UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 6, 2015

Ventas, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-10989 |

|

61-1055020 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

353 N. Clark Street, Suite 3300, Chicago, Illinois |

|

60654 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (877) 483-6827

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On April 6, 2015, in connection with the anticipated spin-off described more fully below, Ventas, Inc. (the “Company”) and SpinCo (as defined below) entered into a CEO Employment Agreement Term Sheet with the Company’s President, Raymond J. Lewis, who will become Chief Executive Officer of SpinCo upon consummation of the spin-off. The term sheet provides for a three-year term of employment commencing as of the spin-off, with an annual base salary of $750,000, a target annual bonus of 200% of base salary, and a target annual long-term incentive award grant date value of 200% of base salary. The term sheet also provides for an inaugural grant of SpinCo restricted stock with a grant date value of $2,500,000 that will vest in three equal annual installments, beginning on the first anniversary of the spin-off, generally subject to Mr. Lewis’s continued employment.

Upon a termination of Mr. Lewis’s employment by SpinCo without cause (as defined in the term sheet) or by Mr. Lewis for good reason (as defined in the term sheet) other than as a result of a notice of non-renewal of the term of employment by the Company, the term sheet generally provides for: (i) a lump sum cash severance payment equal to two times (or 2.5 times, if such termination occurs during the 12 months following a change in control) base salary plus target bonus; (ii) full vesting of the inaugural grant of SpinCo restricted stock; (iii) accelerated vesting of any service-based annual long-term incentive awards outstanding as of the date of termination that would have vested if Mr. Lewis had remained employed for an additional 12 months following the date of termination (or, if such termination occurs during the 12 months following a change in control, full vesting of all annual long-term incentive awards outstanding as of the date of termination, with performance-based awards to vest based on the greater of target or actual performance as of immediately prior to the date of termination, unless the level of performance was previously determined); (iv) a pro-rated annual bonus for the year of termination, determined based on actual performance (or, if such termination occurs during the 12 months following a change in control, target performance); and (v) health care welfare benefits reimbursement for 24 months. In the event that the circumstance giving rise to good reason is a notice of non-renewal of the term of employment by the Company, the term sheet provides for limited severance benefits, which generally consist of: (x) a lump sum cash severance payment equal to one times base salary plus target bonus, (y) accelerated vesting of any service-based annual long-term incentive awards outstanding as of the date of termination that would have vested if Mr. Lewis had remained employed for an additional 12 months following the date of termination, and (z) health care welfare benefits reimbursement for 12 months.

Pursuant to the term sheet, Mr. Lewis has agreed to noncompetition and nonsolicitation covenants for a period of two years (or one year, if the termination occurs as a result of a non-renewal of the term of employment by the Company) following termination of his employment for any reason.

The term sheet provides that the parties will endeavor prior to the spin-off to memorialize the terms of the term sheet in a formal employment agreement, but that the term sheet will be binding if no such agreement has been finalized. The term sheet, or any such employment agreement, will take effect only upon consummation of the spin-off. Upon the spin-off, Mr. Lewis’s existing employment agreement with the Company will cease to be of further effect.

2

Item 7.01. Regulation FD Disclosure.

On April 6, 2015, the Company issued press releases relating to the proposed transactions referenced in Item 8.01 below, copies of which are attached hereto as Exhibits 99.1 and 99.2 and incorporated into this Item 7.01 by reference. A copy of the Company’s investor presentation regarding the transactions referenced in Item 8.01 below is also attached hereto as Exhibit 99.3 and incorporated into this Item 7.01 by reference. The press releases and investor presentation are furnished under this Item 7.01 and shall not be deemed filed with the U.S. Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. The information contained in the press releases and investor presentation shall not be incorporated by reference into any filing of the Company regardless of general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 8.01. Other Events.

On April 6, 2015, the Company announced that its Board of Directors has unanimously approved a plan to spin off most of the Company’s post-acute/skilled nursing facility (“SNF”) portfolio into an independent, publicly traded real estate investment trust (“SpinCo”). Under the terms of the spin-off, shareholders of the Company are expected to receive one common share of SpinCo via a special distribution for every four shares of the Company they own. The spin-off is subject to certain conditions, including the effectiveness of SpinCo’s Form 10 registration statement, receipt of an opinion from tax counsel regarding the tax-free nature of the distribution, and final approval and declaration of the distribution by the Company’s Board of Directors. The spin-off is expected to be completed in the second half of 2015 and is intended to qualify as a tax-free distribution to the Company’s shareholders. However, there can be no assurance as to whether or when the spin-off will occur.

Also, on April 6, 2015, the Company announced that it has signed a definitive agreement to acquire Ardent Medical Services, Inc. (“Ardent Health Services”) for $1.75 billion in cash. Concurrent with the closing of the transaction, the Company will separate Ardent Health Services’ hospital operations from its owned real estate and sell the hospital operations to one or more newly formed entities (collectively, “Ardent”) owned by current management of Ardent Health Services, other equity sources and up to 9.9% owned by the Company. Upon closing, the Company will enter into long-term triple-net leases with Ardent to operate the acquired properties. The acquisition is subject to the satisfaction of customary closing conditions, including regulatory approvals, and is expected to be completed mid-year 2015. However, there can be no assurance as to whether, when or on what terms the acquisition or any sale of Ardent Health Services’ hospital operations will be completed.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

3

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release issued by the Company on April 6, 2015, relating to the Company’s planned spin-off. |

|

|

|

|

|

99.2 |

|

Press release issued by the Company on April 6, 2015, relating to the Ardent Health Services acquisition. |

|

|

|

|

|

99.3 |

|

Investor Presentation dated April 6, 2015. |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

VENTAS, INC. |

|

|

|

|

|

|

|

|

|

Date: April 6, 2015 |

|

By: |

/s/ Kristen M. Benson |

|

|

|

Name: |

Kristen M. Benson |

|

|

|

Title: |

Senior Vice President, Associate General Counsel and Corporate Secretary |

5

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release issued by the Company on April 6, 2015, relating to the Company’s planned spin-off. |

|

|

|

|

|

99.2 |

|

Press release issued by the Company on April 6, 2015, relating to the Ardent Health Services acquisition. |

|

|

|

|

|

99.3 |

|

Investor Presentation dated April 6, 2015. |

6

Exhibit 99.1

FOR IMMEDIATE RELEASE

VENTAS ANNOUNCES PLAN TO SPIN OFF

POST-ACUTE/SKILLED NURSING FACILITY PORTFOLIO

Creates an Independent, Publicly Traded Skilled Nursing REIT Positioned for Growth

CHICAGO — April 6, 2015 — Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) announced today that the Company’s Board of Directors has unanimously approved a plan to spin off most of its post-acute/skilled nursing facility (“SNF”) portfolio into an independent, publicly traded REIT (“SpinCo”). The transaction is expected to be completed in the second half of 2015 and is intended to qualify as a tax-free distribution to Ventas shareholders.

