- 2015 Second Quarter Normalized FFO

Grows Five Percent to $1.18 Per Diluted Share

- 2015 Normalized FFO Guidance

Increases to $4.70 to $4.76 Per Diluted Share

- CCP Spin-Off and Ardent Hospital

Transactions on Track to Close in Third Quarter 2015

Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) today

reported that normalized Funds From Operations (“FFO”) for the

quarter ended June 30, 2015 increased 19 percent to $394.3 million,

from $331.6 million for the comparable 2014 period. Normalized FFO

per diluted common share grew five percent to $1.18 for the quarter

ended June 30, 2015, as compared to $1.12 for the comparable 2014

period. Weighted average diluted shares outstanding for the second

quarter of 2015 increased to 334.0 million, compared to 296.5

million in the second quarter of 2014.

Strong Results and Near-Term Completion

of Spin-Off and Ardent Transactions

“We are pleased to report strong second quarter results and

increase our expectations for the full year. We drove positive

same-store NOI growth in our seniors housing portfolio, generated

attractive cash flow and closed accretive acquisitions,” Ventas

Chairman and Chief Executive Officer Debra A. Cafaro said. “We are

on track to complete our innovative and value creating spin-off of

Care Capital Properties and the Ardent hospital acquisition during

the third quarter, positioning Ventas to finish 2015 as a superior,

faster growing company with outstanding dividend growth and

portfolio and operator quality.”

Net income attributable to common stockholders for the quarter

ended June 30, 2015 was $149.8 million, or $0.45 per diluted common

share. Net income attributable to common stockholders for the

quarter ended June 30, 2014 was $138.4 million, or $0.47 per

diluted common share.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), for the second quarter of 2015 was

$389.0 million, or $1.16 per diluted common share. NAREIT FFO for

the second quarter of 2014 was $315.8 million, or $1.07 per diluted

common share, a per share growth rate of eight percent.

Portfolio Performance

- Total seniors housing operating

portfolio (“SHOP”) net operating income (“NOI”) was $155.4 million

in the second quarter, an increase of 24 percent over the

comparable 2014 period. Same-store SHOP NOI grew four percent,

expressed in constant currency, for the 234 same-store properties

over second quarter 2014 results.

- Same-store cash NOI growth for the

Company’s total portfolio (1,342 assets) was 2.4 percent, expressed

in constant currency, for the quarter ended June 30, 2015 compared

to the same period in 2014. Year-to-date, same-store cash NOI

growth for the Company’s total portfolio was 2.8 percent.

Recent Developments

- As announced on July 7, 2015, the

Company reached an agreement with Equity Group Investments (EGI) to

capitalize Ardent’s hospital operating company at an implied

valuation of $475 million, subject to working capital and other

adjustments. Ardent’s equity will be owned by a consortium of EGI,

Ardent’s existing management and Ventas (9.9 percent). At closing,

Ventas expects to have approximately $1.4 billion invested in high

quality owned hospital real estate, and Ardent will enter long term

triple net leases with Ventas at an expected going in cash yield

approximating 7.5 percent. Funding for the Ardent investment is

expected to include a five year unsecured term loan, as well as

proceeds of fixed income securities, asset sales and equity.

- In connection with Ventas’s previously

announced plan to spin off (the “Spin-Off”) most of its skilled

nursing facility portfolio into an independent, publicly traded

REIT named Care Capital Properties, Inc. (“CCP”), CCP filed

Amendment No. 2 to its Form 10 registration statement relating to

the Spin-Off with the Securities and Exchange Commission on July

15, 2015. The transaction is expected to be completed in August

2015, subject to applicable approvals.

- Ventas made investments totaling $222

million during the second quarter of 2015 at an expected unlevered

cash yield of 6.8 percent. These include an investment in the U.K.

with an existing customer and development and redevelopment funding

approximating $29 million.

Balance Sheet and

Liquidity

- During the second and third quarters of

2015, Ventas issued and sold a total of 1.6 million shares of

common stock for aggregate proceeds of approximately $105 million

(before sales commissions) under its “at the market” equity

offering program at an average price per share of $64.30.

- In July 2015, Ventas issued $500

million of 4.125 percent senior notes due 2026.

- Year-to-date, Ventas has sold assets,

including real estate and fixed income securities, and received

final loan repayments, generating approximately $591 million in

aggregate proceeds. The GAAP yield on the dispositions was seven

percent.

- Ventas generated $373.6 million in

operating cash flow in the second quarter of 2015, an increase of

20 percent over Q2 2014. On a per share basis, operating cash flow

increased seven percent.

- The Company’s Net Debt to Adjusted Pro

Forma EBITDA at June 30, 2015 was 5.6x. Current debt-to-enterprise

value now stands at 35 percent.

- The Company currently has a strong

liquidity position, with approximately $1.7 billion available under

its revolving credit facility, as well as $410 million of cash on

hand.

Increasing 2015 Normalized FFO Per

Share Guidance

Ventas currently expects its 2015 normalized FFO per diluted

share to increase to a range between $4.70 and $4.76. This updated

guidance range represents five to six percent growth in normalized

FFO per share over 2014. Ventas currently expects its 2015 NAREIT

FFO per diluted share to increase to a range between $4.51 and

$4.61.

The Company’s expectations include its pending acquisition of

Ardent upon the terms and timing discussed above. This guidance

does not take into account any impact from the Spin-Off. No further

investment or disposition activity is included in the Company’s

guidance range. Same-store cash NOI is forecast to grow 2.5 to 3.5

percent in 2015, which is consistent with previous guidance. A

reconciliation of the Company’s guidance to the Company’s projected

GAAP earnings is included in this press release.

The Company’s guidance is based on a number of other assumptions

that are subject to change and many of which are outside the

control of the Company. If actual results vary from these

assumptions, the Company’s expectations may change. There can be no

assurance that the Company will achieve these results. The Company

intends to update its publicly announced guidance following

completion of the Spin-Off, but it is not obligated to do so.

SECOND QUARTER CONFERENCE CALL

Ventas will hold a conference call to discuss this earnings

release today at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

The dial-in number for the conference call is (877) 474-9505 (or

(857) 244-7558 for international callers). The participant passcode

is “Ventas.” The conference call is being webcast live by NASDAQ

OMX and can be accessed at the Company’s website at

www.ventasreit.com. A replay of the

webcast will be available following the call online, or by calling

(888) 286-8010 (or (617) 801-6888 for international callers),

passcode 84642312, beginning at approximately 2:00 p.m. Eastern

Time and will remain for 35 days.

