Notice of Exempt Solicitation. Definitive Material. (px14a6g)

March 26 2015 - 4:50PM

Edgar (US Regulatory)

From: Association of BellTel Retirees Inc.

Butler Associates, LLC. 212 -685 -4600 204 East 23 rd Street New York, NY 10010

Contact: Tom Butler Tbutler@butlerassociates. com Victoria Carman Vcarman@butlerassociates. com

Verizon Retirees Launch Latest Fight Against Golden Parachutes

Retirees Question, Should CEO Be Entitled to $37.3 Million Golden Parachute?

Cold Spring Harbor, NY March 25, 2015 Following Verizon Communications (NYSE: VZ) filing its annual proxy statement with the S.E.C., the company s retirees launched their 17 th annual shareowners corporate governance reform campaign with a focus on improving the company s executive compensation practices. Retiree leaders of the Association of BellTel Retirees Inc. ( www. BellTelRetirees. org ) have introduced a proposal (Item #6) to require that excessive executive golden parachute severance payments be approved by shareholders.

The annual meeting is May 7 in Minneapolis, Minnesota.

BellTel leaders are asking Verizon to seek shareholder approval for any new or renewed golden parachute severance payments for executive officers exceeding three times the sum of the executive s base salary plus target short -term bonus.

Unlike the current policy, the proposal defines the total value of severance or termination payments to include any equity awards if vesting is accelerated, or a performance condition waived, due to termination.

Currently if CEO Lowell McAdam is terminated without cause, whether or not there is a change in control, he could receive an estimated $37.3 million in termination payments, seven times his 2014 base salary plus short -term bonus (see 2015 Proxy, page 61) http://tinyurl. com/lmfa4dy

A $37 million golden parachute is outrageous, particularly since it waives all the performance conditions that supposedly justify Verizon s lucrative performance stock options, said shareholder Jack Cohen. This $37 million golden parachute would be in addition to pension and deferred compensation plans, worth many millions more. Mr. Cohen is chairman of the board of the 130,000 member non -profit retiree association.

BellTel President John Brennan said, We believe the severance approval policy must include the total cost of termination payments, including the estimated value of accelerating restricted stock and performance shares that otherwise would not have been earned or vested until after the Verizon executive s termination.

Currently, the company policy excludes the value of accelerated vesting of performance shares (PSUs) and of restricted stock (RSUs), including accrued dividends, from the total cost calculation that trigger the need for shareholder ratification. If this proxy receives a majority vote it will close the loophole in the policy.

In 2003 a 59% majority of shares voting supported BellTel s original proposal to require shareholder approval for Golden Parachutes exceeding 2.99 times the exec utive s base pay plus bonus . For over 17 years BellTel leaders have introduced governance and compensation changes at Verizon, achieving 11 reforms, three by majority vote and eight others agreed to by the Verizon Board after negotiation with BellTel leaders.

Founded in 1996, the 130,000-plus member Association of BellTel Retirees advocates for the pension and benefits of Verizon retirees.

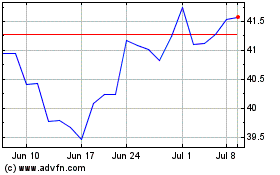

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

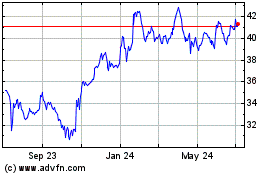

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024