SpinCo will own 355 high-quality triple-net leased SNFs and other healthcare assets operated by 44 private regional and local care providers. SpinCo will have an independent, experienced management team and strategy focused on its “pure-play” post-acute/skilled nursing business. With a strong balance sheet, equity currency and independent access to capital markets, SpinCo will drive growth and create value through acquisitions and active asset management including redevelopment.

The spin-off transaction will enhance Ventas’s growth profile and increase the contribution of net operating income (“NOI”) from private pay assets and assets operated by leading operators and care providers globally. The Company will maintain its scale and diversification across a wide spectrum of high-quality seniors housing, medical office buildings and other select healthcare segments, as well as its strong balance sheet.

SpinCo’s portfolio will be diversified by geography, spanning 37 states, and by operator, with no single tenant expected to constitute more than 10 percent of SpinCo’s NOI (other than Senior Care Centers at 12 percent). SpinCo’s leases contain annual escalations and have a weighted average remaining term of approximately 10 years. In its first full year of operations, SpinCo is expected to generate estimated NOI of $315 million to $320 million and estimated funds from operations (“FFO”) of $240 million to $245 million. Upon completion of the spin-off, Raymond J. Lewis, currently President of Ventas, will serve as Chief Executive Officer and as a director of SpinCo, and Douglas Crocker II, currently Ventas’s Presiding Director, will serve as SpinCo’s independent Non-Executive Chairman of the Board.

“Over the past 15 years, Ventas has delivered 29 percent compound annual return to shareholders. This transaction demonstrates our continued commitment to enhancing shareholder value by creating two focused companies with distinct strategies,” said Ventas Chairman and Chief Executive Officer Debra A. Cafaro. “SpinCo will thrive as an independent, pure-play SNF REIT with a seasoned management team and a strong Ventas heritage. For Ventas, the spin-off enhances our growth profile, increases our NOI contribution from top-tier operators, and improves our industry-leading private pay NOI composition. As one of the top REITs globally, Ventas will maintain our diversification, scale, strong balance sheet, and superior dividend and cash flow growth.”

Mr. Lewis commented, “With a focus on the highly fragmented post-acute/SNF market, SpinCo will have the necessary size, balance sheet strength and access to capital to pursue significant consolidation opportunities. I am excited to join my colleagues to launch a new company poised for success, delivering strong cash flows and growth to drive value for shareholders.”

Transaction Benefits

· Creates a Competitive Pure-Play Post-Acute/SNF REIT, Poised for Growth. The SNF industry benefits from attractive dynamics, including a growing 85 and over population and significant growth in SNF expenditures. As one of only two pure-play publicly-traded SNF REITs with a large and diverse triple-net leased portfolio, SpinCo will be positioned for success. SpinCo will have the necessary relationships, expertise, size and balance sheet strength to pursue growth and consolidation opportunities within a large, fragmented industry.

· Enhances Ventas’s Growth Profile and Further Aligns Portfolio with Core Strategy. Ventas believes that its same-store NOI growth rate will increase as a result of the spin-off. On a pro forma basis, Ventas’s same-store NOI growth rate for the full year 2014 would have been approximately 10 percent higher than reported. Following completion of the spin-off, approximately 83 percent of Ventas’s NOI will come from top 20 operators in seniors housing, post-acute facilities and hospitals; approximately 83 percent of NOI will be derived from private pay assets; more than 50 percent of NOI will come from medical office buildings and seniors housing operating assets that have greater upside to a growing economy; and, NOI from SNFs will be approximately five percent.

· Ventas and SpinCo Will Maintain Strong Financial Positions. Each company will have a strong balance sheet that will provide the financial flexibility necessary to pursue future growth opportunities. It is anticipated that Ventas will use proceeds from the new debt raised by SpinCo to pay down Ventas debt. There is no change expected to Ventas’s credit ratings or related outlook.

· Combined Dividend Expected to Increase by at Least 10 Percent. Following completion of the spin-off, Ventas and SpinCo expect to have a combined annualized dividend that represents an increase of at least 10 percent on an aggregate basis. On a standalone basis, Ventas expects to maintain its best-in-class dividend payout ratio.

Leadership

SpinCo will be led by an experienced, independent management team and Board of Directors:

· Raymond J. Lewis, currently President of Ventas, will serve as Chief Executive Officer and a director of SpinCo;

· Douglas Crocker II, Presiding Director of Ventas’s Board, will serve as Non-Executive Chairman of the Board of SpinCo;

· Lori B. Wittman, currently Senior Vice President, Capital Markets and Investor Relations of Ventas, will serve as Executive Vice President and Chief Financial Officer of SpinCo;

· Kristen M. Benson, currently Senior Vice President, Associate General Counsel and Corporate Secretary of Ventas, will serve as Executive Vice President and General Counsel of SpinCo; and

· Timothy A. Doman, currently Senior Vice President and Chief Portfolio Officer of Ventas, will serve as Executive Vice President and Chief Operating Officer of SpinCo.

Additional members of the SpinCo Board will be announced as Ventas works towards completion of the transaction.

Ventas will continue to be headed by Debra A. Cafaro, its current Chairman and Chief Executive Officer. Upon completion of the transaction, Ventas does not intend to replace the position of President, and the remainder of Ventas’s executive team will remain intact.

Transaction Details

Under the terms of the spin-off, Ventas shareholders are expected to receive one common share of SpinCo via a special distribution for every four shares of Ventas they own. Following the distribution, Ventas’s shareholders will own shares in both Ventas and SpinCo. Importantly, the number of Ventas shares owned by each shareholder will not change as a result of the distribution.

SpinCo expects to file its initial Form 10 registration statement relating to the spin-off with the Securities and Exchange Commission (“SEC”) in April 2015, and the spin-off is expected to be completed in the second half of 2015.

The transaction is subject to certain conditions, including the effectiveness of SpinCo’s Form 10 registration statement, receipt of an opinion from tax counsel regarding the tax-free nature of the distribution, and final approval and declaration of the distribution by Ventas’s Board of Directors. There can be no assurance regarding the ultimate timing of the spin-off or that it will be completed. SpinCo intends to apply to have its common stock authorized for listing on the New York Stock Exchange.

Advisors

Centerview Partners and Bank of America Merrill Lynch are serving as financial advisors to Ventas, and Wachtell, Lipton, Rosen & Katz is serving as legal advisor in connection with the spin-off.

Conference Call Details

Ventas will hold a conference call to discuss the transaction today at 8:30 a.m. Eastern Time. The dial-in number for the conference call is (866) 953-6858 (or (617) 399-3482 for international callers). The participant passcode is “Ventas.” The call will also be webcast live and can be accessed at the Company’s website at www.ventasreit.com. A replay of the call will be available at the Company’s website, or by calling (888) 286-8010 (or (617) 801-6888 for international callers), passcode 65539086, beginning at approximately 12:30 p.m. Eastern Time and will remain for 29 days.

Additional information regarding the spin-off can be found on the Company’s website under the “Investor Relations” section.

