New York, United States Ontario, Canada Franklin Lakes, United States Hamilton, Bermuda Miami, United States Santiago, Chile London, England Dubai, United Arab Emirates Republic of Singapore Dublin, Ireland Boston, United States Sydney, Australia Scottsdale, United States Labuan, Malaysia Zurich, Switzerland INVESTOR PRESENTATION – FOURTH QUARTER 2015 Validus Holdings, Ltd.

2 This presentation may include forward-looking statements, both with respect to us and our industry, that reflect our current views with respect to future events and financial performance. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” “may” and similar statements of a future or forward-looking nature identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. We believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) rating agency actions; 3) adequacy of Validus Holdings, Ltd.’s (“Validus” or the “Company”) risk management and loss limitation methods; 4) cyclicality of demand and pricing in the insurance and reinsurance markets; 5) statutory or regulatory developments including tax policy, reinsurance and other regulatory matters; 6) Validus’ ability to implement its business strategy during “soft” as well as “hard” markets; 7) adequacy of Validus’ loss reserves; 8) continued availability of capital and financing; 9) retention of key personnel; 10) competition; 11) potential loss of business from one or more major insurance or reinsurance brokers; 12) Validus’ ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 13) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 14) the integration of businesses Validus may acquire or new business ventures Validus may start; 15) the effect on Validus’ investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 16) acts of terrorism or outbreak of war; and 17) availability of reinsurance and retrocessional coverage, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in our most recent reports on Form 10-K and Form 10-Q and other documents on file with the Securities and Exchange Commission. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. We undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Cautionary Note Regarding Forward-looking Statements

3 • Since commencing operations in late 2005, Validus has developed a global re/insurance platform consisting of U.S. specialty insurance, Lloyd’s of London, third party reinsurance asset management and Bermuda reinsurance • The diversified portfolio as measured by gross premium written is comprised of 46% insurance and 54% reinsurance for the year ended December 31, 2015 • Business plan since formation has been to focus on short-tail lines with strategic diversification into select longer-tail classes • Maintained a focus on underwriting profits in conjunction with a strong balance sheet • Profitable in all ten years of operation, 2006 through 2015 • Delivered outstanding financial results since 2007 IPO as measured by growth in book value per diluted common share plus accumulated dividends • Active capital management, returning $3.59 billion to investors through repurchases and dividends from Validus’ 2007 IPO through February 18, 2016 Validus – Key Accomplishments

4 Validus – Four Diversified Yet Complementary Businesses • U.S. based specialty property and casualty underwriter • Focused on U.S. Excess and Surplus Lines • Pioneer in the binding authority business • 11% of 2015 GPW • Bermuda based investment adviser • Focused on managing capital for third parties and Validus in ILS and other property catastrophe reinsurance investments • AUM of $2.4 billion as of January 1, 2016 • 7% of 2015 GPW • The 11th largest Syndicate at Lloyd’s of London • Focused on short tail specialty lines in the Lloyd’s of London market • Market leader in War and Terror and Energy and Marine Classes • 40% of 2015 GPW • Bermuda based reinsurer • Focused on short tail lines of reinsurance, including property cat • Specializing in Property CAT XOL, Marine, and Agriculture • 42% of 2015 GPW Validus Research – Provides Analytical Support Across All Platforms 1) Lloyd’s Syndicate size is measured by gross premium written (“GPW”), as taken from Lloyd’s 2014 Reports and Accounts. 2) Assets under management (AUM) of $2.4 billion includes $2.1 billion of third party investment and $0.3 billion of related party investment.

5 Validus Timeline – Celebrating Our 10th Anniversary as a Company 2005 2006 2007 2008 2009 2012 2013 2014 2015 2005 Founding of Validus October 19, 2005 2007 Acquisition of Talbot July 2, 2007 2008 Founding of AlphaCat July 29, 2008 2012 Launch of PaCRe April 2, 2012 2013 Acquisition of Longhorn Re April 25, 2013 2015 Validus 10th Year Anniversary October 19, 2015 2006 Launch of Petrel Re I Sidecar June 30, 2006 2007 Validus IPO July 30, 2007 2009 Acquisition of IPC September 4, 2009 2012 Acquisition of Flagstone November 30, 2012 2014 Acquisition of Western World October 2, 2014

