Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

x

|

|

Definitive Proxy Statement

|

|

|

|

|

|

o

|

|

Definitive Additional Materials

|

|

|

|

|

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

VENTAS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

|

Explanatory Note

This Amendment No. 1 to the Ventas, Inc. Proxy Statement filed with the Securities and Exchange Commission on March 29, 2016 corrects an immaterial printer’s error that occurred when the printer converted the file through the EDGAR system. The only change is to a photograph on page 20 of the Proxy Statement. This error was not made in the printed version of the Proxy Statement and there are no revisions, corrections or amendments to the Ventas, Inc. Proxy Statement that was distributed to stockholders.

Table of Contents

353 North Clark Street

Suite 3300

Chicago, Illinois 60654

(877) 483-6827

March 29, 2016

Dear Ventas Stockholder:

Please join me and the Board of Directors at our 2016 Annual Meeting of Stockholders, which will be held on Tuesday, May 10, 2016, at our headquarters in Chicago, Illinois. The business we will conduct at the meeting is described in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

We worked hard in 2015 to continue our commitment to stakeholders and once again delivered superior performance through our strong FFO and dividend growth, the continued expansion and success of our business, and the strength and character of our team. These core consistencies are what define Ventas and place us in the top tier of all companies. We welcome the opportunity to present you with the information contained in this Proxy Statement and we hope that, after you review it, you will vote at the meeting (either in person or by proxy) in accordance with our Board of Directors’ recommendations. Your vote is important to us and our business.

If you are voting by proxy, please submit your proxy as soon as possible to ensure your vote is recorded at the Annual Meeting. You may vote by telephone, over the Internet or – if you have requested paper copies of our proxy materials by mail – by signing, dating and returning the proxy card in the envelope provided.

Our Board of Directors greatly appreciates your investment and continued support.

Sincerely,

Debra A. Cafaro

Chairman of the Board and Chief Executive Officer

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Tuesday, May 10, 2016

8:00 a.m., Local (Central) Time

James C. Tyree Auditorium, 353 North Clark Street, Chicago, Illinois 60654

We are pleased to invite you to join our Board of Directors and senior management for Ventas, Inc.’s 2016 Annual Meeting of Stockholders. The Annual Meeting will be held at 8:00 a.m. local (Central) time on Tuesday, May 10, 2016, in the James C. Tyree Auditorium, located at 353 North Clark Street, Chicago, Illinois 60654. The purposes of the meeting are:

|

1.

|

to elect the nine director nominees named in the Proxy Statement to serve until the 2017 Annual Meeting of Stockholders;

|

|

|

|

|

2.

|

to ratify the selection of KPMG LLP as our independent registered public accounting firm for the 2016 fiscal year;

|

|

|

|

|

3.

|

to hold an advisory vote to approve our executive compensation; and

|

|

|

|

|

4.

|

to transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting.

|

The Proxy Statement following this Notice describes these matters in detail. We have not received notice of any other proposals to be presented at the Annual Meeting.

Our Board of Directors established March 14, 2016 as the record date for the Annual Meeting. Accordingly, holders of record of shares of our common stock as of the close of business on that date are entitled to vote at the Annual Meeting and any postponements or adjournments of the meeting. We will make available to our stockholders, for ten days prior to the Annual Meeting, a list of stockholders entitled to vote. That list will be available for inspection during normal business hours at our principal executive offices located at 353 North Clark Street, Suite 3300, Chicago, Illinois 60654, and it will also be available at the Annual Meeting.

Please vote your shares promptly by telephone, over the Internet or, if you have requested paper copies of our proxy materials by mail, by signing, dating and returning the proxy card in the envelope provided. Voting your shares prior to the Annual Meeting will not prevent you from changing your vote in person if you choose to attend the meeting.

By Order of the Board of Directors,

T. Richard Riney

Executive Vice President, Chief Administrative Officer,

General Counsel and Ethics and Compliance Officer

March 29, 2016

Chicago, Illinois

Table of Contents

|

PROXY STATEMENT

PROXY STATEMENT SUMMARY

|

|

We prepared the following summary to highlight important information you will find in this Proxy Statement regarding our 2015 performance and the matters to be considered at the 2016 Annual Meeting of Stockholders. As it is only a summary, please review our Annual Report on Form 10-K for the year ended December 31, 2015 (which we refer to as our “2015 Form 10-K”) and the other information contained in this Proxy Statement before you vote. This Proxy Statement and the materials accompanying it are first being sent to stockholders on or about March 29, 2016.

|

|

|

|

|

2015 Performance*

|

|

|

|

Financial and Operating Performance Highlights

|

|

|

|

In 2015, we made two key strategic decisions that have us well-positioned to continue delivering outstanding long-term value to our stockholders. We completed the spin-off (“Spin-off”) of over $4 billion of our post-acute/skilled nursing facility portfolio into an independent, publicly traded pure-play REIT called Care Capital Properties, Inc. (“CCP”). The Spin-off has been well-received by our stockholders and in 2016 we are already realizing the benefits of the strategic and forward-thinking actions we took in 2015.

In addition, we entered the hospital market through our investment in the real estate of Ardent Medical Services (“Ardent”), a top 10 investor-owned hospital company. This was a long-term strategic initiative for us and provides a platform for future growth.

We achieved outstanding financial and operating results, including comparable normalized Funds From Operations (“FFO”) growth of 9%, after arithmetically adjusting to exclude the impact of the Spin-off. We also achieved record cash flow from operations of $1.4 billion.

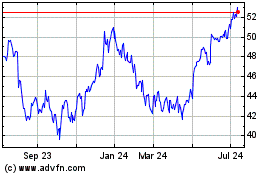

For the period from January 1, 2000 through December 31, 2015 (the 16 completed fiscal years of our Chief Executive Officer’s tenure), we delivered compound annual total stockholder return (“TSR”) of over 26%, outperforming the S&P 500 index and the RMS index and ranking us first among our compensation peer group. For the one-year period ended December 31, 2015, our TSR placed us first among the three large-cap diversified healthcare REITs.

|

|

|

__________

* See Annex A for reconciliations of certain financial measures presented in this Proxy Statement to the most directly comparable measure computed in accordance with U.S generally accepted accounting principles (“GAAP”).

|

|

|

|

|

1

Table of Contents

|

|

|

Strategic Spin-off of CCP

We completed the Spin-off of most of our post-acute/skilled nursing facility portfolio to CCP. The Spin-off was executed on a tax-efficient basis and has improved the quality of our portfolio, reliability of our cash flow and our relative equity multiple (among the large-cap diversified healthcare REITs). Following the completion of the Spin-off, we have an outstanding portfolio consisting of nearly 1,300 properties, sector-leading private pay net operating income (“NOI”) composition and NOI contribution from top-tier operators. At the same time, we have maintained our diversification, scale, strong balance sheet and excellent dividend and cash flow growth.