Bios

Raymond J. Lewis, who will serve as Chief Executive Officer of SpinCo, has been President of Ventas since 2010. He previously served as Ventas’s Executive Vice President and Chief Investment Officer from 2006 to 2010 and as Senior Vice President and Chief Investment Officer from 2002 to 2006. Prior to joining Ventas in 2002, he was managing director of business development for GE Capital Healthcare Financial Services, a division of General Electric Capital Corporation (“GECC”), which is a subsidiary of General Electric Corporation, where he led a team focused on mergers and portfolio acquisitions of healthcare assets. Before that, Mr. Lewis was Executive Vice President of Healthcare Finance for Heller Financial, Inc. (which was acquired by GECC in 2001), where he had primary responsibility for healthcare lending. He is Chairman Emeritus of the National Investment Center for the Seniors Housing & Care Industry (NIC). Mr. Lewis is also a member of the Executive Board of the American Seniors

Housing Association where he serves as Vice Chair on the Executive Committee. He is a graduate of the University of Wisconsin.

Douglas Crocker II, who will serve as Non-Executive Chairman of the Board of SpinCo, has more than 40 years of real estate experience and has been a director of Ventas since 1998. He is currently Managing Partner of DC Partners LLC, a firm that invests in and develops apartment properties, where he previously served as principal from 2003 to 2006. From 2006 to 2014, Mr. Crocker was the Chairman and Chief Investment Officer of Pearlmark Multifamily Partners, L.L.C., a commercial real estate firm. From 1993 to 2003, he was the President, Chief Executive Officer and a trustee of Equity Residential, a prominent multifamily REIT, most recently serving as Vice Chairman of the Board. Mr. Crocker is currently a trustee of Acadia Realty Trust, a shopping center REIT, and a director of Associated Estates Realty Corporation, an apartment REIT, and CYS Investments, Inc., a specialty finance company that primarily invests in agency residential mortgage-backed securities. He serves on the Advisory Board of the DePaul University Real Estate School and is a member of the Board of Trustees of Milton Academy and the National Multi Housing Counsel. He is also a former member of the Board of Governors of the National Association of Real Estate Investment Trusts (NAREIT).

Lori B. Wittman, who will serve as Executive Vice President and Chief Financial Officer of SpinCo, currently serves as Ventas’s Senior Vice President, Capital Markets and Investor Relations, and has been with Ventas since 2011. Prior to that, she was the Chief Financial Officer and Managing Principal of Big Rock Partners, a real estate private equity firm with over $500 million of assets under management at its peak. She previously served as Senior Vice President and Treasurer for General Growth Properties, Inc. and held various capital markets and finance positions with Heitman, Homart Development Company, Citibank and Mellon Bank. Ms. Wittman received a B.A. in Geography and Sociology from Clark University, a Masters in City Planning from the University of Pennsylvania and an M.B.A. from the University of Chicago. She serves on the Board of Directors of IMH Financial Inc. and is a member of the audit committee and chairs the compensation committee.

Kristen M. Benson, who will serve as Executive Vice President and General Counsel of SpinCo, currently serves as Ventas’s Senior Vice President, Associate General Counsel and Corporate Secretary. She has been with Ventas since 2004, previously serving as Vice President, Associate General Counsel and Corporate Secretary from 2012 to 2014, as Vice President and Senior Securities Counsel from 2007 to 2012 and as Senior Securities Counsel from 2004 to 2007. From 1997 to 2004, Ms. Benson was an associate at the law firm of Sidley Austin LLP in Chicago, Illinois, where her principal practice areas were securities, mergers and acquisitions, and corporate finance. She received her J.D. from the University of Virginia School of Law and her B.B.A. summa cum laude in Finance and Computer Applications from the University of Notre Dame. Ms. Benson is admitted to the Bar in Illinois and currently serves on the Legal Advisory Board of World Business Chicago and as a member of the Association of Corporate Counsel, the Society of Corporate Secretaries and Governance Professionals and NAREIT.

Timothy A. Doman, who will serve as Executive Vice President and Chief Operating Officer of SpinCo, currently serves as Ventas’s Senior Vice President and Chief Portfolio Officer. Mr. Doman has been with Ventas since 2002, previously serving as Senior Vice President, Asset Management from 2007 to 2012 and as Vice President, Asset Management from 2002 to 2007. Before joining Ventas, Mr. Doman was a senior asset manager for GE Capital Real Estate, where he managed a commercial real estate equity and loan portfolio. Before that, he was Vice President of Asset Management at Kemper Corporation and a senior appraiser for Arthur Andersen & Co. Mr. Doman received his B.B.A. in Real Estate and Finance from the University of Wisconsin and an M.B.A. in Finance from Indiana University.

About Ventas, Inc.

Ventas, Inc., an S&P 500 company, is a leading real estate investment trust. Its diverse portfolio of more than 1,600 assets in the United States, Canada and the United Kingdom consists of seniors housing communities, medical office buildings, skilled nursing facilities, hospitals and other properties. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States. More information about Ventas and Lillibridge can be found at www.ventasreit.com and www.lillibridge.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although Ventas believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such factors include, but are not limited to: uncertainties as to the completion and timing of the spin-off, the failure to satisfy any conditions to complete the spin-off, the expected tax treatment of the spin-off, the inability to obtain certain third party consents required to transfer certain properties, and the impact of the spin-off on the businesses of Ventas and SpinCo. Other important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements made in this press release are described in Ventas’s most recent Annual Report on Form 10-K filed with the SEC. Ventas assumes no obligation to update these statements except as is required by law.

Non-GAAP Financial Measures

This press release includes forward-looking statements regarding estimated non-GAAP financial measures of initial year NOI and FFO for SpinCo, and certain NOI metrics for Ventas following the anticipated spin-off, based upon the assets currently expected to be included in SpinCo.

NOI is a supplemental non-GAAP financial measure that aids in the assessment of unlevered property-level operating results. The most directly comparable GAAP measure is net income. NOI is defined as total revenues, less interest and other income, and, with respect to Ventas, property-level operating expenses and medical office building services costs (in each case including amounts in discontinued operations). Cash receipts may differ due to straight line recognition of certain rental income and the application of other GAAP policies.

Ventas uses the National Association of Real Estate Investment Trusts (“NAREIT”) definition of FFO. The most directly comparable GAAP measure is net income. NAREIT defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of real estate property, including gain on re-measurement of equity method investments, and impairment write-downs of depreciable real estate, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis.

Ventas believes that NOI and FFO are helpful to investors, analysts and management because they are widely recognized measures of the performance of equity REITs and provide a relevant basis for comparison of Ventas’s operating results with the operating results of other real estate companies and between periods on a consistent basis.

The non-GAAP financial measures we present in this press release may not be comparable to those reported by other real estate companies due to the fact that all real estate companies do not use the same definitions. These non-GAAP financial measures should not be considered as alternatives to net income as indicators of operating performance or as alternatives to cash flows from operating activities as indicators of liquidity, nor are they necessarily indicative of sufficient cash flow to fund capital needs. Because certain terms of the spin-off have not yet been determined, including as to the balance sheet of SpinCo, it is not reasonably possible at this time to provide a comparable forward-looking estimation of initial year net income for SpinCo or a reconciliation to the estimated NOI and FFO figures included in this press release. Historical GAAP financial information for Ventas is included in its most recent Annual Report on Form 10-K filed with SEC, and historical GAAP financial information for SpinCo will be included in the Form 10 registration statement relating to the spin-off.

