UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 15, 2016

Ventas, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-10989 |

|

61-1055020 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

353 N. Clark Street, Suite 3300, Chicago, Illinois |

|

60654 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (877) 483-6827

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

As previously disclosed, Ventas, Inc. (“Ventas” or the “Company”) completed the acquisition of American Realty Capital Healthcare Trust, Inc. on January 16, 2015, the acquisition of Ardent Medical Services, Inc. (“AHS”), and the separation and sale of AHS’s hospital operations on August 4, 2015, and the transfer of most of the Company’s post-acute / skilled nursing facility portfolio to Care Capital Properties, Inc. (“CCP”) and distribution of all of the Company-owned common stock of CCP to the Company’s stockholders, effective at 11:59 p.m., Eastern Time, on August 17, 2015 (collectively, the “Transactions”). The Company is disclosing in this Current Report on Form 8-K certain updated pro forma financial information with respect to the Transactions and other adjustments as described in further herein.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

The Unaudited Pro Forma Condensed Consolidated Statement of Income for the nine months ended September 30, 2015 is filed as Exhibit 99.1 hereto and incorporated herein by reference.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Unaudited Pro Forma Condensed Consolidated Financial Statements of Income for the nine months ended September 30, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

VENTAS, INC. |

|

|

|

|

|

|

|

Date: January 15, 2016 |

By: |

/s/ T. Richard Riney |

|

|

Name: T. Richard Riney |

|

|

Title: Executive Vice President, General Counsel and Chief Administrative Officer |

3

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Unaudited Pro Forma Condensed Consolidated Financial Statements for the nine months ended September 30, 2015. |

4

Exhibit 99.1

VENTAS, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Nine Months Ended September 30, 2015

On August 4, 2015, Ventas completed its acquisition of Ardent Medical Services, Inc. (“AHS”). Concurrent with the closing of the transaction, the Company separated AHS’s hospital operations from its owned real estate and sold the hospital operations to a newly formed and capitalized operating company (“Ardent”). An entity controlled by Equity Group Investments acquired a majority stake in Ardent, while Ventas retained a 9.9 percent interest and AHS management retained a significant ownership stake.

Also, on August 17, 2015, Ventas, Inc. (“Ventas” or the “Company”), entered into a Separation and Distribution Agreement with Care Capital Properties, Inc. (“CCP”), pursuant to which the Company agreed to transfer most of its post-acute / skilled nursing facility portfolio to CCP (the “Separation”) and distribute all of the Company-owned common stock of CCP to the Company’s stockholders in a distribution intended to be tax-free to the Company’s stockholders (the “Distribution”). The Distribution was effective at 11:59 p.m., Eastern Time, on August 17, 2015 (the “Effective Time”) to the Company’s stockholders of record as of the close of business on August 10, 2015. As a result of the Distribution, CCP is now an independent public company and its common stock is listed under the symbol “CCP” on the New York Stock Exchange.

The following unaudited pro forma condensed consolidated financial information sets forth:

· The historical consolidated financial information of Ventas for the nine months ended September 30, 2015, derived from Ventas’s unaudited consolidated financial statements;

· Pro forma adjustments to give effect to Ventas’s other 2015 transactions, including the 2015 acquisition of American Realty Capital Healthcare Trust, Inc. (“HCT”), excluding 20 properties that were included in the spin-off of CCP on August 17, 2015, and other 2015 significant debt activity, on Ventas’s consolidated statement of income for the nine months ended September 30, 2015, as if these transactions occurred on January 1, 2015;

· Pro forma adjustments to give effect of the spin-off of CCP on August 17, 2015 on Ventas’s consolidated statement of income for the nine months ended September 30, 2015 as if the spin-off occurred on January 1, 2015; and

· Pro forma adjustments to give effect of the AHS transaction on August 4, 2015 on Ventas’s consolidated statement of income for the nine months ended September 30, 2015 as if the transaction occurred on January 1, 2015.

