The softening market for bank stocks threatens to cool the TARP

program's hot returns.

As U.S. banks have returned to health following the worst

financial crisis in decades, the U.S. Treasury has shared in their

gains. Banks that have exited the government's Troubled Asset

Relief Program, or TARP, have on average earned taxpayers 10.3% in

annualized returns for their investments, according to Keefe

Bruyette & Woods. Wall Street firms Goldman Sachs Group Inc.

(GS) and Morgan Stanley (MS), which each repaid their $10 billion

in government investments last summer, generated returns of nearly

20% and 16%.

Now, with financial stocks sliding, the Treasury and taxpayers

are facing the prospect of diminishing returns as more companies

repay their public support.

The government is "still going to make a nice return," said Fred

Cannon, co-director of research at Keefe Bruyette & Woods. "But

I'm not sure the 10% will hold up."

Here's why: While the government got a 5% dividend on preferred

stock it received under TARP, its ultimate return depends in part

on where that company's stock is trading when the government gets

paid for warrants that were also part of the TARP investments. And

lately, the market for bank stocks has belonged to skeptical

buyers.

Financial stocks in the Standard & Poor's 500 have fallen

about 18% since April, threatening the size of proceeds from the

government's sales of the stock warrants. (Volatility and term also

influence the pricing of options.)

Nearly two years ago, as the financial crisis threatened to

implode the U.S. economy, the Treasury used TARP to make hundreds

of billions of dollars in investments in private companies in order

to stabilize the U.S. financial system. As the healthiest of those

companies exit the program, U.S. taxpayers have been compensated

for crisis-hour rescue.

In July, as economic fears faded and bank stocks rallied, the

government started selling its warrants--in some cases, back to the

companies themselves. When companies didn't buy at the government's

price, Treasury sold the warrants at auction. By the end of May,

the Treasury had raked in $6.8 billion just from warrants tied to

the 14 biggest banks to exit TARP.

For the roughly 60 financial firms that have exited the

program--including much smaller institutions like First Manitowoc

Bancorp Inc. (FMWC) and Old Line Bancshares Inc. (OLBK)--the

Treasury has collected proceeds of $6.98 billion on the warrants

and $5.55 billion on the dividends on the preferred shares, KBW

said in an analysis released Tuesday. That's an annualized return

of 10.3% on the $131.8 billion that the government initially

invested in those companies, according to KBW.

The government has yet to sell warrants tied to insurer Hartford

Financial Services Group Inc. (HIG), credit card lender Discover

Financial Services (DFS) and lender Webster Financial Group (WBS),

among others.

Hundreds of companies in the TARP program, of course, have yet

to repay their investments, including Detroit-based automakers

General Motors Co. and Chrysler Holding Co.

Moreover, the rescued giant insurer American International Group

Inc. (AIG), along with nearly 100 smaller banks, have missed

dividend payments to the government due to their poor financial

condition. And the government has taken permanent losses from a

handful of TARP participants, including CIT Group Inc. (CIT), which

filed for bankruptcy.

The government's $3.4 billion stake in American Express Co.

(AXP) produced the best return, at 23.3%.

Government officials used the TARP funds, which were authorized

by Congress, to stabilize a wide range of firms, ranging from small

banks to car companies. Only a handful of the selected companies

have so far repaid the investments, but some of those that did have

paid handsomely for the help.

Goldman and Morgan Stanley each received investments of $10

billion, and the government collected returns on those investments

of 19.9% and 16.3%, respectively.

The nation's three big trust banks, Bank of New York Mellon

Corp. (BK), State Street Corp. (STT) and Northern Trust Corp.

(NTRS), also accounted for solid gains for taxpayers. From its $3

billion investment in BNY Mellon, the government returned 10.1%.

The $2 billion in State Street produced returns of 9% and the $1.6

billion that Northern Trust accepted returned 11%.

The Treasury's investments in more traditional banks, like J.P.

Morgan Chase & Co. (JPM) and Bank of America Corp. (BAC), have

turned in smaller returns.

The $25 billion investment in Bank of America returned 8.3%,

while identical investments in J.P. Morgan and Wells Fargo &

Co. (WFC) returned 6.2% and 5.8%, respectively.

The government's investment in strong U.S. regional banks have

also produced solid returns. A $6.6 billion investment in U.S.

Bancorp (USB) returned 7.7%, and the Treasury's $7.6 billion

investment in PNC Financial Services Group Inc. (PNC) returned

7.3%. Capital One Financial Corp.'s (COF) $3.6 billion returned

6.7%, while BB&T Corp.'s (BBT) $3.1 billion returned 7.5%.

Warren Buffett's investment in Goldman has so far soared past

those returns, with an annualized return of 36%, according to Dr.

Linus Wilson, a finance professor at University of Louisiana at

Lafayette who has authored a paper about Berkshire's Goldman

investment.

In September 2008, shortly before the government took its stake

in Goldman, Warren Buffett, the billionaire chairman of Berkshire

Hathaway Inc. (BRKA, BRKB), agreed to buy $5 billion in preferred

shares from Goldman. He negotiated a hefty 10% dividend and

demanded, as a bonus, warrants to buy $5 billion of Goldman stock

at $115 a share.

That means that the Oracle of Omaha's eventual return, just like

some of the government's, depends in part on the future price of a

single stock.

-By Marshall Eckblad, Dow Jones Newswires; 212-416-2156;

marshall.eckblad@dowjones.com

(Matthias Rieker contributed to this article.)

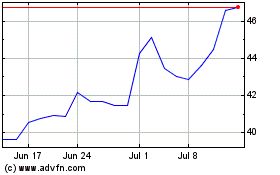

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

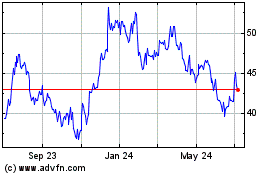

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Apr 2023 to Apr 2024