UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 28, 2015

VENTAS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-10989 |

|

61-1055020 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

353 N. Clark Street, Suite 3300, Chicago, Illinois |

|

60654 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (877) 483-6827

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On July 28, 2015, Ventas Realty, Limited Partnership, Ventas SSL Ontario II, Inc. and Ventas SSL Ontario III, Inc., each of which is a wholly owned subsidiary of Ventas, Inc. (the “Company”), as borrowers (collectively, the “Borrowers”), and the Company, as guarantor, entered into a First Amendment (the “Amendment”) to that certain Amended and Restated Credit and Guaranty Agreement dated as of December 9, 2013 (the “Credit Agreement”) with the lenders identified therein and Bank of America, N.A., as Administrative Agent, Swing Line Lender, L/C Issuer and Alternative Currency Fronting Lender. The Amendment, among other things, revises the definition of a change of control under the Credit Agreement to exclude directors elected or nominated to the Company’s board of directors as result of an actual or threatened proxy contest.

The foregoing description is qualified by reference in its entirety to the Amendment, a copy of which is filed herewith as Exhibit 10.1 and incorporated in this Item 1.01 by reference.

Item 7.01. Regulation FD Disclosure.

On July 30, 2015, the Company’s board of directors approved the spin-off of most of the Company’s post-acute/skilled nursing facility portfolio into an independent, publicly traded REIT called Care Capital Properties, Inc. (“CCP”). A copy of a presentation dated July 2015 to be used by CCP in discussions with investors is furnished herewith as Exhibit 99.1 and incorporated in this Item 7.01 by reference. The investor presentation shall not be deemed filed with the U.S. Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. The information contained in the investor presentation shall not be incorporated by reference into any filing of the Company regardless of general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits:

2

|

Exhibit

Number |

|

Description |

|

|

|

|

|

10.1 |

|

First Amendment dated as of July 28, 2015 to that certain Amended and Restated Credit and Guaranty Agreement among Ventas Realty, Limited Partnership and the additional borrowers named therein, as borrowers, Ventas, Inc,. as guarantor, Bank of America, N.A., as Administrative Agent, Swingline Lender, L/C Issuer and Alternative Current Fronting Lender and the lenders identified therein. |

|

|

|

|

|

99.1 |

|

Care Capital Properties, Inc. Investor Presentation dated July 2015. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

VENTAS, INC. |

|

|

|

|

|

|

|

|

|

Date: July 31, 2015 |

By: |

/s/ T. Richard Riney |

|

|

|

T. Richard Riney |

|

|

|

Executive Vice President, Chief Administrative Officer and General Counsel |

4

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

|

|

|

|

10.1 |

|

First Amendment dated as of July 28, 2015 to that certain Amended and Restated Credit and Guaranty Agreement among Ventas Realty, Limited Partnership and the additional borrowers named therein, as borrowers, Ventas, Inc., as guarantor, Bank of America, N.A., as Administrative Agent, Swingline Lender, L/C Issuer and Alternative Current Fronting Lender and the lenders identified therein. |

|

|

|

|

|

99.1 |

|

Care Capital Properties, Inc. Investor Presentation dated July 2015. |

5

Exhibit 10.1

FIRST AMENDMENT

THIS FIRST AMENDMENT dated as of July 28, 2015 (this “Amendment”) to that certain Amended and Restated Credit and Guaranty Agreement referenced below is by and among VENTAS REALTY, LIMITED PARTNERSHIP, a Delaware limited partnership (“Parent Borrower”), VENTAS SSL ONTARIO II, INC., an Ontario corporation (“Ventas SSL II”), and VENTAS SSL ONTARIO III, INC., an Ontario corporation (“Ventas SSL III” and together with the Parent Borrower and Ventas SSL II, the “Borrowers” and each individually a “Borrower”), VENTAS, INC., a Delaware corporation (“Ventas”) as guarantor, the Lenders identified on the signature pages hereto, and BANK OF AMERICA, N.A., as administrative agent (in such capacity, the “Administrative Agent”) and as Swing Line Lender, L/C Issuer and Alternative Currency Fronting Lender.

W I T N E S S E T H

WHEREAS, a revolving credit and term loan facility was established in favor of the Borrowers pursuant to the terms of that certain Amended and Restated Credit and Guaranty Agreement, dated as of December 9, 2013, among the Borrowers, Ventas, the financial institutions party thereto from time to time, as lenders (the “Lenders”) and the Administrative Agent (as amended, supplemented or otherwise modified prior to the effectiveness of this Amendment, the “Existing Credit Agreement”);

WHEREAS, the Borrowers, Ventas, the Lenders and the Administrative Agent have agreed to amend the Existing Credit Agreement as set forth herein;

NOW, THEREFORE, in consideration of these premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

PART 1

DEFINITIONS

SUBPART 1.1 Definitions. Unless otherwise defined herein or the context otherwise requires, terms used in this Amendment, including its preamble and recitals, have the meanings provided in the Existing Credit Agreement.

