Wells Fargo Creates ‘Steps to Better Banking’

August 25 2015 - 1:00PM

Business Wire

New offerings make opening a checking account

simple, easy

Wells Fargo & Company (NYSE: WFC) today announced its ‘Steps

to Better Banking’ initiative, which makes the experience of

opening an account easier for the millions of consumers who choose

a banking relationship with Wells Fargo. Wells Fargo serves over 22

million Retail Bank households, and through May of this year,

household growth was the strongest in four years, and primary

consumer checking customers increased 5.6 percent

year-over-year*.

“More than a year ago, we set out to look at every experience a

checking or savings account customer might have as they open an

account with Wells Fargo, and our goal was to make the experience

simple and easy,” said Erin Constantine, head of Consumer Checking

and Savings for Wells Fargo. “We listened and learned a lot, and

‘Steps to Better Banking’ is the result, which sets the tone for

how we help customers succeed financially.”

For example, most recently, a new customized welcome email was

introduced that is sent to a customer within one hour of opening a

checking or savings account. The email thanks the customer for

choosing Wells Fargo and its extensive network of approximately

6,200 retail bank locations, 24/7 phone bank, and 12,800 ATMs. It

includes a summary of the deposit accounts opened with Wells Fargo,

and details about how to avoid service fees. The email provides

several ways to contact the bank, including online, by phone and by

visiting a branch. The email is signed by the banker and store

manager, with a phone number that connects directly to the branch.

The email also includes other helpful resources related to the

customer’s new Wells Fargo relationship.

Other enhancements have included:

- Updated Consumer Account Agreement and

Fee and Information Schedule in plain-language style that seeks to

turn regulatory and legal language into terms and explanations that

are more readily understood by customers.

- Paperless ‘New Account Disclosure

Kits,’ which are emailed during the account opening, greatly

reducing the reliance on paper and offering a more convenient

option to customers.

- “A guide to your common checking

account fees” in English and Spanish, which provides a brief,

straight-forward overview of potential fees.

New Wells Fargo customers have additional opportunities to make

managing their accounts easy:

- Checking Account Quick Start Guide – a

handy website highlighting tools and tips for getting the most out

of a new account.

- Automatic linkage of new accounts to

the customer’s secure Online Banking session.

- Timely alerts for eligible account

transactions. Alerts give the status of account activities at a

glance and help customers monitor their accounts. Wells Fargo

offers more than a dozen different consumer deposit alerts that can

be sent by email or to a wireless device.**

- Greater visibility into pending

Automated Clearing House (ACH) and check transactions within secure

Online Banking. This can alert customers to a pending payment,

allowing them to make a deposit to cover the transaction if

necessary, and avoid overspending.

- Monthly service fee summary included in

print or online statements and within secure Online Banking. The

summary provides specific information for the account about the

monthly service fee and ways to waive the fee.

Additionally, educational information is conveniently available

online. A number of short videos have been created to help

customers with common questions around setting up account alerts,

direct deposit, using your debit card and more. Wells Fargo has

also created the “Making Sense” video series, available in English

and Spanish, where topics like understanding holds and overdrafts

are addressed.

“Technology advances have given us the opportunity to further

enhance the experience our customers have when it comes to opening

their checking account and managing their money,” said Constantine.

“We’re excited about how these changes will help our

customers.”

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a nationwide,

diversified, community-based financial services company with $1.7

trillion in assets. Founded in 1852 and headquartered in San

Francisco, Wells Fargo provides banking, insurance, investments,

mortgage, and consumer and commercial finance through 8,700

locations, 12,800 ATMs, the internet (wellsfargo.com) and mobile

banking, and has offices in 36 countries to support customers who

conduct business in the global economy. With approximately 266,000

team members, Wells Fargo serves one in three households in the

United States. Wells Fargo & Company was ranked No. 30 on

Fortune’s 2015 rankings of America’s largest corporations. Wells

Fargo’s vision is to satisfy our customers’ financial needs and

help them succeed financially. Wells Fargo perspectives are

also available at Wells Fargo Blogs and Wells Fargo Stories.

*Data as of May 2015, comparison with May 2014.

**Mobile carrier’s text messaging and web access charges may

apply for text message alerts.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150825006097/en/

Wells Fargo & CompanyRichele Messick, 651-205-6560

(Media)Richele.j.messick@wellsfargo.com@RJMessickWF

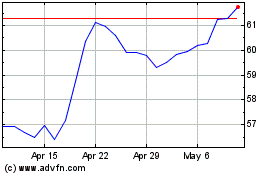

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

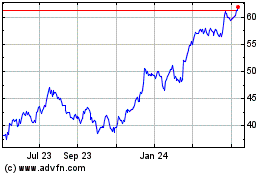

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024