providers across the world in 15 major industry

segments across key parameters like product development

capabilities & innovation, client relationships, human capital,

financials, ecosystem linkages, infrastructure, and business

sustainability.

Wipro has been positioned as a "Leader" by Forrester Research

Inc, in its report ‘The Forrester Wave™: Global Workplace Services,

Q4 2015’. The report cites Wipro’s relative strength in

infrastructure services delivery, well-balanced staff distribution

across EMEA, North America and Asia Pacific, highest overall

customer reference scores of any supplier evaluated in the

analysis, strong customer value proposition, and compelling vision

for workplace services.

Wipro has been positioned as a “Leader” in the IDC MarketScape:

Worldwide Life Science Manufacturing and Supply Chain 2015 vendor

assessment for services in all the 3 service categories of

strategic consulting, ITO and BPO.

Wipro has been recognised as a “Leader” by leading global

analyst firm Everest Group, in the Healthcare Payer Digital IT

Services PEAK Matrix Assessment 2015. This reaffirms our growing

capabilities in the Healthcare Digital space.

Wipro has also been featured as a “Star Performer” in the

Everest Group Healthcare Provider IT Services PEAK Matrix

Assessment 2015. This reflects Wipro’s large scale and deeper

client relationships, technology capability and investments in

tools, platforms, and a global delivery presence in the Healthcare

Provider space.

Wipro has been recognised as a “Leader” in the Gartner Magic

Quadrant for Application Testing Services, Worldwide for the second

consecutive year.

Wipro has been positioned in the 'Winner's Circle' of HfS

Blueprint Report on Trust-as-a-Service 2015. The report covers the

market view of Digital Trust and Security Framework, the Digital

Trust Maturity Scale, and the As-a-Service Economy.

Wipro has won 8 awards at the seventh Annual Golden Bridge

Business and Innovation Awards Ceremony including the Grand Trophy

Award for being the overall winner with maximum impact. Wipro

was recognized for its innovations in API Management and Solutions,

Information Technology (Software), Mobile Innovative Products or

Services, Business Process Management and Application

Development.

IT Products

- Our IT Products Segment delivered

Revenue of Rs 6.5 billion ($98 million1) for the quarter ended

December 31, 2015.

Please refer to the table on page 7 for reconciliation between

IFRS IT Services Revenue and IT Services Revenue on a non-GAAP

constant currency basis.

About Non-GAAP financial measuresThis press release

contains non-GAAP financial measures within the meaning of

Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP

financial measures are measures of our historical or future

performance, financial position or cash flows that are adjusted to

exclude or include amounts that are excluded or included, as the

case may be, from the most directly comparable financial measure

calculated and presented in accordance with IFRS.

The table on page 7 provides IT Services Revenue on a constant

currency basis, which is a non-GAAP financial measure that is

calculated by translating IT Services Revenue from the current

reporting period into U.S. dollars based on the currency conversion

rate in effect for the prior reporting period. We refer to growth

rates in constant currency so that business results may be viewed

without the impact of fluctuations in foreign currency exchange

rates, thereby facilitating period-to-period comparisons of our

business performance.

This non-GAAP financial measure is not based on any

comprehensive set of accounting rules or principles and should not

be considered a substitute for, or superior to, the most directly

comparable financial measure calculated in accordance with IFRS,

and may be different from non-GAAP measures used by other

companies. In addition to this non-GAAP measure, the financial

statements prepared in accordance with IFRS and the reconciliation

of these non-GAAP financial measures with the most directly

comparable IFRS financial measure should be carefully

evaluated.

Results for the quarter ended December 31, 2015, prepared

under IFRS, along with individual business segment reports, are

available in the Investors section of our website

www.wipro.com.

Quarterly Conference CallWe will hold an earnings

conference call today at 11:00 a.m. Indian Standard Time (12:30

a.m. US Eastern Time) to discuss our performance for the quarter.

An audio recording of the management discussions and the question

and answer session will be available online and will be accessible

in the Investor Relations section of our website at

www.wipro.com.