PART 2

AMENDMENTS TO EXISTING CREDIT AGREEMENT

Effective on (and subject to the occurrence of) the First Amendment Effective Date (as defined in Subpart 3.1), the Existing Credit Agreement is hereby amended in accordance with this Part 2.

SUBPART 2.1 Amendments to Section 1.1.

(a) The definition of “Change of Control” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended by deleting clause (c) in its entirety and replacing it with the following:

(c) during any period of 24 consecutive months, a majority of the members of the board of directors or other equivalent governing body of Ventas cease to be composed of individuals (i) who were members of that board or equivalent governing body on the first day of such period, (ii) whose election or nomination to that board or equivalent governing body was approved by individuals referred to in clause (i) above

1

constituting at the time of such election or nomination at least a majority of that board or equivalent governing body or (iii) whose election or nomination to that board or other equivalent governing body was approved by individuals referred to in clauses (i) and (ii) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body.

(b) The definition of “Committed Loan Notice” set forth in Section 1.1 of the Existing Credit Agreement is hereby deleted in its entirety and replaced with the following:

“Committed Loan Notice” means a notice of (a) a Committed Borrowing, (b) a Term Borrowing, (c) a conversion of Loans from one Type to the other, or (d) a continuation of Eurocurrency Rate Loans, in each case provided to the Administrative Agent pursuant to Section 2.02(a), which, if in writing, shall be substantially in the form of Exhibit A, or such other form as may be approved by the Administrative Agent (including any form on an electronic platform or electronic transmission system as shall be approved by the Administrative Agent), appropriately completed and signed by a Responsible Officer of the Borrower.

(c) The definition of “Responsible Officer” set forth in Section 1.1 of the Existing Credit Agreement is hereby deleted in its entirety and replaced with the following:

“Responsible Officer” means the chief executive officer, president, chief financial officer, any executive vice president, any senior vice president, and the treasurer of any Credit Party or any entity authorized to act on behalf of a Credit Party and, solely for purposes of notices given pursuant to Article II, any other officer or employee of the applicable Credit Party so designated by any of the foregoing officers in a notice to the Administrative Agent or any other officer or employee of the applicable Credit Party designated in or pursuant to an agreement between the applicable Credit Party and the Administrative Agent. Any document delivered hereunder that is signed by a Responsible Officer shall be conclusively presumed to have been authorized by all necessary corporate, partnership and/or other action on the part of such Credit Party and such Responsible Officer shall be conclusively presumed to have acted on behalf of such Credit Party.

(d) A new Section 1.10 is hereby added to the Existing Credit Agreement which shall read as follows:

1.10 Electronic Execution of Assignments and Certain Other Documents.

The words “delivery,” “execute,” “execution,” “signed,” “signature,” and words of like import in any Loan Document or any other document executed in connection herewith shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Administrative Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable Law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that notwithstanding anything contained herein to the contrary, but subject to the agreements set forth in Section 10.02, neither the

2

Administrative Agent nor any Lender is under any obligation to agree to accept electronic signatures in any form or in any format unless expressly agreed to by the Administrative Agent or such Lender pursuant to procedures approved by it; and provided further without limiting the foregoing, upon the request of any party, any electronic signature shall be promptly followed by such manually executed counterpart

(e) Section 6.02(b) of the Existing Credit Agreement is hereby deleted in its entirety and replaced with the following:

(b) promptly after any request by the Administrative Agent, copies of any management letters submitted to the board of directors (or the audit committee of the board of directors) of the Guarantor by independent accountants in connection with an audit of the accounts of the Guarantor (which delivery may, unless the Administrative Agent, or a Lender requests executed originals, be by electronic communication including fax or email and shall be deemed to be an original authentic counterpart thereof for all purposes);

(f) Section 5.06 of the Existing Credit Agreement is hereby deleted in its entirety and replaced with the following:

There are no actions, suits, proceedings, claims, investigations or disputes pending or, to the knowledge of the Credit Parties, threatened or contemplated, (collectively, “Claims”) at law, in equity, in arbitration or before any Governmental Authority, by or against a Credit Party or any Subsidiary or against any of their properties or revenues that (a) affect or pertain to this Agreement (other than “dead hand proxy put” Claims that could not reasonably be expected to have Material Adverse Effect) or any other Loan Document, or any of the transactions contemplated hereby, or (b) as to which there is a reasonable possibility of an adverse determination, and, if so adversely determined, either individually or in the aggregate, could reasonably be expected to have a Material Adverse Effect.

PART 3

CONDITIONS TO EFFECTIVENESS

SUBPART 3.2 First Amendment Effective Date. This Amendment shall be and become effective as of the date hereof (the “First Amendment Effective Date”) when all of the following conditions shall have been satisfied:

(a) Execution of Counterparts of Amendment. The Administrative Agent shall have received counterparts of this Amendment, which collectively shall have been duly executed on behalf of each of the Credit Parties, the Required Lenders and the Administrative Agent.

