Telecom Industry Sees Relief in Trump Policy Agenda

December 09 2016 - 8:30AM

Dow Jones News

The telecommunications industry is embracing the idea of a Trump

administration.

President-elect Donald Trump's promises to reduce corporate

taxes and to eliminate regulations have been welcomed by executives

from an industry facing intense oversight. Four of the biggest

players generate more than $340 billion in annual revenue from

largely domestic operations.

"I think that it's very clear there's going to be less

regulation," T-Mobile US Inc. Chief Financial Officer Braxton

Carter said this week. "I think that it's hard to imagine that

there's not going to be more openness to consolidation."

AT&T Inc. chief Randall Stephenson this week noted that the

Federal Communications Commission has stopped moving ahead on

passing several rules such as privacy oversight and business

broadband pricing. Republican congressional leaders last month

asked the agency to stop taking controversial regulatory actions

until the new presidential administration is on board.

During the administration of President Barack Obama, the FCC has

had two chiefs, both of whom have taken strong positions on

everything from the open internet to merger review, often at odds

with industry heavyweights. Two major wireless mergers were

torpedoed by federal authorities in recent years.

Republican FCC commissioner Mike O'Rielly said Wednesday he was

encouraged by Mr. Trump's comments about the "detrimental impact of

the current stifling regulatory environment on the American

economy."

"I particularly like his call for the elimination of two

regulations for every new one created," Mr. O'Rielly said.

One key area for optimism is taxes. Verizon Communications Inc.

chief Lowell McAdam this week expressed hope that the Trump

Administration will be able to lower the corporate rate. "We are

not planning on getting into the 15% range; that would be great if

it did," Mr. McAdam said at the same conference.

AT&T's Mr. Stephenson, who has long pushed for changes in

the corporate tax code, said that tax relief could increase capital

investment across the economy and improve productivity.

AT&T has a lot on the line right now as a review of its

proposed $85 billion Time Warner Inc. takeover begins, a deal that

Mr. Trump addressed on the campaign trail as one he would block as

president. Mr. Trump hasn't commented on his position since the

election.

While the telecom market is dominated by huge national players,

many smaller telecom companies depend on regulatory protections

pushed by Democrats in recent years to help compete with their

larger brethren.

"Traditional Republican telecom policy has favored incumbents

who are heavily engaged in regulatory capture over innovators like

us," said David Morken, the founder of two firms, Bandwidth.comand

Republic Wireless, that use internet technology to offer low-cost

phone service.

Mr. Morken is a lifelong Republican, but "every election I have

to choose between voting personal conviction or business

interests." Together, his companies employ about 500 people and

generate more than $200 million in annual revenue.

Dane Jasper, CEO of Sonic.net, a Santa Rosa, Calif.,-based

internet service provider said that Democratic regulators have

acted to promote competition, but he had some hope for Republicans

under Mr. Trump.

"It's not clear to me that a Republican-led FCC wouldn't also

foster open competition," he said. "Perhaps the Republican ideals

of free market will extend beyond the instinct to protect

incumbents."

Mr. Jasper pointed out that the FCC under former President

George W. Bush "dismantled competition" in favor of the traditional

telecom companies. "I hope we don't see that again," he said.

Write to Thomas Gryta at thomas.gryta@wsj.com and Ryan Knutson

at ryan.knutson@wsj.com

(END) Dow Jones Newswires

December 09, 2016 08:15 ET (13:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

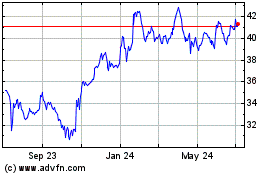

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

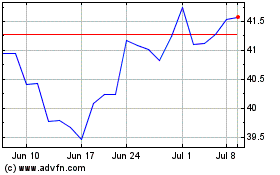

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024