Investment Highlights, Including Entry into Hospital Sector

We completed over $5 billion of attractive, accretive investments in seniors housing and healthcare assets. We entered the hospital market through our investment in $1.3 billion of real estate networks of sites in three key markets operated by Ardent, a top 10 investor-owned and well-capitalized hospital company. This transaction provided unlevered returns of over 8% and serves as a platform for future growth.

|

|

2

Table of Contents

|

Portfolio Highlights

We achieved industry-leading same-store cash flow growth of 3.8%. In 2015, our proceeds from asset sales and loan repayments exceeded $700 million.

|

|

Balance Sheet and Liquidity Highlights

|

|

|

|

In 2015, we maintained our significant financial strength and flexibility and improved our attractive cost of capital through efficient and nimble issuance of debt and equity capital, including:

|

|

|

|

ü

the issuance of $2.8 billion in equity at an average price of over $76 per share (the majority of which was issued prior to the Spin-off);

|

|

|

|

ü

the issuance and sale of $1.6 billion aggregate principal amount of senior notes with a weighted average interest rate of 3.9% and a weighted average term of 13 years;

|

|

|

|

ü

the completion of a $900 million five-year term loan having a variable interest rate of LIBOR plus 97.5 basis points; and

|

|

|

|

ü

the reaffirmation of our BBB+ credit ratings.

|

|

|

|

These transactions strengthened our liquidity, lengthened and further staggered our debt maturities and lowered our effective annual interest rate. We ended the year with a strong balance sheet and liquidity position.

|

3

Table of Contents

|

2015 Executive Compensation

Our executive compensation programs are designed to attract, retain and motivate talented executives, to reward executives for the achievement of pre-established company and tailored individual goals consistent with our strategic plan and to link compensation to company performance. We compensate our executives primarily through base salary, annual cash incentive compensation and long-term equity incentive compensation. Our executive compensation philosophy emphasizes performance-based incentive compensation over fixed cash compensation, so that the vast majority of total direct compensation is variable and not guaranteed. In addition, a significant percentage of our incentive compensation is in the form of equity awards granted to reward past performance. Even though these equity awards are fully earned for performance that has already been achieved at the time of grant, a substantial portion of the awards vests over time to provide additional retention benefits and create greater alignment with stockholders. We believe this structure appropriately focuses our executive officers on the creation of long-term value and encourages prudent evaluation of risks.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 Executive Compensation Decisions

In 2015, our compensation decisions once again reflected strong alignment between pay and performance. In determining the incentive compensation paid to our Named Executive Officers for 2015, our Executive Compensation Committee (the “Compensation Committee”) and, in the case of our Chief Executive Officer, the independent members of our Board of Directors (the “Board”) rigorously evaluated company and individual performance relative to the pre-established measures and goals under our annual cash and long-term equity incentive plans. In 2015, we delivered excellent strategic, financial and operating performance, including industry-leading comparable FFO growth, same-store cash flow growth and fixed charge coverage. However, along with the other two large-cap diversified healthcare REITs, we delivered total stockholder return in the bottom quartile among our 16-company peer group for the one- and three-year periods ended December 31, 2015, resulting in zero payout for the TSR metrics, which represent 35% of our long-term incentive plan.

Regarding qualitative performance criteria, our Compensation Committee and Board considered all of the factors established under our executive compensation program for 2015 (the “2015 Plan”) and other relevant factors and placed the greatest significance on our:

|

|

4

Table of Contents

|

|

|

|

|

|

ü

|

excellent strategic decision-making regarding the tax-efficient Spin-off and its outstanding execution;

|

|

|

|

|

|

|

ü

|

entry into the hospital market, a long-term strategic objective of the Company, with Ardent, a top 10 hospital company, including the simultaneous structuring and sale of the Ardent hospital operating company;

|

|

|

|

|

|

|

ü

|

closing of over $5 billion of accretive acquisitions;

|

|

|

|

|

|

|

ü

|

delivery of sector-leading same-store cash flow growth;

|

|

|

|

|

|

|

ü

|

improved relative equity multiple (among the large-cap diversified healthcare REITs) and issuance of $2.8 billion in equity capital at over $76 per share (the majority of which was issued prior to the Spin-off);

|

|

|

|

|

|

|

ü

|

generation and receipt of over $700 million in sales proceeds and loan repayments;

|

|

|

|

|

|

|

ü

|

enhanced investor messaging and outreach, including holding a very successful inaugural Investor Day;

|

|

|

|

|

|

|

ü

|

realignment of the executive management team following the Spin-off, with improved organizational efficiency and effectiveness; and

|

|

|

|

|

|

|

ü

|

successful issuance of long-term (13-year average) debt at attractive (under 4%) all-in pricing.

|

|

|

|

|

|

The graph below illustrates our long-term pay-for-performance alignment by comparing our Chief Executive Officer’s total direct compensation to our TSR performance (indexed to a 2010 base year) for each of the past five years.

|

|

|

|

|

|

|

5

Table of Contents

|

This graph differs from compensation reported in the 2015 Summary Compensation Table in that it aligns the value of long-term equity incentive awards with the performance year for which they were earned, rather than the year in which they were granted (e.g., long-term equity incentive awards granted in January 2016 for 2015 performance are shown in the graph as 2015 compensation), consistent with the manner in which our Compensation Committee and, in the case of our Chief Executive Officer, the independent members of our Board, evaluate compensation and pay-for-performance.

2015 Annual Cash Incentive Awards

For 2015, annual cash incentive awards were based on our performance with respect to pre-established company financial goals. For our Named Executive Officers (other than Mr. Lillibridge) the goals were normalized FFO per share, excluding non-cash items (50% of the target award opportunity), fixed charge coverage ratio at year end (15%), and the achievement of individual objectives tailored for each Named Executive Officer (35%). For Mr. Lillibridge, the goals were normalized FFO per share, excluding non-cash items (27% of the target award opportunity), fixed charge coverage ratio at year end (8%), segment-specific objectives (40%) and the achievement of individual objectives (25%).

As further explained in the “Compensation Discussion and Analysis” section below, our performance in 2015 with respect to these metrics resulted in cash incentive awards granted to our Named Executive Officers between the target and maximum levels.

2015 Long-Term Equity Incentive Awards

For 2015, long-term equity incentive awards were based on our performance with respect to pre-established quantitative measures, specifically one- and three-year relative TSR and a risk management measure, net debt to adjusted pro forma EBITDA, at year end (which together accounted for 50% of the long-term equity incentive award opportunity), and a qualitative evaluation of our performance with respect to pre-established financial, operational and strategic objectives (which accounted for the remaining 50% of the long-term equity incentive award opportunity).

As further explained in the “Compensation Discussion and Analysis” section below, our performance in 2015 with respect to these metrics resulted in long-term equity incentive awards granted to our Named Executive Officers for 2015 performance that approximated the threshold level.