PART 4

MISCELLANEOUS

SUBPART 4.1 Representations and Warranties. The Credit Parties affirm that, immediately before and immediately after giving effect to this Amendment, the representations and warranties set forth in the Existing Credit Agreement and the other Loan Documents are true and correct in all material respects as of the date hereof (except those which expressly relate to an earlier period or date).

3

SUBPART 4.2 Guarantor Acknowledgment. Each Guarantor hereby (a) acknowledges and consents to all of the terms and conditions of this Amendment and (b) reaffirms that, jointly and severally together with the other Guarantors, it guarantees the prompt payment and performance of their obligations as provided in Article XI of the Existing Credit Agreement.

SUBPART 4.3 References in Other Credit Documents. On and after the First Amendment Effective Date, all references to the Existing Credit Agreement in each of the Loan Documents shall hereafter mean the Existing Credit Agreement as amended by this Amendment. Except as specifically amended hereby, the Existing Credit Agreement is hereby ratified and confirmed and shall remain in full force and effect according to its terms.

SUBPART 4.4 Counterparts/Telecopy. This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original, and it shall not be necessary in making proof of this Amendment to produce or account for more than one such counterpart. Delivery by any party hereto of an executed counterpart of this Amendment by facsimile or other electronic means shall be effective as such party’s original executed counterpart and shall constitute a representation that such party’s original executed counterpart will be delivered upon request by the Administrative Agent.

SUBPART 4.5 Governing Law. This Amendment shall be deemed to be a contract made under, and for all purposes shall be construed in accordance with, the laws of the State of New York applicable to agreements made and to be performed entirely within such state.

SUBPART 4.6 FATCA. For purposes of determining withholding Taxes imposed under the Foreign Account Tax Compliance Act (FATCA), from and after the effective date of this Amendment, the Borrower and the Administrative Agent shall treat (and the Lenders hereby authorize the Administrative Agent to treat) the Credit Agreement as not qualifying as a “grandfathered obligation” within the meaning of Treasury Regulation Section 1.1471-2(b)(2)(i).

[remainder of page intentionally left blank]

4

IN WITNESS WHEREOF, each of the parties hereto has caused a counterpart of this Amendment to be duly executed and delivered as of the day and the year first above written.

