Verizon Puts Yahoo on Notice After Data Breach -- WSJ

October 14 2016 - 3:02AM

Dow Jones News

By Thomas Gryta and Deepa Seetharaman

Verizon Communications Inc. signaled it may demand to

renegotiate its $4.8 billion deal for Yahoo Inc. following the

internet company's recent disclosure of a data breach that affected

more than 500 million accounts.

At a meeting in Verizon's Washington offices on Thursday,

General Counsel Craig Silliman said it was "reasonable" to believe

that the breach represented a material event that could allow it to

change the terms of the takeover. He said it was up to Yahoo to

prove the full impact of the data leak and prove it wasn't

material.

"If they believe that it's not, then they'll need to show us

that," said Mr. Silliman, who has been leading Verizon's review of

the situation.

The breach occurred two years ago but was discovered after the

merger deal was signed in July.

After a prolonged auction, Verizon outbid other suitors by

agreeing to buy Yahoo's core internet business with plans to close

the deal by the end of March. Shares of Yahoo fell 1.7% to $41.62

Thursday, though much of the company's market value reflects its

investments in Alibaba Group Holding Ltd. and Yahoo Japan Corp.

"We are confident in Yahoo's value and we continue to work

towards integration with Verizon," a Yahoo spokeswoman said in

response to Mr. Silliman's comments.

Yahoo disclosed the massive breach last month, one of the

largest thefts of personal user data. Yahoo said "state sponsored"

hackers stole names, email addresses, dates of birth, telephone

numbers and encrypted passwords. Yahoo said it discovered the

breach in July. It didn't notify Verizon until September.

Earlier this week, Verizon Chief Executive Lowell McAdam said

the carrier didn't plan to walk away from the acquisition but

didn't rule out seeking changes to the terms. At a technology

conference in Menlo Park, Calif., on Monday, Mr. McAdam said he

considered Yahoo as "a real value asset," but added: "In fairness

we are still understanding what was going on and defining whether

it was a material impact on the business or not."

Many merger agreements contain provisions allowing buyers to

withdraw from deals if the value of a transaction has been hurt by

a significant development.

Legal experts said the contract language gives Verizon leverage

to renegotiate or even walk away because of the security breach,

but enforcing material adverse change clauses is difficult and

courts have resisted their use.

In 2007 a Delaware court blocked Hexion Specialty Chemicals'

attempt to walk away from a deal to buy Huntsman Corp. after its

rival's earnings fell. But in 2011, private-equity firm Cerberus

walked away from a deal to buy hotel company Innkeepers citing

turmoil in financial markets, and later struck a new deal that was

$100 million lower.

Looking to renegotiate the deal could bring risks for Verizon as

well. Several suitors, including private-equity firms and a group

led by Quicken Loans founder Dan Gilbert, have closely studied

Yahoo's business and made bids to acquire the business. If the

Verizon-Yahoo deal gets terminated, Yahoo may be required to pay

Verizon relatively small termination fee of $145 million in certain

circumstances.

In the days after disclosing the breach, Yahoo's investor

relations team called analysts and major investors. In those calls,

Yahoo officials said they couldn't comment on whether the breach

was a material adverse change that would upend the deal -- but then

laid out an argument for why it probably wouldn't fall into this

category, a person familiar with the matter said.

Yahoo's team argued that if the user experience changed due to

the breach, the "consequences" were already baked into the

company's results, the person said. Yahoo officials also said they

considered the hack to be low risk because all stolen user

passwords were encrypted.

Yahoo also told investors there was no financial fraud because

the breach came from a state-sponsored actor, who the company

didn't believe would be interested in using financial data, the

person said.

Yahoo declined to comment on its outreach to investors.

"One of their crown jewel assets is the audience," said Larry

Ponemon, chairman of Ponemon Institute, a data-security research

firm. "What this does is it basically puts the value of that asset

as a lot less."

Verizon is waiting for the results of Yahoo's investigation into

the breach before deciding how to proceed, said another person

familiar with the matter.

Officials from both companies have continued integration

planning, the two persons familiar with the matter said.

The carrier plans to combine Yahoo with AOL, which it acquired

in 2015, to expand its push into online advertising.

Robert McMillan contributed to this article.

Write to Thomas Gryta at thomas.gryta@wsj.com and Deepa

Seetharaman at Deepa.Seetharaman@wsj.com

(END) Dow Jones Newswires

October 14, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

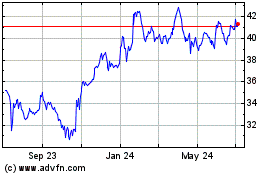

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

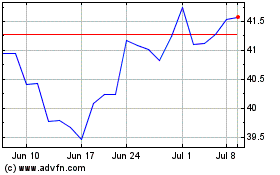

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024