UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ¨ |

|

Definitive Proxy Statement |

|

|

| x |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

VERIZON

COMMUNICATIONS INC.

(Name of

Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

(2) Aggregate number of

securities to which transaction applies:

|

|

|

(3) Per unit price or

other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4) Proposed maximum

aggregate value of transaction:

|

|

|

(5) Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing. |

|

|

|

|

(1) Amount Previously Paid:

|

|

|

(2) Form, Schedule or

Registration Statement No.:

|

|

|

(3) Filing Party:

|

|

|

(4) Date Filed:

|

(Verizon Communications Inc. letterhead)

(Date)

(Address)

Dear Investor,

I am writing to ask you to consider and support

our Board’s positions on the proposals contained in Verizon’s 2015 proxy statement. Through our long-standing investor outreach program, we have had a great exchange of ideas with you and other institutional investors that have helped us

shape and maintain executive compensation and corporate governance practices that are responsive to the interests of our shareholders. As a result, Verizon is consistently a leader in adopting best practices with respect to its executive

compensation and corporate governance practices. The following are just a few of the many practices we have either modified or implemented in response to our changing business:

| |

• |

|

Annual advisory vote on executive compensation program since 2009 |

| |

• |

|

No guaranteed pension or supplemental retirement benefits |

| |

• |

|

No executive employment agreements |

| |

• |

|

No cash severance for the CEO |

| |

• |

|

Shareholder approval of severance benefits that exceed 2.99 times base and bonus |

| |

• |

|

Double trigger change in control provisions for accelerated vesting of equity |

| |

• |

|

No excise tax gross-ups |

| |

• |

|

Significant executive ownership requirements |

| |

• |

|

Clawback and anti-hedging policy |

| |

• |

|

Independent Lead Director |

I want to call your attention to two shareholder proposals in this year’s proxy statement

regarding our executive compensation program. While the proposals appear straightforward, they must be considered in relation to Verizon’s comprehensive executive compensation program and when doing so, the Board believes that they do not merit

your support and could in fact, create increased risk to our shareholders.

Item 6 on this year’s proxy card is a shareholder proposal

requesting a change to Verizon’s long-standing policy to obtain shareholder ratification of any new executive employment agreement or severance agreement that provides for severance benefits with a total cash value exceeding 2.99 times the sum

of the executive’s base salary plus target short-term incentive opportunity. The proposal, which is included on pages 70-72 of the proxy statement, would significantly expand our current policy by including the total value of an

executive’s outstanding equity awards in the calculation of severance benefits. Our Board believes that the proposal does not merit your support for the following reasons:

| |

• |

|

Outstanding equity under Verizon’s program is not a separation benefit. Our Board fundamentally disagrees with the proposal’s characterization of the amounts payable under the outstanding equity plan

following termination as a “golden parachute” because in the case where an executive is terminated without cause, or as a result of death, retirement or disability, the outstanding equity awards are payable pursuant to the terms and

conditions of the shareholder approved Long-Term Incentive Plan and the applicable award agreements. These terms and conditions state that the awards are only payable to the extent the performance criteria are ultimately achieved and are otherwise

payable on the regularly scheduled timeframe. Accordingly, in these cases the awards do not become payable as a result of the separation – they remain subject to applicable performance and other requirements. |

| |

• |

|

Proposal conflicts with the terms of our shareholder approved Long-Term Incentive Plan. Under the terms of our Long-Term Incentive Plan, which was approved by over 88% of Verizon’s shareholders in 2013, all

outstanding equity awards are subject to double-trigger change in control provisions (i.e., the awards will vest following a change in control if the executive’s employment is also involuntarily terminated within 12 months of the change in

control). Implementing this proposal with respect to annual equity grants could require setting aside these provisions, which have been previously approved by the vast majority of our shareholders. |

| |

• |

|

Proposal could create additional risk for shareholders and put Verizon at a competitive disadvantage for retaining and attracting talent. Implementing this proposal could, as a practical matter, increase risk by

placing Verizon at a competitive disadvantage in attracting and retaining highly qualified executives because the vast majority of public companies provide for accelerated vesting of equity awards upon a termination of employment following a change

in control. This double-trigger change in control provision is in the best interests of shareholders because it provides an important tool for retention of executives during difficult and uncertain situations. |

For all these reasons, our Board strongly recommends that you vote against this proposal. Additional discussion of this proposal is included in the Frequently

Asked Questions attached to this letter.

Item 7 on this year’s proxy card is a shareholder proposal seeking adoption of a policy requiring that

senior leaders retain at least 75% of net after-tax shares acquired through equity compensation programs until reaching normal retirement age or terminating employment with the Company. Our Board believes that the proposal does not merit your

support for the following reasons:

| |

• |

|

Verizon’s executive compensation program is designed to closely align the interests of the Company’s management with those of its shareholders. Verizon has robust stock ownership guidelines for all

senior executives. We require our CEO to maintain share ownership equal to at least seven times his base salary, and all of his current direct reports must maintain at least four times base salary. Moreover, approximately 70% of a senior

executive’s target annual compensation is in the form of long-term incentives which vest over a three-year performance cycle. As a result, at any given time, a senior executive has three years of unvested equity-based awards, the value of which

is partially or wholly dependent on the price of Verizon stock and dividends on that stock. |

| |

• |

|

The Board believes the proposed policy could negatively impact the Company’s business. A compensation program should not incentivize executives to be overly conservative when managing the business in a

dynamic and competitive environment. Because the proposed policy would require executives to concentrate a great deal of wealth in the Company’s stock in addition to that required by existing stock ownership guidelines and the vesting structure

of the Long-Term Incentive Plan, the Board believes that the proposed policy would have the effect of discouraging appropriate and desirable risk taking by management. |

In summary, we have provided our shareholders with the opportunity to cast an advisory vote on our executive compensation program since 2009. Based on the

favorable voting results in each of the past six years and the positive feedback we have received from our investor outreach program, we believe that our program deserves your support again this year.