|

BORROWERS: |

VENTAS REALTY, LIMITED PARTNERSHIP |

|

|

|

|

|

By: |

Ventas, Inc., its General Partner |

|

|

|

|

|

By: |

/s/ Robert F. Probst |

|

|

Name: |

Robert F. Probst |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

VENTAS SSL ONTARIO II, INC. |

|

|

VENTAS SSL ONTARIO III, INC. |

|

|

|

|

|

By: |

/s/ Robert F. Probst |

|

|

Name: |

Robert F. Probst |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

GUARANTOR: |

VENTAS, INC. |

|

|

|

|

|

By: |

/s/ Robert F. Probst |

|

|

Name: |

Robert F. Probst |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

ADMINISTRATIVE AGENT: |

BANK OF AMERICA, N.A., as Administrative Agent |

|

|

|

|

|

|

|

|

By: |

/s/ Yinghua Zhang |

|

|

Name: |

Yinghua Zhang |

|

|

Title: |

Director |

|

LENDERS: |

BANK OF AMERICA, N.A. |

|

|

|

|

|

By: |

/s/ Yinghua Zhang |

|

|

Name: |

Yinghua Zhang |

|

|

Title: |

Director |

|

|

|

|

|

|

|

|

|

|

JPMORGAN CHASE BANK, N.A. |

|

|

|

|

|

By: |

/s/ Brendan Poe |

|

|

Name: |

Brendan Poe |

|

|

Title: |

Executive Director |

|

|

|

|

|

|

|

|

|

|

CITIBANK, N.A. |

|

|

|

|

|

By: |

/s/ Michael Chlopak |

|

|

Name: |

Michael Chlopak |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK |

|

|

|

|

|

By: |

/s/ Thomas Randolph |

|

|

Name: |

Thomas Randolph |

|

|

Title: |

Managing Director |

|

|

|

|

|

|

By: |

/s/ Jeff Ferrell |

|

|

Name: |

Jeff Ferrell |

|

|

Title: |

Managing Director |

|

|

|

|

|

|

|

|

|

|

ROYAL BANK OF CANADA |

|

|

|

|

|

By: |

/s/ Rina Kansagra |

|

|

Name: |

Rina Kansagra |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

|

|

|

|

TD BANK, N.A. |

|

|

|

|

|

By: |

/s/ Sean C. Dunne |

|

|

Name: |

Sean C. Dunne |

|

|

Title: |

Vice President |

|

|

TORONTO DOMINION (NEW YORK) LLC |

|

|

|

|

|

By: |

/s/ Robyn Zeller |

|

|

Name: |

Robyn Zeller |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

UBS AG, STAMFORD BRANCH |

|

|

|

|

|

By: |

/s/ Darlene Arias |

|

|

Name: |

Darlene Arias |

|

|

Title: |

Director |

|

|

|

|

|

|

By: |

/s/ Denise Bushee |

|

|

Name: |

Denise Bushee |

|

|

Title: |

Associate Director |

|

|

|

|

|

|

|

|

|

|

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH |

|

|

|

|

|

By: |

/s/ Bill O’Daly |

|

|

Name: |

Bill O’Daly |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

By: |

/s/ Sean MacGregor |

|

|

Name: |

Sean MacGregor |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

|

|

|

|

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD. |

|

|

|

|

|

By: |

/s/ Scott O’Connell |

|

|

Name: |

Scott O’Connell |

|

|

Title: |

Director |

|

|

|

|

|

|

|

|

|

|

COMPASS BANK |

|

|

|

|

|

By: |

/s/ Brian Tuerff |

|

|

Name: |

Brian Tuerff |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

GOLDMAN SACHS BANK USA |

|

|

|

|

|

By: |

/s/ Jamie Minieri |

|

|

Name: |

Jamie Minieri |

|

|

Title: |

Authorized Signatory |

|

|

MORGAN STANLEY BANK, N.A. |

|

|

|

|

|

By: |

/s/ Emanuel Ma |

|

|

Name: |

Emanuel Ma |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

|

|

|

|

MORGAN STANLEY SENIOR FUNDING, INC. |

|

|

|

|

|

By: |

/s/ Emanuel Ma |

|

|

Name: |

Emanuel Ma |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

|

|

|

|

WELLS FARGO BANK, NATIONAL ASSOCIATION |

|

|

|

|

|

By: |

/s/ Andrea S. Chen |

|

|

Name: |

Andrea S. Chen |

|

|

Title: |

Director |

|

|

|

|

|

|

|

|

|

|

RBS CITIZENS, N.A. |

|

|

|

|

|

By: |

/s/ Kerri Colwell |

|

|

Name: |

Kerri Colwell |

|

|

Title: |

SVP |

|

|

|

|

|

|

|

|

|

|

FIFTH THIRD BANK, an Ohio Banking Corporation |

|

|

|

|

|

By: |

/s/ Michael P. Perillo |

|

|

Name: |

Michael P. Perillo |

|

|

Title: |

Assistant Vice President |

|

|

|

|

|

|

|

|

|

|

CAPITAL ONE, N.A. |

|

|

|

|

|

By: |

/s/ Alicia Cook |

|

|

Name: |

Alicia Cook |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

|

|

|

|

CITY NATIONAL BANK |

|

|

|

|

|

By: |

/s/ Bob Besser |

|

|

Name: |

Bob Besser |

|

|

Title: |

Senior Vice President |

Exhibit 99.1

|

|

Investor Presentation July 2015 |

|

|

Care Capital Properties Forward-Looking Statements This presentation contains forward-looking statements regarding the Company’s expected future financial condition, results of operations, cash flows, funds from operations, business strategies, operating metrics, competitive positions, growth opportunities and other matters. The words “believe”, “expect”, “anticipate”, “intend”, “may”, “could”, “should”, “will”, and other similar expressions, generally identify such forward-looking statements, which speak only as of the date of this presentation. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results to differ materially from those projected, anticipated or implied in the forward-looking statements. Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Company management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Factors that could cause actual results or events to differ materially from those anticipated are described in Amendment No. 3 to the Company’s Registration Statement on Form 10 under the heading “Risk Factors.” |

|

|

Name Care Capital Properties, Inc. Ticker NYSE: CCP Portfolio 355 properties Distribution Ratio 1:4 (one share of CCP for every four shares owned of VTR) Pro Forma Fully Diluted Shares and OP Units Outstanding Approximately 84 million shares Timing When-Issued Trading: August 6th Record Date: August 10th Distribution Date: August 17th First Day of Regular-Way Trading: August 18th Spin Transaction Overview & Timing 3 |

|

|

Provide Consistent, Superior Shareholder Returns Through Care Capital Properties Highlights Large fragmented $120 billion real estate market, < 20% owned by public REITs, largely regional and local operators Excellent demand / supply balance; supply of SNFs declined from 2000 to 2014 +65 population growing ~3x national average, +85 population of 7 million strong by 2020 Skilled nursing / post-acute facilities lower cost, payors pursuing care in these settings Stable and growing reimbursement environment Attractive Post-Acute Care Fundamentals and Strong Tailwind Large, diversified, triple-net portfolio with strong rent coverage 41 operator relationships across 37 states High Quality Post- Acute Portfolio Escalators average 2.3% providing steady growth Redevelopment opportunities identified and growing Large acquisition pipeline Internal and External Growth Opportunities Low leverage range - 4.5x to 5.0x (net debt / EBITDA) Strong operating cash flow > $230 million annually All unencumbered balance sheet Excellent Balance Sheet CEO, COO have long track record with Ventas, 13+ years of post-acute industry experience and operator knowledge CFO experienced capital markets and financial background General Counsel has long track record with Ventas, strong securities background Ventas heritage Experienced Management Team 4 |