2015 Compensation Practices at a Glance

|

|

|

|

|

|

ü

DO

provide executive officers with the opportunity to earn market-competitive compensation through a mix of cash and equity compensation, with a strong emphasis on performance-based incentive awards

|

|

û

DO NOT

base incentive awards on a single performance measure, thereby discouraging unnecessary or excessive risk-taking

|

|

|

|

|

|

ü

DO

have a robust peer selection process and benchmark executive compensation to target the median of our comparative group of peer companies

|

|

û

DO NOT

provide guaranteed minimum payouts or uncapped award opportunities

|

|

|

|

|

|

ü

DO

evaluate relative TSR when determining performance under incentive awards to enhance stockholder alignment

|

|

û

DO NOT

have employment agreements with executive officers that provide single-trigger change of control benefits

|

|

|

|

|

|

ü

DO

require executive officers and directors to own and retain shares of our common stock with significant value to further align interests with our stockholders

|

|

û

DO NOT

permit new tax gross-up arrangements under our anti-tax gross-up policy and do not provide our Chief Executive Officer with tax gross-ups with respect to payments made in connection with a change of control

|

|

|

|

|

|

ü

DO

enhance executive officer retention with time-based vesting schedules for equity incentive awards earned for prior-year performance

|

|

û

DO NOT

permit liberal share recycling under our 2012 Incentive Plan

|

|

|

|

|

|

ü

DO

enable Board to “claw back” incentive compensation in the event of a financial restatement pursuant to recoupment policy

|

|

û

DO NOT

permit executive officers or directors to engage in derivative or other hedging transactions in our securities

|

|

|

|

|

|

ü

DO

align pay and performance by linking a substantial portion of compensation to the achievement of pre-established performance measures that drive stockholder value

|

|

û

DO NOT

provide executive officers with pension or retirement benefits other than pursuant to a broad-based 401(k) plan and do not provide executive officers with excessive perquisites or other personal benefits

|

6

Table of Contents

|

|

|

|

|

ü

DO

maintain a Compensation Committee comprised solely of independent directors

|

|

û

DO NOT

permit repricing of underwater stock options or granting of discounted stock options or SARs

|

|

|

|

|

|

ü

DO

engage an independent compensation consultant to advise the Compensation Committee on executive compensation matters

|

|

û

DO NOT

permit executive officers or directors to pledge or hold our securities in margin accounts without preapproval by the Audit Committee (no executive officer or director did so at any time during 2015)

|

|

|

|

|

|

2016 Annual Meeting of Stockholders

Voting and Meeting Information

You are entitled to vote at the 2016 Annual Meeting of Stockholders if you were a stockholder of record at the close of business on March 14, 2016, the record date for the meeting. On the record date, there were 336,206,400 shares of common stock issued and outstanding and entitled to vote at the meeting.

Information regarding the meeting date and location is set forth below.

|

|

|

|

When:

Tuesday, May 10, 2016, 8:00 a.m. local (Central) time

|

|

|

|

Where:

James C. Tyree Auditorium, 353 North Clark Street, Chicago, Illinois 60654

|

|

|

|

You may vote at the Annual Meeting through any of the following methods:

|

|

|

|

|

Vote by Telephone:

Call (800) 690-6903, 24 hours a day, seven days a week through May 9, 2016

|

|

|

|

|

|

Vote on the Internet:

Visit

www.proxyvote.com

, 24 hours a day, seven days a week through May 9, 2016

|

|

|

|

|

|

Vote by Mail:

Request, complete and return a copy of the proxy card in the postage-paid envelope provided

|

|

|

|

|

|

Vote in Person:

Request, complete and deposit a copy of the proxy card or complete a ballot at the Annual Meeting

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

Table of Contents

|

|

Proposals Requiring Your Vote

Proposal 1 — Election of Directors (see page 60)

The following table provides summary information about our nine director-nominees, each of whom currently serves on our Board. Age is as of the date of the 2016 Annual Meeting. Directors are elected annually by a majority of votes cast in uncontested elections. Our Board recommends that you vote

FOR

each of the named director-nominees.

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Director

since

|

Primary Position

|

Current

Committees**

|

Principal Skills

|

|

|

|

|

Melody C. Barnes*

|

52

|

2014

|

Co-Founder and Principal of MB Squared Solutions LLC and Chair, Aspen Institute Forum for Community Solutions

|

N

|

Public Policy, Government Relations, Strategic Planning, Leadership Development

|

|

|

|

|

Debra A. Cafaro

|

58

|

1999

|

Chairman and CEO of Ventas

|

E; I

|

Real Estate Industry, Corporate Finance, Mergers and Acquisitions, Capital Markets, Strategic Planning

|

|

|

|

|

Jay M. Gellert*

|

62

|

2001

|

President and CEO of Health Net, Inc.

|

C

; I

|

Healthcare Industry, Mergers and Acquisitions, Strategic Planning, Government Relations, Executive Compensation

|

|

|

|

|

Richard I. Gilchrist*

|

70

|

2011

|

Senior Advisor to The Irvine Company and Chairman of TIER REIT, Inc.

|

C; N

|

Real Estate Industry, Mergers and Acquisitions, Strategic Planning, Executive Compensation, Corporate Governance

|

|

|

|

|

Matthew J. Lustig*

|

55

|

2011

|

Managing Partner of North America Investment Banking and Head of Real Estate, Gaming and Lodging at Lazard Frères & Co. LLC

|

E; I

|

Real Estate Industry, Corporate Finance, Mergers and Acquisitions, Capital Markets, Strategic Planning, International Transactions

|

|

|

|

|

Douglas M. Pasquale*

|

61

|

2011

|

Founder and CEO of Capstone Enterprises Corporation; former CEO of Nationwide Health Properties, Inc.

|

I

|

Real Estate Industry, Healthcare Industry, Corporate Finance, Mergers and Acquisitions, Strategic Planning

|

|

|

|

|

Robert D. Reed*

|

63

|

2008

|

Former Senior Vice President and Chief Financial Officer of Sutter Health

|

A

; E

|

Healthcare Industry, Corporate Finance, Strategic Planning, Capital Intensive Operations, Pension Fund Investments

|

|

|

|

|

Glenn J. Rufrano*

|

66

|

2010

|

CEO of VEREIT, Inc.

|

A

|

Real Estate Industry, Corporate Finance, Strategic Planning, International Operations

|

|

|

|

|

James D. Shelton*

|

62

|

2008

|

Senior Advisor to CCMP Capital Advisors, LLC and Former Chairman of Omnicare, Inc.

|

E

;

N

|

Healthcare Industry, Mergers and Acquisitions, Strategic Planning, Capital Intensive Operations, Government Relations, Executive Compensation, Corporate Governance

|

|

|

|

|

|

|

|

|

|

*

|

Independent Director

|

|

|

|

|

|

|

|

|

|

|

**

|

Abbreviations: A = Audit and Compliance; C = Executive Compensation; E = Executive; I = Investment; N = Nominating and Corporate Governance.

