- Record 2015 First Quarter Normalized

FFO Grows Eight Percent to $1.18 Per Diluted Share

- Total 2015 First Quarter Investments

Exceed $3.5 Billion

- Increases 2015 Normalized FFO

Guidance to $4.67 to $4.75 Per Diluted Share

Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) today

reported that normalized Funds From Operations (“FFO”) for the

quarter ended March 31, 2015 increased 20 percent to $387.5

million, from $323.4 million for the comparable 2014 period.

Normalized FFO per diluted common share grew eight percent to $1.18

for the quarter ended March 31, 2015, as compared to $1.09 for the

comparable 2014 period. Weighted average diluted shares outstanding

for the first quarter of 2015 increased to 329.2 million, compared

to 296.2 million in 2014.

Record Results, Value Creating

Acquisitions and Innovative Transactions

“Once again, we are pleased to report record results, in line

with our expectations, driven by accretive acquisitions,

well-executed capital markets transactions and active asset

management of our diverse, high-quality portfolio,” Ventas Chairman

and Chief Executive Officer Debra A. Cafaro said. “Our recently

announced spin-off of most of our skilled nursing portfolio into a

pure-play REIT and our pending Ardent hospital acquisition will

create two focused higher growth companies and enhance our leading

position in healthcare and senior living real estate.”

Net income attributable to common stockholders for the quarter

ended March 31, 2015 was $120.4 million, or $0.37 per diluted

common share. Net income attributable to common stockholders for

the quarter ended March 31, 2014 was $121.0 million, or $0.41 per

diluted common share. Net income attributable to common

stockholders for the quarter ended December 31, 2014 was $107.2

million, or $0.36 per diluted common share.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), for the first quarter of 2015 was

$358.8 million, or $1.09 per diluted common share. NAREIT FFO for

the first quarter of 2014 was $309.8 million, or $1.05 per diluted

common share. NAREIT FFO per share growth was lower than normalized

FFO per share growth for the same period due principally to the

exclusion of transaction costs in both periods in normalized FFO,

consistent with the Company’s guidance and historical practice.

First Quarter 2015 Highlights

- Same-store cash net operating income

(“NOI”) growth for the Company’s total portfolio (1,344 assets) was

3.2 percent, expressed in constant currency, for the quarter ended

March 31, 2015 compared to the same period in 2014.

- Total seniors housing operating

portfolio (“SHOP”) NOI was $148.6 million, an increase of 21

percent over the comparable 2014 period. Same-store SHOP NOI grew

0.9 percent, expressed in constant currency, for the 234 same-store

properties over first quarter 2014 results. The year earlier period

benefited from $2.2 million in real estate tax credits; without

such credit, same-store NOI growth would have been 2.7%.

- In January 2015, the Company completed

its previously announced acquisition of 152 healthcare and senior

living assets owned by American Realty Capital Healthcare Trust,

Inc. (“HCT”) in a stock and cash transaction. The transaction was

funded with 28.4 million shares of Ventas common stock, 1.1 million

units redeemable for shares of Ventas common stock, cash and the

assumption of debt.

- Ventas made investments totaling $3.6

billion during the first quarter of 2015, including five care homes

in the U.K., twelve skilled nursing facilities and development and

redevelopment fundings approximating $33.5 million.

- In January 2015, Ventas issued and sold

$1.1 billion of senior notes with a weighted average interest rate

below 3.7 percent and a weighted average maturity of 15 years. The

issuances were composed of $900 million aggregate principal amount

of USD senior notes and CAD notes of 250 million.

- During the first quarter of 2015,

Ventas issued and sold a total of 3.8 million shares of common

stock for aggregate proceeds of approximately $290 million (before

sales commissions) under its “at the market” (“ATM”) equity

offering program. Ventas replaced its expiring shelf registration

statement during the quarter and in conjunction therewith replaced

its prior ATM program with a new ATM program. The Company has not

issued any shares under the new ATM program.

- Year-to-date, Ventas has sold 45

properties and received final repayment on loans receivable for

approximately $474 million in aggregate proceeds. The GAAP yield on

the dispositions and loan repayments was seven percent.

Recent Developments

- In April 2015, Ventas announced its

plan to spin off (the “Spin-Off”) most of its skilled nursing

facility (“SNF”) portfolio into an independent, publicly traded

REIT named Care Capital Properties, Inc. (“CCP”). The transaction

is expected to be completed in the second half of 2015 and is

intended to qualify as a tax-free distribution to Ventas

shareholders. CCP filed its Form 10 registration statement relating

to the Spin-Off with the Securities and Exchange Commission on

April 23, 2015.

- Ventas also announced in April 2015 its

plan to acquire privately-owned Ardent Medical Services, Inc. (with

its affiliates, “Ardent Health Services”), one of the ten largest

for-profit hospital companies in the U.S. The accretive

transaction, which is expected to close mid-year 2015, will also

consist of (a) a buy-out of a minority partner interest for

incremental investment, (b) the separation of Ardent Health

Services’ hospital operations from its owned real estate and (c)

the sale of these hospital operations to one or more newly formed

entities (collectively, “Ardent”), to be owned by current

management of Ardent Health Services, other equity sources, and up

to 9.9 percent by Ventas. Ventas and Ardent will enter into

pre-agreed long-term triple-net leases with an expected going in

cash yield exceeding 7 percent on a projected $1.4 billion net real

estate investment value. The transaction is subject to the

satisfaction of certain specified closing conditions, including

receipt of regulatory approvals.

- The Company’s net debt to Adjusted Pro

Forma EBITDA (as defined herein) at March 31, 2015 is 5.7x. Current

debt-to-enterprise value now stands at 32 percent.

- The Company currently has a strong

liquidity position, with approximately $1.7 billion available under

its revolving credit facility, as well as $71 million of cash on

hand.

- The Company paid a dividend of $0.79

per share during the first quarter, in two installments, a nine

percent increase over the first quarter of 2014.

Increasing 2015 Normalized FFO

Guidance

Ventas currently expects its 2015 normalized FFO per diluted

share to increase to a range between $4.67 and $4.75. This updated

guidance range represents four to six percent growth in normalized

FFO per share over 2014. Second quarter 2015 normalized FFO per

diluted share growth is expected to be below this full-year growth

range due to timing of dispositions, reinvestments and fee income.