|

|

Net Debt / EBITDA of ~4.5x Fixed Charge Coverage Ratio > 9x Annualized run-rate FFO of $235 - $250 million Normalized FFO Provide consistent, superior shareholder returns through growth and investment focused on the post-acute healthcare real estate sector Strategy Large, diversified mix of 355 triple-net properties leased to regional and local care operators that effectively serve their markets Portfolio Attractive market for growth; scale and breadth of operators and geography; strong coverage; excellent balance sheet; experienced management team; one of two pure-play publicly traded SNF REITs Strengths ____________________ EBITDARM Coverage as of March 31, 2015 pro forma for acquisitions in the quarter. Expected annualized dividend of $2.28 per share. Value Drivers For Care Capital Properties, Inc. 5 EBITDARM Coverage of 1.7x Rent Coverage Run-Rate NOI Annualized run-rate NOI of $310 – 320 million Balance Sheet (1) Dividend $2.28 / Share ~75% payout Full dividend for 3Q 2015 to be declared/paid (2) |

|

|

CCP is well positioned to perform and grow in a large, fragmented Post-Acute Care market External Acquisitions Driving growth through redevelopment, expansion and enhancement of existing properties Strategically pursing opportunities to invest in complementary healthcare properties Development & Redevelopment Capital Plan Outstanding initial liquidity to fund acquisition pipeline Maintain moderate leverage to permit balance sheet flexibility Solid access to equity and debt markets to support investments Target to achieve investment grade ratings Annualized dividend of $2.28 per share(1) Average lease escalators of 2.3% Limited near-term lease renewals Strong coverage Market rents Growing Internal Cash Flows Leverage size, relationships, and expertise to opportunistically consolidate a fragmented industry Capitalize on favorable demographics and policy tailwinds through local and regional operators Sourcing investments from operator relationships, existing and new Committed Growth Strategy 6 ____________________ Expected annualized dividend per share. |

|

|

Portfolio Overview 7 |

|

|

Large National Footprint Well Positioned to Capitalize on Favorable Industry Dynamics Operates in 37 States 355 Properties 41 Operators 38,718 Beds Average Remaining Lease Term: 9 – 10 yrs Nursing Home Specialty Hospital & Healthcare Seniors Housing Portfolio Highlights 8 P:Presentation CenterMapsVentasUS MapLocations |

|

|

High-Quality SNF-Focused REIT Positioned to Capitalize on Favorable Industry Dynamics Annualized run-rate NOI of $310 - $320 million Properties will be primarily leased under triple-net leases to third-party operators Strong portfolio rent coverage(2) 1.7x EBITDARM 1.3x EBITDAR Other key metrics ~79% occupancy 54% Q-mix 2.3% rent escalators No tenant >12% NOI No state >10% NOI except Texas Weighted average remaining lease term of 9 to 10 years Key Operating Metrics As of June 30, 2015 Asset Mix (1) ____________________ Based on NOI. TTM as of March 31, 2015 pro forma for acquisitions in the quarter. One of The Largest Portfolios of Triple-Net Leased SNFs in U.S. 9 Lease Expiration Schedule 0.0% 2.2% 0.7% 1.9% 0.2% 0.0% 5.0% 10.0% 15.0% 20.0% 2015 2016 2017 2018 2019 Seniors Housing (5%) Specialty Hospitals & Healthcare (4%) Loans (1%) Skilled Nursing (90%) |

|

|

State Diversification by Beds State Diversification by NOI 58% of NOI generated from CON states 10 Portfolio Diversified by Geography Texas 19% Massachusetts 10% Indiana 8% Kentucky 8% Wisconsin 6% Ohio 4% Oregon 4% North Carolina 4% New York 4% Missouri 4% Other 27 States 30% Texas 23% Massachusetts 9% Indiana 8% Kentucky 8% Oregon 6% New York 6% Washington 4% North Carolina 3% Wisconsin 3% Ohio 3% Other 27 States 27% |