This unaudited pro forma condensed consolidated financial statement has been prepared for informational purposes only and is based on assumptions and estimates considered appropriate by Ventas’s management; however, it is not necessarily indicative of what Ventas’s consolidated financial condition or results of operations actually would have been assuming the transactions had been consummated as of the date indicated, nor does it purport to represent Ventas’s consolidated financial position or results of operations for future periods. This unaudited pro forma condensed consolidated financial statement does not include the impact of any synergies that may be achieved in the transactions or any strategies that management may consider in order to continue to efficiently manage Ventas’s operations. This pro forma condensed consolidated financial information should be read in conjunction with:

· Ventas’s unaudited consolidated financial statements and the related notes thereto as of and for the nine months ended September 30, 2015 included in the Company’s Quarterly Report on Form 10-Q for the quarter then ended, filed with the Securities and Exchange Commission (“SEC”) on October 26, 2015.

VENTAS, INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF INCOME

For the Nine Months Ended September 30, 2015

(In thousands, except per share amounts)

|

|

|

Ventas

Historical |

|

Other 2015

Transactions (A) |

|

Pro Forma for

Other 2015

Transactions |

|

CCP Spin-Off

Adjustments (B) |

|

Pro Forma for

Other 2015

Transactions

and CCP Spin-

Off Adjustments |

|

AHS

Transaction

Adjustments (C) |

|

|

|

Total Pro Forma |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Triple-net leased |

|

$ |

571,591 |

|

$ |

668 |

|

$ |

572,259 |

|

$ |

— |

|

$ |

572,259 |

|

$ |

62,097 |

|

(D) |

|

$ |

634,356 |

|

|

Medical office buildings |

|

420,287 |

|

4,519 |

|

424,806 |

|

— |

|

424,806 |

|

— |

|

|

|

424,806 |

|

|

|

|

991,878 |

|

5,187 |

|

997,065 |

|

— |

|

997,065 |

|

62,097 |

|

|

|

1,059,162 |

|

|

Resident fees and services |

|

1,356,384 |

|

6,684 |

|

1,363,068 |

|

— |

|

1,363,068 |

|

— |

|

|

|

1,363,068 |

|

|

Medical office building and other services revenue |

|

29,951 |

|

— |

|

29,951 |

|

1,582 |

|

31,533 |

|

— |

|

|

|

31,533 |

|

|

Income from loans and investments |

|

66,192 |

|

37 |

|

66,229 |

|

— |

|

66,229 |

|

— |

|

|

|

66,229 |

|

|

Interest and other income |

|

719 |

|

(8 |

) |

711 |

|

— |

|

711 |

|

— |

|

|

|

711 |

|

|

Total revenues |

|

2,445,124 |

|

11,900 |

|

2,457,024 |

|

1,582 |

|

2,458,606 |

|

62,097 |

|

|

|

2,520,703 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

263,422 |

|

(3,217 |

) |

260,205 |

|

43,513 |

|

303,718 |

|

18,080 |

|

(E) |

|

321,798 |

|

|

Depreciation and amortization |

|

657,262 |

|

12,666 |

|

669,928 |

|

— |

|

669,928 |

|

20,374 |

|

(F) |

|

690,302 |

|

|

Property-level operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior living |

