Indicator score down to 63; international

business still important long-term

Amid concerns of weak global economic conditions, U.S. companies

anticipate a decrease in the volume of exports and profits stemming

from international business this year, according to the latest

Wells Fargo International Business Indicator. Thirty-nine percent

of the U.S. companies surveyed expect to see an increase in profits

from their international business in 2015, down from 51 percent in

2014. Similarly, only 30 percent expect to see exports increase in

2015, compared to 50 percent in 2014. However, despite dampened

short-term expectations, a majority of companies remain bullish on

future international business, with 80 percent agreeing that U.S.

companies should consider expanding internationally for long-term

growth.

Released today by the International Group of Wells Fargo &

Company (NYSE:WFC), the Wells Fargo International Business

Indicator tracks the strength and direction of the international

outlook of U.S. companies, surveying more than 250 U.S. companies

with annual revenue of $50 million or more that conduct at least

some international business.

“The latest Indicator results reflect what we’re seeing in the

marketplace and hearing from our customers,” said Sanjiv Sanghvi,

head of Wells Fargo Global Banking. “Continued concern about global

economic conditions, slowing growth in China, the value of the U.S.

dollar and its effect on exports, are impacting short-term

international business activity. However, while the near-term

outlook has softened, U.S. companies value international markets

for business development and we expect to continue to see them

investing in the global marketplace as they plan for long-term

growth.”

Expectations cool for short-term international

activity

Continuing in positive territory for the second consecutive

year, the overall 2015 Wells Fargo Business Indictor score fell

five points from 68 in 2014 to 63 in 2015, reflecting the dampened

short-term outlook. Only 37 percent of U.S. companies surveyed said

they see the global business climate improving this year. As a

result, only 54 percent of companies surveyed said they plan to

increase activity in 2015, a decline from 69 percent in 2014.

U.S. companies see long-term value in international

expansion

U.S. companies remain confident about the future of the global

marketplace. A majority of the U.S. companies surveyed (60 percent)

expect to increase international business development planning in

2015. Additionally, nearly half (49 percent) believe business

outside the U.S. will be increasingly important to their overall

financial success in the coming year.

Factors impacting international decisions

According to the Indicator, U.S. businesses expect international

business factors, including regulations at home (57 percent) and

abroad (56 percent); political stability abroad (51 percent); and

currency and exchange rates (39 percent) to have a negative impact

on their businesses in 2015.

When assessing new international markets to enter, U.S.

companies are most concerned with the following factors: political

stability (89 percent), infrastructure (82 percent), trade

regulations (82 percent), ability to enforce contracts (80

percent), ease of trading (80 percent) and availability of skilled

labor (79 percent).

U.S. neighbors, China remain key markets; Brazil, India also

eyed for future growth

According to the Indicator, U.S. companies consider Canada and

China as the most important countries today for international

business, followed closely by Mexico and Western Europe:

- China 23 percent

- Canada 23 percent

- Mexico 20 percent

- Western Europe 19 percent

Looking out two to three years, U.S. companies also believe

China (25 percent) and Mexico (22 percent ) are the top two

“hot-spots” for their future growth, with Brazil and India (each 13

percent) also showing promise.

The International Business Indicator score represents the

average of responses for two questions regarding the level of

importance and activity that U.S. companies expect from their

international business in the next 12 months. The Indicator score

ranges from zero to 100, where 100 indicates an absolute positive

outlook, 50 indicates a neutral outlook, and zero indicates an

absolute negative outlook.

For more information on the Wells Fargo Indicator, including a

complete report of the findings and a video overview with Sanjiv

Sanghvi, visit https://www.wellsfargo.com/indicator.

About the Wells Fargo International Business

Indicator

On behalf of Wells Fargo, global research firm GfK conducted 253

telephone interviews between December 12, 2014 and February 6, 2015

with executives at U.S. companies with $50 million or more in

annual revenue that conduct business internationally. Additionally,

participants had to be associate vice president/director level or

above, with either direct decision-making or some influence over

the company’s international business plans and/or strategies. The

margin of error on the total is +/-7.9 percentage points at the 95%

confidence level.

About Wells Fargo & Company

Wells Fargo operates from 36 countries, including branches in

the Cayman Islands, Dubai International Financial Center (DIFC),

Hong Kong, London, Seoul, Shanghai, Singapore, Taipei, Tokyo and

Toronto. The company provides middle market businesses,

corporations, financial institutions, and multilateral

organizations with a wide range of international solutions.

Wells Fargo & Company (NYSE: WFC) is a nationwide,

diversified, community-based financial services company with $1.7

trillion in assets. Founded in 1852 and headquartered in San

Francisco, Wells Fargo provides banking, insurance, investments,

mortgage, and consumer and commercial finance through more than

8,700 locations, 12,500 ATMs, and the internet (wellsfargo.com) and

mobile banking, and has offices in 36 countries to support

customers who conduct business in the global economy. With

approximately 265,000 team members, Wells Fargo serves one in three

households in the United States. Wells Fargo & Company was

ranked No. 29 on Fortune’s 2014 rankings of America’s largest

corporations.

About GfK

GfK is one of the world’s largest research companies, with more

than 13,000 experts working to discover new insights into the way

people live, think and shop, in over 100 markets, every day. GfK is

constantly innovating and using the latest technologies and the

smartest methodologies to give its clients the clearest

understanding of the most important people in the world: their

customers. In 2014, GfK’s sales amounted to €1.45 billion. To find

out more, visit www.gfk.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20150401005196/en/

Wells Fargo & CompanyMediaKathryn Ellis,

1-415-222-3767kathryn.d.ellis@wellsfargo.com@KatieEllisWF

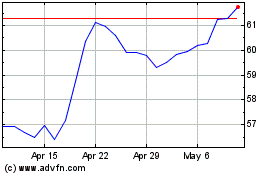

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

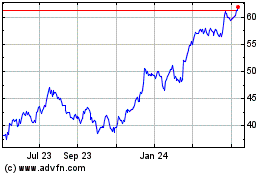

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024