By Jack Nicas, Jack Marshall and Suzanne Vranica

AT&T Inc., Verizon Communications Inc. on Wednesday joined a

growing number of companies pulling much of their advertising from

Google, expanding a controversy over the internet giant's ad

placements on objectionable content and deepening the financial

impact on the company even after it announced measures to assuage

concerns.

The new moves by advertisers amplify a problem for Google that

had been centered in the U.K., and suggests the Alphabet Inc. unit

is finding it harder than expected to quell the backlash. The

crisis has created an opening for some advertisers to press Google

for long-sought changes, while highlighting its complicated

relationship with some of its customers. AT&T and Verizon, for

example, in addition to being big advertisers, are building online

video and ad services to compete with Google.

The two wireless carriers and pharmaceutical company

GlaxoSmithKline PLC suspended advertising spending on Google except

for search, encompassing all ads on Google's YouTube site and the

more than two million third-party websites in Google's advertising

network. Johnson & Johnson and rental-car firm Enterprise

Holdings Inc. said they were canceling advertising on YouTube.

Distiller Beam Suntory Inc. said it also canceled some advertising

with Google.

The companies said the suspensions were in response to evidence

that Google placed their ads on extremist YouTube videos.

"We are deeply concerned that our ads may have appeared

alongside YouTube content promoting terrorism and hate," AT&T

said in a statement, adding that its move would last "until Google

can ensure this won't happen again." AT&T declined to disclose

how much it spends on YouTube, but a person familiar with the

matter said AT&T is among the video site's top customers.

On Tuesday, Google unveiled changes to its policies and

enforcement designed to keep ads away from controversial sites and

videos, after brands such as the British newspaper the Guardian,

HSBC Holdings PLC and L'Oréal SA reduced their ad dollars within

the past week.

Verizon said in a statement that it is working with digital-ad

partners "to understand the weak links so we can prevent this from

happening in the future." Verizon's suspension applies to all

so-called programmatic advertising, which uses software to

automatically place ads across the web. Such advertising includes

ads on YouTube and Google's network of third-party sites.

A Google spokeswoman said it is working on measures "to further

safeguard our advertisers' brands." She declined to comment on

specific companies.

For Google, the world's largest advertising platform, the uproar

has spiraled from a public-relations issue into a crisis that some

analysts say could hit its bottom line. Serving ads on third-party

websites brought in revenue of $15.6 billion last year, or 17.3% of

Alphabet's overall revenue. Alphabet doesn't disclose YouTube's

revenue, but has signaled it has been a major driver of growth in

recent quarters. The controversy hasn't touched the company's main

moneymaker, ads atop search results.

"This probably gets worse before it gets better for Google,"

said Brian Wieser, Pivotal Research Group analyst, who downgraded

Alphabet's stock to hold from buy on Monday because of advertisers'

reactiony.

Google's recent policy changes "did nothing to alleviate

concerns."

The advertising backlash began in the U.K. following a report in

the Times of London about videos made by supporters of terrorist

groups. Subsequently, it was found that many American brands

continued to be shown alongside controversial clips, prompting the

wave of ad cancellations Wednesday.

Some of the loudest voices stoking Google's controversy are

companies with axes to grind with the tech giant: telecom companies

that view themselves as rivals of Google in online advertising,

publishers and media companies that have watched Google suck up ad

dollars, and marketers that do battle regularly with Google and see

a chance in the crisis to push for changes.

"We've been talking about brand safety for 20 years. It's not a

new phenomenon," said David Cohen, president of Interpublic Group

of Cos Inc. ad-buying group Magna Global in North America. "In a

world where so much content is being produced, it's really

difficult and challenging to come up with a 100% solution. That

said, we have had a couple conversations with Google over the past

couple of days. We're exerting pressure to do more."

In the past several days, executives at the biggest media-buying

agencies have been fielding calls from marketers eager to find out

more about whether their own ads have landed in foul places, not

just in the U.K. but world-wide.

Meanwhile, a global beverage company has pulled most of its ad

spending from Google, outside of search, in 30 countries including

the U.S., according to a person familiar with the situation. In a

few smaller markets, the beverage giant will continue to buy

inventory from "Google Preferred," which are top YouTube channels

that Google markets as some of the site's most brand-friendly

content, the person said.

Agency executives have been in talks with Google to press for

more details on the new tools it will provide. Industry executives

have long called on Google to give them greater control over where

their ads appear, and more visibility into its ad systems. But they

feel the high-profile nature of the current flare-up gives them a

strong change to make that case.

Mr. Cohen said Interpublic is asking for more specifics about

the brand-safety measures Google said it would implement, and that

it wants Google to be more accessible to third-party companies that

verify the safety of web-ad inventory on behalf of brands.

Havas SA, the world's sixth-largest ad-agency holding company by

revenue, last week pulled ads for its clients in the U.K. off

Google properties. Yannick Bollore, Havas's chief executive, said

the ad firm is working with some marketers to explore if they

should be removing ads everywhere in the world, not just in the

U.K. "Right now it is only discussions. I will know more in a

couple of days," he said.

As for why Havas hasn't already suspended advertising on Google

properties in other countries, Mr. Yannick said, "we had proof that

it happened in the U.K., and I haven't received any proof that it

happened in other markets."

Verizon has built up an online advertising business with the

acquisition of AOL in 2015 and has struck a deal to acquire Yahoo

Inc.'s core business. The combination would give Verizon roughly 2%

of the global digital advertising market in 2016, according to

eMarketer.

Like Google, AOL sells advertising that is automatically

distributed to third-party sites. AT&T, meanwhile, is

positioning itself as a budding competitor to Google as an

advertising platform, pitching its proposed merger with Time Warner

Inc. as a defense against Google's growing power in the

industry.

"Advertisers need more competition," Time Warner CEO Jeff Bewkes

said on an October conference call with analysts. "This will give

another outlet, not just the Google and Facebook one that's been

gaining all the traction."

--Ryan Knutson, Drew FitzGerald and Alexandra Bruell contributed

to this article.

Write to Jack Nicas at jack.nicas@wsj.com, Jack Marshall at

Jack.Marshall@wsj.com and Suzanne Vranica at

suzanne.vranica@wsj.com

(END) Dow Jones Newswires

March 22, 2017 20:07 ET (00:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

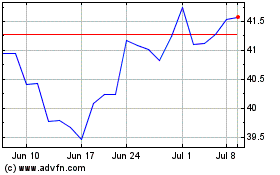

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

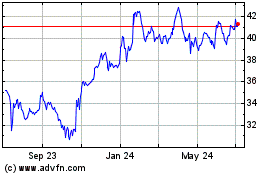

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024