About Wipro Limited (NYSE: WIT)Wipro Ltd. (NYSE:WIT) is a

leading information technology, consulting and business process

services company that delivers solutions to enable its clients to

do business better. Wipro delivers winning business outcomes

through its deep industry experience and a 360 degree view of

"Business through Technology.” By combining digital strategy,

customer centric design, advanced analytics and product engineering

approach, Wipro helps its clients create successful and adaptive

businesses. A company recognized globally for its comprehensive

portfolio of services, strong commitment to sustainability and good

corporate citizenship, Wipro has a dedicated workforce of over

160,000, serving clients in 175+ cities across 6 continents.

For more information, please visit www.wipro.com

Forward-looking statementsThe forward-looking statements

contained herein represent Wipro’s beliefs regarding future events,

many of which are by their nature, inherently uncertain and outside

Wipro’s control. Such statements include, but are not limited to,

statements regarding Wipro’s growth prospects, its future financial

operating results, and its plans, expectations and intentions.

Wipro cautions readers that the forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from the results

anticipated by such statements. Such risks and uncertainties

include, but are not limited to, risks and uncertainties regarding

fluctuations in our earnings, revenue and profits, our ability to

generate and manage growth, intense competition in IT services, our

ability to maintain our cost advantage, wage increases in India,

our ability to attract and retain highly skilled professionals,

time and cost overruns on fixed-price, fixed-time frame contracts,

client concentration, restrictions on immigration, our ability to

manage our international operations, reduced demand for technology

in our key focus areas, disruptions in telecommunication networks,

our ability to successfully complete and integrate potential

acquisitions, liability for damages on our service contracts, the

success of the companies in which we make strategic investments,

withdrawal of fiscal governmental incentives, political

instability, war, legal restrictions on raising capital or

acquiring companies outside India, unauthorized use of our

intellectual property, and general economic conditions affecting

our business and industry. Additional risks that could affect our

future operating results are more fully described in our filings

with the United States Securities and Exchange Commission,

including, but not limited to, Annual Reports on Form 20-F. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in the company’s filings with the

Securities and Exchange Commission and our reports to shareholders.

We do not undertake to update any forward-looking statement that

may be made from time to time by us or on our behalf.

Wipro limited and subsidiaries CONDENSED CONSOLIDATED

INTERIM STATEMENT OF FINANCIAL POSITION (Rupees in millions, except

share and per share data, unless otherwise stated)