Ventas, Inc., an S&P 500 company, is a leading real estate

investment trust. Its diverse portfolio of more than 1,600 assets

in the United States, Canada and the United Kingdom consists of

seniors housing communities, medical office buildings, skilled

nursing facilities, hospitals and other properties. Through its

Lillibridge subsidiary, Ventas provides management, leasing,

marketing, facility development and advisory services to highly

rated hospitals and health systems throughout the United States.

More information about Ventas and Lillibridge can be found at

www.ventasreit.com and www.lillibridge.com.

Supplemental information regarding the Company can be found on

the Company’s website under the “Investor Relations” section or at

www.ventasreit.com/investor-relations/financial-information/supplemental-information.

A comprehensive listing of the Company’s properties is available at

www.ventasreit.com/our-portfolio/properties-by-location.

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

statements regarding the expected timing of the completion of the

proposed transaction with Ardent Medical Services, Inc. ("Ardent

Medical Services") and the Spin-Off, the benefits of the proposed

transaction with Ardent Medical Services and the Spin-Off,

including future financial and operating results, statements

regarding plans, objectives, and expectations relating to the

proposed transaction with Ardent Medical Services and the Spin-Off

and other statements that are not historical facts. In addition,

all statements regarding the Company’s or its tenants’, operators’,

borrowers’ or managers’ expected future financial condition,

results of operations, cash flows, funds from operations, dividends

and dividend plans, financing opportunities and plans, capital

markets transactions, business strategy, budgets, projected costs,

operating metrics, capital expenditures, competitive positions,

acquisitions, investment opportunities, dispositions, merger or

acquisition integration, growth opportunities, expected lease

income, continued qualification as a real estate investment trust

(“REIT”), plans and objectives of management for future operations

and statements that include words such as “anticipate,” “if,”

“believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,”

“should,” “will” and other similar expressions are forward-looking

statements. These forward-looking statements are inherently

uncertain, and actual results may differ from the Company’s

expectations. The Company does not undertake a duty to update these

forward-looking statements, which speak only as of the date on

which they are made.

The Company’s actual future results and trends may differ

materially from expectations depending on a variety of factors

discussed in the Company’s filings with the Securities and Exchange

Commission. These factors include without limitation: (a) the

ability and willingness of the Company’s tenants, operators,

borrowers, managers and other third parties to satisfy their

obligations under their respective contractual arrangements with

the Company, including, in some cases, their obligations to

indemnify, defend and hold harmless the Company from and against

various claims, litigation and liabilities; (b) the ability of the

Company’s tenants, operators, borrowers and managers to maintain

the financial strength and liquidity necessary to satisfy their

respective obligations and liabilities to third parties, including

without limitation obligations under their existing credit

facilities and other indebtedness; (c) the Company’s success in

implementing its business strategy and the Company’s ability to

identify, underwrite, finance, consummate and integrate

diversifying acquisitions and investments, including investments in

different asset types and outside the United States; (d)

macroeconomic conditions such as a disruption of or lack of access

to the capital markets, changes in the debt rating on U.S.

government securities, default or delay in payment by the United

States of its obligations, and changes in the federal or state

budgets resulting in the reduction or nonpayment of Medicare or

Medicaid reimbursement rates; (e) the nature and extent of future

competition, including new construction in the markets in which the

Company’s seniors housing communities and medical office buildings

(“MOBs”) are located; (f) the extent of future or pending

healthcare reform and regulation, including cost containment

measures and changes in reimbursement policies, procedures and

rates; (g) increases in the Company’s borrowing costs as a result

of changes in interest rates and other factors; (h) the ability of

the Company’s operators and managers, as applicable, to comply with

laws, rules and regulations in the operation of the Company’s

properties, to deliver high-quality services, to attract and retain

qualified personnel and to attract residents and patients; (i)

changes in general economic conditions or economic conditions in

the markets in which the Company may, from time to time, compete,

and the effect of those changes on the Company’s revenues, earnings

and funding sources; (j) the Company’s ability to pay down,

refinance, restructure or extend its indebtedness as it becomes

due; (k) the Company’s ability and willingness to maintain its

qualification as a REIT in light of economic, market, legal, tax

and other considerations; (l) final determination of the Company’s

taxable net income for the year ended December 31, 2014 and for the

year ending December 31, 2015; (m) the ability and willingness of

the Company’s tenants to renew their leases with the Company upon

expiration of the leases, the Company’s ability to reposition its

properties on the same or better terms in the event of nonrenewal

or in the event the Company exercises its right to replace an

existing tenant or manager, and obligations, including

indemnification obligations, the Company may incur in connection

with the replacement of an existing tenant or manager; (n) risks

associated with the Company’s senior living operating portfolio,

such as factors that can cause volatility in the Company’s

operating income and earnings generated by those properties,

including without limitation national and regional economic

conditions, costs of food, materials, energy, labor and services,

employee benefit costs, insurance costs and professional and

general liability claims, and the timely delivery of accurate

property-level financial results for those properties; (o) changes

in exchange rates for any foreign currency in which the Company

may, from time to time, conduct business; (p) year-over-year

changes in the Consumer Price Index or the UK Retail Price Index

and the effect of those changes on the rent escalators contained in

the Company’s leases and the Company’s earnings; (q) the Company’s

ability and the ability of its tenants, operators, borrowers and

managers to obtain and maintain adequate property, liability and

other insurance from reputable, financially stable providers; (r)

the impact of increased operating costs and uninsured professional

liability claims on the Company’s liquidity, financial condition

and results of operations or that of the Company’s tenants,

operators, borrowers and managers, and the ability of the Company

and the Company’s tenants, operators, borrowers and managers to

accurately estimate the magnitude of those claims; (s) risks

associated with the Company’s MOB portfolio and operations,

including the Company’s ability to successfully design, develop and

manage MOBs, to accurately estimate its costs in fixed

fee-for-service projects and to retain key personnel; (t) the

ability of the hospitals on or near whose campuses the Company’s

MOBs are located and their affiliated health systems to remain

competitive and financially viable and to attract physicians and

physician groups; (u) the Company’s ability to build, maintain and

expand its relationships with existing and prospective hospital and

health system clients; (v) risks associated with the Company’s

investments in joint ventures and unconsolidated entities,

including its lack of sole decision-making authority and its

reliance on its joint venture partners’ financial condition; (w)