|

|

Experienced Property Operators Number of operator relationships: 41 CCP’s existing tenants operate ~2,000 properties throughout the U.S. No single operator currently comprises more than 12% of NOI Top 10 operators make up ~69% of NOI Operator Highlights ____________________ Based on pro forma annualized NOI as of April 2015. Based on trailing three-months as of April 2015. 11 CCP Owned % of EBITDARM Size of Operator Operator States Properties Beds NOI(1) Coverage(2) Properties TX 29 3,537 12% 1.7x 95 CO, ID, OR, WA 28 2,908 11% 1.8x 44 AL, GA, IN, KY, NC, OH, TN, VA 31 3,875 10% 1.6x 125 MA, NY 18 2,471 7% 1.5x 20 KY, PA, TX 20 1,903 6% 1.7x 101 AR, CA, FL, IN, MD, MN, MO, NC, VA, WI 21 2,538 5% 2.0x >300 Magnolia Health Systems IN 24 1,995 5% 1.9x 35 MI, NY 7 1,456 5% 2.4x 7 KS, TX 13 1,298 4% 1.7x 22 TX 16 1,906 3% 1.5x 36 Top 10 206 23,386 69% Top 20 298 33,434 90% |

|

|

Pro Forma Peer Comparison 12 ____________________ Source: Company filings, investor presentations; Excludes acquisitions since 3/31/2015; Omega: Investor Presentation (10/31/2014), Q1’15 Supplemental; Aviv: Q4’14 Supplemental, FY2014 10-K. Based on trailing three months financials as of 12/31/14. Based on trailing twelve months financials as of 9/30/14. Represents skilled nursing quality mix. Based on trailing twelve months financials as of 12/31/14. Represents skilled nursing coverage. As of 6/30/14. As % of NOI maturing. As % of 2015 contractual cash revenue during 2015-2019. As % of total rent during 2015-2019. Represents number of licensed beds. Represents sum of Omega & Aviv. Represents number of operating beds. As of 12/31/14. (1) (2) (4) (6) (13) (2) (2) (7) (8) (9) (11) (12) (3) (4) (5) (5) (10) Pro Forma Omega Healthcare Investors Standalone Omega Healthcare Investors Standalone Aviv REIT Financials Quality Mix 54.0% -- 45.7% 46.4% EBITDARM Coverage (TTM) 1.7x -- 1.8x 1.7x EBITDAR Coverage (TTM) 1.3x 1.4x 1.4x 1.4x Lease Expiration CY'15-'19 5.0% -- 9.6% 14.4% # of Beds 38,718 91,185 61,539 29,646 Weighted Avg Remaining Lease Term ~9.5 yrs -- -- 8.7 yrs |

|

|

Growth Platform 13 |

|

|

Well-Positioned for External Growth 2,191 SNF Facilities Fragmented SNF Ownership $103 billion SNFs owned outside of public REITs ____________________ Source: Company provided information and public company filings as of March 31, 2015. Represents post-acute / SNF facilities. Represents long-term / post-acute facilities. Significant opportunity to consolidate fragmented skilled nursing asset ownership Only 16% of SNFs are owned by public REITs CCP is one of the largest publicly traded SNF-focused REITs 14 (Pro Forma) SNH (1) (2) Private, for Profit Owned , $69 , 56% Not for Profit Owned , $32 , 26% Public Operator Owned , $2 , 2% Public REIT Owned , $19 , 16% 881 322 301 243 104 98 73 71 54 44 |

|

|

Total ~$900 million acquisition pipeline Expected lease yield between 7-9% States include IA, CO, MO, NJ, CA, MA among others Acquisition Pipeline Operator Evaluation Criteria CCP Has an Active Acquisition Pipeline 15 Balance operator quality and rent/yield/ coverage criteria Quality operations Good at revenue cycle management Good alignment with hospital systems and can survive in the ACO/Bundled payment world Good relationships with Managed Care Organizations Good partners that are transparent and proactive when facing issues Appropriate size and scale of company In geographic footprint or adjacent state $445 million $235 million $210 million Early Stage Middle Stage Late Stage |

|

|

Successful Re-leasing Deepened Market Depth & Knowledge of Management Team 16 Superior Knowledge of Markets and Operators 105 Former Kindred Assets Re-leased to New Operators 2 pools of assets – 50 (2013) and 55 (2014) Total of 11 operators, 10 were new to Ventas, 1 was an existing operator in the portfolio Competitive bid process, well over 100 interested parties Process completed efficiently – from launch to signing took <13 months and 12 months to re-lease the two asset pools CCP Executives Ran Process CCP management intricately involved in all aspects of the transaction: market analysis, asset pool segregation, operator selection and diligence, lease negotiation, etc. Rent Set to Market No near-term lease maturities |

|

|

Rent paid by customers earns CCP a spread on its cost of capital Projects typically provide double digit cash-on-cash returns for customers, creating value for the operator Provides access to capital for customers to finance improvements Allows CCP to directly invest in and upgrade its portfolio while earning a return Expansions Adding units and amenities to existing property, typically combined with an upgrade of existing building Conversions Converting units to serve a different market better (e.g., converting long-term care to transitional care / rehab) Repositioning Comprehensive renovation of most or all spaces in a property Replacement/New Development Creating new property from the ground up utilizing existing assets (e.g. licensed beds) 4 Categories of Redevelopment CCP Redevelopment Strategy A variety of options that create value for CCP and our existing customers 17 Active pipeline aggregating ~$90 million at yields of 7% – 9% Proactively working with existing operators to identify additional redevelopment opportunities Accretive investments improve portfolio, drive operator profitability and extend lease terms |