Contact

Ventas, Inc.

Lori B. Wittman

(877) 4-VENTAS

Exhibit 99.2

FOR IMMEDIATE RELEASE

VENTAS TO ACQUIRE ARDENT HEALTH SERVICES FOR $1.75 BILLION

Creates Growth Platform in Attractive U.S. Hospital Real Estate Market

Ventas to Retain Owned Real Estate and Separate Operations into Company Led by

Ardent Management Team

CHICAGO — April 6, 2015 — Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) announced today that it has signed a definitive agreement to acquire privately-owned Ardent Medical Services, Inc. (with its affiliates “Ardent Health Services”), a premier provider of health care services and one of the ten largest for-profit hospital companies in the U.S., for $1.75 billion in cash. Ardent Health Services will be entitled to distribute up to $75 million in excess cash to its existing shareholders. The transaction is expected to be immediately accretive to Ventas’s normalized funds from operations (“FFO”) per share by $0.08 to $0.10 in the first full year after close.

Ardent Health Services is owned by private equity funds managed by Welsh, Carson, Anderson & Stowe. Based in Nashville, Tennessee, Ardent Health Services and its subsidiaries own and operate leading health systems in major markets in the U.S. Ardent Health Services currently generates approximately $2 billion in annual revenues with over 50 percent of its revenue derived from commercial (private) payors.

Concurrent with the closing of the transaction, Ventas intends to separate Ardent Health Services’ hospital operations from its owned real estate and sell the hospital operations to one or more newly formed entities (collectively, “Ardent”) owned by current management of Ardent Health Services, other equity sources, and up to 9.9 percent owned by Ventas. Ventas and Ardent will enter into pre-agreed long-term triple-net leases with an expected going in cash yield exceeding 7 percent and annual escalators estimated at 2.5 percent. The EBITDARM to rent coverage ratio for the purchased facilities is expected to be approximately 2.9x in year one.

Ventas will own ten high-quality hospitals (and related real estate) operated by Ardent under the names BSA Health System in Amarillo, Texas, Hillcrest HealthCare System in Tulsa, Oklahoma and Lovelace Health System in Albuquerque, New Mexico. These assets include acute care, heart, rehab and women’s health hospitals, comprising approximately 3.2 million square feet and 2,045 beds.

“This transaction builds upon our excellent track record of executing innovative and value-creating opportunities, and solidifies our leadership position in healthcare real estate,” said Ventas Chairman and Chief Executive Officer Debra A. Cafaro. “The addition of Ardent’s platform, which includes high-quality assets with significant market share in three key markets, and a highly-regarded hospital management team, creates a strong avenue for growth in the attractive hospital real estate market. The transaction also increases our diversification by property type and operator. We look forward to partnering with Ardent’s seasoned management team as a best-in-class operator to grow its business.”

David T. Vandewater, President and Chief Executive Officer of Ardent, said, “We have built a leading U.S. hospital franchise, currently focused on three key markets with incredible growth potential. The current management team and Ardent employees are excited about this agreement with Ventas and we look forward to expanding Ardent and capitalizing on the significant growth opportunities we see in the immense, highly fragmented U.S. hospital market. With this strong capital and operating partnership, we can expand while continuing to serve patients and our communities.”

Transaction Benefits

· Accretive Transaction/Leverage Neutral. This transaction is expected to be immediately accretive to Ventas’s normalized FFO per share by $0.08 to $0.10 (cash) in the first full year after close on a leverage neutral basis. Ventas’s going in cash unlevered yield on the Company’s aggregate net investment is expected to exceed 7 percent. Ventas will maintain its strong credit profile and balance sheet, and there is no expected change to the Company’s credit rating or outlook.

· Increases Ventas’s Presence in Attractive Industry. The $1 trillion U.S. hospital market (by revenues) is benefiting from attractive dynamics, including an increase in U.S. hospital expenditures, increasing emergency room visits and admissions, a growing 65 and over population, and more than 10 million newly insured individuals. With Ventas’s support, Ardent will be well positioned to drive future consolidation opportunities in a highly fragmented market. The Medicare Payment Advisory Commission (MedPAC) has recommended a 3.25 percent increase in Medicare rates for acute-care services for fiscal year 2016.

· Provides Follow On Investment Opportunities. Ventas expects to participate in Ardent’s future hospital acquisitions. Ardent has a robust pipeline of attractive revenue-enhancing investment opportunities in its portfolio, in addition to a visible external growth pipeline.

· Adds High-Quality Hospital Portfolio with >50 Percent Commercial (Private) Payor Mix and Substantial Market Share. Ardent is a top ten for-profit hospital operator in the U.S. with high-quality hospital systems with strong payor and provider relationships and substantial market share in three key markets. Over 50 percent of Ardent’s revenue base is derived from private pay commercial payors.

· Ardent Will Continue to be Run by an Exceptional, Tenured Management Team. Ardent’s best-in-class management team will continue to lead the company, and its strong employee base will remain in place. Ardent will remain headquartered in Nashville with no expected changes to its current operations.

· Enhances Diversification. The transaction enhances Ventas’s rental revenue diversification by property type and operator. U.S. acute care hospitals will represent approximately 6 percent of Ventas’s pro forma net operating income (“NOI”).

· Extends Proven Track Record of Fueling Operator Growth. Ventas has a successful track record of identifying and growing scalable operating platforms as evidenced by the dramatic growth of Lillibridge Healthcare Services and Atria Senior Living since investment by Ventas. The Ardent acquisition adds a best-in-class operator and will expand Ventas’s industry leadership across healthcare segments.

Approvals, Timing and Funding

The transaction is subject to the satisfaction of certain specified closing conditions, including receipt of regulatory approvals, and is expected to close mid-year 2015.

Ventas expects to fund the transaction on a leverage neutral basis with proceeds from previously announced dispositions and loan repayments, bank debt and long-term debt and equity capital sources.

Advisors

UBS Investment Bank is serving as exclusive financial advisor to Ventas, and Kirkland & Ellis LLP and Waller Lansden Dortch & Davis, LLP are serving as legal advisors in connection with the transaction. Barclays is serving as exclusive financial advisor to Welsh, Carson, Anderson & Stowe and Ropes & Gray LLP is serving as legal advisor. Katten Muchin Rosenman LLP is serving as legal advisor to Ardent Health Services.

Conference Call Details

Separately today, Ventas announced that the Company’s Board of Directors unanimously approved a plan to spin off most of its post-acute/skilled nursing facility portfolio into an independent, publicly traded REIT.