the impact of market or issuer events on the liquidity or value of

the Company’s investments in marketable securities; (x) merger and

acquisition activity in the seniors housing and healthcare

industries resulting in a change of control of, or a competitor’s

investment in, one or more of the Company’s tenants, operators,

borrowers or managers or significant changes in the senior

management of the Company’s tenants, operators, borrowers or

managers; (y) the impact of litigation or any financial,

accounting, legal or regulatory issues that may affect the Company

or its tenants, operators, borrowers or managers; (z) changes in

accounting principles, or their application or interpretation, and

the Company’s ability to make estimates and the assumptions

underlying the estimates, which could have an effect on the

Company’s earnings; (aa) the inability to complete the acquisition

of Ardent Medical Services and the separation and sale of Ardent

Medical Services’ hospital operations on terms acceptable to Ventas

or at all; (bb) the failure to satisfy any conditions to completion

of the Ardent Medical Services transaction on terms acceptable to

Ventas or at all; (cc) the occurrence of any event, change or other

circumstances that could give rise to the termination of the Ardent

Medical Services purchase agreement or any other agreement relating

to the transaction; (dd) the risk that the expected benefits of the

Ardent Medical Services transaction, including financial results,

may not be fully realized or may take longer to realize than

expected; (ee) risks related to disruption of management’s

attention from ongoing business operations due to the proposed

Ardent Medical Services transaction; (ff) the effect of the

announcement of the proposed Ardent Medical Services transaction on

Ventas’s or Ardent Medical Services’ relationships with their

respective customers, tenants, lenders, operating results and

businesses generally; (gg) uncertainties as to the completion and

timing of the Spin-Off; and (hh) the impact of the Spin-Off on the

businesses of Ventas and CCP. Many of these factors are beyond the

control of the Company and its management.

CONSOLIDATED BALANCE SHEETS As of June 30, 2015,

March 31, 2015, December 31, 2014, September 30, 2014 and June 30,

2014 (In thousands, except per share amounts)

June 30, March 31,

December 31, September 30, June 30,

2015 2015 2014 2014 2014

Assets Real estate investments: Land and improvements $

2,288,356 $ 2,252,402 $ 1,956,128 $ 1,937,888 $ 1,848,922 Buildings

and improvements 22,051,067 21,933,742 19,895,043 19,664,973

18,591,786 Construction in progress 145,873 134,195 120,123 116,975

93,629 Acquired lease intangibles 1,308,052 1,300,654

1,039,651 1,039,949 1,009,474 25,793,348

25,620,993 23,010,945 22,759,785 21,543,811 Accumulated

depreciation and amortization (4,428,252 ) (4,202,334 ) (4,025,386

) (3,833,974 ) (3,657,541 ) Net real estate property 21,365,096

21,418,659 18,985,559 18,925,811 17,886,270 Secured loans

receivable and investments, net 789,408 773,773 829,756 407,551

414,051 Investments in unconsolidated entities 85,461 95,147

91,872 88,175 89,423 Net real estate

investments 22,239,965 22,287,579 19,907,187 19,421,537 18,389,744

Cash and cash equivalents 60,532 120,225 55,348 64,595 86,635

Escrow deposits and restricted cash 193,960 223,772 71,771 78,746

75,514 Deferred financing costs, net 68,284 71,386 60,328 64,898

63,399 Other assets 1,712,421 1,736,909 1,131,537

1,021,389 1,175,494

Total assets $

24,275,162 $ 24,439,871 $ 21,226,171 $

20,651,165 $ 19,790,786

Liabilities and

equity Liabilities: Senior notes payable and other debt $

11,507,861 $ 11,603,925 $ 10,888,092 $ 10,469,106 $ 9,602,439

Accrued interest 77,631 77,359 62,097 69,112 56,722 Accounts

payable and other liabilities 1,026,359 1,016,592 1,005,232 965,240

975,282 Deferred income taxes 370,161 371,785 344,337

361,454 256,392 Total liabilities 12,982,012

13,069,661 12,299,758 11,864,912 10,890,835 Redeemable OP

unitholder and noncontrolling interests 199,404 257,246 172,016

163,080 169,292 Commitments and contingencies Equity:

Ventas stockholders' equity: Preferred stock, $1.00 par value;

10,000 shares authorized, unissued — — — — — Common stock, $0.25

par value; 331,965; 330,913; 298,478; 294,359; and 294,358 shares

issued at June 30, 2015, March 31, 2015, December 31, 2014,

September 30, 2014 and June 30, 2014, respectively 82,982 82,718

74,656 73,603 73,602 Capital in excess of par value 12,708,898

12,616,056 10,119,306 9,859,490 9,849,301 Accumulated other

comprehensive income 10,180 4,357 13,121 16,156 26,255 Retained

earnings (deficit) (1,772,529 ) (1,660,856 ) (1,526,388 )

