Notice of Exempt Solicitation. Definitive Material. (px14a6g)

April 23 2015 - 3:55PM

Edgar (US Regulatory)

President and Executive Director

John M. Brennan

(201) 666-8174

Senior Staff Manager

Susan M. Donegan

(631) 367-3067

BOARD OF DIRECTORS

Officers

Jack K. Cohen

Chairman of the Board

(914) 245-3129

Eileen T. Lawrence

Executive Vice President

(718) 229-6078

Robert G. Gaglione

Treasurer

(516) 676-0937

Pamela M. Harrison

Secretary &

V.P. Union Relations

(845) 225-6497

Directors

John W. Hyland

(845) 278-9115

Donald R. Kaufmann

(717) 398-2423

Charles F. Schalch

(610) 399-3626

David J. Simmonds

(732) 636-4847

Thomas M. Steed

(845) 457-9848

John L. Studebaker

(610) 296-0281

Board Member

Emeritus

Louis Miano

Board Member

Emeritus

Robert A. Rehm

Board Member

Emeritus

C. William Jones

April 2015

DEAR FELLOW VERIZON SHAREHOLDER:

We urge you to vote FOR Item 6 and AGAINST Item 3 on Verizon’s proxy card for the upcoming Annual Meeting, scheduled to be held May 7 in Minneapolis, Minnesota:

Item 6: Vote FOR the “Severance Approval Policy” for Excessive Golden Parachutes

While we support generous performance-based pay, we believe that requiring shareholder approval of “golden parachute” severance with a total cost exceeding 2.99 times an executive’s base salary plus

target bonus is a prudent policy that will better align compensation with shareholder interests.

According to the 2015 Proxy Statement (table, page 61), if CEO Lowell McAdam terminates without cause following a change in control he would receive an estimated $37.3 million in termination

payments, more than seven (7) times his 2014 base salary plus target short-term bonus. According to the proxy, McAdam would also receive this estimated $37.3 million payout if he is terminated without

cause at any time, or for termination due to disability or death (Proxy, page 61).

These estimated termination payments are in addition to compensation earned prior to termination, including pension plans, deferred compensation plans, and executive life insurance benefits, which

each pay out millions more.

Similarly, CFO Francis Shammo and Executive Vice President Daniel Mead would receive an estimated $12.8 and $14.8 million, respectively, for any termination without cause following a change

in control – more than six (6) times their 2014 base salary plus target bonus (Proxy, pp. 47, 61). Shammo and Mead are eligible for a cash payment of two times base salary plus bonus ($4.1 and $4.7

million, respectively) after any involuntary termination without cause, or even a voluntary termination following demotion or relocation (proxy, pp. 56-57). In addition, a termination following a change in

control triggers the immediate vesting of performance equity, termination payments Verizon estimates at $8.7 million for Mr. Shammo and $10.1 million for Mr. Mead as of Dec. 31, 2014 (proxy p. 61).

A decade ago, after a shareholder proposal on Golden Parachutes sponsored by our Association received support from 59% of the shares voted, Verizon adopted a policy to seek shareholder approval

for severance with a “cash value” in excess of 2.99 times salary plus target bonus. But this left a huge loophole, in our view: The Company policy excludes the value of the accelerated vesting of

performance shares (PSUs) and of restricted stock (RSUs), including accrued dividends, from the total cost calculation that would trigger the need for shareholder ratification (2015 Proxy, p. 46).

Because PSUs and RSUs are not vested or earned prior to termination, they are disclosed as termination payments in the Proxy (see p. 61). If a senior executive terminates after a “change in

control,” all outstanding PSUs immediately “vest at target level performance” (Proxy, p. 60), which is 100% of the shares. Had the executive not terminated, the PSUs would not have vested until the end

of the performance period (up to 3 years later) – and could potentially have been worthless if

performance compared badly to the Related Dow Peer index and free cash flow metric used by the Board.

For example, if CEO McAdam terminated next month after a change in control, the PSU grant for the 2014-2016 performance cycle would vest at the “target” level ($5.0 million as of 12/31/14) regardless of the company’s performance. Although the payout is made based on the price of Verizon’s stock at the end of each three-year performance cycle, the PSUs vest upon termination at 100% of the shares granted. The RSUs ($4.9 million as of 12/31/14) would also immediately vest, with the payout based on the price of Verizon’s stock at the end of the performance period (Proxy, page 50).

We believe our Company’s severance approval policy should be updated to include the total cost of termination payments, including the estimated value of accelerated vesting of RSUs and PSUs that otherwise would not have been earned or vested until after the executive’s termination.

Item 3: Vote AGAINST Approving the Executive Compensation Package

We urge you to use your “say on pay” to send a message that requiring shareholder approval of windfall severance benefits (Item 6, above) and adopting more challenging pay-for-performance thresholds for Performance Stock Units (PSUs) are reforms needed to align executive pay with shareholder interests.

The case for executive compensation changes at Verizon is compelling in our view:

• - Verizon’s Performance Stock Unit program provides significant payouts (32% of target) for below-median performance as low as the 27th percentile among the Related Dow Peer index selected by the

Board – and even if total shareholder return is negative. Executive officers receive 102% of target for relative total share return (TSR) as low as the 56th percentile (2015 Proxy, page 41).

• - Verizon’s nonqualified retirement saving plan continues to offer more generous benefits to senior executives than to rank-and-file managers and employees. For example, CEO

McAdam received $461,000 in company contributions to the nonqualified plan in 2014, plus $45,700 in “above-market earnings” on his nonqualified plan assets. (Compensation Tables, pp. 47-48).

The cost of this letter is being borne entirely by the Association of BellTel Retirees Inc. This is not a solicitation. Please do not send your proxy card to the Association.

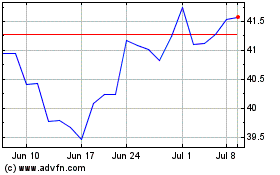

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

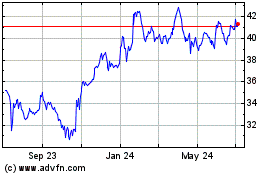

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024