Bold print indicates committee chair

.

|

|

|

|

|

|

|

|

|

|

Proposal 2 — Ratification of the Selection of KPMG LLP as Our Independent Registered Public Accounting Firm for Fiscal Year 2016 (see page 65)

|

|

|

|

|

|

|

|

|

|

KPMG audited our financial statements for the year ended December 31, 2015 and has been our independent registered public accounting firm since July 2014. Our Board recommends that you vote

FOR

the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2016.

|

|

|

|

|

|

|

|

|

|

Proposal 3 — Advisory Vote to Approve Our Executive Compensation (see page 67)

|

|

|

|

|

|

|

|

|

|

We submit an advisory vote to approve our executive compensation to our stockholders on an annual basis. Because your vote is advisory, it will not be binding on the Board or our Compensation Committee. However, your vote is important because it will be taken into account when making future decisions relating to executive compensation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

Table of Contents

|

|

Our executive compensation programs are designed to attract, retain and motivate talented executives, to reward executives for the achievement of pre-established Company and tailored individual goals consistent with our strategic plan and to link compensation to Company performance. We compensate our executives primarily through base salary, annual cash incentive compensation and long-term equity incentive compensation. Our executive compensation philosophy emphasizes performance-based incentive compensation over fixed cash compensation, so that the vast majority of total direct compensation is variable and not guaranteed. In addition, a significant percentage of incentive compensation is in the form of equity awards granted to reward past performance. Even though these equity awards are fully earned for performance that has already been achieved at the time of grant, a substantial portion of the awards vests over time to provide additional retention benefits and create greater alignment with stockholders. We believe this structure appropriately focuses our executive officers on the creation of long-term value and encourages prudent evaluation of risks.

Our Compensation Committee and, with respect to our Chief Executive Officer, the independent members of our Board have carefully evaluated our overall executive compensation program and believe that it is well designed to achieve our objectives of retaining talented executives and rewarding superior performance in the context of our business risk environment. By maintaining a performance- and achievement-oriented environment that provides the opportunity to earn market-competitive levels of compensation, we believe that our executive compensation program is structured optimally to support our goal to deliver sustained, superior returns to stockholders, and our exceptional long-term performance demonstrates the success of this program. For these reasons, our Board recommends that you vote

FOR

the approval, on an advisory basis, of our executive compensation.

Electronic Document Delivery to Stockholders

Instead of receiving future copies of our Notice of Annual Meeting, Proxy Statement and Annual Report by mail, stockholders of record and most beneficial owners may elect to receive an e-mail that will provide electronic links to these documents. Electronic document delivery saves us the cost of producing and mailing documents and will give you an electronic link to the proxy voting site. It is also more environmentally friendly.

We are making this Proxy Statement and the materials accompanying it available to our stockholders via the Internet, as permitted by Securities and Exchange Commission (“SEC”) rules. We will mail to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials and how to vote by proxy online. Starting on or about March 29, 2016, we will also mail this Proxy Statement and the materials accompanying it to stockholders who have requested paper copies. If you would like to receive a printed copy of our proxy materials by mail, you should follow the instructions for requesting those materials included in the Notice that we mail to you.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 10, 2016:

This Proxy Statement, our 2015 Form 10-K and our 2015 Annual Report are available at

www.proxyvote.com.

Questions and Answers

More information about proxy voting, proxy materials and attending the Annual Meeting can be found in the “Questions and Answers” section of this Proxy Statement.

|

|

9

Table of Contents

ANNUAL MEETING INFORMATION

Quorum

The holders of a majority of the shares of our common stock outstanding as of the close of business on the record date for the Annual Meeting, March 14, 2016, must be present in person or represented by proxy to constitute a quorum to transact business at the Annual Meeting. Stockholders who abstain from voting and broker non-votes are counted for purposes of establishing a quorum. A broker non-vote occurs when a beneficial owner does not provide voting instructions to the beneficial owner’s broker or custodian with respect to a proposal on which the broker or custodian does not have discretionary authority to vote.

Who Can Vote

Only Ventas stockholders of record at the close of business on the record date are entitled to vote at the Annual Meeting. As of that date, 336,206,400 shares of our common stock, par value $0.25 per share, were outstanding. Each share of our common stock entitles the owner to one vote on each matter properly brought before the Annual Meeting. However, certain shares designated as “Excess Shares” (generally any shares owned by a beneficial owner in excess of 9.0% of our outstanding common stock) or as “Special Excess Shares” pursuant to our Amended and Restated Certificate of Incorporation, as amended (our “Charter”), may not be voted by the record owner of those shares and will be voted in accordance with Article IX of our Charter.

A list of all stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder for any purpose reasonably related to the meeting at the Annual Meeting and during ordinary business hours for the ten days preceding the meeting at our principal executive offices located at 353 North Clark Street, Suite 3300, Chicago, Illinois 60654.

How to Vote

You may vote your shares in one of several ways, depending on how you own your shares:

Stockholders of Record

If you own shares registered in your name (a “stockholder of record”), you may:

|

|

|

Vote your shares by proxy by calling (800) 690-6903, 24 hours a day, seven days a week until 11:59 p.m. Eastern time on May 9, 2016. Please have your proxy card in hand when you call. The telephone voting system has easy-to-follow instructions and provides confirmation that the system has properly recorded your vote.

|

|

|

|

|

|

|

|

OR

|

|

|

|

|

|

|

|

Vote your shares by proxy via the website

www.proxyvote.com

, 24 hours a day, seven days a week until 11:59 p.m. Eastern time on May 9, 2016. Please have your proxy card in hand when you access the website. The website has easy-to-follow instructions and provides confirmation that the system has properly recorded your vote.

|

|

|

|

|

|

|

|

OR

|

|

|

|

|

|

|

|

If you have requested or receive paper copies of our proxy materials by mail, vote your shares by proxy by signing, dating and returning the proxy card in the postage-paid envelope provided. If you vote by telephone or over the Internet, you do not need to return your proxy card by mail.

|

|

|

|

|

|

|

|

OR

|

|

|

|

|

|

|

|

Vote your shares by attending the Annual Meeting in person and depositing your proxy card at the registration desk (if you have requested paper copies of our proxy materials by mail) or completing a ballot that will be distributed at the Annual Meeting.

|

Beneficial Owners

If you own shares registered in the name of a broker, bank or other custodian (a “beneficial owner”), follow the instructions provided by your broker, bank or custodian to instruct it how to vote your shares. If you want to vote your shares in person at the Annual Meeting, contact your broker, bank or custodian to obtain a legal proxy or broker’s proxy card that you should bring to the Annual Meeting to demonstrate your authority to vote.