Ventas currently expects its 2015 NAREIT FFO per diluted share to

range between $4.47 and $4.59, due principally to deal costs

related to its investment activity.

The Company’s expectations include its pending acquisition of

Ardent Health Services, funded on a leverage neutral basis, upon

the terms and timing discussed above. This guidance does not take

into account any impact from the Spin-Off of CCP. The Company’s

guidance assumes about $600 million in property dispositions and

receipt of loan repayments, substantially all of which were

completed and received in the first quarter of 2015, with mid-year

reinvestment of net proceeds into the Ardent acquisition. No

further investment or disposition activity is included in the

Company’s guidance range.

Same-store cash NOI is forecast to grow 2.5 to 3.5 percent in

2015, which is consistent with previous guidance.

A reconciliation of the Company’s guidance to the Company’s

projected GAAP earnings is included in this press release.

FIRST QUARTER CONFERENCE CALL

Ventas will hold a conference call to discuss this earnings

release today at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

The dial-in number for the conference call is (866) 700-6293 (or

(617) 213-8835 for international callers). The participant passcode

is “Ventas.” The conference call is being webcast live by NASDAQ

OMX and can be accessed at the Company’s website at

www.ventasreit.com. A replay of the

webcast will be available following the call online, or by calling

(888) 286-8010 (or (617) 801-6888 for international callers),

passcode 31511307, beginning at approximately 2:00 p.m. Eastern

Time and will remain available for 35 days.

Ventas, Inc., an S&P 500 company, is a leading real estate

investment trust. Its diverse portfolio of more than 1,600 assets

in the United States, Canada and the United Kingdom consists of

seniors housing communities, medical office buildings, skilled

nursing facilities, hospitals and other properties. Through its

Lillibridge subsidiary, Ventas provides management, leasing,

marketing, facility development and advisory services to highly

rated hospitals and health systems throughout the United States.

More information about Ventas and Lillibridge can be found at

www.ventasreit.com and www.lillibridge.com.

Supplemental information regarding the Company can be found on

the Company’s website under the “Investor Relations” section or at

www.ventasreit.com/investor-relations/financial-information/supplemental-information.

A comprehensive listing of the Company’s properties is available at

www.ventasreit.com/our-portfolio/properties-by-location.

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

statements regarding the expected timing of the completion of the

proposed transaction with Ardent Health Services and the Spin-Off,

the benefits of the proposed transaction with Ardent Health

Services and the Spin-Off, including future financial and operating

results, statements regarding plans, objectives, and expectations

relating to the proposed transaction with Ardent Health Services

and the Spin-Off and other statements that are not historical

facts. In addition, all statements regarding the Company’s or its

tenants’, operators’, borrowers’ or managers’ expected future

financial condition, results of operations, cash flows, funds from

operations, dividends and dividend plans, financing opportunities

and plans, capital markets transactions, business strategy,

budgets, projected costs, operating metrics, capital expenditures,

competitive positions, acquisitions, investment opportunities,

dispositions, merger or acquisition integration, growth

opportunities, expected lease income, continued qualification as a

real estate investment trust (“REIT”), plans and objectives of

management for future operations and statements that include words

such as “anticipate,” “if,” “believe,” “plan,” “estimate,”

“expect,” “intend,” “may,” “could,” “should,” “will” and other

similar expressions are forward-looking statements. These

forward-looking statements are inherently uncertain, and actual

results may differ from the Company’s expectations. The Company

does not undertake a duty to update these forward-looking

statements, which speak only as of the date on which they are

made.

The Company’s actual future results and trends may differ

materially from expectations depending on a variety of factors

discussed in the Company’s filings with the Securities and Exchange

Commission. These factors include without limitation: (a) the

ability and willingness of the Company’s tenants, operators,

borrowers, managers and other third parties to satisfy their

obligations under their respective contractual arrangements with

the Company, including, in some cases, their obligations to

indemnify, defend and hold harmless the Company from and against

various claims, litigation and liabilities; (b) the ability of the

Company’s tenants, operators, borrowers and managers to maintain

the financial strength and liquidity necessary to satisfy their

respective obligations and liabilities to third parties, including

without limitation obligations under their existing credit

facilities and other indebtedness; (c) the Company’s success in

implementing its business strategy and the Company’s ability to

identify, underwrite, finance, consummate and integrate

diversifying acquisitions and investments, including investments in

different asset types and outside the United States; (d)

macroeconomic conditions such as a disruption of or lack of access

to the capital markets, changes in the debt rating on U.S.

government securities, default or delay in payment by the United

States of its obligations, and changes in the federal or state

budgets resulting in the reduction or nonpayment of Medicare or

Medicaid reimbursement rates; (e) the nature and extent of future

competition, including new construction in the markets in which the

Company’s seniors housing communities and medical office buildings

(“MOBs”) are located; (f) the extent of future or pending

healthcare reform and regulation, including cost containment

measures and changes in reimbursement policies, procedures and

rates; (g) increases in the Company’s borrowing costs as a result

of changes in interest rates and other factors; (h) the ability of

the Company’s operators and managers, as applicable, to comply with

laws, rules and regulations in the operation of the Company’s

properties, to deliver high-quality services, to attract and retain

qualified personnel and to attract residents and patients; (i)

changes in general economic conditions or economic conditions in

the markets in which the Company may, from time to time, compete,

and the effect of those changes on the Company’s revenues, earnings

and funding sources; (j) the Company’s ability to pay down,

refinance, restructure or extend its indebtedness as it becomes

due; (k) the Company’s ability and willingness to maintain its

qualification as a REIT in light of economic, market, legal, tax

and other considerations; (l) final determination of the Company’s

taxable net income for the year ended December 31, 2014 and for the

year ending December 31, 2015; (m) the ability and willingness of

the Company’s tenants to renew their leases with the Company upon

expiration of the leases, the Company’s ability to reposition its

properties on the same or better terms in the event of nonrenewal

or in the event the Company exercises its right to replace an

existing tenant or manager, and obligations, including

indemnification obligations, the Company may incur in connection

with the replacement of an existing tenant or manager; (n) risks

associated with the Company’s senior living operating portfolio,

such as factors that can cause volatility in the Company’s

operating income and earnings generated by those properties,

including without limitation national and regional economic

conditions, costs of food, materials, energy, labor and services,

employee benefit costs, insurance costs and professional and

general liability claims, and the timely delivery of accurate

property-level financial results for those properties; (o) changes

in exchange rates for any foreign currency in which the Company

may, from time to time, conduct business; (p) year-over-year

changes in the Consumer Price Index or the UK Retail Price Index

and the effect of those changes on the rent escalators contained in

the Company’s leases and the Company’s earnings; (q) the Company’s

ability and the ability of its tenants, operators, borrowers and

managers to obtain and maintain adequate property, liability and

other insurance from reputable, financially stable providers; (r)