(1,398,378 ) (1,294,048 ) Treasury stock, 28; 32; 7; 32; and 0

shares at June 30, 2015, March 31, 2015, December 31, 2014,

September 30, 2014 and June 30, 2014, respectively (2,048 ) (2,385

) (511 ) (2,075 ) — Total Ventas stockholders' equity

11,027,483 11,039,890 8,680,184 8,548,796 8,655,110 Noncontrolling

interest 66,263 73,074 74,213 74,377

75,549 Total equity 11,093,746 11,112,964

8,754,397 8,623,173 8,730,659

Total

liabilities and equity $ 24,275,162 $ 24,439,871

$ 21,226,171 $ 20,651,165 $ 19,790,786

CONSOLIDATED STATEMENTS OF INCOME For the three and six

months ended June 30, 2015 and 2014 (In thousands, except

per share amounts) For the Three

Months Ended For the Six Months Ended June 30,

June 30, 2015 2014 2015 2014

Revenues: Rental income: Triple-net leased $ 260,562 $

242,726 $ 526,768 $ 480,572 Medical office buildings 140,403

114,890 277,393 230,113 400,965 357,616

804,161 710,685 Resident fees and services 454,645 374,473 901,559

745,534 Medical office building and other services revenue 9,408

4,367 19,951 10,667 Income from loans and investments 26,068 14,625

48,967 25,392 Interest and other income 236 173 708

446 Total revenues 891,322 751,254 1,775,346

1,492,724

Expenses: Interest 107,591 91,501 214,181 179,342

Depreciation and amortization 249,195 190,818 496,636 384,412

Property-level operating expenses: Senior living 299,252 249,424

597,614 497,719 Medical office buildings 43,321 39,335

85,670 78,680 342,573 288,759 683,284 576,399

Medical office building services costs 5,764 1,626 12,682 4,997

General, administrative and professional fees 33,962 31,306 68,292

64,172 (Gain) loss on extinguishment of debt, net (455 ) 2,924 (434

) 2,665 Merger-related expenses and deal costs 14,585 9,599 49,757

20,359 Other 5,091 4,863 10,387 10,092

Total expenses 758,306 621,396 1,534,785

1,242,438 Income before income (loss) from unconsolidated

entities, income taxes, discontinued operations, real estate

dispositions and noncontrolling interest 133,016 129,858 240,561

250,286 Income (loss) from unconsolidated entities 9 348 (242 ) 596

Income tax benefit (expense) 9,789 (3,274 ) 17,039

(6,707 ) Income from continuing operations 142,814 126,932 257,358

244,175 Discontinued operations 67 (255 ) (356 ) 2,776 Gain on real

estate dispositions 7,469 11,889 14,155 12,889

Net income 150,350 138,566 271,157 259,840 Net income

attributable to noncontrolling interest 529 168 894

395 Net income attributable to common stockholders $

149,821 $ 138,398 $ 270,263 $ 259,445

Earnings per common share: Basic: Income from continuing

operations attributable to common stockholders, including real

estate dispositions $ 0.45 $ 0.47 $ 0.82 $ 0.87 Discontinued

operations 0.00 (0.00 ) (0.00 ) 0.01 Net income

attributable to common stockholders $ 0.45 $ 0.47 $

0.82 $ 0.88 Diluted: Income from continuing

operations attributable to common stockholders, including real

estate dispositions $ 0.45 $ 0.47 $ 0.82 $ 0.87 Discontinued

operations 0.00 (0.00 ) (0.00 ) 0.01 Net income

attributable to common stockholders $ 0.45 $ 0.47 $

0.82 $ 0.88

Weighted average shares used in

computing earnings per common share: Basic 330,715 293,988

327,890 293,932 Diluted 334,026 296,504 331,424 296,369

Dividends declared per common share $ 0.79 $ 0.725 $ 1.58 $ 1.45

QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (In

thousands, except per share amounts)

2015 Quarters 2014 Quarters

Second First Fourth Third Second

Revenues: Rental income: Triple-net leased $ 260,562

$ 266,206 $ 245,599 $ 244,206 $ 242,726 Medical office buildings

140,403 136,990 116,907 116,598 114,890

400,965 403,196 362,506 360,804 357,616 Resident fees and

services 454,645 446,914 411,170 396,247 374,473 Medical office

building and other services revenue 9,408 10,543 11,124 7,573 4,367

Income from loans and investments 26,068 22,899 15,734 14,043

14,625 Interest and other income 236 472 3,453

368 173 Total revenues 891,322 884,024 803,987

779,035 751,254

Expenses: Interest 107,591 106,590

99,031 98,469 91,501 Depreciation and amortization 249,195 247,441

241,275 201,224 190,818 Property-level operating expenses: Senior

living 299,252 298,362 273,563 265,274 249,424 Medical office

buildings 43,321 42,349 38,715 41,147

39,335 342,573 340,711 312,278 306,421 288,759 Medical

office building services costs 5,764 6,918 7,527 4,568 1,626

General, administrative and professional fees 33,962 34,330 28,108

29,466 31,306 (Gain) loss on extinguishment of debt, net (455 ) 21

485 2,414 2,924 Merger-related expenses and deal costs 14,585

35,172 7,943 16,749 9,599 Other 5,091 5,296 13,604

15,229 4,863 Total expenses 758,306

776,479 710,251 674,540 621,396

Income before income (loss) from unconsolidated entities, income

taxes, discontinued operations, real estate dispositions and

noncontrolling interest 133,016 107,545 93,736 104,495 129,858

Income (loss) from unconsolidated entities 9 (251 ) (688 ) (47 )

348 Income tax benefit (expense) 9,789 7,250 13,552

1,887 (3,274 ) Income from continuing operations

142,814 114,544 106,600 106,335 126,932 Discontinued operations 67

(423 ) (411 ) (259 ) (255 ) Gain on real estate dispositions 7,469

6,686 1,456 3,625 11,889 Net

income 150,350 120,807 107,645 109,701 138,566 Net income

attributable to noncontrolling interest 529 365 455

569 168 Net income attributable to common

stockholders $ 149,821 $ 120,442 $ 107,190 $

109,132 $ 138,398

Earnings per common

share: Basic: Income from continuing operations attributable to

common stockholders, including real estate dispositions $ 0.45 $

0.37 $ 0.36 $ 0.37 $ 0.47 Discontinued operations 0.00 (0.00

) (0.00 ) (0.00 ) (0.00 ) Net income attributable to common

stockholders $ 0.45 $ 0.37 $ 0.36 $ 0.37

$ 0.47 Diluted: Income from continuing operations

attributable to common stockholders, including real estate

dispositions $ 0.45 $ 0.37 $ 0.36 $ 0.37 $ 0.47 Discontinued

operations 0.00 (0.00 ) (0.00 ) (0.00 ) (0.00 ) Net income

attributable to common stockholders $ 0.45 $ 0.37 $

0.36 $ 0.37 $ 0.47

Weighted average

shares used in computing earnings per common share: Basic

330,715 325,454 294,810 294,030 293,988 Diluted 334,026 329,203

297,480 296,495 296,504

CONSOLIDATED STATEMENTS OF CASH

FLOWS For the six months ended June 30, 2015 and 2014

(In thousands) 2015 2014 Cash

flows from operating activities: Net income $ 271,157 $ 259,840

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization (including

amounts in discontinued operations) 496,660 385,940 Amortization of

deferred revenue and lease intangibles, net (13,630 ) (9,879 )

Other non-cash amortization 909 (2,928 ) Stock-based compensation

11,192 11,411 Straight-lining of rental income, net (16,761 )

