Current Report Filing (8-k)

March 28 2017 - 1:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 28, 2017

WELLS FARGO & COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-02979

|

|

No. 41-0449260

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

420 Montgomery Street, San Francisco, California 94163

(Address of principal executive offices) (Zip Code)

1-866-249-3302

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On March 28, 2017, Wells Fargo & Company (the “Company”) issued a press release announcing its most recent Community Reinvestment Act (“CRA”) rating of “Needs to Improve.” A “Needs to Improve” rating imposes regulatory restrictions and limitations on certain of the Company’s nonbank activities, including its ability to engage in certain nonbank mergers and acquisitions or undertake new financial in nature activities, and CRA performance is taken into account by regulators in reviewing applications to establish bank branches and for approving proposed bank mergers and acquisitions. The rating also results in the loss of expedited processing of applications to undertake certain activities, and requires the Company to receive prior regulatory approval for certain activities, including to issue or prepay certain subordinated debt obligations, open or relocate bank branches, or make certain public welfare investments. In addition, a “Needs to Improve” rating could have an impact on the Company’s relationships with certain states, counties, municipalities or other public agencies to the extent applicable law, regulation or policy limits, restricts or influences whether such entity may do business with a company that has a below “Satisfactory” rating.

A copy of the press release is included as Exhibit 99.1 to this report and is incorporated by reference into this Item 8.01. Information available on the Company’s website and referenced in the press release is not incorporated by reference into this Item 8.01 or this report.

Item 9.01

Financial Statements and Exhibits

|

|

|

|

|

|

(d) Exhibits

|

|

|

|

|

|

99.1

|

Press Release dated March 28, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Dated:

|

March 28, 2017

|

WELLS FARGO & COMPANY

|

|

|

|

|

|

|

|

|

By:

|

/s/ TIMOTHY J. SLOAN

|

|

|

|

|

Timothy J. Sloan

|

|

|

|

|

President and Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

Location

|

|

|

|

|

|

99.1

|

Press Release dated March 28, 2017

|

Filed herewith

|

|

|

|

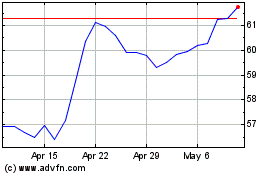

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

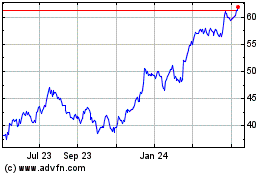

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024