the impact of increased operating costs and uninsured professional

liability claims on the Company’s liquidity, financial condition

and results of operations or that of the Company’s tenants,

operators, borrowers and managers, and the ability of the Company

and the Company’s tenants, operators, borrowers and managers to

accurately estimate the magnitude of those claims; (s) risks

associated with the Company’s MOB portfolio and operations,

including the Company’s ability to successfully design, develop and

manage MOBs, to accurately estimate its costs in fixed

fee-for-service projects and to retain key personnel; (t) the

ability of the hospitals on or near whose campuses the Company’s

MOBs are located and their affiliated health systems to remain

competitive and financially viable and to attract physicians and

physician groups; (u) the Company’s ability to build, maintain and

expand its relationships with existing and prospective hospital and

health system clients; (v) risks associated with the Company’s

investments in joint ventures and unconsolidated entities,

including its lack of sole decision-making authority and its

reliance on its joint venture partners’ financial condition; (w)

the impact of market or issuer events on the liquidity or value of

the Company’s investments in marketable securities; (x) merger and

acquisition activity in the seniors housing and healthcare

industries resulting in a change of control of, or a competitor’s

investment in, one or more of the Company’s tenants, operators,

borrowers or managers or significant changes in the senior

management of the Company’s tenants, operators, borrowers or

managers; (y) the impact of litigation or any financial,

accounting, legal or regulatory issues that may affect the Company

or its tenants, operators, borrowers or managers; (z) changes in

accounting principles, or their application or interpretation, and

the Company’s ability to make estimates and the assumptions

underlying the estimates, which could have an effect on the

Company’s earnings; (aa) the inability to complete the acquisition

of Ardent Health Services and the separation and sale of Ardent

Health Services’ hospital operations on terms acceptable to Ventas

or at all; (bb) the failure to satisfy any conditions to completion

of the Ardent Health Services transaction on terms acceptable to

Ventas or at all; (cc) the occurrence of any event, change or other

circumstances that could give rise to the termination of the Ardent

Health Services purchase agreement or any other agreement relating

to the transaction; (dd) the risk that the expected benefits of the

Ardent Health Services transaction, including financial results,

may not be fully realized or may take longer to realize than

expected; (ee) risks related to disruption of management’s

attention from ongoing business operations due to the proposed

Ardent Health Services transaction; (ff) the effect of the

announcement of the proposed Ardent Health Services transaction on

Ventas’s or Ardent Health Services’ relationships with their

respective customers, tenants, lenders, operating results and

businesses generally; (gg) uncertainties as to the completion and

timing of the Spin-Off; (hh) the failure to satisfy any conditions

to complete the Spin-Off, (ii) the expected tax treatment of the

Spin-Off, (jj) the inability to obtain certain third party consents

required to transfer certain properties in connection with the

Spin-Off; and (kk) the impact of the Spin-Off on the businesses of

Ventas and CCP. Many of these factors are beyond the control of the

Company and its management.

CONSOLIDATED BALANCE SHEETS As of March 31, 2015,

December 31, 2014, September 30, 2014, June 30, 2014 and March 31,

2014 (In thousands, except per share amounts)

March 31, December 31,

September 30, June 30, March 31, 2015

2014 2014 2014 2014

Assets Real estate investments: Land and improvements $

2,252,402 $ 1,956,128 $ 1,937,888 $ 1,848,922 $ 1,867,146 Buildings

and improvements 21,933,742 19,895,043 19,664,973 18,591,786

18,658,616 Construction in progress 134,195 120,123 116,975 93,629

71,862 Acquired lease intangibles 1,300,654 1,039,651

1,039,949 1,009,474 1,014,711 25,620,993

23,010,945 22,759,785 21,543,811 21,612,335 Accumulated

depreciation and amortization (4,202,334 ) (4,025,386 ) (3,833,974

) (3,657,541 ) (3,515,868 ) Net real estate property 21,418,659

18,985,559 18,925,811 17,886,270 18,096,467 Secured loans

receivable and investments, net 773,773 829,756 407,551 414,051

376,074 Investments in unconsolidated entities 95,147 91,872

88,175 89,423 90,929 Net real estate

investments 22,287,579 19,907,187 19,421,537 18,389,744 18,563,470

Cash and cash equivalents 120,225 55,348 64,595 86,635 59,791

Escrow deposits and restricted cash 223,772 71,771 78,746 75,514

76,110 Deferred financing costs, net 71,386 60,328 64,898 63,399

59,726 Other assets 1,736,909 1,131,537 1,021,389

1,175,494 943,671

Total assets $

24,439,871 $ 21,226,171 $ 20,651,165 $

19,790,786 $ 19,702,768

Liabilities and

equity Liabilities: Senior notes payable and other debt $

11,603,925 $ 10,888,092 $ 10,469,106 $ 9,602,439 $ 9,481,051

Accrued interest 77,359 62,097 69,112 56,722 61,083 Accounts

payable and other liabilities 1,016,592 1,005,232 965,240 975,282

938,098 Deferred income taxes 371,785 344,337 361,454

256,392 252,499 Total liabilities 13,069,661

12,299,758 11,864,912 10,890,835 10,732,731 Redeemable OP

unitholder and noncontrolling interests 257,246 172,016 163,080

169,292 160,115 Commitments and contingencies Equity:

Ventas stockholders' equity: Preferred stock, $1.00 par value;