10

Table of Contents

If you do not instruct your broker, bank or custodian how to vote, it will have discretionary authority, under current New York Stock Exchange (“NYSE”) rules, to vote your shares in its discretion on the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2016 (Proposal 2). However, your broker, bank or custodian will not have discretionary authority to vote on the election of directors (Proposal 1) or the advisory vote to approve our executive compensation (Proposal 3) without instructions from you. As a result, if you do not provide instructions to your broker, bank or custodian, your shares will not be voted on Proposal 1 or Proposal 3.

Votes by Proxy

All shares that have been properly voted by proxy and not revoked will be voted at the Annual Meeting in accordance with the instructions contained in the proxy. Shares represented by proxy cards that are signed and returned, but do not contain any voting instructions will be voted consistent with the Board’s recommendations:

|

ü

|

|

FOR

the election of all director-nominees named in this Proxy Statement (Proposal 1);

|

|

|

|

|

|

ü

|

|

FOR

the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2016 (Proposal 2);

|

|

|

|

|

|

ü

|

|

FOR

the approval, on an advisory basis, of our executive compensation (Proposal 3); and

|

|

|

|

|

|

ü

|

|

In the discretion of the proxy holders, on such other business as may properly come before the Annual Meeting.

|

OUR BOARD OF DIRECTORS

Our Board provides guidance and oversight with respect to our financial and operating performance, strategic plans, key corporate policies and decisions and enterprise risk management. Among other matters, our Board considers and approves significant acquisitions, dispositions and other transactions and advises and counsels senior management on key financial and business objectives. Members of the Board monitor our progress with respect to these matters on a regular basis, including through presentations made at Board and committee meetings by our Chief Executive Officer, Chief Financial Officer, Chief Investment Officer and other members of senior management.

Criteria for Board Membership

Our Guidelines on Governance set forth the process by which our Nominating and Corporate Governance Committee (the “Nominating Committee”) identifies and evaluates nominees for Board membership. In accordance with this process, the Nominating Committee annually considers and recommends to the Board a slate of directors for election at the next annual meeting of stockholders. In selecting this slate, the Nominating Committee considers the following: incumbent directors who have indicated a willingness to continue to serve on our Board; candidates, if any, nominated by our stockholders; and other potential candidates identified by the Nominating Committee. Additionally, if at any time during the year a seat on the Board becomes vacant or a new seat is created, the Nominating Committee considers and recommends to the Board a candidate for appointment to fill the vacant or newly-created seat.

The Nominating Committee considers different perspectives, skill sets, education, ages, genders, ethnic origins and business experience in its annual nomination process. In general, the Nominating Committee seeks to include on our Board a complementary mix of individuals with diverse backgrounds, knowledge and viewpoints reflecting the broad set of challenges that the Board confronts without representing any particular interest group or constituency. The Nominating Committee regularly reviews the size and composition of the Board on a holistic basis, utilizing a rigorous matrix of identified skills, experiences and other criteria for maintaining an excellent, independent Board in light of our changing requirements and seeks nominees who, taken together as a group, possess the skills, diversity and expertise appropriate for an effective Board.

The Nominating Committee also monitors the average tenure of our Board members and seeks to achieve a variety of director tenures in order to benefit from long-tenured directors’ institutional knowledge and newly-elected directors’ fresh perspectives. Following the completion of our Spin-off, the Nominating Committee and the Board has taken the opportunity to refresh the composition of the Board, with our two longest-tenured directors departing from the Board.

The Nominating Committee seeks to recommend candidates that have adequate time to devote to Board activities, recognizing that public company board of directors responsibilities command a significant portion of directors’

11

Table of Contents

time. As a result, during March 2016, the Nominating Committee recommended, and the Board approved, an overboarding policy that prohibits directors from simultaneously serving on more than four public company boards other than the Company’s.

In evaluating potential director candidates, the Nominating Committee considers, among other factors, the experience, qualifications and attributes listed below and any additional characteristics that it believes one or more directors should possess, based on an assessment of the needs of our Board at that time. Our Guidelines on Governance provide that, in general, nominees for membership on the Board should:

|

ü

|

|

have demonstrated management or technical ability at high levels in successful organizations;

|

|

|

|

|

|

ü

|

|

have experience relevant to our operations, such as real estate, REITs, healthcare, finance or general management;

|

|

|

|

|

|

ü

|

|

be well-respected in their business and home communities;

|

|

|

|

|

|

ü

|

|

have time to devote to Board duties; and

|

|

|

|

|

|

ü

|

|

be independent from us and not related to our other directors or employees.

|

In addition, our directors are expected to be active participants in governing our enterprise, and our Nominating Committee looks for certain characteristics common to all Board members, including integrity, independence, leadership ability, constructive and collegial personal attributes, candor and the ability and willingness to evaluate, challenge and stimulate.

No single factor or group of factors is necessarily dispositive of whether a candidate will be recommended by our Nominating Committee. The Nominating Committee considers and applies these same standards in evaluating individuals recommended for nomination to our Board by our stockholders in accordance with the procedures described in this Proxy Statement under “Requirements for Submission of Stockholder Proposals, Director Nominations and Other Business.” Our Board’s satisfaction of these criteria is implemented and assessed through ongoing consideration of directors and nominees by the Nominating Committee and the Board, as well as the Board’s annual self-evaluation process. Based upon these activities, our Nominating Committee and our Board believe that the director-nominees named in this Proxy Statement satisfy these criteria.

We have from time to time retained search firms and other third parties to assist us in identifying potential candidates based on specific criteria that we provided to them, including the qualifications described above. We may retain search firms and other third parties on similar or other terms in the future.

Director Independence

Our Guidelines on Governance require that at least a majority of the members of our Board meet the criteria for independence under the rules and regulations of the NYSE. For a director to be considered independent under the NYSE’s listing standards, the director must satisfy certain bright-line tests, and the Board must affirmatively determine that the director has no direct or indirect material relationship with us. Not less than annually, our Board evaluates the independence of each non-management director on a case-by-case basis by considering any matters that could affect his or her ability to exercise independent judgment in carrying out the responsibilities of a director, including all transactions and relationships between that director, members of his or her family and organizations with which that director or family members have an affiliation, on the one hand, and us, our subsidiaries and our management, on the other hand. Any such matters are evaluated from the standpoint of both the director and the persons or organizations with which the director has an affiliation. Each director abstains from participating in the determination of his or her independence.

Based on its most recent review, the Board has affirmatively determined that each of the following directors has no direct or indirect material relationship with us and qualifies as independent under the NYSE’s listing standards: Melody C. Barnes, Douglas Crocker II, Jay M. Gellert, Richard I. Gilchrist, Matthew J. Lustig, Douglas M. Pasquale, Robert D. Reed, Glenn J. Rufrano and James D. Shelton. Ms. Cafaro is not considered independent under the NYSE listing standards due to her employment as our Chief Executive Officer.

In evaluating the independence of Mr. Pasquale, the Board considered his employment with us following our acquisition of Nationwide Health Properties, Inc. (“NHP”) in July 2011. Prior to the acquisition, Mr. Pasquale was Chief Executive Officer of NHP, and he served as Senior Advisor to our Chief Executive Officer from July 1, 2011 through December 31, 2011 to facilitate the integration of NHP with our company. Under the NYSE listing standards, Mr.