Sincerely,

Marc C. Reed

Answers to Frequently Asked Questions about the Severance Approval Proposal (Item 6) for the

Verizon 2015 Annual Meeting

How does the Board recommend shareholders vote on this proposal?

The Board recommends shareholders vote AGAINST this proposal for the reasons stated in the Board’s Statement in Opposition to the Shareholder Proposal in

item 6 (on pages 71-72 of the 2015 Proxy Statement).

What action does the proposal request of Verizon’s Board?

Verizon has a long-standing policy requiring its shareholders to ratify new executive employment agreements or severance agreements that provide for severance

benefits with a total cash value exceeding 2.99 times the sum of an executive’s base salary plus target short-term incentive opportunity. The proposal would significantly expand what constitutes “severance benefits” for purposes of

this policy by requiring Verizon to treat the total value of an executive’s outstanding equity awards as severance benefits. As a practical matter, this proposal conflicts with the terms of our shareholder-approved Long-Term Incentive Plan.

That Plan provides that outstanding equity awards will vest if there is both a change of control (i.e., if Verizon is acquired) and the executive is involuntarily terminated within the 12 months following the change in control. This provision is

important in order to align our executives’ interests with the goal of completing a transaction that is in our shareholders’ best interests.

Does Verizon waive performance conditions when an executive’s employment terminates?

No. Except in the event of a termination within the 12 months following a change in control (discussed in the next question), Verizon does not waive any

performance conditions with respect to outstanding equity awards. The payout of any executive’s performance stock unit award can be zero, there is no guarantee of any amount, and any payout is determined after the end of the applicable award

cycle. And in all cases, equity awards pay out on their regularly scheduled payment date.

What happens to an executive’s outstanding equity

awards in the event of a change in control of Verizon?

Verizon does not have any outstanding equity awards that pay out solely because a change in

control has occurred. Under our 2009 Long-Term Incentive Plan, which was most recently approved by over 88% of our shareholders in 2013, all of our outstanding equity awards are subject to a “double-trigger”. The shareholder-approved plan

expressly provides that if an executive’s employment is involuntarily terminated within the 12-month period following a change in control, his or her performance stock unit awards will vest at target performance and be payable on the regularly

scheduled payment date. The executive’s restricted stock unit awards will also vest and be payable on the regularly scheduled payment date. We note that the amount that is ultimately payable under both performance stock unit and restricted

stock unit awards is still at risk because the amount that will be paid is tied to Verizon’s stock price through the end of the performance period. The Board believes and our shareholders have agreed that this practice encourages our executive

officers, who might be distracted by a potential loss of employment, to remain with the Company and deliver on Board-and shareholder-approved goals, including completing the transaction and any related transition process.

Why does the Board recommend that shareholders vote against this proposal?

As set forth on pages 71-72 of the 2015 Proxy Statement (attached) the Board fundamentally disagrees with the proposal. The Board believes that the terms of

our equity awards are common in a majority of companies, and this proposal is not in our shareholders’ best interests because it would increase risk by placing Verizon at a competitive disadvantage in recruiting and retaining executive talent.

The Board believes, and our shareholders have agreed, that Verizon’s treatment of equity awards upon a termination following a change in control promotes stability and focus during a time of potential uncertainty. In 2013, our shareholders

approved Verizon’s Long-Term Incentive Plan with a vote of over 88% in favor.

Also, Glass Lewis, a proxy advisory firm, recommends a vote AGAINST

the proposal because its adoption “could prove burdensome for the Company and present challenges in its implementation.” The firm’s report also notes that any equity payments made in connection with a change in control are required to

be subject to a shareholder vote.

The proposal says that your Chief Executive Officer, Lowell C. McAdam, will receive $37 million in “golden

parachute” termination payments if his employment is terminated without cause or due to his death or disability. Is this true?

No.

Mr. McAdam does not have a “golden parachute”. He does not have an employment agreement with Verizon, and he is not entitled to any cash separation payment if his employment is terminated. In accordance with the disclosure rules of

the Securities and Exchange Commission, Verizon, like every other public company, must disclose an estimate of what our executive officers could earn under their outstanding equity awards if those awards became payable as of the last day of the

calendar year. Thus, the amounts listed in our 2015 Proxy Statement are only estimates based on assumptions required by the SEC proxy disclosure rules. It is incorrect to say he would receive this amount because his performance stock unit awards are

entirely at risk. Any payout will be determined after the end of the applicable award cycle. If the threshold performance criterion for a performance stock unit award is not met at the end of the award cycle, he gets nothing with respect to the

award.

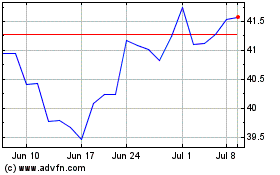

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

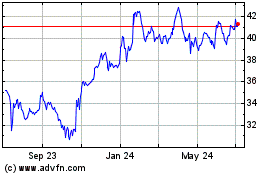

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024