Ventas will hold a conference call to discuss both transactions today at 8:30 a.m. Eastern Time. The dial-in number for the conference call is (866) 953-6858 (or (617) 399-3482 for international callers). The participant passcode is “Ventas.” The call will also be webcast live and can be accessed at the Company’s website at www.ventasreit.com. A replay of the call will be available at the Company’s website, or by calling (888) 286-8010 (or (617) 801-6888 for international callers), passcode 65539086, beginning at approximately 12:30 p.m. Eastern Time and will remain for 29 days.

Additional information regarding the Ardent Health Services acquisition can be found on the Company’s website under the “Investor Relations” section.

About Ventas

Ventas, Inc., an S&P 500 company, is a leading real estate investment trust. Its diverse portfolio of more than 1,600 assets in the United States, Canada and the United Kingdom consists of seniors housing communities, medical office buildings, skilled nursing facilities, hospitals and other properties. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States. More information about Ventas and Lillibridge can be found at www.ventasreit.com and www.lillibridge.com.

About Ardent Health Services

Ardent Health Services invests in quality health care. In people, technology, facilities and communities, Ardent makes considerable investments, producing high quality care and extraordinary results. Based in Nashville, Tenn., Ardent’s subsidiaries own and operate acute care health systems in three markets — Amarillo, Texas; Tulsa, Okla. and Albuquerque, N.M. — that include 14 hospitals and three multi-specialty physician groups. For more information, go to www.ardenthealth.com.

About Welsh, Carson, Anderson & Stowe

Welsh, Carson, Anderson & Stowe focuses its investment activity in two target industries, information/business services and healthcare. Since its founding in 1979, the Firm has organized 16 limited partnerships with total capital of over $21 billion. The Firm is currently investing an equity fund, Welsh, Carson, Anderson & Stowe XII, L.P., and has a current portfolio of approximately 25 companies. WCAS’s strategy is to partner with outstanding management teams and build value for the Firm’s investors through a combination of operational improvements, internal growth initiatives and strategic acquisitions. See www.welshcarson.com to learn more.

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding the expected timing of the completion of the proposed transaction, the benefits of the proposed transaction, including future financial and operating results, statements regarding plans, objectives, expectations relating to the proposed transaction and other statements that are not historical facts. All statements regarding the Company’s or its tenants’, operators’, borrowers’ or managers’ expected future financial condition, results of operations, cash flows, funds from operations, dividends and dividend plans, financing opportunities and plans, capital markets transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, acquisition integration, growth opportunities, expected lease income, continued qualification as a real estate investment trust (“REIT”), plans and objectives of management for future operations and statements that include words such as “anticipate,” “if,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “will” and other similar expressions are forward-looking statements. These forward-looking statements are inherently uncertain, and actual results may differ from the Company’s expectations. The Company does not undertake a duty to update these forward-looking statements, which speak only as of the date on which they are made.

The Company’s actual future results and trends may differ materially from expectations depending on a variety of factors discussed in the Company’s filings with the Commission. These factors include without limitation: (a) the inability to complete the acquisition of Ardent Health Services and the separation and sale of Ardent Health Services’ hospital operations on terms acceptable to Ventas or at all; (b) the failure to satisfy any conditions to completion of the transaction on terms acceptable to Ventas or at all; (c) the occurrence of any event, change or other circumstances that could give rise to the termination of the purchase agreement or any other agreement relating to the transaction; (d) the risk that the expected benefits of the transaction, including financial results, may not be fully realized or may take longer to realize than expected; (e) risks related to disruption of management’s attention from ongoing business operations due to the proposed transaction; (f) the effect of the announcement of the proposed transaction on Ventas’s or Ardent Health Services’ relationships with their respective customers, tenants, lenders, operating results and businesses generally;(g) the ability and willingness of the Company’s tenants, operators, borrowers, managers and other third parties to satisfy their obligations under their respective contractual arrangements with the Company, including, in some cases, their obligations to indemnify, defend and hold harmless the Company from and against various claims, litigation and liabilities; (h) the ability of the Company’s tenants, operators, borrowers and managers to maintain the financial strength and liquidity necessary to satisfy their respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness; (i) the Company’s success in implementing its business strategy and the Company’s ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions and investments, including investments in different asset types and outside the United States; (j) macroeconomic conditions such as a disruption of or lack of access to the capital markets, changes in the debt rating on U.S. government securities, default or delay in payment by the United States of its obligations, and changes in the federal or state budgets resulting in the reduction or nonpayment of Medicare or Medicaid reimbursement rates; (k) the nature and extent of future competition, including new construction in the markets in which the Company’s seniors housing communities and medical office buildings (“MOBs”) are located; (l) the extent of future or pending healthcare reform and regulation, including cost containment measures and changes in reimbursement policies, procedures and rates; (m) increases in the Company’s borrowing costs as a result of changes in interest rates and other factors; (n) the ability of the Company’s operators and managers, as applicable, to comply with laws, rules and regulations in the operation of the Company’s properties, to deliver high-quality services, to attract and retain qualified personnel and to attract residents and patients; (o) changes in general economic conditions or economic conditions in the markets in which the Company may, from time to time, compete, and the effect of those changes on the Company’s revenues, earnings and capital sources; (p) the Company’s ability to pay down, refinance, restructure or extend its indebtedness as it becomes due; (q) the Company’s ability and willingness to maintain its qualification as a REIT in light of economic, market, legal, tax and other considerations; (r) final determination of the Company’s taxable net income for the year ended December 31, 2014 and for the year ending December 31, 2015; (s) the ability and willingness of the Company’s tenants to renew their leases with the Company upon expiration of the leases, the Company’s ability to reposition its properties on the same or better terms in the event of nonrenewal or in the event the Company exercises its right to replace an existing tenant, and obligations, including indemnification obligations, the Company may incur in connection with the replacement of an existing tenant; (t) risks associated with the Company’s senior living operating portfolio, such as factors that can cause volatility in the Company’s operating income and earnings generated by those properties, including without limitation national and regional economic conditions, costs of food, materials, energy, labor and services, employee benefit costs, insurance costs and professional and general liability claims, and the timely delivery of accurate property-level financial results for those properties; (u) changes in exchange rates for any foreign currency in which the Company may, from time to time, conduct business; (v) year-over-year changes in the Consumer Price Index or the UK Retail Price Index and the effect of those changes on the rent escalators contained in the Company’s leases and the Company’s earnings; (w) the Company’s ability and the ability of its tenants, operators, borrowers and managers to obtain and maintain adequate property, liability and other insurance from reputable, financially stable providers; (x) the impact of increased operating costs and uninsured professional liability claims on the Company’s liquidity, financial condition and results of operations or that of the Company’s tenants, operators, borrowers and managers, and the ability of the Company and the Company’s tenants, operators, borrowers and managers to accurately estimate the magnitude of those claims; (y) risks associated with the Company’s MOB portfolio and operations, including the Company’s ability to successfully design, develop and manage MOBs, to accurately estimate its costs in fixed fee-for-service projects and to retain key

personnel; (z) the ability of the hospitals on or near whose campuses the Company’s MOBs are located and their affiliated health systems to remain competitive and financially viable and to attract physicians and physician groups; (aa) the Company’s ability to build, maintain and expand its relationships with existing and prospective hospital and health system clients; (ab) risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision-making authority and its reliance on its joint venture partners’ financial condition; (ac) the impact of market or issuer events on the liquidity or value of the Company’s investments in marketable securities; (ad) merger and acquisition activity in the seniors housing and healthcare industries resulting in a change of control of, or a competitor’s investment in, one or more of the Company’s tenants, operators, borrowers or managers or significant changes in the senior management of the Company’s tenants, operators, borrowers or managers; (ae) the impact of litigation or any financial, accounting, legal or regulatory issues that may affect the Company or its tenants, operators, borrowers or managers; and (af) changes in accounting principles, or their application or interpretation, and the Company’s ability to make estimates and the assumptions underlying the estimates, which could have an effect on the Company’s earnings. Many of these factors are beyond the control of the Company and its management.