12

Table of Contents

Pasquale’s former employment relationship with us ceased to impair his independence on January 1, 2015. The Board believes that this former employment relationship will not affect Mr. Pasquale’s ability to exercise independent judgment in carrying out his responsibilities as a member of our Board.

In evaluating the independence of Mr. Reed, the Board considered our ownership of two medical office buildings (“MOBs”) that are 100% leased by Sutter Health and generated approximately $6.5 million of rent in 2015. The Board also considered our $170 million development project affiliated with Sutter Health in which Sutter Health is a tenant. Until his retirement on January 1, 2015, Mr. Reed served as Senior Vice President and Chief Financial Officer of Sutter Health, which has annual revenues in excess of $9 billion. The Board believes that these business transactions are not considered to be material and this former employment relationship will not affect Mr. Reed’s ability to exercise independent judgment in carrying out his responsibilities as a member of our Board. See also “Corporate Governance—Transactions with Related Persons.”

Leadership Structure and Independent Presiding Director

Our Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide effective oversight of management and a fully engaged, high-functioning Board. The Board understands that no single approach to Board leadership is universally accepted and that the appropriate leadership structure may vary based on a company’s size, industry, operations, history and culture. Consistent with this understanding, our Board, led by our Nominating Committee, annually assesses its leadership structure in light of our operating and governance environment at the time to achieve the optimal model for us and for our stockholders. Following its most recent review, the Board has determined that our existing leadership structure—under which our Chief Executive Officer also serves as Chairman of the Board and a Presiding Director assumes specific responsibilities on behalf of the independent directors—is effective, provides the appropriate balance of authority between those persons charged with overseeing our company and those who manage it on a day-to-day basis and achieves the optimal governance model for us and for our stockholders.

Under our Fourth Amended and Restated By-Laws, as amended (our “By-Laws”), and our Guidelines on Governance, our Board has discretion to determine whether to separate or combine the roles of Chief Executive Officer and Chairman of the Board as part of its leadership structure evaluation. Ms. Cafaro has served in both capacities since 2003, and our Board continues to believe that her combined role is most advantageous to us and our stockholders. Ms. Cafaro possesses extensive knowledge of the issues, opportunities and risks facing us, our business and our industry and has consistently demonstrated the vision and leadership necessary to focus the Board’s time and attention on the most critical matters and to facilitate constructive dialogue among Board members on strategic issues. Moreover, the combined roles enable decisive leadership, clear accountability and consistent communication of our message and strategy to all of our stakeholders. These leadership attributes are uniquely important to our company given the value to our business of opportunistic capital markets execution, our history of rapid and significant growth, and our culture of proactive engagement and risk management.

In connection with Ms. Cafaro’s service as our Chief Executive Officer and Chairman of the Board, our Guidelines on Governance require that the independent members of our Board annually select one independent director to serve as Presiding Director, whose specific responsibilities include, among other things, presiding at all meetings of our Board at which the Chairman is not present, including executive sessions and all other meetings of the independent directors. The Presiding Director also serves as liaison between the Chairman and the independent directors, approves information sent to the Board and approves Board meeting agendas and meeting schedules to assure that there is sufficient time for discussion of all agenda items. The Presiding Director has authority to call meetings of the independent directors and, if requested by major stockholders, ensures that he or she is available for consultation and direct communication with stockholders. In addition, the Presiding Director reviews with our General Counsel potential conflicts of interest and has such other duties as may be assigned from time to time by the independent directors or the Board. Although the Presiding Director is elected on an annual basis, the Board generally expects that he or she will serve for more than one year. Douglas Crocker II, a well-respected and recognized leader in the real estate industry, has served as our Presiding Director since 2003.

Committees

Our Board has five standing committees that perform certain delegated functions for the Board: the Audit and Compliance Committee (the “Audit Committee”); the Compensation Committee; the Executive Committee; the Investment Committee; and the Nominating Committee. Each of the Audit, Compensation and Nominating Committees operates under a written charter that is available in the Corporate Governance section of our website at

www.ventasreit.com/investor-relations/corporate-governance

. We also provide copies of the Audit, Compensation and

13

Table of Contents

Nominating Committee charters, without charge, upon request to our Corporate Secretary at Ventas, Inc., 353 North Clark Street, Suite 3300, Chicago, Illinois 60654. Information on our website is not a part of this Proxy Statement. Additional details regarding the five standing committees of our Board are described below.

Board and Committee Meetings

Our Board held a total of eight meetings during 2015. Evidencing a strong commitment to our company, each director attended at least 75% of the total meetings of the Board and the committees on which he or she served that were held during 2015. The table below provides current membership and 2015 meeting information for each of our Board committees:

|

Name

|

Audit

Committee

|

Compensation

Committee

|

Executive

Committee

|

Investment

Committee

|

Nominating

Committee

|

|

|

|

|

|

|

|

|

Melody C. Barnes*

|

|

|

|

|

Member

|

|

Debra A. Cafaro

|

|

|

Member

|

Member

|

|

|

Douglas Crocker II*

†

|

Member

|

Member

|

Member

|

Chair

|

|

|

Jay M. Gellert*

|

|

Chair

|

|

Member

|

|

|

Richard I. Gilchrist*

|

|

Member

|

|

|

Member

|

|

Matthew J. Lustig*

|

|

|

Member

|

Member

|

|

|

Douglas M. Pasquale*

|

|

|

|

Member

|

|

|

Robert D. Reed*

|

Chair

|

|

Member

|

|

|

|

Glenn J. Rufrano*

|

Member

|

|

|

|

|

|

James D. Shelton*

|

|

|

Chair

|

|

Chair

|

|

Total Meetings in 2015

|

4

|

6

|

0

|

3

|

3

|

* Independent Director

†

Presiding Director

Our independent directors meet in executive session, outside the presence of management, at each regularly scheduled quarterly Board meeting and at other times as necessary or desirable. The Presiding Director (currently Mr. Crocker) chairs all regularly scheduled executive sessions of the Board and all other meetings of the independent directors. Members of our Audit, Compensation and Nominating Committees also meet in executive session, outside the presence of management, at each regularly scheduled committee meeting and at other times as necessary or desirable.

We strongly encourage, but do not require, directors to attend our annual meetings of stockholders. All eleven of our directors who were nominated for reelection at our 2015 Annual Meeting of Stockholders attended that meeting.

How to Communicate with Directors

Stockholders and other parties interested in communicating directly with our Board or any director on Board-related issues may do so by writing to Board of Directors, c/o Corporate Secretary, Ventas, Inc., 353 North Clark Street, Suite 3300, Chicago, Illinois 60654, or by submitting an e-mail to bod@ventasreit.com. Additionally, stockholders and other parties interested in communicating directly with the Presiding Director of the Board or with the independent directors as a group may do so by writing to Presiding Director, Ventas, Inc., 353 North Clark Street, Suite 3300, Chicago, Illinois 60654, or by sending an e-mail to independentbod@ventasreit.com. Communications addressed to our Board or individual members of the Board are screened by our Corporate Secretary for appropriateness before distributing to the Board, or to any individual director or directors, as applicable.