|

902,154 |

|

4,126 |

|

906,280 |

|

— |

|

906,280 |

|

— |

|

|

|

906,280 |

|

|

Medical office buildings |

|

129,152 |

|

1,926 |

|

131,078 |

|

— |

|

131,078 |

|

— |

|

|

|

131,078 |

|

|

|

|

1,031,306 |

|

6,052 |

|

1,037,358 |

|

— |

|

1,037,358 |

|

— |

|

|

|

1,037,358 |

|

|

Medical office building services costs |

|

19,098 |

|

— |

|

19,098 |

|

— |

|

19,098 |

|

— |

|

|

|

19,098 |

|

|

General, administrative and professional fees |

|

100,399 |

|

— |

|

100,399 |

|

(4,718 |

) |

95,681 |

|

— |

|

|

|

95,681 |

|

|

Gain on extinguishment of debt, net |

|

14,897 |

|

— |

|

14,897 |

|

— |

|

14,897 |

|

— |

|

|

|

14,897 |

|

|

Merger-related expenses and deal costs |

|

105,023 |

|

— |

|

105,023 |

|

— |

|

105,023 |

|

— |

|

|

|

105,023 |

|

|

Other |

|

13,948 |

|

(1 |

) |

13,947 |

|

— |

|

13,947 |

|

— |

|

|

|

13,947 |

|

|

Total expenses |

|

2,205,355 |

|

15,500 |

|

2,220,855 |

|

38,795 |

|

2,259,650 |

|

38,454 |

|

|

|

2,298,104 |

|

|

Income (loss) before loss from unconsolidated entities, income taxes, discontinued operations, real estate dispositions and noncontrolling interest |

|

239,769 |

|

(3,600 |

) |

236,169 |

|

(37,213 |

) |

198,956 |

|

23,643 |

|

|

|

222,599 |

|

|

(Loss) income from unconsolidated entities |

|

(1,197 |

) |

— |

|

(1,197 |

) |

— |

|

(1,197 |

) |

3,109 |

|

(G) |

|

1,912 |

|

|

Income tax benefit |

|

27,736 |

|

3,187 |

|

30,923 |

|

— |

|

30,923 |

|

— |

|

|

|

30,923 |

|

|

Income (loss) from continuing operations |

|

266,308 |

|

(413 |

) |

265,895 |

|

(37,213 |

) |

228,682 |

|

26,752 |

|

|

|

255,434 |

|

|

Gain on real estate dispositions |

|

14,420 |

|

— |

|

14,420 |

|

— |

|

14,420 |

|

— |

|

|

|

14,420 |

|

|

Income (loss) from continuing operations, including real estate dispositions |

|

280,728 |

|

(413 |

) |

280,315 |

|

(37,213 |

) |

243,102 |

|

26,752 |

|

|

|

269,854 |

|

|

Net income (loss) attributable to noncontrolling interest |

|

1,047 |

|

— |

|

1,047 |

|

— |

|

1,047 |

|

— |

|

|

|

1,047 |

|

|

Income (loss) from continuing operations attributable to common stockholders, including real estate dispositions |

|

$ |

279,681 |

|

$ |

(413 |

) |

$ |

279,268 |

|

$ |

(37,213 |

) |

$ |

242,055 |

|

$ |

26,752 |

|

|

|

$ |

268,807 |

|

|

Income from continuing operations attributable to common stockholders per common share, including real estate dispositions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.85 |

|

N/A |

|

$ |

0.84 |

|

N/A |

|

$ |

0.73 |

|

N/A |

|

|

|

$ |

0.81 |

|

|

Diluted |

|

$ |

0.84 |

|

N/A |

|

$ |

0.84 |

|

N/A |

|

$ |

0.73 |

|

N/A |

|

|

|

$ |

0.81 |

|

|

Weighted average shares used in computing earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

329,440 |

|

N/A |

|

329,440 |

|

N/A |

|

329,440 |

|

N/A |

|

|

|

329,440 |

|

|

Diluted |

|

333,210 |

|

N/A |

|

333,210 |

|

N/A |

|

333,210 |

|

N/A |

|

|

|

333,210 |

|

See accompanying notes to unaudited pro forma condensed consolidated financial statement.

VENTAS, INC.

NOTES AND MANAGEMENT’S ASSUMPTIONS TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENT

(Unaudited)

NOTE 1 - BASIS OF PRO FORMA PRESENTATION

Ventas, Inc. (“Ventas” or the “Company”) is a real estate investment trust (“REIT”) with a geographically diverse portfolio of seniors housing and healthcare properties in the United States, Canada and the United Kingdom. The historical consolidated financial statements of Ventas include the accounts of the Company and its wholly owned subsidiaries and joint venture entities over which it exercises control.

On August 4, 2015, Ventas completed its acquisition of Ardent Medical Services, Inc. (“AHS”). Concurrent with the closing of the transaction, the Company separated AHS’s hospital operations from its owned real estate and sold the hospital operations to a newly formed and capitalized operating company (“Ardent”). An entity controlled by Equity Group Investments acquired a majority stake in Ardent, while Ventas retained a 9.9 percent interest and AHS management retained a significant ownership stake.