6 12.0% Compound Annual Growth in Diluted BVPS Plus Accumulated Dividends from Company Formation Through December 31, 2015 Growth in Book Value Per Diluted Share Plus Accumulated Dividends 16.93 19.73 24.00 23.78 29.68 32.98 32.28 35.22 36.23 39.65 42.33 0.80 1.60 2.48 3.48 4.48 7.68 8.88 10.16 16.93 19.73 24.00 24.58 31.28 35.46 35.76 39.70 43.91 48.53 52.49 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 $55.00 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Diluted BVPS Cumulative Dividends Diluted BVPS plus Accumulated Dividends

7 1) Source: SNL Financial. 2) VR starting point is Pro Forma diluted BVPS at September 30, 2007 of $20.89 as disclosed in the VR IPO Prospectus. 3) Book value per diluted share calculation includes impact of quarterly and special dividends. From VR IPO Through December 31, 2015 Compound Growth in Book Value per Diluted Share Versus Peers 15.3% 13.9% 12.8% 11.4% 11.2% 10.9% 10.9% 10.6% 9.2% 6.0% 0.0% 5.0% 10.0% 15.0% 20.0% AWH ACGL RNR VR ENH PRE AXS RE AHL AGII

8 Validus Common Shareholders’ Equity vs. Selected Peers 1) Source: SNL Financial. Peer Comparison – Q4 2015 Common Shareholders’ Equity in $US Billions 7.6 6.0 5.9 5.2 4.4 4.3 3.6 3.5 2.9 1.7 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 RE PRE ACGL AXS ENH RNR VR AWH AHL AGII

9 1) Source: SNL Financial. 2) Peer group includes; AWH, ACGL, AGII, AHL, AXS, ENH, PRE, RE and RNR. 3) Starting point of chart is January 1, 2007. From VR IPO Through December 31, 2015 Validus Stock Total Return Versus Peers and S&P 500 -50.0% -25.0% 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% 175.0% 200.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Validus Peers S&P 500

10 Validus Mix of Business 2015 Gross Premium Written of $2.6 Billion 1) $2.6 billion consolidated gross premiums written net of $42.7 million of intersegment eliminations. By Operating SegmentBy Class of Business Validus Re 42% Talbot 40% Western World 11% AlphaCat 7% Specialty 31% Property Cat XOL 23% Marine 18% Other Property 19% Liability 9%

11 Insurance Underwriting Income – Validus vs. Bermuda Peers 1) Source: SEC filings and other public disclosures. 2) Underwriting income above assumes that all Lloyd’s underwriting income is insurance. 3) AGII is excluded as they do not disclose underwriting income as insurance / reinsurance. Insurance Underwriting Income in $US Millions: 2012 - 2015 437.4 270.3 221.6 182.3 66.7 (34.7) (54.4) (343.9) -$400.0 -$300.0 -$200.0 -$100.0 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 VR AXS AWH ACGL AHL RNR ENH RE

12 Validus – Growth and Diversification Net Premiums Written in $US Millions – 2006 to 2015 477.1 633.3 624.8 672.6 1,038.1 963.8 987.4 1,016.3 954.9 977.7 285.2 613.5 715.7 723.0 795.9 850.0 865.8 909.6 819.9 75.7 140.1 130.6 122.4 171.6 58.8 259.6 $- $500.0 $1,000.0 $1,500.0 $2,000.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Validus Re Talbot AlphaCat Western World 1) 2014 Net Premiums Written for Western World cover the time period from the acquisition by Validus on October 2, 2014 through December 31, 2014.

13 Validus - Adapting to Market Demand 1) 2006 was the first full year of operations for Validus. 2) GPW for 2006 and 2015 is for the full year. Growth and Diversification in VR’s Business Since Inception Reinsurance 100% Validus 2006 GPW $540.8 million Validus 2015 GPW $2,557.5 million • Significant growth in GPW through acquisitions of: – 2007 – Talbot – 2009 – 2012: IPCRe, Flagstone, Longhorn Re – 2014 – Western World • Improved portfolio balance in insurance through Talbot and Western World acquisitions • AlphaCat established in 2008 to capitalize on the insurance linked securities market • Access to multiple sources of capital to respond to business opportunities as presented Reinsurance 54% Insurance 46%