(17,231 ) (Gain) loss on extinguishment of debt, net (434 ) 2,665

Gain on real estate dispositions (including amounts in discontinued

operations) (14,432 ) (14,142 ) Gain on sale of marketable

securities (5,800 ) — Income tax (benefit) expense (18,240 ) 6,407

Loss (income) from unconsolidated entities 242 (596 ) Other 17,967

6,494 Changes in operating assets and liabilities: (Increase)

decrease in other assets (9,711 ) 11,208 Increase in accrued

interest 16,108 2,374 Decrease in accounts payable and other

liabilities (17,503 ) (45,861 ) Net cash provided by operating

activities 717,724 595,702 Cash flows from investing activities:

Net investment in real estate property (1,253,910 ) (271,526 )

Investment in loans receivable and other (55,659 ) (44,488 )

Proceeds from real estate disposals 273,191 52,350 Proceeds from

loans receivable 93,275 5,980 Purchase of marketable securities —

(46,689 ) Proceeds from sale or maturity of marketable securities

57,225 — Funds held in escrow for future development expenditures

4,003 2,602 Development project expenditures (62,630 ) (44,423 )

Capital expenditures (43,429 ) (35,526 ) Other (8,813 ) (3,713 )

Net cash used in investing activities (996,747 ) (385,433 ) Cash

flows from financing activities: Net change in borrowings under

credit facility (321,334 ) (199,951 ) Proceeds from debt 1,107,971

696,661 Repayment of debt (278,442 ) (272,726 ) Purchase of

noncontrolling interest (3,816 ) — Payment of deferred financing

costs (14,608 ) (6,846 ) Issuance of common stock, net 352,167 —

Cash distribution to common stockholders (516,404 ) (426,952 ) Cash

distribution to redeemable OP unitholders (4,697 ) (2,762 )

Purchases of redeemable OP units (33,188 ) — Distributions to

noncontrolling interest (9,467 ) (4,908 ) Other 5,928 (574 )

Net cash provided by (used in) financing activities 284,110

(218,058 ) Net increase (decrease) in cash and cash equivalents

5,087 (7,789 ) Effect of foreign currency translation on cash and

cash equivalents 97 (392 ) Cash and cash equivalents at beginning

of period 55,348 94,816 Cash and cash equivalents at

end of period $ 60,532 $ 86,635 Supplemental

schedule of non-cash activities: Assets and liabilities assumed

from acquisitions: Real estate investments $ 2,554,590 $ 54,282

Other assets acquired 16,505 1,634 Debt assumed 177,857 51,115

Other liabilities 49,788 3,675 Deferred income tax liability 51,620

1,126 Noncontrolling interests 87,245 — Equity issued 2,204,585 —

QUARTERLY CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) 2015

Quarters 2014 Quarters Second First

Fourth Third Second Cash flows from operating

activities: Net income $ 150,350 $ 120,807 $ 107,645 $ 109,701 $

138,566 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization (including

amounts in discontinued operations) 249,207 247,453 241,291 201,236

192,064 Amortization of deferred revenue and lease intangibles, net

(7,027 ) (6,603 ) (4,096 ) (4,896 ) (4,496 ) Other non-cash

amortization 1,428 (519 ) 304 2,312 (963 ) Stock-based compensation

4,885 6,307 4,202 5,381 5,367 Straight-lining of rental income, net

(8,082 ) (8,679 ) (9,043 ) (12,413 ) (9,317 ) (Gain) loss on

extinguishment of debt, net (455 ) 21 485 2,414 2,924 Gain on real

estate dispositions (including amounts in discontinued operations)

(7,746 ) (6,686 ) (1,457 ) (3,584 ) (11,705 ) Gain on real estate

loan investments — — (1,206 ) (249 ) — Gain on sale of marketable

securities (5,800 ) — — — — Income tax (benefit) expense (10,390 )

(7,850 ) (13,851 ) (1,987 ) 2,974 (Income) loss from unconsolidated

entities (9 ) 251 688 47 (348 ) Other 15,107 2,860 2,140 7,105

3,418 Changes in operating assets and liabilities: (Increase)

decrease in other assets (14,326 ) 4,615 8,623 (14,514 ) 4,967

Increase (decrease) in accrued interest 316 15,792 (6,877 ) 12,461

(4,379 ) Increase (decrease) in accounts payable and other

liabilities 6,097 (23,600 ) 6,025 21,256

(7,791 ) Net cash provided by operating activities 373,555 344,169

334,873 324,270 311,281 Cash flows from investing activities: Net

investment in real estate property (181,371 ) (1,072,539 ) (284,250

) (912,510 ) (89,660 ) Investment in loans receivable and other

(16,086 ) (39,573 ) (432,556 ) (21,948 ) (43,296 ) Proceeds from

real estate disposals 106,850 166,341 5,500 60,396 26,200 Proceeds

from loans receivable 1,219 92,056 17,984 49,593 4,817 Purchase of

marketable securities — — (50,000 ) — (21,689 ) Proceeds from sale

or maturity of marketable securities 57,225 — — 21,689 — Funds held

in escrow for future development expenditures — 4,003 1,988 — —

Development project expenditures (29,163 ) (33,467 ) (35,613 )

(26,952 ) (20,475 ) Capital expenditures (22,258 ) (21,171 )

(31,219 ) (20,709 ) (19,392 ) Other (4,633 ) (4,180 ) (10,704 )

(296 ) (3,588 ) Net cash used in investing activities (88,217 )

(908,530 ) (818,870 ) (850,737 ) (167,083 ) Cash flows from

financing activities: Net change in borrowings under credit

facility 131,563 (452,897 ) 693,887 46,267 (381,705 ) Proceeds from

debt 15,138 1,092,833 — 1,311,046 696,661 Repayment of debt

(253,795 ) (24,647 ) (246,278 ) (632,391 ) (204,953 ) Purchase of

noncontrolling interest (1,156 ) (2,660 ) — — — Payment of deferred

financing costs (173 ) (14,435 ) 726 (8,100 ) (6,679 ) Issuance of

common stock, net 66,840 285,327 242,107 — — Cash distribution to

common stockholders (261,494 ) (254,910 ) (235,200 ) (213,462 )

(213,479 ) Cash distribution to redeemable OP unitholders (2,332 )