10,000 shares authorized, unissued — — — — — Common stock, $0.25

par value; 330,913; 298,478; 294,359; 294,358; and 294,346 shares

issued at March 31, 2015, December 31, 2014, September 30, 2014,

June 30, 2014 and March 31, 2014, respectively 82,718 74,656 73,603

73,602 73,599 Capital in excess of par value 12,616,056 10,119,306

9,859,490 9,849,301 9,858,733 Accumulated other comprehensive

income 4,357 13,121 16,156 26,255 18,464 Retained earnings

(deficit) (1,660,856 ) (1,526,388 ) (1,398,378 ) (1,294,048 )

(1,218,967 ) Treasury stock, 32; 7; 32; 0; and 3 shares at March

31, 2015, December 31, 2014, September 30, 2014, June 30, 2014 and

March 31, 2014, respectively (2,385 ) (511 ) (2,075 ) — (162

) Total Ventas stockholders' equity 11,039,890 8,680,184 8,548,796

8,655,110 8,731,667 Noncontrolling interest 73,074 74,213

74,377 75,549 78,255 Total equity

11,112,964 8,754,397 8,623,173 8,730,659

8,809,922

Total liabilities and equity $

24,439,871 $ 21,226,171 $ 20,651,165 $

19,790,786 $ 19,702,768

CONSOLIDATED

STATEMENTS OF INCOME For the three months ended March 31,

2015 and 2014 (In thousands, except per share amounts)

For the Three Months Ended March 31,

2015 2014 Revenues: Rental income: Triple-net

leased $ 266,206 $ 237,846 Medical office buildings 136,990

115,223 403,196 353,069 Resident fees and services 446,914

371,061 Medical office building and other services revenue 10,543

6,300 Income from loans and investments 22,899 10,767 Interest and

other income 472 273 Total revenues 884,024 741,470

Expenses: Interest 106,590 87,841 Depreciation and

amortization 247,441 193,594 Property-level operating expenses:

Senior living 298,362 248,295 Medical office buildings 42,349

39,345 340,711 287,640 Medical office building

services costs 6,918 3,371 General, administrative and professional

fees 34,330 32,866 Loss (gain) on extinguishment of debt, net 21

(259 ) Merger-related expenses and deal costs 35,172 10,760 Other

5,296 5,229 Total expenses 776,479 621,042

Income before (loss) income from unconsolidated entities,

income taxes, discontinued operations, real estate dispositions and

noncontrolling interest 107,545 120,428 (Loss) income from

unconsolidated entities (251 ) 248 Income tax benefit (expense)

7,250 (3,433 ) Income from continuing operations 114,544

117,243 Discontinued operations (423 ) 3,031 Gain on real estate

dispositions 6,686 1,000 Net income 120,807 121,274

Net income attributable to noncontrolling interest 365 227

Net income attributable to common stockholders $ 120,442

$ 121,047

Earnings per common share: Basic:

Income from continuing operations attributable to common

stockholders, including real estate dispositions $ 0.37 $ 0.40

Discontinued operations (0.00 ) 0.01 Net income attributable

to common stockholders $ 0.37 $ 0.41 Diluted: Income

from continuing operations attributable to common stockholders,

including real estate dispositions $ 0.37 $ 0.40 Discontinued

operations (0.00 ) 0.01 Net income attributable to common

stockholders $ 0.37 $ 0.41

Weighted average

shares used in computing earnings per common share: Basic

325,454 293,875 Diluted 329,203 296,245 Dividends declared

per common share $ 0.79 $ 0.725

QUARTERLY CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share

amounts) 2015 First

2014 Quarters Quarter Fourth Third

Second First Revenues: Rental income:

Triple-net leased $ 266,206 $ 245,599 $ 244,206 $ 242,726 $ 237,846

Medical office buildings 136,990 116,907 116,598

114,890 115,223 403,196 362,506 360,804

357,616 353,069 Resident fees and services 446,914 411,170 396,247

374,473 371,061 Medical office building and other services revenue

10,543 11,124 7,573 4,367 6,300 Income from loans and investments

22,899 15,734 14,043 14,625 10,767 Interest and other income 472

3,453 368 173 273 Total revenues

884,024 803,987 779,035 751,254 741,470

Expenses:

Interest 106,590 99,031 98,469 91,501 87,841 Depreciation and

amortization 247,441 241,275 201,224 190,818 193,594 Property-level

operating expenses: Senior living 298,362 273,563 265,274 249,424

248,295 Medical office buildings 42,349 38,715 41,147

39,335 39,345 340,711 312,278 306,421 288,759

287,640 Medical office building services costs 6,918 7,527 4,568

1,626 3,371 General, administrative and professional fees 34,330

28,108 29,466 31,306 32,866 Loss (gain) on extinguishment of debt,

net 21 485 2,414 2,924 (259 ) Merger-related expenses and deal

costs 35,172 7,943 16,749 9,599 10,760 Other 5,296 13,604

15,229 4,863 5,229 Total expenses

776,479 710,251 674,540 621,396 621,042

Income before (loss) income from unconsolidated

entities, income taxes, discontinued operations, real estate

dispositions and noncontrolling interest 107,545 93,736 104,495

129,858 120,428 (Loss) income from unconsolidated entities (251 )