As of March 31,

As of December 31, 2015

2015 2015

Convenience translation into

US dollar in millions (unaudited) - Refer

footnote 1 on Page 1

ASSETS

Goodwill 68,078 75,361 1,139 Intangible assets 7,931 8,274 125

Property, plant and equipment 54,206 57,360 867 Derivative assets

736 237 4 Available for sale investments 3,867 4,391 66 Non-current

tax assets 11,409 11,551 175 Deferred tax assets 2,945 3,850 58

Other non-current assets 14,369 13,718 207

Total non-current

assets 163,541 174,742 2,641 Inventories 4,849 6,095 92

Trade receivables 91,531 99,959 1,510 Other current assets 73,359

97,751 1,477 Unbilled revenues 42,338 45,662 690 Available for sale

investments 53,908 151,651 2,291 Current tax assets 6,490 8,371 126

Derivative assets 5,077 3,486 53 Cash and cash equivalents 158,940

89,973 1,359

Total current assets 436,492 502,948 7,598

TOTAL ASSETS 600,033 677,690 10,239

EQUITY

Share capital 4,937 4,941 75 Share premium 14,031 14,532 220

Retained earnings 372,248 418,176 6,318 Share based payment reserve

1,312 1,950 29 Other components of equity 15,454 16,968 256 Equity

attributable to the equity holders of the Company 407,982 456,567

6,898 Non-controlling interest 1,646 2,035 31

Total equity

409,628 458,602 6,929

LIABILITIES

Long - term loans and borrowings 12,707 16,427 248 Deferred tax

liabilities 3,240 3,379 51 Derivative liabilities 71 50 1

Non-current tax liabilities 6,695 7,397 112 Other non-current

liabilities 3,658 7,296 110 Provisions 5 15 -

Total non-current

liabilities 26,376 34,564 522 Loans and borrowings and

bank overdrafts 66,206 81,501 1,231 Trade payables and accrued

expenses 58,745 61,918 935 Unearned revenues 16,549 19,122 289

Current tax liabilities 8,036 7,209 109 Derivative liabilities 753

908 14 Other current liabilities 12,223 12,622 191 Provisions 1,517

1,244 19

Total current liabilities 164,029 184,524 2,788

TOTAL LIABILITIES 190,405 219,088 3,310

TOTAL EQUITY AND LIABILITIES 600,033 677,690 10,239

Wipro limited and subsidiaries CONDENSED CONSOLIDATED

INTERIM STATEMENTS OF INCOME (Rupees in millions, except share and

per share data, unless otherwise stated)

Three Months ended December 31,

Nine months ended December 31, 2014

2015 2015 2014 2015

2015

Convenience translation into

US dollar in millions (unaudited)- Refer

footnote 1 on Page 1

Convenience translation into

USdollar in millions(unaudited) - Refer

footnote 1 on Page 1

Gross revenues 119,929 128,605 1,943 348,125 376,116 5,682

Cost of revenues (82,867 ) (90,270 ) (1,364 ) (238,675 ) (260,881 )

(3,941 )

Gross profit 37,062 38,335 579

109,450 115,235 1,741 Selling and

marketing expenses (7,524 ) (8,362 ) (126 ) (22,709 ) (25,114 )

(379 ) General and administrative expenses (6,426 ) (7,010 ) (106 )

(19,217 ) (20,710 ) (313 ) Foreign exchange gains/(losses), net 922

911 14 3,343 2,774 42

Results from operating

activities 24,034 23,874 361 70,867

72,185 1,091 Finance expenses (810 ) (1,423 )

(21 ) (2,687 ) (4,298 ) (65 ) Finance and other income 5,035 6,227

94 14,383 17,663 267

Profit before tax 28,259

28,678 434 82,563 85,550 1,293

Income tax expense (6,228 ) (6,248 ) (95 ) (18,369 )

(18,679 ) (282 )

Profit for the period

22,031 22,430 339

64,194 66,871

1,011 Attributable to: Equity holders of the

company 21,928 22,341 338 63,808 66,572 1,006 Non-controlling

interest 103 89 1 386 299

5

Profit for the period

22,031 22,430 339 64,194 66,871

1,011

Earnings per

equity share: Attributable to equity share holders of the

company Basic 8.92 9.09 0.14 25.97 27.10 0.41 Diluted 8.88 9.07

0.14 25.85 27.05 0.41

Weighted average number of equity shares

used in computing earnings per equity share

Basic 2,457,766,859 2,457,022,905 2,457,022,905 2,457,491,867

2,456,551,992 2,456,551,992 Diluted 2,469,323,243 2,462,220,926

2,462,220,926 2,468,262,835 2,461,282,411 2,461,282,411

Additional Information Segment Revenue IT Services

Business Units BFSI 29,177 32,322 489 85,653 95,595 1,444 HLS

13,247 14,719 222 36,713 41,453 626 RCTG 16,005 19,158 289 45,951

54,650 826 ENU 18,637 17,708 268 53,792 52,949 800 MFG 20,718

22,683 343 59,721 66,769 1,009 GMT 15,661 16,557

250 45,933 47,932

724

IT SERVICES TOTAL 113,445 123,147 1,861 327,763

359,348 5,429 IT PRODUCTS 7,740 6,503 98 24,552 20,119 304

RECONCILING ITEMS (334 ) (134 ) (2 ) (847 ) (577 )

(9 ) TOTAL 120,851 129,516

1,957 351,468 378,890

5,724

Segment Result IT Services Business

Units BFSI 7,035 7,199 109 19,904 21,147 320 HLS 2,981 3,188 48

7,534 8,991 136 RCTG 3,255 3,809 57 9,648 10,211 154 ENU 4,262

3,436 52 13,483 10,745 162 MFG 4,228 4,142 63 12,630 13,270 201 GMT

3,438 3,093 47 10,696 8,928 135 OTHERS - - - 583 - - UNALLOCATED

(458 ) (47 ) (1 ) (1,606 ) 759

11

TOTAL IT SERVICES 24,741 24,820 375 72,872 74,051

1,119 IT PRODUCTS 89 (505 ) (7 ) 316 (574 ) (9 ) RECONCILING ITEMS

(796 ) (441 ) (7 ) (2,321 ) (1,292 )