|

|

$7.5 million expansion/repositioning $11.2 million ground-up development positions Avamere to provide full continuum of post acute services in Tacoma market Investment allowed Avamere to optimize market delivery by creating more specialized product offerings, including a new transitional care facility New Development: Avamere Transitional Care of Tacoma, Washington Expansion: Welcov Firesteel, South Dakota Addition of 20 beds, new therapy gym and core area renovation Add 20 additional private beds which will allow for 42 total Transitional Care Beds (TCU), to use total license capacity of 168 Focus on Transitional Care and private pay in market due to strong ALF presence Develop expansive clinical grid to be a regional player in the center of the state Renovation will increase Medicare census, total census and maintain percentage of private pay 9.0% lease rate on $11.2 million investment = $1.0 million of incremental rent 9.5% lease rate on $7.5 million investment = $0.7 million of incremental rent Redevelopment Examples 18 New Development - Transitional Care of Tacoma 1 S 2 3 S 1 2 3 Bed Licenses Residents Georgian House – Shut down, licenses in “bank” Heritage Rehab of Tacoma – Traditional SNF Skilled Nursing of Tacoma – Traditional SNF |

|

|

Growing internal cash flows Average contractual rent escalators of 2.3% Recent re-leasing of assets resets lease rates to market rates ~30% of portfolio re-leased in last three years 9 to 10 years weighted average remaining lease term Tenants responsible for maintenance, repairs and other required capital expenditures Conservative lease structure protects cash flows NNN leases with staggered maturities LCs, security deposits and/or guarantees provide further protection Structural supports with master leases or cross-default provisions Solid EBITDARM and EBITDAR coverage protects internal cash flows Focus on Growing Internal Cash Flows 19 |

|

|

Attractive Industry Fundamentals 20 |

|

|

Growing Population 85 and Over Favorable Demographics Continued growth of seniors population Seniors made up ~12% of population in 2000, expected to be 20% in 2030 Estimated that ~70% of Americans who reach age 65 will require some form of long-term care for an average of 3 years Rising acuity of patients driven by aging demographics ____________________ Source: Company provided information and U.S. Census Bureau. Growing Seniors Population ____________________ Source: U.S. Census Bureau. Indexed to 100%. 21 ____________________ Source: AHCA Reimbursement and Research Department. Trend in Resident Activities of Daily Living (ADL) Dependence 3.85 3.88 3.90 3.91 3.93 3.95 3.99 4.01 4.04 4.08 4.05 4.13 4.17 4.20 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 4 6 7 10 15 21 1.5% 2.0% 2.2% 2.6% 3.9% 5.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0 5 10 15 20 25 2000A 2010A 2020E 2030E 2040E 2050E 85+ Population (MMs) % of Total Population 130% 205% 313% 2020 2030 2040 2050 2060 Total Population 65+ 85+ |

|

|

Comparison of per Case Rates Skilled Nursing Facilities Independent Rehab Facilities Long-Term Acute Care Tracheotomy with Vent $10,051 $26,051 $115,463 Respiratory with Vent 7,897 26,051 74,689 Joint Replacement 6,165 17,135 67,104 Hip Fracture 10,618 18,487 44,633 Stroke 8,905 34,196 31,496 Average $8,727 $24,384 $66,677 SNFs Well Positioned as Lowest Cost Providers Payors Driving Seniors to SNFs – Lower Cost Setting of Care ____________________ Source: MedPAC Acute Care Hospital Medicare Discharge Destination ____________________ Source: CMS, Wall Street research, and Company provided information. Payors focused on driving seniors to skilled nursing facilities which provide the lowest cost setting of care Comprehensive delivery of post-acute care for a lower cost than alternative inpatient settings SNFs typically employ lower cost and less staff than long-term acute care hospitals and inpatient rehabilitation facilities Significantly less physical plant requirements and efficiently designed to deliver care 22 55% 1% 1% 3% 4% 16% 20% No Post Acute Care IPF LTACH Hospice IRF Home Health SNF |