(688 ) (47 ) 348 248 Income tax benefit (expense) 7,250

13,552 1,887 (3,274 ) (3,433 ) Income from continuing

operations 114,544 106,600 106,335 126,932 117,243 Discontinued

operations (423 ) (411 ) (259 ) (255 ) 3,031 Gain on real estate

dispositions 6,686 1,456 3,625 11,889

1,000 Net income 120,807 107,645 109,701 138,566 121,274 Net

income attributable to noncontrolling interest 365 455

569 168 227 Net income attributable to

common stockholders $ 120,442 $ 107,190 $ 109,132

$ 138,398 $ 121,047

Earnings per

common share: Basic: Income from continuing operations

attributable to common stockholders, including real estate

dispositions $ 0.37 $ 0.36 $ 0.37 $ 0.47 $ 0.40 Discontinued

operations (0.00 ) (0.00 ) (0.00 ) (0.00 ) 0.01 Net income

attributable to common stockholders $ 0.37 $ 0.36 $

0.37 $ 0.47 $ 0.41 Diluted: Income from

continuing operations attributable to common stockholders,

including real estate dispositions $ 0.37 $ 0.36 $ 0.37 $ 0.47 $

0.40 Discontinued operations (0.00 ) (0.00 ) (0.00 ) (0.00 ) 0.01

Net income attributable to common stockholders $ 0.37

$ 0.36 $ 0.37 $ 0.47 $ 0.41

Weighted average shares used in computing earnings per common

share: Basic 325,454 294,810 294,030 293,988 293,875 Diluted

329,203 297,480 296,495 296,504 296,245

CONSOLIDATED

STATEMENTS OF CASH FLOWS For the three months ended March

31, 2015 and 2014 (In thousands) 2015

2014 Cash flows from operating activities: Net income

$ 120,807 $ 121,274 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

(including amounts in discontinued operations) 247,453 193,876

Amortization of deferred revenue and lease intangibles, net (6,603

) (5,383 ) Other non-cash amortization (519 ) (1,965 ) Stock-based

compensation 6,307 6,044 Straight-lining of rental income, net

(8,679 ) (7,914 ) Loss (gain) on extinguishment of debt, net 21

(259 ) Gain on real estate dispositions (including amounts in

discontinued operations) (6,686 ) (2,437 ) Income tax (benefit)

expense (7,850 ) 3,433 Loss (income) from unconsolidated entities

251 (248 ) Other 2,860 3,076 Changes in operating assets and

liabilities: Decrease in other assets 21,073 6,241 Increase in

accrued interest 15,792 6,753 Decrease in accounts payable and

other liabilities (40,058 ) (38,070 ) Net cash provided by

operating activities 344,169 284,421 Cash flows from investing

activities: Net investment in real estate property (1,072,539 )

(181,866 ) Investment in loans receivable and other (39,573 )

(1,192 ) Proceeds from real estate disposals 166,341 26,150

Proceeds from loans receivable 92,056 1,163 Purchase of marketable

securities — (25,000 ) Funds held in escrow for future development

expenditures 4,003 2,602 Development project expenditures (33,467 )

(23,948 ) Capital expenditures (21,171 ) (16,134 ) Other (4,180 )

(125 )

Net cash used in investing activities

(908,530 ) (218,350 ) Cash flows from financing activities: Net

change in borrowings under credit facility (452,897 ) 181,754

Proceeds from debt 1,092,833 — Repayment of debt (24,647 ) (67,773

) Purchase of noncontrolling interest (2,660 ) — Payment of

deferred financing costs (14,435 ) (167 ) Issuance of common stock,

net 285,327 — Cash distribution to common stockholders (254,910 )

(213,473 ) Cash distribution to redeemable OP unitholders (2,365 )

(1,402 ) Purchases of redeemable OP units (569 ) — Distributions to

noncontrolling interest (1,822 ) (2,237 ) Other 5,690 1,641

Net cash provided by (used in) financing

activities

629,545 (101,657 ) Net increase (decrease) in cash and cash

equivalents 65,184 (35,586 ) Effect of foreign currency translation

on cash and cash equivalents (307 ) 561 Cash and cash equivalents

at beginning of period 55,348 94,816 Cash and cash

equivalents at end of period $ 120,225 $ 59,791

Supplemental schedule of non-cash activities: Assets and

liabilities assumed from acquisitions: Real estate investments $

2,542,829 $ 2,952 Other assets acquired 16,711 — Debt assumed

177,857 — Other liabilities 45,736 2,952 Deferred income tax

liability 44,117 — Noncontrolling interests 87,245 — Equity issued

2,204,585 —

QUARTERLY CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands)

2015 First 2014 Quarters Quarter Fourth

Third Second First Cash flows from operating

activities: Net income $ 120,807 $ 107,645 $ 109,701 $ 138,566 $

121,274 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization (including

amounts in discontinued operations) 247,453 241,291 201,236 192,064

193,876 Amortization of deferred revenue and lease intangibles, net

(6,603 ) (4,096 ) (4,896 ) (4,496 ) (5,383 ) Other non-cash

amortization (519 ) 304 2,312 (963 ) (1,965 ) Stock-based

compensation 6,307 4,202 5,381 5,367 6,044 Straight-lining of

rental income, net (8,679 ) (9,043 ) (12,413 ) (9,317 ) (7,914 )

Loss (gain) on extinguishment of debt, net 21 485 2,414 2,924 (259

) Gain on real estate dispositions (including amounts in

discontinued operations) (6,686 ) (1,457 ) (3,584 ) (11,705 )

(2,437 ) Gain on real estate loan investments — (1,206 ) (249 ) — —

Income tax (benefit) expense (7,850 ) (13,851 ) (1,987 ) 2,974

3,433 Loss (income) from unconsolidated entities 251 688 47 (348 )

(248 ) Other 2,860 2,140 7,105 3,418 3,076 Changes in operating

assets and liabilities: Decrease (increase) in other assets 21,073

8,623 (14,514 ) 4,967 6,241 Increase (decrease) in accrued interest

15,792 (6,877 ) 12,461 (4,379 ) 6,753 (Decrease) increase in

accounts payable and other liabilities (40,058 ) 6,025

21,256 (7,791 ) (38,070 ) Net cash provided by operating

activities 344,169 334,873 324,270 311,281 284,421 Cash flows from

investing activities: Net investment in real estate property

(1,072,539 ) (284,250 ) (912,510 ) (89,660 ) (181,866 ) Investment

in loans receivable and other (39,573 ) (432,556 ) (21,948 )

(43,296 ) (1,192 ) Proceeds from real estate disposals 166,341

5,500 60,396 26,200 26,150 Proceeds from loans receivable 92,056

17,984 49,593 4,817 1,163 Purchase of marketable securities —

(50,000 ) — (21,689 ) (25,000 ) Proceeds from sale or maturity of

marketable securities — — 21,689 — — Funds held in escrow for

future development expenditures 4,003 1,988 — — 2,602 Development

project expenditures (33,467 ) (35,613 ) (26,952 ) (20,475 )

(23,948 ) Capital expenditures (21,171 ) (31,219 ) (20,709 )

(19,392 ) (16,134 ) Other (4,180 ) (5,177 ) (296 ) — (125 )

Net cash used in investing activities (908,530 ) (813,343 )