Also, on August 17, 2015, Ventas, Inc. (“Ventas” or the “Company”), entered into a Separation and Distribution Agreement with Care Capital Properties, Inc. (“CCP”), pursuant to which the Company agreed to transfer most of its post-acute / skilled nursing facility portfolio to CCP (the “Separation”) and distribute all of the Company-owned common stock of CCP to the Company’s stockholders in a distribution intended to be tax-free to the Company’s stockholders (the “Distribution”). The Distribution was effective at 11:59 p.m., Eastern Time, on August 17, 2015 (the “Effective Time”) to the Company’s stockholders of record as of the close of business on August 10, 2015. As a result of the Distribution, CCP is now an independent public company and its common stock is listed under the symbol “CCP” on the New York Stock Exchange.

NOTE 2 - ADJUSTMENTS TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(A) Adjustments reflect the financial statement effects of Ventas’s January 2015 acquisition of American Realty Capital Healthcare Trust, Inc. (“HCT”), excluding 20 properties that were included in the spin-off of CCP on August 17, 2015. Adjustments also reflect the Company’s senior note debt issuances and maturities during the nine months ended September 30, 2015 as if those transactions were consummated on January 1, 2015.

(B) The historical results of operations of the CCP properties, including a pro rata allocation of $61.6 million of interest expense to the properties, have been presented as discontinued operations in the consolidated statement of income. Adjustments reflect the consummation of the spin-off and a $1.3 billion distribution received by Ventas from CCP, principally used to repay $1.1 billion of Ventas indebtedness and related fees. Interest expense is being adjusted to reflect the effects of these transactions. Adjustments also reflect the financial statement effect of the transition services arrangement entered into with CCP.

The adjustment to general, administrative and professional fees reflects the actual savings that Ventas expects to realize after the spin-off of CCP, principally related to staffing and other corporate costs.

(C) Reflects adjustments to record the income statement effect of the AHS transaction.

(D) Adjustment reflects $105.0 million annual rental income to be received relating to the leases of the AHS real estate.

(E) Adjustments reflect the financial statement effects of Ventas’s issuance in July 2015 of $500.0 million aggregate principal amount of 4.125% senior notes due 2026 and an August 2015 $900.0 million five year variable rate term loan.

(F) Based on its initial estimate of the acquisition date fair values of real estate from the AHS transaction, Ventas has recorded the following fair values to the asset classes: $97.9 million to land and improvements, $1.1 billion to buildings and improvements, and $77.6 million to acquired in-place lease intangibles. Depreciation expense is calculated on a straight-line basis based on Ventas’s fair value determinations and its estimates of the remaining useful lives of each asset. The adjustment to depreciation and amortization reflects the following components (in thousands):

AHS Acquisition Adjustments

|

|

|

Weighted

Average

Useful Life

(Years) |

|

For the Nine

Months Ended

September 30, 2015 |

|

|

Ventas’s AHS acquisition adjustments for depreciation and amortization, by asset type: |

|

|

|

|

|

|

Land improvements |

|

10.3 |

|

$ |

1,418 |

|

|

Building and improvements |

|

40.3 |

|

22,836 |

|

|

In-place lease intangibles |

|

30.0 |

|

1,941 |

|

|

Adjustment for depreciation and amortization |

|

|

|

$ |

26,195 |

|

(G) Adjustment reflects the estimate of Ventas’s proportionate share of net income from its 9.9% ownership interest in Ardent.

NOTE 3 - FUNDS FROM OPERATIONS AND NORMALIZED FUNDS FROM OPERATIONS

VENTAS, INC.