(19 ) TOTAL 24,034 23,874 361

70,867 72,185 1,091 FINANCE

EXPENSE (810 ) (1,423 ) (22 ) (2,687 ) (4,298 ) (65 ) FINANCE AND

OTHER INCOME 5,035 6,227 94

14,383 17,663 267 PROFIT BEFORE

TAX 28,259 28,678 433 82,563 85,550 1,293 INCOME TAX EXPENSE

(6,228 ) (6,248 ) (94 ) (18,369 ) (18,679 )

(282 )

PROFIT FOR THE PERIOD 22,031

22,430 339 64,194

66,871 1,011

Segment result represents operating profits of the segments and

dividend income and gains or losses (net) relating to strategic

investments, which are presented within “Finance and other income”

in the statement of Income. The Company is organized by the

following operating segments; IT Services and IT Products.

The IT Services segment primarily consists

of IT Service offerings to our customers organized by industry

verticals as follows: Banking, Financial Services and Insurance

(BFSI), Healthcare and Life Sciences (HLS), Retail, Consumer,

Transport and Government (RCTG), Energy, Natural Resources and

Utilities (ENU), Manufacturing (MFG), Global Media and Telecom

(GMT). Starting with quarter ended September 30, 2014, it also

includes Others which comprises dividend income and gains or losses

(net) relating to strategic investments, which are presented within

“Finance and other income” in the statement of Income. Key service

offering to customers includes software application development and

maintenance, research and development services for hardware and

software design, business application services, analytics,

consulting, infrastructure outsourcing services and business

process services.

In the IT Products segment, the Company is

a value added reseller of desktops, servers, notebooks, storage

products, networking solutions and packaged software for leading

international brands. In certain total outsourcing contracts of the

IT Services segment, the Company delivers hardware products,

software licenses and other related deliverables.

Reconciliation of Non-GAAP Constant Currency IT

Services Revenue to IT Services Revenue as per IFRS

($MN) Three Months ended December 31, 2015

Three Months ended December 31, 2015 IT Services Revenue as

per IFRS $ 1,838.3 IT Services Revenue as per IFRS $ 1,838.3 Effect

of Foreign currency exchange movement $ 19.8 Effect

of Foreign currency exchange movement $ 69.9 Non-GAAP

Constant Currency IT Services Revenue based on exchange rates of

previous quarter $ 1,858.1

Non-GAAP Constant Currency IT Services Revenue based

on exchange rates of comparable quarter in the previous year

$ 1,908.2

- For the convenience of the reader, the

amounts in Indian Rupees in this release have been translated into

United States Dollars at the noon buying rate in New York City on

December 31, 2015, for cable transfers in Indian rupees, as

certified by the Federal Reserve Board of New York, which was US

$1= Rs 66.19. However, the realized exchange rate in our IT

Services business segment for the quarter ended December 31, 2015

was US$1= Rs 66.99

- Refers to ‘Profit for the period

attributable to equity holders of the company’

- Refers to Segment Results

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160117005129/en/

WiproInvestor RelationsPavan N Rao, +91-80-4672

6143pavan.rao@wipro.comorAbhishek Kumar Jain, +1 978 826

4700abhishekkumar.jain@wipro.comorMedia & PressVipin

Nair, +91-98450 14036vipin.nair1@wipro.com

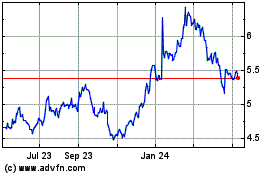

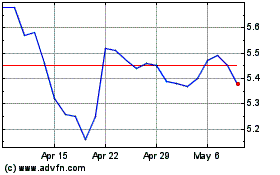

Wipro (NYSE:WIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wipro (NYSE:WIT)

Historical Stock Chart

From Apr 2023 to Apr 2024