CenturyLink in Advanced Talks to Merge With Level 3 Communications

October 27 2016 - 2:00PM

Dow Jones News

CenturyLink Inc. is in advanced talks to merge with Level 3

Communications Inc., a deal that would give the telecommunications

companies greater heft in a brutally competitive industry.

A deal could be announced in the coming weeks, according to

people familiar with the matter. As always, there is a possibility

the talks could fall apart.

Terms of the deal couldn't be learned. As of Thursday afternoon

before the Journal's report of the talks, Level 3, based in

Broomfield, Colo., had a market value of $16.8 billion.

CenturyLink, based in Monroe, La., was worth $15.2 billion.

Shares of Level 3 rose 6.1%, while CenturyLink shares jumped 14%

in midday trading after the Journal's report.

Level 3, which traditionally focused on so-called enterprise

customers, was one of the biggest telecom operators to survive the

dot-com bust. The company runs one of the largest internet

backbones in the world but has turned its focus increasingly to

small and midsize business in an attempt to reverse slowing sales

growth in its core business.

Year to date, the company's stock had fallen more than 14%

before the talks were reported. Singapore state investment firm

Temasek Holdings Pte. is Level 3's largest shareholder, with 18% of

its stock, according to FactSet. Level 3 is scheduled to report

third-quarter earnings next week.

CenturyLink, traditionally a rural local-phone service provider,

has sought to upgrade its network with fiber-optic lines in a bid

to compete with AT&T Inc., Verizon Communications Inc. and

rivals in the cable industry. The company has also branched into

hosting and cloud services though lately it has been looking to

sell some of its data centers. CenturyLink operates more than 55

data centers, according to its website.

The so-called wireline business of running telephone and

internet lines has suffered from brutal competition over the past

15 years, hurt by plummeting prices for network bandwidth and high

capital costs.

The possible deal also illustrates both companies' dwindling

acquisition opportunities in the sector after years of

consolidation.

Both companies have historically been acquisitive. In 2014,

Level 3 bought TW Telecom for about $6 billion. In 2011, it bought

rival Global Crossing Ltd. for around $2 billion.

CenturyLink, formerly called CenturyTel, has also been a

voracious acquirer. In 2011, it bought Qwest Communications

International for $11 billion and Savvis Inc. for about $2 billion,

two years after it purchased Embarq Corp. for about $6 billion.

Drew FitzGerald contributed to this article

Write to Dana Mattioli at dana.mattioli@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

October 27, 2016 13:45 ET (17:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

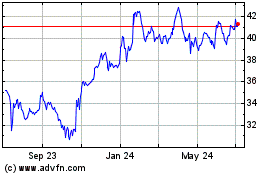

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

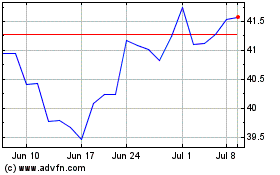

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024