Bethpage, N.Y.—When employees at the small cable operator

Suddenlink Communications requested money to fix a broken ice

machine in West Virginia, they weren't expecting so many

questions.

But during a March "investment committee" meeting, executives

from the company's new owner, Altice NV, quizzed them on everything

from the differences between various ice-machine suppliers to

whether it was better to buy or lease. "A complete waste of

people's time and energy," said one former Suddenlink employee.

Altice views it as cost discipline. "That's our whole

philosophy," said Charles Stewart, chief financial officer of

Altice's U.S. unit. "It triggers a discussion at a very

nitty-gritty level, which is where the difference is made."

The European telecom company's strategy of drastically reducing

costs as it expands globally will soon face its biggest test yet as

it digests the $17.7 billion acquisition of New York cable operator

Cablevision Systems Corp., six months after its $9.1 billion

acquisition, including debt, of Suddenlink.

Altice is under pressure to prove that its formula of slashing

expenses on everything from customer call centers to set-top boxes

and then reinvesting those savings in networks and services can

lead to subscriber growth in the mature U.S. cable market. Altice

has promised to squeeze out an ambitious $900 million in cost

savings from Cablevision, including by reducing programming costs

as channel contracts come up for renewal.

A lot is riding on Altice's success in the U.S. Its shares have

declined 59% in the past 12 months as investors questioned the

effectiveness of Altice's strategy and its debt burden, which is

forecast to increase to just above $50 billion by the end of this

year. While its cost-cutting has helped boost the bottom line,

Altice has yet to prove that it can deliver sales growth.

Some U.S. cable executives question whether Altice's playbook

with St. Louis-based Suddenlink, a more rural operator that it

purchased last year, can work at Cablevision, which faces intense

competition from Verizon Communications Inc.'s Fios service and

already has 3 million customers that account for a relatively high

percentage of its greater New York service area.

In a series of interviews in New York last week during their

first 48 hours of owning Cablevision, Altice executives made no

secret of their bigger ambitions to end up in the top two in U.S.

cable.

"It's easier to go from No. 4 to No. 1 than it is from number

zero to No. 4," Altice founder and controlling shareholder Patrick

Drahi told employees as he helped change a "Cablevision" sign to

"Altice" last week, standing on a construction worker's orange

hydraulic lift. "This is the first day of paradise."

Asked about a potential bid for No. 2 Charter Communications

Inc. after this year's integration of Cablevision, Altice USA Chief

Executive Dexter Goei said he is going to be patient. "There can be

a couple of meaningful acquisitions before thinking about something

as large as that," he said.

One challenge for future deals is that some of the only

remaining sizable U.S. cable operators, such as Cox Communications

Inc. and Mediacom Communications Corp., are controlled by families

and not public shareholders. Altice executives said they would also

look for deals in wireless and content.

At Suddenlink, Altice created an authoritarian investment

committee that scrutinizes every expense in hourslong meetings each

week, as it does with all of its takeovers and will do with

Cablevision. The goal is to use Altice's global clout to negotiate

better deals with suppliers.

"It creates consternation for about two months," Mr. Goei said.

"Then people realize, 'Boy, I really don't want to go to the

investment committee. We just got 500 printers a year ago; we can

probably extend their life one more year.'"

At Suddenlink, Altice didn't announce job cuts when the deal

closed. Instead, workers have exited in threes and fours each week

as Altice has created new teams, contributing to what one former

Suddenlink employee called a "culture of fear." An Altice spokesman

said the departures represented normal churn.

The contrast between Cablevision's former owners—the Dolan

family of New York—and Altice's executives was on stark display in

recent days.

Altice's top executives dined in the staff canteen on their

first day after the deal closed, much to the surprise of several

Cablevision employees. Cablevision's former CEO James Dolan would

rarely be seen outside the executive suite and was often

accompanied by bodyguards outside the building.

While Altice has told New York regulators it won't reduce

customer-facing jobs for four years, it is looking for other cuts.

In the past few weeks, Altice has given Cablevision the blessing to

close Freewheel, the Wi-Fi mobile service it launched last

year.

Altice executives also said they would focus on channel-carriage

costs, which have ballooned in recent years. "We have about half of

our programming lineup that's up for renewal very soon," Mr. Goei

said. "There is clearly a lot of channels that we'd like to get rid

of." But he noted many networks are part of broader programming

deals that require all of a company's channels to be carried.

Last week, curious Cablevision employees streamed out to

congratulate Mr. Drahi as he roamed Cablevision's Long Island

headquarters—a far cry from Altice's appearances in France where it

has been met by union protests. He told them about his first

company, "South Cablevision," which he started at age 28.

"This has been our life: every year we are a bigger group," he

said. "For us, everything is possible."

Write to Nick Kostov at Nick.Kostov@wsj.com and Shalini

Ramachandran at shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

June 28, 2016 10:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

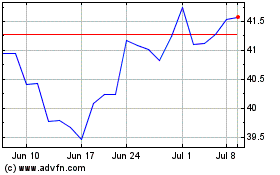

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

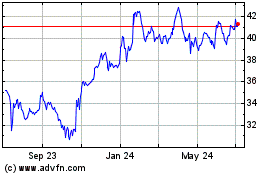

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024