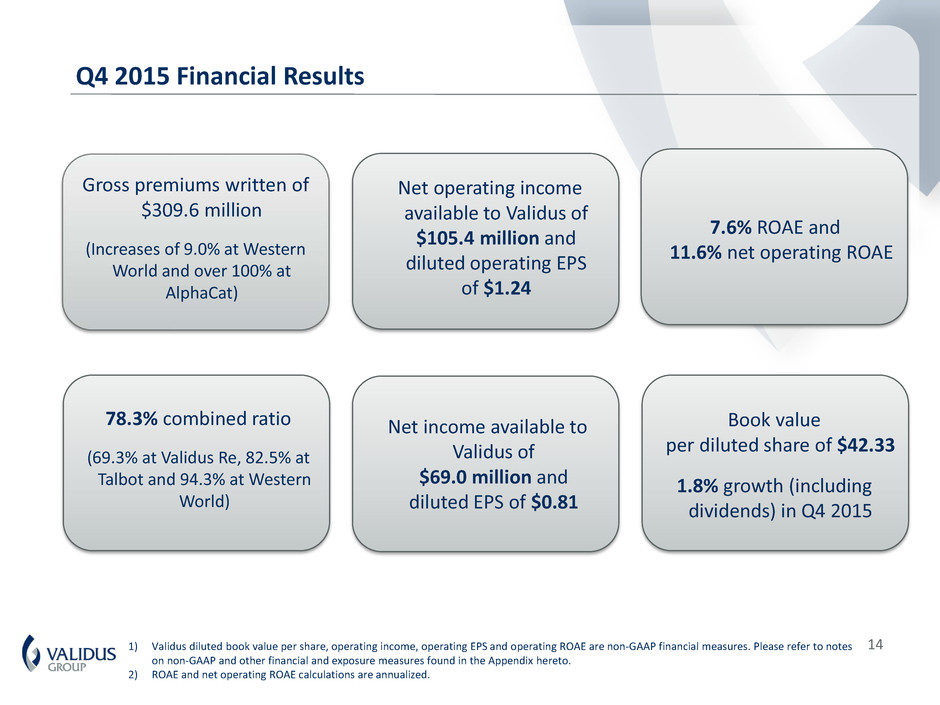

14 Gross premiums written of $309.6 million (Increases of 9.0% at Western World and over 100% at AlphaCat) 7.6% ROAE and 11.6% net operating ROAE 1) Validus diluted book value per share, operating income, operating EPS and operating ROAE are non-GAAP financial measures. Please refer to notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 2) ROAE and net operating ROAE calculations are annualized. 78.3% combined ratio (69.3% at Validus Re, 82.5% at Talbot and 94.3% at Western World) Net income available to Validus of $69.0 million and diluted EPS of $0.81 Book value per diluted share of $42.33 1.8% growth (including dividends) in Q4 2015 Q4 2015 Financial Results Net operating income available to Validus of $105.4 million and diluted operating EPS of $1.24

15 Validus Reinsurance Highlights Gross Premium Written - $1.1 Billion for the year ended Dec 31, 2015 Validus Re Overview 1) Validus Re financial reporting based on reporting of the Validus Re segment which does not include AlphaCat. 2) Net underwriting income is expressed in millions of U.S. Dollars. Net Underwriting Income • Validus Re formed in October 2005 as the first operating subsidiary of Validus Holdings, Ltd. • Headquartered in Bermuda with overseas offices in Asia, Continental Europe and Latin America • Global provider focused on treaty reinsurance including – Property catastrophe – Marine and energy – Other specialty lines • A.M Best rating of A (Stable); S&P Rating of A (Stable) Property Cat XOL 37% Marine 14% Other Specialty 14% Agriculture 24% Other Property 11% 277.7 91.5 413.2 240.4 15.5 227.8 443.4 387.0 280.6 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 2007 2008 2009 2010 2011 2012 2013 2014 2015