Contact

Ventas, Inc.

Lori B. Wittman

(877) 4-VENTAS

Exhibit 99.3

|

|

Investor Presentation– Spin-off of Post-Acute / SNF Portfolio and Planned Acquisition of Ardent |

|

|

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although Ventas believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such factors include, but are not limited to: uncertainties as to the completion and timing of the spin-off, the failure to satisfy any conditions to complete the spin-off, the expected tax treatment of the spin-off, the inability to obtain certain third party consents required to transfer certain properties, the impact of the spin-off on the businesses of Ventas and SpinCo, uncertainties as to the completion and timing of the acquisition of Ardent Medical Services, Inc. (“Ardent Health Services”), the inability to separate and sell the hospital operations of Ardent Health Services on terms acceptable to Ventas or at all; the failure to satisfy any conditions to completion of the Ardent Health Services acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement for Ardent Health Services or any other agreement relating to the transactions; the risk that the expected benefits of the transactions, including financial results, may not be fully realized or may take longer to realize than expected; risks related to disruption of management’s attention from ongoing business operations due to the proposed transactions; the effect of the announcement of the proposed transactions on Ventas’s or Ardent Health Services’ relationships with their respective customers, tenants and lenders, on their operating results and on their businesses generally. Other important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements made in this presentation are described in Ventas’s most recent Annual Report on Form 10-K filed with the SEC. Ventas assumes no obligation to update these statements except as is required by law. |

|

|

Ventas—Significant Strategic Transactions Spin-Off of Post Acute / SNF Portfolio Acquisition of Ardent Spin-off most of its post-acute and SNF portfolio Creates two focused companies with distinct strategies Two companies with strong growth Two experienced management teams ~$1.4 billion investment (net) in U.S. Acute Care Hospital Real Estate $0.08 - $0.10 per share (cash) per annum accretive investment in high-quality assets Scalable platform to grow in $1 trillion revenue Hospitals segment Long-term triple-net leases with initial cash yield >7% (expected) Top 10 for-profit hospital operator Tangible Examples of Ventas Capital Allocation Excellence |

|

|

Compelling Ventas Investment Thesis Ventas Positioned to Deliver Outstanding Financial and Operating Results Highest % Private Pay: 83% Dividend Increase — >10% Projected at Spin Best Dividend Payout Ratio Among Big 3 — Provides Significant Room for Growth Highly Experienced Management Team Strong Relationships with Top Operators >83% of Senior Housing, Hospital and Post-Acute Portfolio NOI from Top 20 Industry Operators Affiliated properties defined as on-campus or off-campus assets with significant hospital sponsorship. Financial Strength, Advantaged Capital Structure Best MOB Platform/Franchise >90% On-Campus or Affiliated(1) >87% NOI from Investment Grade Systems and HCA Top Quality SHOP Portfolio Excellent Markets with Strong Growth Potential Diverse Business Model with Scale Including New Strategic Segments — Acute Care Hospitals Leading Post-Acute Q-Mix of >78% Increased NOI and FFO per share expected growth rates |

|

|

Transactions Enhance Ventas Growth Rate and Segment Diversification Ventas (Pre-Ardent & Spin-Off) PF Ventas (Post-Ardent & Spin-Off) International International Loan & Other Loan & Other Specialty Hospitals Seniors Housing NNN Seniors Housing NNN Specialty Hospitals Hospital Asset Mix(1) NOI % NOI % MOBs MOBs Seniors Housing Operating Seniors Housing Operating SNFs SNFs 2015 NOI(2) $2.1bn $1.9bn 2015 FFO(3) $1.6bn $1.3bn (7) 9.0% FFO Growth(4) 8.2% Comparable NOI Growth(4) 4.3% 3.9% Net Debt / EBITDA (5) 5.9x 5.9x (6) (7) TTM NNN Occupancy 82.7% 85.1% (1) (2) (3) Excludes Canadian SHOP assets from SHOP (included in international). Q4 annualized NOI pro forma for January acquisitions. 2015 pre-Ardent and separation per Ventas guidance issued February 13, 2015. Based on Same Store Cash NOI and FFO growth from 2013 – 2014. (5) Pre-separation: Based on year-end 2014 balance sheet and Q4 annualized pro forma EBITDA. Post-separation: Estimated 2015 year-end annualized data. Based on Q3 2014 occupancy as reported in the Q4 2014 quarter earnings release, pro forma for year-to-date acquisitions. Excludes Ardent. (6) 5 (4) (7) |

|

|

Ventas Growing with Leading Tenants and Operators % Total VTR NOI (2) Top 20 Operating Partners in the Industry Post-Acute Care Seniors Housing 11% 58% % Segment NOI From Top 20 Ranked Operators >95% ~80% Medical Office 20% ~70%(1) Hospitals 7% 100% Includes only Lillibridge and Pacific Medical Buildings. Segments shown exclude Other and Loan Income. |

|

|

Spin-Off Transaction Overview and Introduction to SpinCo |

|

|

Spin-Off Transaction Overview Mission: To own stable, quality NNN post-acute/SNF and other healthcare assets primarily operated by diversified mix of regional and local care providers that effectively serve their markets and grow through acquisitions and redevelopment Will consist of 355 properties and will be one of only two pure-play, publicly traded SNF REITs Expected beginning annualized run-rate NOI of $315 - $320mm SpinCo PF Ventas PF Ventas will focus on its strategy of investing in high-quality private pay and select healthcare assets, primarily operated by leading providers in the U.S. and abroad PF Ventas will use cash from the new debt raised by SpinCo for debt paydown No change expected to PF Ventas’s credit rating or related outlook Continuity of PF Ventas CEO and management Transaction Description Ventas has announced its plan to spin-off most of its post-acute / SNF portfolio to a new REIT Spin-off distribution intended to qualify as tax-free for U.S. federal income tax purposes Spin-off expected to be completed in second half of 2015 Pro forma annualized dividend of the combined entities expected to increase at least 10% |