(850,737 ) (163,495 ) (218,350 ) Cash flows from financing

activities: Net change in borrowings under credit facility (452,897

) 693,887 46,267 (381,705 ) 181,754 Proceeds from debt 1,092,833 —

1,311,046 696,661 — Repayment of debt (24,647 ) (246,278 ) (632,391

) (204,953 ) (67,773 ) Purchase of noncontrolling interest (2,660 )

(5,527 ) — (3,588 ) — Payment of deferred financing costs (14,435 )

726 (8,100 ) (6,679 ) (167 ) Issuance of common stock, net 285,327

242,107 — — — Cash distribution to common stockholders (254,910 )

(235,200 ) (213,462 ) (213,479 ) (213,473 ) Cash distribution to

redeemable OP unitholders (2,365 ) (1,548 ) (1,452 ) (1,360 )

(1,402 ) Purchases of redeemable OP units (569 ) (503 ) — — —

Contributions from noncontrolling interest — 491 — — —

Distributions to noncontrolling interest (1,822 ) (2,799 ) (1,852 )

(2,671 ) (2,237 ) Other 5,690 25,153 23 (2,215

) 1,641 Net cash provided by (used in) financing activities

629,545 470,509 500,079 (119,989 ) (101,657 )

Net increase (decrease) in cash and cash equivalents 65,184 (7,961

) (26,388 ) 27,797 (35,586 ) Effect of foreign currency translation

on cash and cash equivalents (307 ) (1,286 ) 4,348 (953 ) 561 Cash

and cash equivalents at beginning of period 55,348 64,595

86,635 59,791 94,816 Cash and cash

equivalents at end of period $ 120,225 $ 55,348 $

64,595 $ 86,635 $ 59,791 Supplemental

schedule of non-cash activities: Assets and liabilities assumed

from acquisitions: Real estate investments $ 2,542,829 $ 16,746 $

299,713 $ 51,330 $ 2,952 Other assets acquired 16,711 11,597 2,049

1,634 — Debt assumed 177,857 12,926 177,035 51,115 — Other

liabilities 45,736 4,598 15,766 723 2,952 Deferred income tax

liability 44,117 641 108,961 1,126 — Noncontrolling interests

87,245 — — — — Equity issued 2,204,585 10,178 — — —

NON-GAAP

FINANCIAL MEASURES RECONCILIATION

Funds From Operations (FFO) and Funds

Available for Distribution (FAD)(1)

(Dollars in thousands, except per share amounts)

Tentative Estimates Preliminary and Midpoint

YOY Subject to Change YOY 2014

2015 Growth

FY2015 - Guidance

Growth Q1 Q2 Q3

Q4 FY Q1

'14-'15

Low High

'14-'15E

Net income attributable to common stockholders $ 121,047 $ 138,398

$ 109,132 $ 107,190 $ 475,767

$ 120,442 $

574,045

$

603,991

Net income attributable to common stockholders per share $ 0.41 $

0.47 $ 0.37 $ 0.36 $ 1.60

$ 0.37 $ 1.70

$ 1.79 Adjustments: Depreciation and

amortization on real estate assets 192,043 189,219 199,617 239,465

820,344

245,651 965,000 985,000 Depreciation

on real estate assets related to noncontrolling interest (2,644 )

(2,661 ) (2,503 ) (2,506 ) (10,314 )

(2,052 )

(8,000 ) (8,400 ) Depreciation on real

estate assets related to unconsolidated entities 1,494 1,495 1,471

1,332 5,792

1,462

5,600

6,000

Gain on real estate dispositions (1,000 ) (11,889 ) (3,625 ) (1,456

) (17,970 )

(6,686 ) (25,000 )

(35,000 ) Discontinued operations: (Gain) loss on

real estate dispositions (1,438 ) (45 ) 41 (52 ) (1,494 )

—

— — Depreciation and amortization on real estate

assets 281 1,247 12 15

1,555

12

12 12 Subtotal: FFO

add-backs 188,736 177,366 195,013 236,798 797,913

238,387

937,612

947,612

Subtotal: FFO add-backs per share $ 0.64 $

0.60 $ 0.66 $ 0.80 $ 2.69

$ 0.72

$ 2.77 $ 2.80

FFO $ 309,783 $ 315,764 $ 304,145 $ 343,988 $

1,273,680

$ 358,829 16%

$ 1,511,657

$ 1,551,603 20% FFO per share $ 1.05

$ 1.07 $ 1.03 $ 1.16

$ 4.29

$ 1.09

4%

$ 4.47 $ 4.59

6% Adjustments: Change in fair value of

financial instruments (68 ) 109 4,595 485 5,121

(46 )

500 (900 ) Non-cash income tax expense

(benefit) 3,433 2,974 (1,987 ) (13,851 ) (9,431 )

(7,850

) (25,000 ) (31,000 ) (Gain)

loss on extinguishment of debt, net (810 ) 2,924 2,414 485 5,013

21 1,000 2,000 Merger-related expenses, deal

costs and re-audit costs 10,761 9,602 23,401 10,625 54,389

36,002 88,500 81,500 Amortization of other

intangibles 256 255 255

480 1,246

591

2,150 2,650

Subtotal: normalized FFO add-backs 13,572 15,864 28,678 (1,776 )

56,338

28,718 67,150 54,250 Subtotal:

normalized FFO add-backs per share $ 0.05 $

0.05 $ 0.10 $ (0.01 ) $ 0.19

$ 0.09

$ 0.20 $ 0.16

Normalized FFO $ 323,355 $ 331,628 $ 332,823 $

342,212 $ 1,330,018

$ 387,547 20%

$

1,578,807 $ 1,605,853 20% Normalized FFO per

share $ 1.09 $ 1.12 $ 1.12

$ 1.15 $ 4.48

$

1.18 8%

$ 4.67

$ 4.75 5% Non-cash items

included in normalized FFO: Amortization of deferred revenue and

lease intangibles, net (5,383 ) (4,496 ) (4,896 ) (4,096 ) (18,871

)

(6,603 ) (26,400 ) (28,400

) Other non-cash amortization, including fair market value

of debt (1,965 ) (963 ) 2,312 304 (312 )

(519 )