(2,365 ) (1,548 ) (1,452 ) (1,360 ) Purchases of redeemable OP

units (32,619 ) (569 ) (503 ) — — Contributions from noncontrolling

interest — — 491 — — Distributions to noncontrolling interest

(7,645 ) (1,822 ) (2,799 ) (1,852 ) (2,671 ) Other 238 5,690

25,153 23 (2,215 ) Net cash (used in) provided

by financing activities (345,435 ) 629,545 476,036

500,079 (116,401 ) Net (decrease) increase in cash and cash

equivalents (60,097 ) 65,184 (7,961 ) (26,388 ) 27,797 Effect of

foreign currency translation on cash and cash equivalents 404 (307

) (1,286 ) 4,348 (953 ) Cash and cash equivalents at beginning of

period 120,225 55,348 64,595 86,635

59,791 Cash and cash equivalents at end of period $ 60,532

$ 120,225 $ 55,348 $ 64,595 $ 86,635

Supplemental schedule of non-cash activities: Assets

and liabilities assumed from acquisitions: Real estate investments

$ 11,761 $ 2,542,829 $ 16,746 $ 299,713 $ 51,330 Other assets

acquired (206 ) 16,711 11,597 2,049 1,634 Debt assumed — 177,857

12,926 177,035 51,115 Other liabilities 4,052 45,736 4,598 15,766

723 Deferred income tax liability 7,503 44,117 641 108,961 1,126

Noncontrolling interests — 87,245 — — — Equity issued — 2,204,585

10,178 — —

NON-GAAP FINANCIAL MEASURES RECONCILIATION

Funds From Operations (FFO) and Funds Available for Distribution

(FAD)(1) (Dollars in thousands, except per share

amounts) Tentative Estimates Preliminary

and Midpoint YOY Subject to Change

YOY 2014 2015

Growth FY2015 - Guidance Growth

Q2 Q3 Q4 FY

Q1 Q2

YTD

'14-'15 Low High

'14-'15E Net income attributable to common

stockholders $ 138,398 $ 109,132

$ 107,190 $ 475,767 $

120,442 $ 149,821 $ 270,263

$ 570,305 $ 584,808 Net

income attributable to common stockholders per share $

0.47 $ 0.37 $ 0.36 $

1.60 $ 0.37 $ 0.45 $

0.82 $ 1.70 $ 1.75

Adjustments: Depreciation and amortization on real estate

assets 189,219 199,617 239,465

820,344 245,651 247,392 493,043

964,000 988,000 Depreciation on real estate assets

related to noncontrolling interest (2,661 )

(2,503 ) (2,506 ) (10,314

) (2,052 ) (1,964 )

(4,016 ) (7,800 ) (8,200

) Depreciation on real estate assets related to

unconsolidated entities 1,495 1,471 1,332

5,792 1,462 1,464 2,926 5,700

6,100 Gain on real estate dispositions (11,889

) (3,625 ) (1,456 )

(17,970 ) (6,686 ) (7,469

) (14,155 ) (22,500 )

(27,500 ) Discontinued operations: (Gain)

loss on real estate dispositions (45 ) 41

(52 ) (1,494 ) — (277

) (277 ) (277 ) (277

) Depreciation and amortization on real estate assets

1,247 12 15

1,555 12 12

24 48

48 Subtotal: FFO add-backs

177,366 195,013 236,798 797,913

238,387 239,158 477,545 939,171

958,171 Subtotal: FFO add-backs per share

$ 0.60 $ 0.66

$ 0.80 $ 2.69

$ 0.72 $

0.72 $ 1.44

$ 2.80 $ 2.86

FFO (NAREIT) attributable to common

stockholders $ 315,764 $ 304,145

$ 343,988 $ 1,273,680 $

358,829 $ 388,979 $ 747,808

23 % $ 1,509,476 $

1,542,979 20 % FFO (NAREIT) attributable to

common stockholders per share $ 1.07

$ 1.03 $

1.16 $ 4.29

$ 1.09 $ 1.16

$ 2.26 8 %

$ 4.51 $ 4.61

6 % Adjustments: Change in

fair value of financial instruments 109 4,595

485 5,121 (46 ) 70 24

500 (1,100 ) Non-cash income tax expense

(benefit) 2,974 (1,987 ) (13,851

) (9,431 ) (7,850 )

(10,389 ) (18,239 ) (27,000

) (33,000 ) Loss (gain) on extinguishment

of debt, net 2,924 2,414 485 5,013

21 (39 ) (18 ) 1,000

2,000 Merger-related expenses, deal costs and re-audit

costs 9,602 23,401 10,625 54,389

36,002 15,135 51,137 88,500

81,500 Amortization of other intangibles 255

255 480

1,246 591 591

1,182 2,300

2,500 Subtotal: normalized FFO

add-backs 15,864 28,678 (1,776 )

56,338 28,718 5,368 34,086

65,300 51,900 Subtotal: normalized FFO add-backs

per share $ 0.05 $

0.10 $ (0.01 )

$ 0.19 $ 0.09

$ 0.02 $ 0.10

$ 0.19

$ 0.15 Normalized FFO

attributable to common stockholders $ 331,628

$ 332,823 $ 342,212 $

1,330,018 $ 387,547 $ 394,347

$ 781,894 19 % $

1,574,776 $ 1,594,879 19 %

Normalized FFO attributable to common stockholders per share

$ 1.12 $ 1.12

$ 1.15 $

4.48 $ 1.18

$ 1.18 $ 2.36

5 % $ 4.70

$ 4.76 6 %

Non-cash items included in normalized FFO: Amortization

of deferred revenue and lease intangibles, net (4,496

) (4,896 ) (4,096 )

(18,871 ) (6,603 ) (7,027

) (13,630 ) (27,100 )

(28,100 ) Other non-cash amortization, including

fair market value of debt (963 ) 2,312

304 (312 ) (519 ) 1,428

909 4,700 5,700 Stock-based

compensation 5,367 5,381 4,202

20,994 6,307 4,885 11,192 20,700

22,700 Straight-lining of rental income, net

(9,317 ) (12,413 )

(9,043 ) (38,687 )

(8,679 ) (8,082 )

(16,761 ) (32,100

) (33,100 ) Subtotal: non-cash items

included in normalized FFO (9,409 ) (9,616

) (8,633 ) (36,876 )

(9,494 ) (8,796 ) (18,290

) (33,800 ) (32,800 ) Capital

expenditures (21,445 )

(21,822 ) (32,527 )

(92,928 ) (22,148 )

(23,520 ) (45,668 )

