Internet company will add Starboard-backed directors to board,

clearing way for a sale

By Douglas MacMillan and David Benoit

A shake-up of Yahoo Inc.'s board will force Chief Executive

Marissa Mayer to work toward a sale of the struggling Web business

alongside her fiercest critic, activist investor Starboard Value

LP.

Yahoo on Wednesday said it reached an agreement to add Starboard

Chief Executive Jeffrey Smith, along with three of his director

nominees, to its board. Mr. Smith also will join Yahoo's

independent committee in charge of the company's auction process.

Two of Yahoo's current directors won't seek re-election, bringing

the board to a total of 11 directors.

The truce smooths the path to finding a buyer for the Sunnyvale,

Calif., company's core business and figuring out what to do with

its rich stakes in Alibaba Group Holding Ltd. and Yahoo Japan.

Yahoo avoids a proxy battle that could have replaced its entire

board in the middle of an auction process.

But by handing Starboard four board seats, Yahoo ceded

considerable power to an activist investor with a track record of

pushing for changes at all levels of companies, from the merger of

Staples Inc. and Office Depot Inc. to how breadsticks are served at

Darden Restaurants Inc.'s Olive Garden.

Starboard scored a separate win on Wednesday with a deal to get

up to four board seats and lead a search for a new CEO at ailing

chip maker Marvell Technology Group Ltd.

At Yahoo, Starboard's directors will play a central role in

overseeing the auction. Mr. Smith, who has raised concerns the

board wasn't moving quickly enough with its auction process and

wasn't fully open to selling, will now have a seat on the

independent committee of Yahoo directors leading that process.

The field of suitors for Yahoo narrowed this month to a handful

of bidders after a preliminary round that drew interest from dozens

of players. Verizon Communications Inc., seen as the leading

candidate, got a boost as several potential strategic buyers,

including Time Inc., AT&T Inc. and Barry Diller's

IAC/InterActiveCorp. withdrew ahead of a deadline for preliminary

bids last week.

Private-equity firms also are in the running to buy Yahoo. TPG

submitted bids, people familiar with the process said, as well as

an investor group that included Bain Capital, Vista Equity Partners

and former Yahoo CEO Ross Levinsohn.

Yahoo's settlement with Starboard may ease concerns of potential

buyers, who may have worried their bids would be jeopardized by

shareholder angst. Bankers and lawyers said Starboard's presence

likely was adding uncertainty to the bidding process, though also

keeping pressure on the company to sell.

In a news release, Ms. Mayer called the agreement with Starboard

a "constructive resolution." Mr. Smith said in the release that he

looked forward to "getting started right away and working closely

with management and our fellow board members with the common goal

of maximizing value for all shareholders."

It is rare for a company to settle with an activist investor who

pushed to sweep out an entire board, said Patrick McGurn, special

counsel at Institutional Shareholder Services. "Usually the

dissident is not willing to take a minority stake in the boardroom"

after pushing for control of the board, he said.

Since 2008, there have been 99 instances where an activist tried

to throw out the whole board, and only 10 of those companies were

worth more than $1 billion, according to FactSet, which tracks

activist campaigns. Of those attempts, 19 succeeded, only four of

which were worth more than $1 billion, FactSet said.

Yahoo Chairman Maynard Webb led the company's talks with

Starboard, which got more serious over the past week, said a person

familiar with the matter. Thomas McInerney, a Yahoo director and

the former CFO of IAC/InterActive Corp., was key to convincing

Starboard the whole board didn't need to change, the person

said.

In addition to Mr. Smith, Yahoo's board will add Tor Braham,

Eddy Hartenstein and Richard Hill. Mr. Braham was a managing

director at Deutsche Bank AG from 2004 to 2012, and Yahoo said he

has been "directly involved in negotiating or executing numerous

mergers and acquisitions in the technology industry."

Mr. Hartenstein is a director at Tribune Publishing Co., former

chairman and CEO of DirecTV, and former publisher and CEO of the

Los Angeles Times Media Group. Mr. Hill has served as chairman of

Tessera Technologies since 2013.

Two current Yahoo directors, H. Lee Scott, Jr. and Sue James,

opted not to stand for re-election this year, which Yahoo said were

"personal decisions." Yahoo hasn't scheduled the shareholder

meeting, which last year was held in late June.

While Starboard has often forced contentious fights with

companies, it often succeeds in working with management teams after

obtaining board seats. One of Yahoo's new nominees, Mr. Hill,

originally fought Starboard at Tessera before the activist investor

gained seats on that board. He later became a key ally for

Starboard.

That track record has helped Starboard win more settlements like

this one, gaining board seats and influential committee roles

without needing to win the actual votes, a trend that has spread

broadly throughout shareholder activism.

Yahoo added two new directors to its board last month, a move

seen as a step toward girding for a fight with Starboard, and

bringing the board back to a total of nine directors.

Write to Douglas MacMillan at douglas.macmillan@wsj.com and

David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

April 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

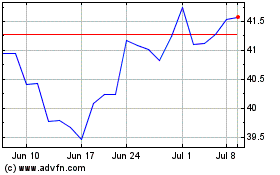

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

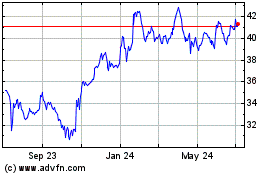

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024