3,400 5,400 Stock-based compensation 6,044 5,367

5,381 4,202 20,994

6,307 22,300 24,500

Straight-lining of rental income, net (7,914 ) (9,317 )

(12,413 ) (9,043 ) (38,687 )

(8,679 ) (32,300 )

(34,300 ) Subtotal: non-cash items included in

normalized FFO (9,218 ) (9,409 ) (9,616 ) (8,633 ) (36,876 )

(9,494 ) (33,000 ) (32,800

) Capital expenditures (17,134 ) (21,445 )

(21,822 ) (32,527 ) (92,928 )

(22,148 ) (110,000

) (120,000 )

Normalized

FAD $ 297,003 $ 300,774 $ 301,385 $ 301,052 $ 1,200,214

$ 355,905 20%

$ 1,435,807 $

1,453,053 20% Normalized FAD per share $ 1.00

$ 1.01 $ 1.02 $ 1.01

$ 4.05

$ 1.08 8%

$ 4.25 $ 4.30

6%

Merger-related expenses, deal costs and re-audit costs

(10,761 ) (9,602 ) (23,401 ) (10,625 )

(54,389 )

(36,002 )

(88,500 ) (81,500 )

FAD $ 286,242 $ 291,172 $ 277,984 $ 290,427 $ 1,145,825

$ 319,903 12%

$ 1,347,307 $

1,371,553 19% FAD per share $ 0.97 $

0.98 $ 0.94 $ 0.98 $ 3.86

$ 0.97 0%

$

3.99 $ 4.06

4%

Weighted average diluted shares 296,245 296,504 296,495 297,480

296,677

329,203 338,074

338,074 1 Totals and per share amounts may not

add due to rounding. Per share quarterly amounts may not add to

annual per share amounts due to material changes in the Company’s

weighted average diluted share count, if any.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. However, since real estate values have historically

risen or fallen with market conditions, many industry investors

deem presentations of operating results for real estate companies

that use historical cost accounting to be insufficient by

themselves. For that reason, the Company considers FFO, normalized

FFO and FAD to be appropriate measures of operating performance of

an equity REIT. In particular, the Company believes that normalized

FFO is useful because it allows investors, analysts and Company

management to compare the Company’s operating performance to the

operating performance of other real estate companies and between

periods on a consistent basis without having to account for

differences caused by unanticipated items and other events such as

transactions and litigation. In some cases, the Company provides

information about identified non-cash components of FFO and

normalized FFO because it allows investors, analysts and Company

management to assess the impact of those items on the Company’s

financial results.

The Company uses the NAREIT definition of FFO. NAREIT defines

FFO as net income (computed in accordance with GAAP) excluding

gains (or losses) from sales of real estate property, including

gain on re-measurement of equity method investments, and impairment

write-downs of depreciable real estate, plus real estate

depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. Adjustments for

unconsolidated partnerships and joint ventures will be calculated

to reflect FFO on the same basis. The Company defines normalized

FFO as FFO excluding the following income and expense items (which

may be recurring in nature): (a) merger-related costs and expenses,

including amortization of intangibles, transition and integration

expenses, and deal costs and expenses, including expenses and

recoveries relating to acquisition lawsuits; (b) the impact of any

expenses related to asset impairment and valuation allowances, the

write-off of unamortized deferred financing fees, or additional

costs, expenses, discounts, make-whole payments, penalties or

premiums incurred as a result of early retirement or payment of the

Company’s debt; (c) the non-cash effect of income tax benefits or

expenses and derivative transactions that have non-cash

mark-to-market impacts on the Company’s income statement; (d)

except as specifically stated in the case of guidance, the impact

of future acquisitions or divestitures (including pursuant to

tenant options to purchase) and capital transactions; (e) the

financial impact of contingent consideration, charitable donations

made to the Ventas Charitable Foundation, gains and losses for

non-operational foreign currency hedge agreements and changes in

the fair value of financial instruments; and (f) expenses related

to the re-audit and re-review in 2014 of the Company’s historical

financial statements and related matters. FAD represents normalized

FFO excluding non-cash components, straight-line rental adjustments

and capital expenditures, including tenant allowances and leasing

commissions.

FFO, normalized FFO and FAD presented herein may not be

comparable to similar measures presented by other real estate

companies due to the fact that not all real estate companies use

the same definitions. FFO, normalized FFO and FAD should not be

considered as alternatives to net income (determined in accordance

with GAAP) as indicators of the Company’s financial performance or

as alternatives to cash flow from operating activities (determined

in accordance with GAAP) as measures of the Company’s liquidity,

nor are they necessarily indicative of sufficient cash flow to fund

all of the Company’s needs. The Company believes that in order to

facilitate a clear understanding of the consolidated historical

operating results of the Company, FFO, normalized FFO and FAD

should be examined in conjunction with net income as presented

elsewhere herein.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Net Debt to Adjusted Pro Forma

EBITDA

The following information considers the

pro forma effect on net income, interest, depreciation and

amortization, and income tax benefit of the Company’s investments

and other capital transactions that were completed during the three

months ended March 31, 2015, as if the transactions had been

consummated as of the beginning of the period. The following table

illustrates net debt to pro forma earnings before interest, taxes,

depreciation and amortization (including non-cash stock-based

compensation expense), excluding gains or losses on extinguishment

of debt, income or loss from noncontrolling interest and

unconsolidated entities, merger-related expenses and deal costs,

expenses related to the re-audit and re-review in 2014 of the

Company's historical financial statements, net gains on real estate

activity and changes in the fair value of financial instruments

(including amounts in discontinued operations) (“Adjusted Pro Forma

EBITDA”) (dollars in thousands):

Net income attributable to common stockholders $ 120,442 Pro

forma adjustments for current period investments, capital

transactions and dispositions (10,289 ) Pro forma net income for

the three months ended March 31, 2015 110,153 Add back: Pro forma

interest 108,403 Pro forma depreciation and amortization 260,753

Stock-based compensation 6,307 Gain on real estate dispositions

(6,686 ) Loss on extinguishment of debt, net 21 Loss from

unconsolidated entities 251 Noncontrolling interest 365 Pro forma

income tax benefit (9,246 ) Change in fair value of financial

instruments (46 ) Other taxes (185 ) Merger-related expenses, deal

costs and re-audit costs 35,893 Adjusted Pro Forma EBITDA

505,983 Adjusted Pro Forma EBITDA annualized $ 2,023,932

As of March 31, 2015: Debt $ 11,603,925 Cash,

adjusted for cash escrows pertaining to debt and debt related to

assets held for sale (140,705 ) Net debt $ 11,463,220

Net debt to Adjusted Pro Forma EBITDA 5.7 x

NON-GAAP FINANCIAL MEASURES RECONCILIATION 1, 2

NOI by Segment (In thousands)