|

|

SpinCo Positioned for Success SpinCo has Strong Growth Profile While Benefiting from Strategic Advantages Delivering Strong Cash Flows and Growth to Drive Shareholder Value Dedicated and experienced management team to implement and execute growth strategy SpinCo will have all the tools to pursue external growth and redevelopment Provides investors with a pure-play opportunity in post-acute / SNF assets Large, diversified NNN portfolio 44 diverse customers SpinCo positioned as a separate company to focus and grow its business Creates a company with a strong balance sheet, equity currency and independent access to capital Highly fragmented market in which SpinCo can capitalize and consolidate Benign reimbursement environment with favorable demographics SpinCo will be well-positioned to compete with targeted capital allocation strategy |

|

|

SpinCo’s Competitive Strengths Experienced in sector, REITs One of two pure-play REITs in the space Strong Ventas heritage Diversified portfolio Rent escalators provide internal growth Reimbursement environment is benign Quality care providers who efficiently serve their markets Large and fragmented market and demographics provide ample growth opportunity Low leverage balance sheet Strong equity currency for compensation and acquisitions Well-Positioned for External Growth Dedicated Management Team Growing Cash Flow SpinCo |

|

|

11 (1) (2) (3) (4) Triple-Net Lease Structure with a Diversified Operator Mix and Growing Rent Based on NOI. Excludes future acquisitions; pro forma for 2015 year-to-date acquisitions Per existing share. Coverage based on projected EBITDARM divided by expected run-rate rent. $0.53 - $0.55 Dividend (3) > No Tenant >10% NOI, except SCC at 12% > Q-mix: 51% 4.5x Net Debt / EBITDA > Weighted average remaining lease term of 10 years $240 - $245mm (2) 2015 FFO > Escalators: 2.3% $315 - $320mm > EBITDARM Coverage: >1.8x(4) (2) 2015 NOI Operating Overview Key Financial Metrics SNFs 2019 2018 2017 2016 2015 0.2% 0.7% 0.9% 1.8% 2.7% Specialty Hospitals Loans / Other Seniors Housing NNN Limited lease expirations through 2019 Lease Expiration Schedule (% of NOI) Asset Mix (1) Financial Highlights SpinCo |

|

|

SpinCo Portfolio Highlights SpinCo is One of Two Large Public SNF-Focused REITs Large National Footprint Well-Advantaged to Capitalize on Favorable Industry Dynamics Nursing Home Hospital Senior Housing Operates in 37 States 355 Properties 44 Operators p:presentation centermapsventasus maplocations |

|

|

SpinCo Management, Board and Timeline Board of Directors Douglas Crocker II will serve as non-executive Chairman (sole overlap with PF Ventas) Committed to best practices in corporate governance; building on Ventas legacy Independent executive management team dedicated to SpinCo SpinCo will have ~20 corporate employees Executive management will consist of current Ventas executives with experience and knowledge of the industry, assets and customers: CEO: Raymond J. Lewis EVP, CFO: Lori B. Wittman EVP, General Counsel: Kristen M. Benson EVP, COO: Timothy A. Doman PF Ventas to provide certain support functions on a transitional basis for up to 2 years Management Transaction Timing SpinCo intends to file initial Form 10 information statement with SEC in April 2015 Target completion in second half of 2015 |

|

|

SpinCo Investment Highlights Per existing share. Diversified Portfolio by Operator, Geography Enhancing Shareholder Value with Transparency and Strong, Growth-Focused Management Team Strong Balance Sheet, Access to Capital Markets 4.5x Net Debt to EBITDA Well-Positioned to Capitalize on External Growth Opportunities Portfolio Primed for Internal Growth Rents at Market with Escalators Built-in Industry Dynamics Provide Strong Tailwind Reimbursement Stable, Large Fragmented Market Ripe for Consolidation / External Growth Opportunities Dividend of $0.53 - $0.55 Attractive Dividend Yield Experienced, Focused Management Team Strong Ventas Heritage Pure-Play in Post-Acute / SNF Assets Only Two Pure-Play SNF REITs (1) |

|

|

Ardent Acquisition Overview |

|

|

Ardent Transaction Overview Financial Overview Transaction Description Ventas to acquire Ardent Health Services (“AHS”) for $1.75 billion Concurrently, (a) Ventas would separate hospital operations (Ardent) from the real estate; (b) Ardent and Ventas will enter into long-term triple-net leases; and (c) Ventas will acquire a minority partner’s stake in one of the health systems for additional consideration Expected ~$1.4 billion net Ventas real estate investment Up to 9.9% Ventas investment in Ardent, with management and other equity sources constituting the balance Target closing date mid-year 2015 AHS's highly regarded management team will continue to manage Ardent and have significant ownership to align interests Ardent scalable for future growth with the ability to drive operational and structural enhancements in a highly fragmented sector with Ventas acting as a stable capital partner Ardent Management Structure & Alignment >7% initial expected cash yield $0.08 - $0.10 per share (cash) expected full year accretion 2.5% annual escalators 2.9x rent coverage Investing in leading top-ten hospital system with best-in-class management team and future growth opportunities in $1 trillion revenue hospital system Opportunity to invest in future acquisitions and expansions |

|

|

Based on post-closing year 1 EBITDARM and expected rent. Acquisition of Ardent Real Estate Assets Fee simple ownership (no purchase options) Long-term master leases >7% initial expected lease yield 2.9x initial cash coverage 2.5% annual rent escalators Long-Term Stable Cash Flows with Excellent Coverage and Embedded Growth 4 hospital facilities with 994 total beds 29% Market Share Low unemployment of 3.5% High commercial payor mix Significant growth in elderly population Hillcrest HealthCare System Tulsa, OK 1 hospital facilities with 445 total beds 52% Market Share Market leader in nearly all service lines State budget surplus Relationships with 1,000+ providers BSA Health System Amarillo, TX 5 hospital facilities with 606 total beds 25% Market Share Medicaid expansion State budget surplus Increasing commercial payor mix Lovelace Health System Albuquerque, NM (1) |

|

|

Ardent Overview Top performing health systems in three key markets Top 10 For-Profit U.S. Hospital Operator with over 10,000 employees Highly experienced and well-regarded management team with proven track record $2 billion revenues Over 50% private pay revenue (commercial payors) High-quality hospitals Increasing volumes Decreasing bad debt Ability to leverage operating platform to continue to drive down expenses Positioned to continue to gain market share Strong relationships with payors and providers Business Highlights |

|

|

Represents publicly reported year-over-year data for HCA, Tenet Health, Community Health Systems, LifePoint Hospitals, and Universal Health Services (where available). (1) 19 Source: CMS, American Hospital Association Annual Survey data and U.S. Census Bureau. 318 BPS Growing Population 65 and Over Q4 2014 Bad Debt Expense Improving +3.25% Increasing ER Visits MedPac Recommended Rate Increase for FY 2016 +5.1% Q4 2014 Same Store Adjusted Admissions Growth Increasing U.S. Hospital Expenditures Strong Performance in the Hospital Sector(1) Continued Growth in U.S. Hospital Expenditures Coupled with Increasing Emergency Room Visits Opportunity Hospital Sector |