AUDIT AND COMPLIANCE COMMITTEE

Our Audit Committee assists our Board in fulfilling its responsibilities relating to our accounting and financial reporting practices, including oversight of the quality and integrity of our financial statements; our compliance with legal and regulatory requirements; the qualifications, independence and performance of our independent registered public accounting firm and the performance of our internal audit function.

14

Table of Contents

The Audit Committee maintains free and open communication with the Board, our independent registered public accounting firm, our internal auditor and our financial and accounting management. Our Audit Committee meets separately in executive session, outside the presence of management, with each of our independent registered public accounting firm and our internal auditor at each regularly scheduled meeting and at other times as necessary or desirable.

Our Board has determined that each member of the Audit Committee is independent and satisfies the independence standards of the Sarbanes-Oxley Act of 2002 and related rules and regulations of the SEC and the NYSE listing standards, including the additional independence requirements for audit committee members. The Board has also determined that each member of the Audit Committee is financially literate and qualifies as an “audit committee financial expert” for purposes of the SEC’s rules.

The Nominating Committee recognizes that Audit Committee members must have adequate time to devote to Audit Committee activities, given that such responsibilities command a significant portion of directors’ time. As a result, during March 2016, the Nominating Committee recommended, and the Board approved, a policy prohibiting Audit Committee members from simultaneously serving on more than two public company audit committees other than the Company’s. The policy grandfathers public company audit committees for which directors are serving as of the policy adoption date.

EXECUTIVE COMMITTEE

Our Board has delegated to our Executive Committee the power to direct the management of our business and affairs in emergency situations during intervals between meetings of the Board, except for matters specifically reserved for our Board and its other committees. The Executive Committee exercises its delegated authority only under extraordinary circumstances and has not held a meeting since 2002.

EXECUTIVE COMPENSATION COMMITTEE

Our Compensation Committee has primary responsibility for the design, review, approval and administration of all aspects of our executive compensation program. The Compensation Committee reviews the performance of, and makes all compensation decisions for, each of our executive officers other than our Chief Executive Officer. Our Compensation Committee also reviews the performance of, and makes compensation recommendations to the independent members of our Board for, our Chief Executive Officer.

The Compensation Committee meets throughout the year to review our compensation philosophy and its continued alignment with our business strategy and to consider and approve our executive compensation program for the subsequent year. With the assistance of a nationally-recognized, independent compensation consultant, the Compensation Committee discusses changes, if any, to the program structure, assesses the appropriate peer companies for benchmarking purposes, sets base salaries and incentive award opportunities, establishes the applicable performance measures and related goals under our incentive plans, evaluates performance in relation to the established measures and goals and determines annual cash and long-term equity incentive awards for our executive officers.

Our executive officers provide support to our Compensation Committee by coordinating meeting logistics, preparing and disseminating relevant financial and other information regarding us and the companies in our compensation peer group as a supplement to the comparative market data prepared by our independent compensation consultant and making recommendations with respect to performance measures and related goals. Our Chief Executive Officer attends meetings at the Compensation Committee’s request and recommends to the Compensation Committee compensation changes affecting our other executive officers. However, our Chief Executive Officer plays no role in setting her own compensation. At various times, our General Counsel and Corporate Secretary, our Assistant General Counsel, Corporate & Securities and our Chief Human Resources Officer may also attend meetings at the Compensation Committee’s request to act as secretary and record the minutes of the meetings, provide updates on legal developments and make presentations regarding certain organizational matters. Our Compensation Committee meets separately in executive session, without management present, at each regularly scheduled meeting and at other times as necessary or desirable.

The Compensation Committee meets during the first quarter of each year, typically in January, to review the achievement of pre-established performance goals for the prior year, to determine the appropriate annual cash and long-term equity incentive awards for executive officers based on that prior-year performance and, as appropriate, to approve grants of equity awards to our executive officers. Our executive officers provide support to our Compensation Committee in this process, and the Chief Executive Officer makes incentive award recommendations with respect to the other executive officers.

15

Table of Contents

Our Board has determined that each member of the Compensation Committee is independent and satisfies the independence standards of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the related NYSE listing standards, including the additional independence requirements for compensation committee members. The Board has also determined that each member of the Compensation Committee meets the additional requirements for “outside directors” set forth in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and “non-employee directors” set forth in Rule 16b-3 under the Exchange Act.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2015, Messrs. Crocker, Gellert and Gilchrist served on our Compensation Committee. No member of the Compensation Committee is, or has been, employed by us or our subsidiaries or is an employee of any entity for which any of our executive officers serves on the board of directors.

Independent Compensation Consultant

Under its charter, our Compensation Committee has authority to retain, and approve the terms of engagement and fees paid to, compensation consultants, outside counsel and other advisors that the Compensation Committee deems appropriate, in its sole discretion, to assist it in discharging its duties. Any compensation consultant engaged by our Compensation Committee reports to the Compensation Committee and receives no fees from us that are unrelated to its role as advisor to our Board and its committees. Our Compensation Committee meets regularly with the compensation consultant without management present. Although a compensation consultant may periodically interact with company employees to gather and review information related to our executive compensation program, this work is done at the direction and subject to the oversight of the Compensation Committee. Under the Compensation Committee charter, any compensation consultant retained by our Compensation Committee must be independent, as determined annually by the Compensation Committee in its reasonable business judgment, considering the specific independence factors set forth in Rule 10C-1 under the Exchange Act and all other relevant facts and circumstances.

Pearl Meyer (“PM”) has served as our Compensation Committee’s independent compensation consultant since 2006. In 2015, our Compensation Committee retained PM to advise it and the independent members of our Board, as applicable, on matters related to our executive compensation levels and program design for 2015. Our Compensation Committee reviews the scope of work provided by PM on an annual basis and, in connection with PM’s engagement in 2015, determined that PM met the independence criteria under the Compensation Committee charter. PM did not perform any consulting services unrelated to executive compensation for us during the year ended December 31, 2015, and PM’s work for the Board and its committees has raised no conflict of interest.

INVESTMENT COMMITTEE

The function of our Investment Committee is to review and approve proposed acquisitions and dispositions of properties and other investments meeting applicable criteria, in accordance with our Amended and Restated Investment and Divestiture Approval Policy.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Our Nominating Committee oversees our corporate policies and other corporate governance matters, as well as matters relating to the practices and procedures of our Board, including the following: identifying, selecting and recommending to the Board qualified director-nominees; making recommendations to the Board regarding its committee structure and composition; reviewing and making recommendations to the Board regarding non-employee director compensation; overseeing an annual evaluation of the Board and its committees; developing and recommending to the Board a set of corporate governance guidelines and the corporate code of ethics; and generally advising the Board on corporate governance and related matters.

