Fed Approves Wells Fargo's Capital Plan -- Update

June 29 2016 - 7:21PM

Dow Jones News

By Emily Glazer

The Federal Reserve approved Wells Fargo & Co.'s capital

plan in the regulator's annual stress test released Wednesday.

Wells Fargo's plan was approved after the Fed found that the

largest U.S. bank by market value could keep lending in a severe

economic downturn. The approval clears the way for the San

Francisco-based firm to reward investors by returning capital --

either through dividend payouts or buying back stock, or both.

The bank later in the day reiterated its previously disclosed 38

cent dividend and didn't give any update on share repurchases.

The bank, along with several others, is expected to unveil plans

on its quarterly dividend and share repurchase activity later in

the day.

At the low point of a hypothetical recession, Wells Fargo's

common equity Tier 1 ratio -- which measures high-quality capital

as a share of risk-weighted assets -- would be 6.1%, above the 4.5%

level the Fed views as a minimum. The new ratio, unlike the one

reported last week by the Fed in a related test, takes into account

the bank's proposed capital plan.

Wells Fargo's Tier 1 leverage ratio, which measures high-quality

capital as a share of all assets, would have reached as low as 5.8%

in a hypothetical recession, above the 4% Fed minimum.

The latest stress-test result incorporates quantitative factors

assessed in data released by the Fed last week. These included a

simulation of how the bank's capital buffers would hold up under a

world-wide recession. The Fed's "severely adverse" scenario of

financial stress this year included a 10% U.S. unemployment rate,

significant losses in corporate and commercial real-estate lending

portfolios, and negative rates on short-term U.S. Treasury

securities.

This second-part of the test also included a qualitative

assessment by the Fed of a bank's capital-planning process and

internal controls. The Fed has the ability to object to a bank's

capital plan on either quantitative or qualitative grounds.

The Fed's Wednesday results are arguably the more important part

of the stress-test process since it dictates how much capital will

be returned to shareholders. Increased dividends and buybacks can

help to bolster a bank's share price.

Wells Fargo also passed last year but certain capital and

leverage results were down more than 0.5 percentage points from its

year-earlier results.

Bernstein bank analyst John McDonald wrote in a June note that

banks including Wells Fargo are "less likely to be viewed as

relative winner since they have less room for upside -- either

because they are already at the higher end of distributions, they

already announced dividend increases recently, and/or they have a

practice of not disclosing their buyback authorizations."

But, he wrote, Wells Fargo is among the U.S. banks expected to

have the highest total payout and dividend yields.

Wells Fargo has doled out much higher dividends and buybacks

than other big banks, making it more attractive for investors. For

example, Wells Fargo paid out dividends and bought back stock equal

to 75% of its net income last year. Bank of America Corp. was at

about 31%, while Citigroup Inc. was around 36%. Wells Fargo

recently raised its dividend to 38 cents a quarter, higher than

before the financial crisis.

Wells Fargo has also expanded more than 37% since it bought

Wachovia in 2008, taking on assets and adding new businesses to its

core Main Street franchise of lending and deposits.

Most notably, Wells Fargo last year agreed to scoop up parts of

the finance arm of General Electric Co., a unit that was unwinding

as a precaution against tighter regulations on big banks. It is the

third-biggest U.S. bank by assets now.

But it hasn't been all smooth sailing. The bank was the only one

flagged for "material errors" in its submission of the "living

wills," where regulators weigh in on banks' plans for navigating a

potential bankruptcy. In April, regulators said the bank needed to

significantly revise its plan, a surprise in part because the last

time regulators tackled this issue they said Wells Fargo was the

sole bank to lay out a viable bankruptcy path.

Write to Emily Glazer at emily.glazer@wsj.com

(END) Dow Jones Newswires

June 29, 2016 19:06 ET (23:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

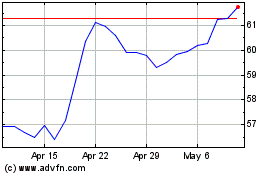

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

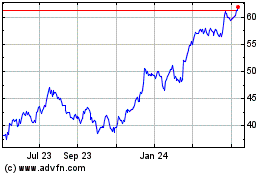

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024