Early Banking 4Q Reports Give Cause For Lending Optimism

January 14 2011 - 4:23PM

Dow Jones News

Three banks of very different size kicked off the fourth-quarter

earnings season in earnest Friday, with all reporting measurable

demand for new business loans.

If other banks report higher loan demand, it could indicate a

trend that may breathe new life into banks. Loan growth could give

bankers an opportunity to grow revenue, following a year when

earnings rose due to lower costs for bad loans.

Analysts have been worried that the slow economic recovery and

new regulation and laws would make 2011 a tough year. But

executives at giant J.P. Morgan Chase & Co. (JPM), midsized

M&T Bank Corp. (MTB), and Webster Financial Corp. (WBS), which

reported fourth-quarter earnings Friday, sounded optimistic that a

sustained recovery of the lending business would lift earnings this

year.

Perhaps those three banks signal the inflection point in

lending, said Ken Usdin, an analyst with Jefferies & Co.

J.P. Morgan Chase reported a year-over-year increase of almost

50% in fourth-quarter profit to $4.8 billion, and a 13% rise in

revenue to $26.1 billion. The bank's corporate lending business,

which caters mostly to the financial needs of mid-sized businesses,

generated record results.

From the third quarter to the fourth, loans to mid-sized

companies rose 4% to $36.6 billion and commercial term loans

increased 2% to $38.6 billion.

Shares of the bank rose 1.3% in afternoon trading.

"What we see is a pretty broad-based strength across corporate,

middle-market, even small businesses," Chairman and Chief Executive

James Dimon told reporters during a conference call. "Capital

markets are wide open, financial conditions have loosened, the rest

of the world is growing."

"We are hopeful this is going to be a good year," Dimon

said.

M&T Chief Financial Officer Rene Jones was similarly

hopeful. During an interview he said "I guess [the economic

recovery] is not fast enough for some, but what I like is that it

is very steady. You don't see a lot of things, if anything, going

into the wrong direction. I like the fact that consumers continue"

to pay down debt and save.

M&T of Buffalo, N.Y., posted earnings growth of almost 50%

to $204 million while revenue rose 14% to $776 million. Although

loan balances are down from a year earlier, commercial loans rose

by $600 million, or 5%, from the third quarter to $13.4

billion.

"The kind of recovery we see is more around manufacturing,

healthcare, perhaps a little bit retail," Jones said. Those trends

could help M&T, which is in markets with much

manufacturing.

M&T also saw increasing demand in so-called "floorplan

lending" that is financing auto dealers' inventory. Shares of

M&T were down 0.2% in afternoon trading.

Webster Chief Executive James Smith said he sees "significant

growth opportunities" in lending to small and mid-sized businesses.

The Waterbury, Conn., bank reported a $32.6 million profit,

compared to a $13.7 million loss a year earlier. Revenue rose 44%,

to $168 million. Its shares added 9.6% in afternoon trading.

Still, there were words of caution. J.P. Morgan's Chief

Financial Officer Douglas Braunstein told analysts during a

conference call the utilization of commercial lines of credit

remains flat and below 35% of their limit.

M&T's Jones said, "the strong commercial loan growth we

experienced in December was not matched by similar inflows into our

current pipeline for new business."

Jefferies' Usdin said the stronger banks reported first this

earnings season; later banks may not show as much loan growth. But

the results bode well for PNC Financial Services Group Inc. (PNC)

and for other banks in manufacturing markets, like Fifth Third

Bancorp (FITB) and Huntington Bancshares Inc. (HBAN), Usdin said.

All three are scheduled to report results this coming Thursday.

Todd Hagerman, an analyst with Collins Stewart, wondered

"whether the increasing demand will really manifest itself into

balance-sheet growth."

He added that "better-than-expected mortgage banking and

asset-management revenues are not likely sustainable in 2011 as the

recovery remains tepid."

-By Matthias Rieker, Dow Jones Newswires; 212-416-2471;

matthias.rieker@dowjones.com

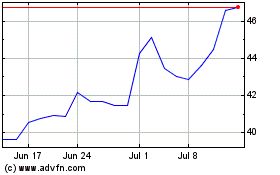

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

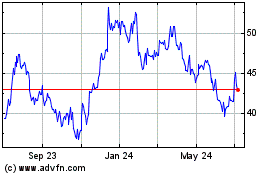

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Apr 2023 to Apr 2024