16 AlphaCat Highlights AlphaCat Overview AlphaCat Assets Under Management 1) AlphaCat financial information based on reporting of the AlphaCat segment. 2) AlphaCat began operations in 2008, and became a stand alone segment in 2012. 3) AlphaCat assets under management are expressed in millions of U.S. Dollars. 2015 Performance • Secured $662.7 million of newly raised capital for deployment during Q4 2015 • Generated management fee revenue of $25.0 million • Validus’ share of AlphaCat income of $22.2 million • Wholly-owned asset management subsidiary which provides ILS investment services • AlphaCat brand was established in 2008 • In 2011, AlphaCat opened access to external investors • As of January 1st, 2016, AlphaCat had $2.4 billion in assets under management 1,204.6 1,533.8 2,059.5 392.4 346.9 326.6 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 1-Jan-14 1-Jan-15 1-Jan-16 Third Party Related Party

17 AlphaCat – Alpha Embedded in the Company’s Portfolios 1) Remote, moderate, and high risk portfolios are represented by AlphaCat contracts In-force as of Jan 1st, 2015 and 2016. 2) Compiled based on the reinsurance market deal flow modeled by Validus as of Jan 1st, 2015 and 2016. AlphaCat has reaped the benefits of Validus’ investment in research and business origination. As a result, the AlphaCat portfolios offer higher premium to risk multiples and have overall experienced less risk-adjusted premium decrease than the reinsurance market 2.85 2.49 0 1.78 1.58 0 1.78 1.61 0 1.20 1.07 0 1.37 1.14 0 0.94 0.81 3.22 2.90 0 2.14 2.25 0 2.29 1.99 0 2.19 1.66 0 1.60 1.56 0 1.18 1.48 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 Remote (US) Remote (Non- US) Moderate (US) Moderate (Non-US) High (US) High (Non-US) N et P re m iu m / E xp ec te d Lo ss Market AlphaCat

18 Talbot Highlights Gross Premium Written - $1.0 Billion for the year ended Dec 31, 2015 Talbot Overview Net Underwriting Income • Founded in 2001 and acquired by Validus in 2007 • Significant competitive position • Focus is on short tail business with meaningful market position in targeted classes • By design, Talbot is underweight in Casualty, Casualty Treaty and Property Treaty classes • Strategically placed offices in international hubs – New York, Miami, Santiago, Dubai, Labuan, Australia and Singapore 1) Talbot financial information based on reporting of the Talbot segment. 2) Energy is Downstream Energy and Power. 3) Lloyd’s Syndicate size is measured by gross premium written, as taken from Lloyd’s 2014 Annual Report. 4) Net underwriting income is expressed in millions of U.S. Dollars. Marine 32% Property 22% Political Lines 19% Energy 10% Aviation 9% Fin. Lines 4% Other 4% 79.3 45.6 78.7 72.0 10.7 85.3 169.3 108.1 136.4 $0.0 $50.0 $100.0 $150.0 $200.0 2007 2008 2009 2010 2011 2012 2013 2014 2015

19 Talbot - Lloyd’s Market Share By Class of Business 1) Source: Lloyd’s Franchise Board. 2) Percentages are calculated based on 2014 year of account gross premium written. Key Class of Business Underweight Classes of Business 0.0% 0.0% 0.1% 0.1% 0.2% 0.3% 0.3% 0.4% 0.5% 0.5% 0.6% 0.8% 0.9% 1.0% 1.2% 1.7% 1.9% 2.1% 2.7% 3.0% 0.0% 1.0% 2.0% 3.0% Directors & Officers (non-US) Agriculture & Hail NM General Liability (US direct) Professional Indemnity (US) Property pro rata Employers Liability/ WCA (US) Overseas Motor NM General Liability (non-US direct) Property D&F (non-US binder) Property Risk XS Professional Indemnity (non-US) Property D&F (US binder) Personal Accident XL Property Cat XL Medical Expenses Difference in Conditions Accident & Health (direct) Energy Onshore Liability Nuclear Total 3.0% 3.2% 3.4% 3.5% 3.5% 3.7% 4.0% 4.1% 4.2% 4.2% 4.2% 4.3% 4.5% 4.6% 4.8% 5.1% 6.0% 6.4% 6.5% 6.7% 7.0% 8.1% 8.4% 10.1% 14.1% 16.7% 0.0% 5.0% 10.0% 15.0% Total Financial Institutions (US) Power Generation Marine XL Property D&F (non-US open market) Financial Institutions (non-US) Space Property D&F (US open market) Fine Art & Specie Cargo Marine Liability Marine Hull General Aviation Contingency/ Other Pecuniary Energy Offshore Property Aviation Products/ Airport Liabilities Yacht Political Risks, Credit & Financial Guarantee Energy Offshore Liability Airline War BBB/ Crime Terrorism Engineering Aviation XL Energy Onshore Property