|

|

Increasing and Stable Reimbursement Environment +1.2% Government projected to continue strong commitment to funding both Medicare and Medicaid programs for SNFs Medicare and Medicaid expenditures for SNFs expected to grow 84% from 2011 to 2021 SNFs represent a small percentage of total Medicare and Medicaid expenditures Limits on new nursing home construction (CON states) Medicaid SNF reimbursement environment in CCP’s top states expected to be stable Final FY16 Medicare Reimbursement Rate ____________________ Source: Company provided information and the American Health Care Association (AHCA). Medicare CAGR of 2.9% Medicaid CAGR of 2.1% SNF Reimbursement – Average Rate Per Day Decreasing SNF Supply ____________________ Source: Company provided information and the American Health Care Association (AHCA). Note: Represents certified skilled nursing facilities as of March of the indicated year. 23 15,726 15,684 15,665 15,679 15,673 15,668 15,650 15,632 2008 2009 2010 2011 2012 2013 2014 2015 $408 $432 $454 $505 $469 $478 $484 $164 $172 $174 $177 $179 $183 $186 2008 2009 2010 2011 2012 2013 2014 |

|

|

Strong Financial Profile 24 |

|

|

Attractive Financial Metrics Target conservative balance sheet to support ongoing growth Maintain reasonable leverage levels of ~4.5x to 5.0x to provide balance sheet flexibility and access to capital markets Target to achieve investment grade rating Leverage >$230 million of operating cash flow annually $500 million revolving credit facility Solid access to equity and debt markets to support investments Liquidity Annualized dividend of $2.28 per share(1) Well-covered at approximately ~75% FFO payout ratio Dividend Policy Expect to provide 2016 earnings guidance in conjunction with Q4 2015 earnings release Earnings Guidance 25 ____________________ Expected annualized dividend per share. |

|

|

$500 million revolver No near-term debt maturities Up to $600 million term loan: 2017 Up to $800 million unsecured notes: 2020 No other debt outstanding, other than the subject facilities, upon completion of the Spin-Off Approximately 4.5x net debt /EBITDA 100% unencumbered balance sheet Key Operating Metrics Key Operating Metrics Strong Balance Sheet 26 $600.0 $800.0 $500.0 2015 2016 2017 2018 2019 2020 2021 Thereafter Term Loans Revolver Availability |

|

|

Experienced Leadership & Strong Corporate Governance 27 |

|

|

Experienced Management Team SVP, Capital Markets and Investor Relations at Ventas Former CFO and Managing Principal at Big Rock Partners Former SVP and Treasurer at General Growth Properties Raymond J. Lewis Chief Executive Officer Lori B. Wittman EVP, Chief Financial Officer Timothy A. Doman EVP, Chief Operating Officer SVP and Chief Portfolio Officer at Ventas Former SVP, Asset Management at Ventas Former Senior Asset Manager at GE Capital Real Estate Former VP of Asset Management at Kemper Corporation SVP, Associate General Counsel, and Corporate Secretary of Ventas Former Associate at Sidley Austin LLP Admitted to the Bar in Illinois Kristen M. Benson EVP, General Counsel President of Ventas Former EVP and CIO of Ventas Former Managing Director of Business Development for GE Capital Healthcare Financial Services Former EVP of Healthcare Finance for Heller Financial External recruits and former Ventas employees will provide both new perspectives and continuity 28 |

|

|

No staggered board (directors elected annually) Board has extensive experience in healthcare, real estate, and finance; independent chairman with extensive REIT experience Fully independent Audit, Compensation, and Nominating Committees No shareholder rights plan Name Position Experience Douglas Crocker II Chairman Managing Partner of DC Partners LLC Ronald G. Geary Director President of Res-Care, Inc. (formerly NASDAQ: RSCR) Raymond J. Lewis Director CEO of CCP; President of Ventas John S. Gates, Jr. Director CEO of PortaeCo, LLC, Co-founded CenterPoint Properties Jeffrey A. Malehorn Director President and CEO of World Business Chicago; GE Capital Dale A. Reiss Director Managing Director of Artemis Advisors, LLC; STAR, TPC, CYS John L. Workman Director CEO of Omnicare Board of Directors Committed to best practices in corporate governance Board of Directors & Corporate Governance 29 |

|

|

Conclusion and Q&A 30 |

|

|

Experienced in sector, REITs One of two pure-play REITs in the space Strong Ventas heritage Large, diversified triple-net portfolio Strong rent coverage with escalators High-quality operators Reimbursement environment is stable Significant consolidation opportunity Demographics and industry dynamics provide strong tailwind Leverage size, relationships, and expertise for growth Opportunistic redevelopment Modest leverage Ample liquidity Access to capital Strong dividend coverage Strong Financial Profile Dedicated Management Team High Quality Post-Acute Portfolio Care Capital CCP Is Positioned to Grow and Deliver Value 31 Well Positioned For External Growth |

Ventas (NYSE:VTR)

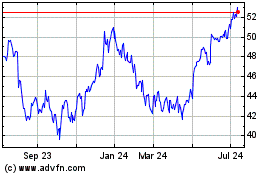

Historical Stock Chart

From Mar 2024 to Apr 2024

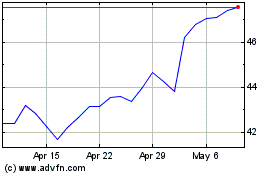

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024