UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) June 23, 2015

Waters Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

| 01-14010 |

|

13-3668640 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

| 34 Maple Street, Milford, Massachusetts |

|

01757 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(508) 478-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 25, 2015, Waters Corporation (the “Company”) announced that Christopher J. O’Connell has been hired to serve as its President and

Chief Executive Officer (“CEO”) and as a member of its Board of Directors, commencing on September 8, 2015. Previously, Mr. O’Connell, age 48, served as Executive Vice President and Group President, Restorative Therapies

Group, of Medtronic plc (formerly Medtronic, Inc.) since August, 2009.

In connection with Mr. O’Connell’s hiring, on June 23, 2015,

the Company entered into an offer letter (the “Agreement”) with Mr. O’Connell. The Agreement provides that, effective September 8, 2015, Mr. O’Connell will serve as the President and CEO of the Company and will be

appointed as a member of its Board of Directors. Pursuant to the terms of the Agreement, Mr. O’Connell is entitled to receive an annual base salary of $825,000 and is eligible for an annual bonus based on achievement of performance

objectives established by the Compensation Committee of the Company’s Board of Directors in its discretion. The target amount of the annual bonus is 125% of Mr. O’Connell’s base salary. In addition, Mr. O’Connell will

be entitled to receive, as his 2015 equity award at the time annual equity awards are granted to Company executives generally (which is expected to be in December 2015), a non-qualified stock option award having a Black-Scholes value on the date of

grant of $5,000,000. The award will vest as to 20% of the shares of common stock underlying the award on each of the first five anniversaries of the date of grant, generally subject to continued employment on each vesting date and subject to the

other terms and conditions of the Company’s equity incentive plan.

The Agreement also provides that in connection with the commencement of his

employment, Mr. O’Connell will receive the following:

| |

• |

|

a restricted stock unit award on September 8, 2015, with the number of restricted stock units subject to the award determined by dividing $2,500,000 by the closing price of a share of Company common stock on such

date. The restricted stock unit award will vest as to one-third of the award on each of the first three anniversaries of the date of grant, generally subject to continued employment on each vesting date and subject to the other terms and conditions

of the Company’s equity incentive plan. The award will vest in full upon a termination of employment due to death or Disability (as defined in the Agreement), a termination by the Company without Cause (as defined in the Agreement) or a

termination by Mr. O’Connell for Good Reason (as defined in the Agreement). |

| |

• |

|

a non-qualified stock option award on September 8, 2015, having a Black-Scholes value on such date of $2,500,000. The non-qualified stock option award will vest as to 20% of the shares of common stock underlying

the award on each of the first five anniversaries of the date of grant, generally subject to continued employment on each vesting date and subject to the other terms and conditions of the Company’s equity incentive plan. The award will vest in

full upon a termination of employment due to death or Disability, a termination by the Company without Cause or a termination by Mr. O’Connell for Good Reason. |

| |

• |

|

a cash payment of $1,700,000 (subject to repayment of a pro rata amount thereof (based on the date of termination of employment) if Mr. O’Connell resigns without Good Reason or his employment is terminated by

the Company for Cause prior to September 8, 2016). |

The Agreement also provides that Mr. O’Connell will be entitled to

reimbursement of certain costs associated with his relocation to the Milford, Massachusetts area pursuant to the Company’s executive relocation program (excluding the allowance for temporary living expenses provided thereunder).

If Mr. O’Connell’s employment is terminated by the Company other than for Cause or if he resigns for Good Reason, Mr. O’Connell will

be entitled to receive, subject to the execution of a release of claims and continued compliance with the restrictive covenants contained in the Employment Agreement, continued salary and target annual bonus for a period of twenty-four

(24) months. In addition, Mr. O’Connell will be entitled to receive a lump sum payment equal to the amount that the Company would have paid in premiums under the life, accident, health and dental insurance plans in which

Mr. O’Connell and his dependents were participating immediately prior to the termination of his employment for the twenty-four (24) -month period following the date of termination. If Mr. O’Connell is employed on or after

July 1 of the year in which his employment termination occurs, he will also be entitled to a pro-rata annual bonus for such year, based on actual performance. Mr. O’Connell will be subject to non-competition and non-solicitation

restrictions for a period of two years following the termination of his employment.

The Agreement includes certain other customary terms, including with

respect to protection of confidential information and documents, assignment of intellectual property rights, reimbursement of business expenses, indemnification and insurance coverage, and reimbursement of legal fees.

The Agreement provides that all of its provisions, including the provisions described above, will only take effect as a binding agreement between the Company

and Mr. O’Connell as of September 8, 2015, except that if Mr. O’Connell is willing and able to commence employment with the Company on September 8, 2015 and the Company refuses to employ him as President and Chief

Executive Officer on such date, the Company will, within 10 business days of September 8, 2015, pay to Mr. O’Connell an amount in cash equal to $6,500,000.