20 Western World Highlights Gross Premium Written - $278.5 Million for the year ended Dec 31, 2015 Western World Highlights for the year ended December 31, 2015 1) Western World financial information based on reporting of the Western World segment. • Founded in 1964 and acquired by Validus in 2014 • Focused on US small and mid sized enterprise business (“SME”) • Commercial General Liability has been the historical focus • Writing on both E&S and admitted paper • Western World Integrated Platform (“WWIP”) is a technological competitive advantage • Validus ownership provides the resources for expansion into short tail classes of business • Meaningful strategic changes have already been made to date: – New Brokerage Property – New Professional Liability – Discontinued lines, Commercial Auto and select Programs Contract GL 51% Property 19% Program GL 14% Auto 6% Professional 6% Brokerage GL 4%

21 Western World Divisional Organization 1) Western World financial information based on reporting of the Western World segment. 2) 2015 GPW is expressed in millions of U.S. dollars. Contract Division Program Division Brokerage Casualty / Professional Brokerage Property 2015 GPW $167 $71 $29 $12 % of Total 60% 25% 11% 4% Description • General & Professional Liability and Property Coverage on small-to-medium size commercial risks offered in 50 states • Distributed through exclusive general agents with binding authority • General, Professional, Liability, Property and Commercial Auto plans • Distributed through affinity group program administrators • Single-class relationships, generally with 50-state binding authority • General Liability and Professional Liability coverage • Underwrites larger, more complex accounts • Distributed through select wholesale brokers • Business accepted from 50 states • Commercial E&S Property Insurance • “Middle Market,” Catastrophe exposed business • Distributed through select wholesale brokers • Business accepted from 50 states Coverages • General & Professional Liability • Property (package) • General Liability & Professional • Commercial Auto and APD • Property • General Liability • Professional Liability (Claims Made) • ISO special, broad and basic causes of loss • Single Peril (Earthquake, Flood, Wind) • Difference in Conditions (DIC) for Earthquake and Flood Business Classes • Manufacturers and Contractors • Owners, Landlords and Tenants • Professional Services / Misc. Malpractice • Spectator Events • Hospitality & Habitational • Contracted Services • Outdoor / Recreation & Amusement • Professional Services • Habitational • Contracting • Manufacturing • Errors & Omissions • Management Liability • Hotel / Motel • Habitational • Retail • Restaurants • Offices

22 Estimated Exposures to Peak Zone Property Catastrophe Losses (Expressed in thousands of U.S. Dollars) Probable Maximum Losses by Zone and Peril Consolidated (Validus Re and Talbot) Estimated Net Loss Zones Perils 20 year return period 50 year return period 100 year return period 250 year return period Validus Re Net Maximum Zonal Aggregate United States Hurricane 295,996 516,169 762,562 1,079,070 2,072,174 California Earthquake 81,708 243,593 342,993 434,323 1,878,187 Europe Windstorm 78,528 201,651 295,883 525,984 1,223,648 Japan Earthquake 60,472 112,746 179,241 271,406 708,656 Japan Typhoon 46,503 104,215 192,989 274,843 634,167 1:100 year PML equal to 17.2% of quarter end capital, 21.0% of shareholders’ equity 1) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 2) 1:100 year PML as a % of capital and shareholder’s equity is based on United States Hurricane PML. Transparent Risk Disclosure – January 1, 2016 Portfolio Peak Zone PML

23 Net Probable Maximum Loss (1:100) by Zone and Peril Compared to Total Capitalization Substantial Capital Margin Above Risk Appetites 1) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 2) Total capitalization equals total shareholder's equity less noncontrolling interests plus Senior Notes and Junior Subordinated Deferrable Debentures. 3) Consolidated (Validus Re and Talbot) estimated net loss 1:100 year PML as a % of capital as and shareholder’s equity. 4) All data points are as at January 1. 1:100 PML Internal Risk Appetite 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2011 2012 2013 2014 2015 2016 United States Hurricane California Earthquake Europe Windstorm Japan Earthquake Japan Typhoon