Our Board has determined that each member of the Nominating Committee is independent and satisfies the NYSE listing standards.

16

Table of Contents

CORPORATE GOVERNANCE

Governance Policies

Our Guidelines on Governance reflect the fundamental corporate governance principles by which our Board and its committees operate. These guidelines set forth general practices the Board and its committees follow with respect to structure, function, organization, composition and conduct. These guidelines are reviewed at least annually by the Nominating Committee and are updated periodically in response to changing regulatory requirements, evolving corporate governance practices, input from our stockholders and otherwise as circumstances warrant.

Our Global Code of Ethics and Business Conduct sets forth the legal and ethical standards for conducting our business to which our directors, officers and employees, including our Chief Executive Officer, our Chief Financial Officer, and the directors, officers and employees of our subsidiaries must adhere. Our Global Code of Ethics and Business Conduct covers all significant areas of professional conduct, including employment practices, conflicts of interest, unfair or unethical use of corporate opportunities, protection of confidential information and other company assets, compliance with applicable laws and regulations, political activities and other public policy matters, and proper and timely reporting of financial results. See also “Public Policy Matters.”

Our Guidelines on Governance and our Global Code of Ethics and Business Conduct are available in the Corporate Governance section of our website at

www.ventasreit.com/investor-relations/corporate-governance

. We also provide copies of our Guidelines on Governance and our Global Code of Ethics and Business Conduct, without charge, upon request to our Corporate Secretary at Ventas, Inc., 353 North Clark Street, Suite 3300, Chicago, Illinois 60654. Waivers from, and amendments to, our Global Code of Ethics and Business Conduct that apply to our Chief Executive Officer, Chief Financial Officer or persons performing similar functions will be timely posted on our website at

www.ventasreit.com

. The information on our website is not a part of this Proxy Statement.

Transactions with Related Persons

Our written Policy on Transactions with Related Persons requires that any transaction involving us in which any of our directors, officers or employees (or their immediate family members) has a direct or indirect material interest be approved or ratified by the Audit Committee or the disinterested members of our Board. Our Global Code of Ethics and Business Conduct requires our directors, officers and employees to disclose in writing to our General Counsel any existing or proposed transaction in which he or she has a personal interest, or in which there is or might appear to be a conflict of interest by reason of his or her connection to another business organization. Our General Counsel reviews these matters with the Presiding Director to determine whether the transaction raises a conflict of interest that warrants review and approval by the Audit Committee or the disinterested members of the Board. In determining whether to approve or ratify a transaction, the Audit Committee or disinterested members of the Board consider all relevant facts and circumstances available to them and other factors they deem appropriate.

Transactions with Sutter Health

We own two newly developed MOBs that are 100% leased by Sutter Health under long-term triple-net leases. In 2015, Sutter Health paid us aggregate annual rent of approximately $6.5 million, which is less than one-tenth of one percent (0.1%) of Sutter Health’s 2015 consolidated gross revenues. We also are engaged in a $170 million development project affiliated with Sutter Health in which Sutter Health is a tenant. Mr. Reed, who served as Senior Vice President and Chief Financial Officer of Sutter Health until his retirement on January 1, 2015, has served as a member of our Board since March 2008. We believe the terms of the leases and development project with Sutter Health are no less favorable to us than those available from an unaffiliated party.

Risk Management

Management has primary responsibility for identifying and managing our exposure to risk, subject to active oversight by our Board of the processes we establish to assess, monitor and mitigate that exposure. The Board, directly and through its committees, routinely discusses with management our significant enterprise risks and reviews the guidelines, policies and procedures we have in place to address those risks, such as our approval process for acquisitions, dispositions and other investments. At Board and committee meetings, directors engage in comprehensive analyses and dialogue regarding specific areas of risk following receipt of written materials and in-depth presentations from management and third-party experts, including an enhanced annual enterprise risk management process and presentation to the Board to better identify risks, owners and mitigants. This process enables our Board to focus on the

17

Table of Contents

strategic, financial, operational, legal, regulatory and other risks that are most significant to us and our business in terms of likelihood and potential impact and ensures that our enterprise risks are well understood, mitigated to the extent reasonable and consistent with the Board’s view of our risk profile and risk tolerance.

In addition to the overall risk oversight function administered directly by our Board, each of our Audit, Compensation, Nominating and Investment Committees exercises its own oversight related to the risks associated with the particular responsibilities of that committee:

|

ü

|

|

Our Audit Committee reviews financial, accounting and internal control risks and the mechanisms through which we assess and manage risk, in accordance with NYSE requirements, and has certain responsibilities with respect to our compliance programs, such as our Global Code of Ethics and Business Conduct, our Global Anti-Corruption Policy and our Investigations Policy.

|

|

|

|

|

|

ü

|

|

Our Compensation Committee, as discussed in greater detail below, evaluates whether our compensation policies and practices, as they relate to both executive officers and employees generally, encourage excessive risk-taking.

|

|

|

|

|

|

ü

|

|

Our Nominating Committee focuses on risks related to corporate governance, board effectiveness and succession planning.

|

|

|

|

|

|

ü

|

|

Our Investment Committee is responsible for overseeing certain transaction-related risks, including the review of transactions in excess of certain thresholds, with existing tenants, operators, borrowers or managers, or that involve investments in non-core assets.

|

The chairs of these committees report on such matters to the full Board at each regularly scheduled Board meeting and other times as appropriate. Our Board believes that this division of responsibilities is the most effective approach for identifying and addressing risk, and through Ms. Cafaro’s combined role as Chief Executive Officer and Chairman, our Board leadership structure appropriately supports the Board’s role in risk oversight by facilitating prompt attention by the Board and its committees to the significant enterprise risks identified by management in our day-to-day operations.

Compensation Risk Assessment

As part of its risk oversight role, our Compensation Committee annually considers whether our compensation policies and practices for all employees, including our executive officers, create risks that are reasonably likely to have a material adverse effect on our company. In conducting its risk assessment in 2016, the Compensation Committee reviewed a report prepared by management regarding our existing compensation plans and programs, including our severance and change-in-control arrangements, in the context of our business risk environment. In its review, the Compensation Committee noted several design features of our compensation programs that reduce the likelihood of excessive risk-taking, including, but not limited to, the following:

|

ü

|

|

a balanced mix of cash and equity compensation with a strong emphasis on performance-based incentive awards;

|

|

|

|

|

|

ü

|

|

multiple performance measures selected in the context of our business strategy and often in tension with each other, for example, goals which promote FFO growth and maintaining a strong balance sheet;

|

|

|

|

|

|

ü

|

|

regular review of comparative compensation data to maintain competitive compensation levels in light of our industry, size and performance;

|

|

|

|

|

|

ü

|

|