(112,500 ) (120,000

) Normalized FAD attributable to common

stockholders $ 300,774 $ 301,385

$ 301,052 $ 1,200,214 $

355,905 $ 362,031 $ 717,936

20 % $ 1,428,476 $

1,442,079 20 % Normalized FAD attributable

to common stockholders per share $ 1.01

$ 1.02 $

1.01 $ 4.05

$ 1.08 $ 1.08

$ 2.17 7 %

$ 4.26 $ 4.30

6 % Merger-related expenses, deal costs and

re-audit costs (9,602 )

(23,401 ) (10,625 )

(54,389 ) (36,002 )

(15,135 ) (51,137 )

(88,500 ) (81,500

) FAD attributable to common

stockholders $ 291,172 $ 277,984

$ 290,427 $ 1,145,825 $

319,903 $ 346,896 $ 666,799

19 % $ 1,339,976 $

1,360,579 18 % FAD attributable to common

stockholders per share $ 0.98

$ 0.94 $ 0.98

$ 3.86 $

0.97 $ 1.04

$ 2.01 6 %

$ 4.00 $ 4.06

4 % Weighted average diluted shares

296,504 296,495 297,480 296,677

329,203 334,026 331,424 335,059

335,059 1 Totals and per

share amounts may not add due to rounding. Per share quarterly

amounts may not add to annual per share amounts due to material

changes in the Company’s weighted average diluted share count, if

any.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. However, since real estate values have historically

risen or fallen with market conditions, many industry investors

deem presentations of operating results for real estate companies

that use historical cost accounting to be insufficient by

themselves. For that reason, the Company considers FFO, normalized

FFO and FAD to be appropriate measures of operating performance of

an equity REIT. In particular, the Company believes that normalized

FFO is useful because it allows investors, analysts and Company

management to compare the Company’s operating performance to the

operating performance of other real estate companies and between

periods on a consistent basis without having to account for

differences caused by unanticipated items and other events such as

transactions and litigation. In some cases, the Company provides

information about identified non-cash components of FFO and

normalized FFO because it allows investors, analysts and Company

management to assess the impact of those items on the Company’s

financial results.

The Company uses the NAREIT definition of FFO. NAREIT defines

FFO as net income attributable to common stockholders (computed in

accordance with GAAP) excluding gains (or losses) from sales of

real estate property, including gain on re-measurement of equity

method investments, and impairment write-downs of depreciable real

estate, plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures.

Adjustments for unconsolidated partnerships and joint ventures will

be calculated to reflect FFO on the same basis. The Company defines

normalized FFO as FFO excluding the following income and expense

items (which may be recurring in nature): (a) merger-related costs

and expenses, including amortization of intangibles, transition and

integration expenses, and deal costs and expenses, including

expenses and recoveries relating to acquisition lawsuits; (b) the

impact of any expenses related to asset impairment and valuation

allowances, the write-off of unamortized deferred financing fees,

or additional costs, expenses, discounts, make-whole payments,

penalties or premiums incurred as a result of early retirement or

payment of the Company’s debt; (c) the non-cash effect of income

tax benefits or expenses and derivative transactions that have

non-cash mark-to-market impacts on the Company’s income statement;

(d) except as specifically stated in the case of guidance, the

impact of future acquisitions or divestitures (including pursuant

to tenant options to purchase) and capital transactions; (e) the

financial impact of contingent consideration, charitable donations

made to the Ventas Charitable Foundation, gains and losses for

non-operational foreign currency hedge agreements and changes in

the fair value of financial instruments; and (f) expenses related

to the re-audit and re-review in 2014 of the Company’s historical

financial statements and related matters. FAD represents normalized

FFO excluding non-cash components, straight-line rental adjustments

and capital expenditures, including tenant allowances and leasing

commissions.

FFO, normalized FFO and FAD presented herein may not be

comparable to similar measures presented by other real estate

companies due to the fact that not all real estate companies use

the same definitions. FFO, normalized FFO and FAD should not be

considered as alternatives to net income (determined in accordance

with GAAP) as indicators of the Company’s financial performance or

as alternatives to cash flow from operating activities (determined

in accordance with GAAP) as measures of the Company’s liquidity,

nor are they necessarily indicative of sufficient cash flow to fund

all of the Company’s needs. The Company believes that in order to

facilitate a clear understanding of the consolidated historical

operating results of the Company, FFO, normalized FFO and FAD

should be examined in conjunction with net income as presented

elsewhere herein.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Net Debt to Adjusted Pro Forma

EBITDA

The following information considers the pro forma effect on net

income, interest, depreciation and amortization, and noncontrolling

interest of the Company’s investments and other capital

transactions that were completed during the three months ended

June 30, 2015, as if the transactions had been consummated as

of the beginning of the period. The following table illustrates net

debt to pro forma earnings before interest, taxes, depreciation and

amortization (including non-cash stock-based compensation expense),

excluding gains or losses on extinguishment of debt, income or loss

from noncontrolling interest and unconsolidated entities,

merger-related expenses and deal costs, expenses related to the

re-audit and re-review in 2014 of the Company’s historical

financial statements, net gains on real estate activity and changes

in the fair value of financial instruments (including amounts in

discontinued operations) (“Adjusted Pro Forma EBITDA”) (dollars in

thousands):

Net income attributable to common

stockholders $ 149,821 Pro forma adjustments for current

period investments, capital transactions and dispositions (2,458 )

Pro forma net income for the three months ended June 30, 2015

147,363 Add back: Pro forma interest 106,384 Pro forma depreciation

and amortization 250,092 Stock-based compensation 4,885 Gain on

real estate dispositions (7,746 )

Gain on extinguishment of debt, net

(455 )

Gain from unconsolidated entities

(9 ) Pro forma noncontrolling interest 226 Income tax benefit

(9,789 ) Change in fair value of financial instruments 70 Other

taxes 1,220 Merger-related expenses, deal costs and re-audit costs

15,010 Adjusted Pro Forma EBITDA 507,251 Adjusted Pro

Forma EBITDA annualized $ 2,029,004 As of June

30, 2015: Debt $ 11,507,861 Cash, adjusted for cash escrows

pertaining to debt (204,761 ) Net debt $ 11,303,100

Net debt to Adjusted Pro Forma EBITDA 5.6 x

NON-GAAP FINANCIAL MEASURES RECONCILIATION 1, 2

NOI by Segment (In thousands)