|

|

Ardent Investment Highlights Strategic Acquisition in New Segment in Platform Built for Future Growth Significant Future Growth Opportunity in $1 Trillion Revenue U.S. Hospital Market with Minimal REIT Ownership Unique Consolidation Opportunity with Top-Ten For-Profit Hospital Operator Ventas Opportunity to Invest in Future Growth Immediately Accretive Transaction Initial Annual Accretion of $0.08 - $0.10 per share (cash) on a Leverage Neutral Basis Strong Alignment with Highly Experienced Management Team Successful Track Record of Identifying and Integrating Hospital Acquisitions Excellent Macro Trends in the Hospital Sector Including Affordable Care Act and 25 million Expected Additional Insured Lives, Demographics and Strengthening Economy Continued Diversification of Ventas NOI Providing Growth in Cash Flow and Dividend with Strong Balance Sheet and Low Payout Ratio Long-Term Consistent Growing Cash Flow with Strong Coverage and Sector Fundamentals |

|

|

Summary |

|

|

Taking Ventas to the Next Level of Excellence PF Ventas Positioned to Deliver Outstanding Financial and Operating Results Spin-Off of Post-Acute / SNF Portfolio Enhanced strategic focus at PF Ventas Improved FFO and NOI growth rate Increased NOI contribution from private pay assets and leading operators Maintain scale, diversification and strong balance sheet Superior dividend growth >10% Acquisition of Ardent Strategic acquisition in attractive and large U.S. Hospitals segment Aligned platform built for future growth Accretive High-quality assets and top-ten operator Both Strategic Transactions Will Serve to Solidify PF Ventas’s Leading Position |

|

|

Appendix |

|

|

SpinCo Process Overview Distribution Process Distribution of SpinCo common shares via a special distribution to Ventas shareholders in an expected 1:4 ratio Following the distribution, Ventas shareholders will own shares in both PF Ventas and SpinCo The number of PF Ventas shares owned by each shareholder will not change as a result of this distribution Conditions Precedent Declaration by SEC that SpinCo’s registration statement is effective Filing and approval of SpinCo listing application by NYSE Final approval and declaration of the distribution by Ventas’s Board of Directors Other customary conditions Transaction Timing SpinCo intends to file initial Form 10 information statement with SEC in April 2015 Target completion in second half of 2015 SpinCo REIT Status / Tax Considerations Intended to qualify as tax-free to Ventas shareholders for U.S. federal income tax purposes SpinCo intends to elect to be treated as a REIT for U.S. federal income tax purposes |

|

|

1.5%2.0%2.2%2.6%673.9%105.0%$505 $469 $478$336 $349 $363 $385$164 $172 $174 $176 $179Source: AHCA, U.S. Census Bureau, Eljay LLC and CMS data.25Average SNF Medicaid Rate Per DayAverage SNF Medicare Rate Per Day2013E2011E200720092005200320011999$0$150$300$276 $287 $312 $325 $301$108 $109 $118 $124 $129 $142 $145 $150 $156$450$408 $432 $454$600Skilled Nursing Homes~4% Medicare / Medicaid CAGR vs. 2.5% InflationAverage Rate Per DaySNF Reimbursement GrowingDecreasing SNF Supply in aLarge and Growing Market% of Total Population2050E2040E2030E2020E85+ Population2010E2000A0.0%02.0%54Public REITOwned,$19, 16%4.0%PublicOperatorOwned, $2,2%10Private, forProfitOwned,$69, 56%6.0%15158.0%Not forProfitOwned,$32, 26%2010.0%21MMsPopulation Age 85+$ in billionsGrowing Population Driving Need for SNF ServicesSNF Represents ~$120 billion Marketwith ~15% Public OwnershipSupporting SpinCoAttractive Industry Fundamentals |

|

|

Strong Hospital Sector Performance (1) +105.6% +173.6% +47.5% Hospital Stocks Have Outperformed the S&P as a Result of Increase in Insured Lives (ACA), Improved U.S. Employment Data and Demographic Trends 3-Year Indexed Stock Price Performance Equity Analyst Perspectives Acute Care Reimbursement FY 2015 market basket increase of 2.9% MedPac recommended increase of 3.25% for FY 2016 “4Q was characterized by ACA-driven payor mix improvements & strong SS volumes, leading to 8% SS revenue growth – the best result in a decade. Margins continue to improve, increasing 230bps y/y” “Hospital survey suggests that Feb inpatient admits were up 1.3% on a calendar adjusted basis (vs up 0.9% in Jan) The Feb results represent the strongest inpatient admit report since July 2011” (1) Public hospital index includes CYH, HCA, LPNT, THC and UHS. 3/26/2012 12/24/2012 9/24/2013 6/25/2014 3/26/2015 50 100 150 200 250 300 Public Hospital Index S&P 500 S&P North American Health Care Sector |

|

|

Non-GAAP Financial Measures This presentation includes forward-looking statements regarding estimated non-GAAP financial measures of initial year NOI and FFO for SpinCo, and certain NOI and FFO metrics for Ventas following the anticipated spin-off, based upon the assets currently expected to be owned by Ventas and SpinCo following the spin-off and the Ardent Health Services acquisition. NOI is a supplemental non-GAAP financial measure that aids in the assessment of unlevered property-level operating results. The most directly comparable GAAP measure is net income. NOI is defined as total revenues, less interest and other income, and, with respect to Ventas, property-level operating expenses and medical office building services costs (in each case including amounts in discontinued operations). Cash receipts may differ due to straight line recognition of certain rental income and the application of other GAAP policies. Ventas uses the National Association of Real Estate Investment Trusts (“NAREIT”) definition of FFO. The most directly comparable GAAP measure is net income. NAREIT defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of real estate property, including gain on re-measurement of equity method investments, and impairment write-downs of depreciable real estate, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. Ventas believes that NOI and FFO are helpful to investors, analysts and management because they are widely recognized measures of the performance of equity REITs and provide a relevant basis for comparison of Ventas’s operating results with the operating results of other real estate companies and between periods on a consistent basis. The non-GAAP financial measures in this presentation may not be comparable to those reported by other real estate companies due to the fact that all real estate companies do not use the same definitions. These non-GAAP financial measures should not be considered as alternatives to net income as indicators of operating performance or as alternatives to cash flows from operating activities as indicators of liquidity, nor are they necessarily indicative of sufficient cash flow to fund capital needs. Because certain terms of the spin-off have not yet been determined, including as to the balance sheet of SpinCo, it is not reasonably possible at this time to provide a comparable forward-looking estimation of initial year net income for SpinCo or a reconciliation to the estimated NOI and FFO figures included in this presentation. Historical GAAP financial information for Ventas is included in its most recent Annual Report on Form 10-K filed with SEC, and historical GAAP financial information for SpinCo will be included in the Form 10 registration statement relating to the spin-off. |

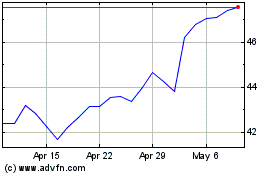

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

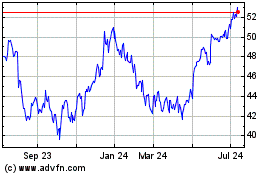

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024