2015 First 2014 Quarters Quarter

Fourth Third Second First

Revenues Triple-Net Triple-Net Rental Income $

266,206 $ 245,599 $ 244,206 $ 242,726 $ 237,846 Medical

Office Buildings Medical Office - Stabilized 123,211 104,171

103,780 101,795 101,259 Medical Office - Lease up 8,429 6,675 6,767

6,839 7,324 Medical Office - Other 5,350 6,061 6,051

6,256 6,640 Total Medical Office Buildings - Rental

Income 136,990 116,907 116,598 114,890

115,223 Total Rental Income 403,196 362,506 360,804 357,616 353,069

Medical Office Building Services Revenue 8,858 9,218

5,937 2,722 4,652 Total Medical Office

Buildings - Revenue 145,848 126,125 122,535 117,612 119,875

Triple-Net Services Revenue 1,136 1,136 1,136 1,145 1,148

Non-Segment Services Revenue 549 770 500 500

500 Total Medical Office Building and Other Services Revenue

10,543 11,124 7,573 4,367 6,300 Seniors Housing Operating

Seniors Housing - Stabilized 431,890 398,855 385,511 363,618

361,404 Seniors Housing - Lease up 15,024 12,083 10,109 10,227

9,018 Seniors Housing - Other — 232 627 628

639 Total Resident Fees and Services 446,914 411,170 396,247

374,473 371,061 Non-Segment Income from Loans and

Investments 22,899 15,734 14,043 14,625

10,767 Total Revenues, excluding Interest and Other Income 883,552

800,534 778,667 751,081 741,197

Property-Level Operating

Expenses Medical Office Buildings Medical Office -

Stabilized 36,807 33,331 34,807 33,641 33,545 Medical Office -

Lease up 3,242 2,509 2,738 2,733 2,783 Medical Office - Other 2,300

2,875 3,602 2,961 3,017 Total Medical

Office Buildings 42,349 38,715 41,147 39,335 39,345 Seniors

Housing Operating Seniors Housing - Stabilized 286,277 262,915

256,702 241,380 241,298 Seniors Housing - Lease up 12,085 10,421

7,972 7,473 6,420 Seniors Housing - Other — 227 600

571 577 Total Seniors Housing 298,362 273,563

265,274 249,424 248,295 Total Property-Level

Operating Expenses 340,711 312,278 306,421 288,759 287,640

Medical Office Building Services Costs 6,918 7,527 4,568

1,626 3,371

Net Operating Income Triple-Net

Triple-Net Properties 266,206 245,599 244,206 242,726 237,846

Triple-Net Services Revenue 1,136 1,136 1,136

1,145 1,148 Total Triple-Net 267,342 246,735 245,342 243,871

238,994 Medical Office Buildings Medical Office - Stabilized

86,404 70,840 68,973 68,154 67,714 Medical Office - Lease up 5,187

4,166 4,029 4,106 4,541 Medical Office - Other 3,050 3,186 2,449

3,295 3,623

Medical Office Building Services

1,940 1,691 1,369 1,096 1,281 Total

Medical Office Buildings 96,581 79,883 76,820 76,651 77,159

Seniors Housing Operating Seniors Housing - Stabilized 145,613

135,940 128,809 122,238 120,106 Seniors Housing - Lease up 2,939

1,662 2,137 2,754 2,598 Seniors Housing - Other — 5

27 57 62 Total Seniors Housing 148,552 137,607

130,973 125,049 122,766 Non-Segment 23,448 16,504

14,543 15,125 11,267

Net Operating Income $

535,923 $ 480,729 $ 467,678 $ 460,696 $

450,186 1 Amounts above are adjusted to exclude discontinued

operations for all periods presented. 2 Amounts above are not

restated for changes between categories from quarter to quarter.

NON-GAAP FINANCIAL MEASURES RECONCILIATION

(Dollars in thousands) Total Portfolio Same-Store

Constant Currency Cash NOI For the Three Months

Ended March 31, 2015 2014

Net Operating Income $ 535,923 $

450,186 Adjustments: Lease Modification Fee 5,200

—

NOI Not Included in Same-Store

(79,650 ) (15,372 ) Straight-Lining of Rental Income (8,678 )

(7,898 ) Non-Cash Rental Income (5,809 ) (4,725 ) Non-Segment NOI

(23,448 ) (11,267 ) Constant Currency Adjustment — (585 )

(112,385 ) (39,847 ) Constant Currency NOI as Reported $

423,538 $ 410,339 Percentage Increase

3.2 % NON-GAAP FINANCIAL MEASURES

RECONCILIATION (Dollars in thousands) Senior

Housing Operating Portfolio Same-Store Constant Currency NOI

For the Three Months Ended March 31,

Percentage

2015 2014

Increase

Net Operating Income $

148,552

$

122,766

Less:

NOI Not Included in Same-Store

26,637

1,306

Constant Currency Adjustment

—

585

26,637

1,891

Constant Currency NOI as Reported $ 121,915 $ 120,875

0.9

%

Less Real Estate Tax Credits

—

2,138

Constant Currency NOI Excluding Real

Estate Tax Credits

$

121,915

$

118,737

2.7

%

Click here to subscribe to Mobile Alerts for Ventas, Inc.

Ventas, Inc.Lori B. Wittman(877) 4-VENTAS

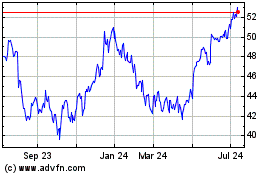

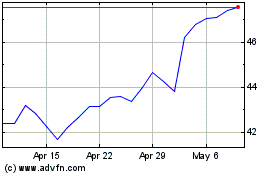

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024