UNAUDITED PRO FORMA FFO AND NORMALIZED FFO

For the Nine Months Ended September 30, 2015

(In thousands, except per share amounts)

|

|

|

Ventas

Historical |

|

Other 2015

Transactions |

|

Pro Forma

for Other

2015

Transactions |

|

CCP Spin-

Off

Adjustments |

|

Pro Forma

for Other

2015

Transactions

and CCP

Spin-Off

Adjustments |

|

AHS

Acquisition

Adjustments |

|

Total Pro

Forma |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations attributable to common stockholders, including real estate dispositions |

|

$ |

279,681 |

|

$ |

(413 |

) |

$ |

279,268 |

|

$ |

(37,213 |

) |

$ |

242,055 |

|

$ |

26,752 |

|

$ |

268,807 |

|

|

Discontinued operations |

|

13,434 |

|

— |

|

13,434 |

|

(12,437 |

) |

997 |

|

— |

|

997 |

|

|

Net income (loss) attributable to common stockholders |

|

293,115 |

|

(413 |

) |

292,702 |

|

(49,650 |

) |

243,052 |

|

26,752 |

|

269,804 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate depreciation and amortization |

|

652,025 |

|

12,666 |

|

664,691 |

|

— |

|

664,691 |

|

20,374 |

|

685,065 |

|

|

Real estate depreciation related to noncontrolling interest |

|

(5,980 |

) |

— |

|

(5,980 |

) |

(202 |

) |

(6,182 |

) |

— |

|

(6,182 |

) |

|

Real estate depreciation related to unconsolidated entities |

|

4,371 |

|

— |

|

4,371 |

|

— |

|

4,371 |

|

— |

|

4,371 |

|

|

Gain on real estate dispositions |

|

(14,420 |

) |

— |

|

(14,420 |

) |

— |

|

(14,420 |

) |

— |

|

(14,420 |

) |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on real estate dispositions |

|

(229 |

) |

— |

|

(229 |

) |

— |

|

(229 |

) |

— |

|

(229 |

) |

|

Depreciation on real estate assets |

|

79,608 |

|

— |

|

79,608 |

|

(79,478 |

) |

130 |

|

— |

|

130 |

|

|

FFO |

|

1,008,490 |

|

12,253 |

|

1,020,743 |

|

(129,330 |

) |

891,413 |

|

47,126 |

|

938,539 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of financial instruments |

|

6 |

|

— |

|

6 |

|

— |

|

6 |

|

— |

|

6 |

|

|

Non-cash income tax benefit |

|

(30,716 |

) |

(3,187 |

) |

(33,903 |

) |

— |

|

(33,903 |

) |

— |

|

(33,903 |

) |

|

Loss on extinguishment of debt, net |

|

16,283 |

|

— |

|

16,283 |

|

— |

|

16,283 |

|

— |

|

16,283 |

|

|

Merger-related expenses, deal costs and re-audit costs |

|

151,685 |

|

— |

|

151,685 |

|

(44,070 |

) |

107,615 |

|

— |

|

107,615 |

|

|

Amortization of other intangibles |

|

1,620 |

|

— |

|

1,620 |

|

— |

|

1,620 |

|

— |

|

1,620 |

|

|

Normalized FFO |

|

$ |

1,147,368 |

|

$ |

9,066 |

|

$ |

1,156,434 |

|

$ |

(173,400 |

) |

$ |

983,034 |

|

$ |

47,126 |

|

$ |

1,030,160 |

|

|

|

|

Ventas

Historical |

|

Total Pro

Forma |

|

|

|

|

|

|

|

|

|

Income from continuing operations attributable to common stockholders, including real estate dispositions |