2015 Quarters 2014 Quarters

Second First Fourth Third Second

Revenues Triple-Net Triple-Net Rental Income $

260,562 $ 266,206 $ 245,599 $ 244,206 $ 242,726 Medical

Office Buildings Medical Office - Stabilized 129,145 123,211

104,171 103,780 101,795 Medical Office - Lease up 8,129 8,429 6,675

6,767 6,839 Medical Office - Other 3,129 5,350 6,061

6,051 6,256 Total Medical Office Buildings - Rental

Income 140,403 136,990 116,907 116,598

114,890 Total Rental Income 400,965 403,196 362,506 360,804 357,616

Medical Office Building Services Revenue 7,749 8,858

9,218 5,937 2,722 Total Medical Office

Buildings - Revenue 148,152 145,848 126,125 122,535 117,612

Triple-Net Services Revenue 1,139 1,136 1,136 1,136 1,145

Non-Segment Services Revenue 520 549 770 500

500 Total Medical Office Building and Other Services Revenue

9,408 10,543 11,124 7,573 4,367 Seniors Housing Operating

Seniors Housing - Stabilized 438,110 431,890 398,855 385,511

363,618 Seniors Housing - Lease up 16,535 15,024 12,083 10,109

10,227 Seniors Housing - Other — — 232 627

628 Total Resident Fees and Services 454,645 446,914 411,170

396,247 374,473 Non-Segment Income from Loans and

Investments 26,068 22,899 15,734 14,043

14,625 Total Revenues, excluding Interest and Other Income 891,086

883,552 800,534 778,667 751,081

Property-Level Operating

Expenses Medical Office Buildings Medical Office -

Stabilized 38,491 36,807 33,331 34,807 33,641 Medical Office -

Lease up 3,087 3,242 2,509 2,738 2,733 Medical Office - Other 1,743

2,300 2,875 3,602 2,961 Total Medical

Office Buildings 43,321 42,349 38,715 41,147 39,335 Seniors

Housing Operating Seniors Housing - Stabilized 286,321 286,277

262,915 256,702 241,380 Seniors Housing - Lease up 12,931 12,085

10,421 7,972 7,473 Seniors Housing - Other — — 227

600 571 Total Seniors Housing 299,252 298,362

273,563 265,274 249,424 Total Property-Level

Operating Expenses 342,573 340,711 312,278 306,421 288,759

Medical Office Building Services Costs 5,764 6,918 7,527

4,568 1,626

Net Operating Income Triple-Net

Triple-Net Properties 260,562 266,206 245,599 244,206 242,726

Triple-Net Services Revenue 1,139 1,136 1,136

1,136 1,145 Total Triple-Net 261,701 267,342 246,735 245,342

243,871 Medical Office Buildings Medical Office - Stabilized

90,654 86,404 70,840 68,973 68,154 Medical Office - Lease up 5,042

5,187 4,166 4,029 4,106 Medical Office - Other 1,386 3,050 3,186

2,449 3,295 Medical Office Building Services 1,985 1,940

1,691 1,369 1,096 Total Medical Office

Buildings 99,067 96,581 79,883 76,820 76,651 Seniors Housing

Operating Seniors Housing - Stabilized 151,789 145,613 135,940

128,809 122,238 Seniors Housing - Lease up 3,604 2,939 1,662 2,137

2,754 Seniors Housing - Other — — 5 27

57 Total Seniors Housing 155,393 148,552 137,607 130,973 125,049

Non-Segment 26,588 23,448 16,504 14,543

15,125

Net Operating Income $ 542,749 $ 535,923

$ 480,729 $ 467,678 $ 460,696 1 Amounts

above are adjusted to exclude discontinued operations for all

periods presented. 2 Amounts above are not restated for changes

between categories from quarter to quarter.

NON-GAAP

FINANCIAL MEASURES RECONCILIATION (Dollars in thousands)

Total Portfolio Same-Store Constant Currency Cash NOI

For the Three Months Ended June 30,

2015 2014 Net Operating Income

$ 542,749 $ 460,696 Adjustments:

NOI Not Included in Same-Store (75,173 ) (14,974 ) Straight-Lining

of Rental Income (8,081 ) (9,319 ) Non-Cash Rental Income (6,199 )

(3,629 ) Non-Segment NOI (26,588 ) (15,125 ) Constant Currency

Adjustment — (945 ) (116,041 ) (43,992 ) Constant

Currency NOI as Reported $ 426,708 $ 416,704

Percentage Increase

2.4 % NON-GAAP

FINANCIAL MEASURES RECONCILIATION (Dollars in thousands)

Total Portfolio Same-Store Constant Currency Cash NOI

For the Six Months Ended June 30,

2015 2014 Net Operating Income

$ 1,078,672 $ 910,882

Adjustments: Lease Modification Fee 5,200 — NOI Not Included in

Same-Store (159,137 ) (34,810 ) Straight-Lining of Rental Income

(16,760 ) (17,217 ) Non-Cash Rental Income (12,008 ) (8,353 )

Non-Segment NOI (50,038 ) (26,392 ) Constant Currency Adjustment —

(1,256 ) (232,743 ) (88,028 ) Constant Currency NOI

as Reported $ 845,929 $ 822,854 Percentage

Increase

2.8 % NON-GAAP FINANCIAL MEASURES

RECONCILIATION (Dollars in thousands) Senior

Housing Operating Portfolio Same-Store Constant Currency NOI

For the Three Months Ended June 30,

2015 2014 Net Operating Income

$ 155,393 $ 125,049 Less: NOI

Not Included in Same-Store (28,013 ) (1,862 ) Constant Currency

Adjustment — (667 ) (28,013 ) (2,529 ) Constant

Currency NOI as Reported $ 127,380 $ 122,520

Percentage Increase

4.0 %

Click here to subscribe to Mobile Alerts for Ventas, Inc.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150724005248/en/

Ventas, Inc.Lori B. Wittman(877) 4-VENTAS

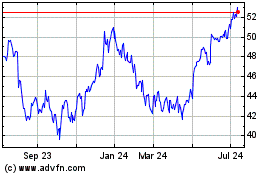

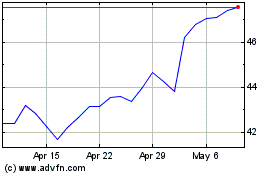

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024