In connection with the execution of the Agreement, the Company entered into a Change of Control/Severance

Agreement dated September 8, 2015 (the “Change of Control Agreement”) with Mr. O’Connell. The Change of Control Agreement provides that if, within nine months prior to a Change of Control (as defined in the Change of Control

Agreement) and subsequent to the commencement of substantive discussions that ultimately result in the Change of Control, or within eighteen (18) months following a Change of Control, the Company terminates Mr. O’Connell’s

employment for a reason other than Cause (as defined in the Change of Control Agreement), death or Disability (as defined in the Change of Control Agreement), or Mr. O’Connell resigns for Good Reason (as defined in the Change of Control

Agreement), then, subject to the execution of a release of claims, the Company will pay to Mr. O’Connell a lump sum amount equal to (I) thirty-six (36) times his monthly base salary, plus (II) the amount payable pursuant to

(I) multiplied by his target bonus percentage (or, if greater, his accrued bonus percentage for the current year), plus (III) the amount that the Company would have paid in premiums under the life, accident, health and dental insurance plans in

which Mr. O’Connell and his dependents were participating immediately prior to the termination of his employment for the thirty-six (36) -month period following the date of the Change of Control. The foregoing amounts payable under

the Change of Control Agreement will be reduced by the amount of any severance or similar amounts paid or payable under the Agreement. In addition, the Change of Control Agreement provides for any outstanding equity awards and qualified or

non-qualified capital accumulation benefits under certain Company benefit plans that are unvested or unexercisable and held by Mr. O’Connell on the date of such termination of employment to vest or become exercisable upon such Change of

Control.

On June 25, 2015, Waters Corporation also announced that CEO, Douglas A. Berthiaume, will retire as CEO on September 8, 2015,

but will continue in his role as Chairman of Waters’ Board of Directors.

| Item 7.01 |

Regulation FD Disclosure. |

On June 25, 2015, Waters Corporation issued a press release announcing

the appointment of Mr. O’Connell and the retirement of Mr. Berthiaume as set forth in Item 5.02 of this Current Report on Form 8-K. A copy of the press release is furnished with this Form 8-K as Exhibit 99.1. Exhibit

99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be

incorporated by reference into any filing of Waters Corporation under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release, dated June 25, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

WATERS CORPORATION |

|

|

|

|

| Dated: June 25, 2015 |

|

|

|

By: |

|

/s/ EUGENE G. CASSIS |

|

|

|

|

Name: |

|

Eugene G. Cassis |

|

|

|

|

Title: |

|

Corporate Vice President and Chief Financial

Officer |

Exhibit 99.1

Waters Corporation Announces Christopher J. O’Connell

as Chief Executive Officer

Milford,

Mass. - June 25, 2015 – Waters Corporation (NYSE:WAT) today announced that Christopher J. O’Connell has been appointed as its new President, Chief Executive Officer (CEO) and member of its Board of Directors, effective in

September 2015. Chris joins Waters® from Medtronic plc.

“From the outset, Waters’

Board of Directors focused on identifying a new CEO whose experience best supports the continuation of Waters’ culture, business strategies and performance drivers,” explained Thomas P. Salice, Lead Director for Waters Corporation.

“Chris O’Connell’s wide range of experiences across all aspects of a technology focused global organization prepares him well for the Waters CEO position. Through the process of getting to know him, we found a leader who reflects

Waters’ core values in addition to being an extremely motivated, thoughtful and engaging person. We are confident Chris is the right person to continue to drive Waters’ leadership performance and chart its future direction.”

“I am thrilled to join Waters Corporation,” said Mr. O’Connell. “Not only am I excited to enter an industry that enables its

customers to advance and push the limits of science, but I’m very proud to join the industry’s technology and customer support leader, and to be given the opportunity to lead a remarkable group of people.”

Over his 21 years at Medtronic, Chris O’Connell held a variety of leadership positions, most recently as president of the Restorative Therapies Group

responsible for $7 billion in revenue and more than 16,000 employees worldwide. He provided overall strategic direction and operational management of the Group’s five divisions, as well as led the integration of the Group’s activities

within the overall strategy of the corporation. Chris earned a Bachelor’s degree from Northwestern University and a Master’s degree in Business Administration from Harvard University.

Retiring CEO, Douglas A. Berthiaume will continue in his role as Chairman of Waters’ Board of Directors. All

other leadership positions within Waters will remain in place with their continued focus on executing the Company’s growth strategies.

“With

this leadership transition, it is important to recognize Doug Berthiaume for all that he accomplished as Waters’ President, CEO and Chairman of the Board,” said Mr. Salice. “As the leading architect of the company’s focused

business strategy, Doug oversaw Waters’ drive to expand applications of our core technologies and commitment to customer relationships. Impressively, the corporation has experienced a 35-fold increase in share value since Doug led the effort

taking the company public in November 1995. We offer our heartfelt gratitude to Doug and look forward to his continued role as Chairman.”

About

Waters Corporation (www.waters.com)

Waters Corporation (NYSE: WAT) develops and manufactures advanced analytical science technologies

for laboratory-dependent organizations. For more than 50 years, the company has pioneered a connected portfolio of separations science, laboratory information management, mass spectrometry and thermal analysis systems.

###

Waters is a registered trademark of the Waters Corporation.

Contacts:

John Lynch

Investor Relations

John_Lynch@waters.com

508.482.2314

Jeff Tarmy

Corporate Communications

Jeff_Tarmy@waters.com

508-482-2268

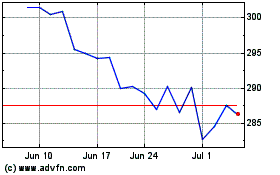

Waters (NYSE:WAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

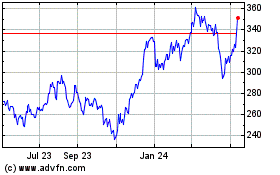

Waters (NYSE:WAT)

Historical Stock Chart

From Apr 2023 to Apr 2024