|

$ |

0.84 |

|

$ |

0.81 |

|

|

Discontinued operations |

|

0.04 |

|

0.00 |

|

|

Net income attributable to common stockholders |

|

0.88 |

|

0.81 |

|

|

Adjustments: |

|

|

|

|

|

|

Real estate depreciation and amortization |

|

1.96 |

|

2.06 |

|

|

Real estate depreciation related to noncontrolling interest |

|

(0.02 |

) |

(0.02 |

) |

|

Real estate depreciation related to unconsolidated entities |

|

0.01 |

|

0.01 |

|

|

Gain on real estate dispositions |

|

(0.04 |

) |

(0.04 |

) |

|

Discontinued operations: |

|

|

|

|

|

|

Gain on real estate dispositions |

|

(0.00 |

) |

(0.00 |

) |

|

Depreciation on real estate assets |

|

0.24 |

|

0.00 |

|

|

FFO |

|

3.03 |

|

2.82 |

|

|

Adjustments: |

|

|

|

|

|

|

Change in fair value of financial instruments |

|

0.00 |

|

0.00 |

|

|

Non-cash income tax benefit |

|

(0.09 |

) |

(0.10 |

) |

|

Loss on extinguishment of debt, net |

|

0.05 |

|

0.05 |

|

|

Merger-related expenses, deal costs and re-audit costs |

|

0.46 |

|

0.32 |

|

|

Amortization of other intangibles |

|

0.00 |

|

0.00 |

|

|

Normalized FFO |

|

$ |

3.44 |

|

$ |

3.09 |

|

|

|

|

|

|

|

|

|

Dilutive shares outstanding used in computing FFO and normalized FFO per common share |

|

333,210 |

|

333,210 |

|

(1) Per share amounts may not add due to rounding.

Unaudited pro forma Funds From Operations (“FFO”) and normalized FFO are presented herein for informational purposes only and are based on available information and assumptions that the Company’s management believes to be reasonable; however, they are not necessarily indicative of what Ventas’s FFO or normalized FFO actually would have been assuming the transactions had occurred as of the dates indicated.

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values historically have risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. To overcome this problem, Ventas considers FFO and normalized FFO to be appropriate measures of operating performance of an equity REIT. In particular, Ventas believes that normalized FFO is useful because it allows investors, analysts and Ventas management to compare Ventas’s operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events such as transactions and litigation. In some cases, Ventas provides information about identified non-cash components of FFO and normalized FFO because it allows investors, analysts and Ventas management to assess the impact of those items on Ventas’s financial results.

Ventas uses the National Association of Real Estate Investment Trusts (“NAREIT”) definition of FFO. NAREIT defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of real estate property, including gain on re-measurement of equity method investments, and impairment write-downs of depreciable real estate, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. Ventas defines normalized FFO as FFO excluding the following income and expense items (which may be recurring in nature): (a) merger-related costs and expenses, including amortization of intangibles, transition and integration expenses, and deal costs and expenses, including expenses and recoveries relating to the Company’s acquisition lawsuits; (b) the impact of any expenses related to asset impairment and valuation allowances, the write-off of unamortized deferred financing fees, or additional costs, expenses, discounts, make-whole payments, penalties or premiums incurred as a result of early retirement or payment of the Company’s debt; (c) the non-cash effect of income tax benefits or expenses and derivative transactions that have non-cash mark-to-market impacts on the Company’s consolidated statements of income; (d) the impact of future acquisitions or divestitures (including pursuant to tenant options to purchase) and capital transactions; (e) the financial impact of contingent consideration, severance-related costs, charitable donations made to the Ventas Charitable Foundation, gains and losses for non-operational foreign currency hedge agreements and changes in the fair value of financial instruments; and (f) expenses related to the re-audit and re-review of the Company’s historical financial statements and related matters.

FFO and normalized FFO presented herein may not be identical to FFO and normalized FFO presented by other real estate companies due to the fact that not all real estate companies use the same definitions. FFO and normalized FFO should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of Ventas’s financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of Ventas’s liquidity, nor is FFO and normalized FFO necessarily indicative of sufficient cash flow to fund all of Ventas’s needs. Ventas believes that in order to facilitate a clear understanding of Ventas’s consolidated historical operating results, FFO and normalized FFO should be examined in conjunction with net income as presented in the unaudited pro forma condensed consolidated financial statements.

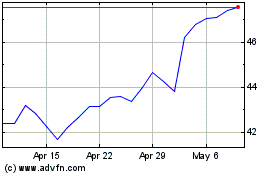

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

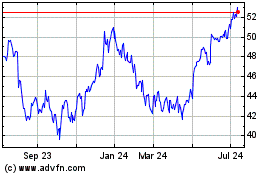

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024