A Chinese technology giant, whose telecom networking equipment

is shut out of the U.S. due to security concerns, is bringing its

high-end smartphone to American consumers for the first time.

But a number of obstacles are blocking Huawei Technologies Co.'s

path to success in the U.S. smartphone market.

U.S. carriers, which distribute more than 80% of handsets in the

country, are reluctant to work with Huawei—the world's

third-largest smartphone maker by shipments behind Samsung

Electronics Co. and Apple Inc.--because of its low brand

recognition and security concerns associated with its networking

equipment, people familiar with the matter say. A 2012

congressional report recommended that U.S. carriers avoid using

Huawei gear in their networks for fear that China might use it to

spy on Americans. Huawei has denied such accusations, saying it

operates independently of Beijing.

There are also technical hurdles related to cellular standards

that would make U.S. expansion costly for the Chinese company.

"We haven't figured out how to remove those obstacles," said a

U.S.-based Huawei manager who declined to be named. "It's very

challenging."

Huawei said this month that it would launch its high-end Mate 9

smartphone in the U.S. But the phone, which carries a €699 ($759)

price tag in Europe, will likely be sold just through online

retailers such as Amazon.com Inc., people familiar with the matter

said. Huawei hasn't disclosed the price or exact release date in

the U.S.

The U.S. is the biggest missing piece in Huawei's smartphone

global expansion strategy. The company, founded by former People's

Liberation Army engineer Ren Zhengfei three decades ago, has become

a major force thanks to its growth in China—the world's biggest

smartphone market—as well as Europe, the Middle East, Africa and

Latin America. In the U.S., where it sells inexpensive models, it

had a market share of just 0.4 % in the third quarter, according to

research firm Canalys. Apple was the U.S. market leader with 39%,

followed by Samsung with 23%.

The U.S. is the world's largest market for high-end phones

priced above $500, according to Canalys. Cracking that market would

help Huawei in its mission to overtake Apple and Samsung within

five years as the world's top smartphone maker.

"It takes time to build trust in the U.S.," Richard Yu, head of

Huawei's smartphone business who has set that ambitious goal, said

in an interview this month.

But there are technical challenges. To comply with the cellular

standard used by Verizon Communications Inc. and Sprint Corp.,

Huawei would have to make substantial and costly changes to its

mobile chips. Verizon and Sprint also see little upside in adding

Huawei devices to their already crowded lineup of phones given

Washington's wariness toward the Chinese company, people familiar

with the matter said.

Huawei is also in a patent dispute with T-Mobile US Inc., making

collaborations between the two unlikely.

While Huawei is more hopeful about the possibility of working

with AT&T Inc., one of the country's two biggest carriers along

with Verizon, and has communicated with the telecom giant, it is

unclear whether they can agree on a partnership, according to the

U.S.-based Huawei manager.

AT&T and T-Mobile declined to comment.

Until now, Huawei has largely ignored the U.S. as it

concentrated on more welcoming markets. In Western Europe, it has

spent heavily on advertising, working closely with local retailers

and sponsored professional soccer teams. As a result, its market

share there more than doubled to 13% in the third quarter from 6% a

year earlier, according to research firm IDC.

In the U.S., where handsets sold by retailers account for a

small part of the market, Huawei needs a different strategy. Apple

and Samsung dominate the premium segment, making it hard for other

vendors to convince U.S. carriers to sell their high-end phones,

analysts say.

For carriers, "it's easier to sell brands that consumers already

know, brands that are heavily marketed," said Canalys analyst Chris

Jones. Samsung, for example, spent years building relationships

with U.S. carriers while outspending rivals in marketing.

Other Chinese players, such as ZTE Corp. and TCL Communication

Technology Holdings Ltd., which owns the Alcatel brand, work with

U.S. carriers by focusing on handsets that cost less than half of

Apple and Samsung phones. ZTE also promoted its brand by sponsoring

National Basketball Association teams.

Targeting the low-end segment, where margins are thin, doesn't

fit well with Huawei's attempt to move upscale and sell more

expensive phones.

"The U.S. device market is significant for Huawei," a Huawei

spokesman said. "We are patient, however, and we measure our

success over the long term."

Archibald Preuschat in Frankfurt contributed to this

article.

Write to Juro Osawa at juro.osawa@wsj.com and Ryan Knutson at

ryan.knutson@wsj.com

(END) Dow Jones Newswires

November 27, 2016 20:55 ET (01:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

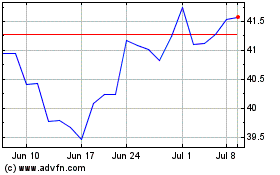

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

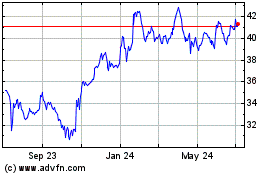

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024