24 1) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. Realistic Disaster Scenarios Estimated Exposures to Specified Loss Scenarios - As of July 1, 2015 (Expressed in millions of U.S. Dollars) Consolidated (Validus Re and Talbot) Estimated Consolidated (Validus Re and Talbot) Net Loss % of latest 12 Months Consolidated Net Premiums EarnedType Catastrophe Scenarios Description Terrorism Rockefeller Center Midtown Manhattan suffers a 2-tonne conventional bomb blast $ 95.6 4.3% Terrorism Exchange Place Lower Manhattan suffers a 2-tonne conventional bomb blast 38.6 1.7% Marine Marine collision in Prince William Sound Fully laden tanker collides with a cruise vessel in Prince William Sound 92.2 4.1% Marine Major cruise vessel incident US-owned cruise vessel sunk or severely damaged 101.9 4.5% Marine Loss of major complex Total loss to all platforms and bridge links of a major oil complex 186.0 8.3% Aviation Aviation collision Collision of two aircraft over a major city 107.4 4.8% Satellite Solar flare Large single or sequence of proton flares results in loss to all satellites in synchronous orbit 40.6 1.8% Satellite Generic defect Undetected defect in a number of operational satellites causing major loss 16.0 0.7% Liability Professional lines Failure or collapse of a major corporation 22.5 1.0% Liability Professional lines UK pensions mis-selling 16.0 0.7% Political Risks South East Asia Chinese economy has a "hard landing" with sharp fall in growth rates; regional contagion 109.7 4.9% Political Risks Middle East US and Iran escalate into military confrontation; regional contagion 26.8 1.2% Political Risks Russia The Russian corporate sector struggles to deal with the effects of crashing commodity and stock prices 48.8 2.2% Political Risks Turkey Severe economic crisis in Turkey due to political upheaval 45.9 2.0% Political Risks Nigeria Severe economic, political and social crisis in Nigeria leads to widespread civil unrest 39.7 1.8%

25 Validus – Active Capital Management Expressed in millions of U.S. Dollars 1) Capital management actions of $3.59 billion is through February 18, 2015. Capital Management Inception to Date of $3.59 Billion • On Feb 3, 2015 Validus reset the common share repurchase authorization to $750.0 million • Common share repurchases of $260.4 million • Increased quarterly dividend to $0.32 per share 2015 Capital Management 2016 Capital Management • Common share repurchases of $39.4 million • Remaining authorization of $493.2 million • Increased quarterly dividend to $0.35 per share 2,531.2 829.2 230.8 Share Repurchase Common Share Dividends Special Dividend

26 Managed Investment Portfolio at December 31, 2015 • Total managed investments and cash and cash equivalents of $6.44 billion – $8.59 billion total investments, cash and cash equivalents and restricted cash inclusive of investments supporting AlphaCat collateralized business – Emphasis on the preservation of invested assets – Provision of sufficient liquidity for prompt payment of claims – Comprehensive portfolio disclosure • Average portfolio rating of A+ • Duration of 2.15 years • 2015 average investment yield: 1.91% (2014: 1.51%) 23.1% 14.6% 9.5% 9.0% 8.4% 6.9% 6.8% 5.2% 4.7% 4.0% 3.7% 3.7% 0.4% 0% 5% 10% 15% 20% 25% U.S. corporate U.S. Govt. and Agency Agency RMBS Bank loans Cash Non-U.S. corporate ABS Other State and local CMBS Non-U.S. Govt. and Agency Short term Non-Agency RMBS

27 Validus Invested Asset Strategy and Performance • In 2014, Validus set out to increase portfolio yield without increasing tail risk. Validus’ Chief Investment Officer worked with our risk and financial modeling teams to establish a new portfolio allocation • Noteworthy benefit in terms of higher yields on the portfolio during the past five quarters. The second half of 2015 confirmed our conservative risk profile as the portfolio, absent PaCRe, generated minimal losses in very challenging investment markets 1.42% 1.30% 1.55% 1.78% 1.83% 2.02% 1.91% 1.90% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 31-Mar-14 30-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15 30-Jun-15 30-Sep-15 31-Dec-15

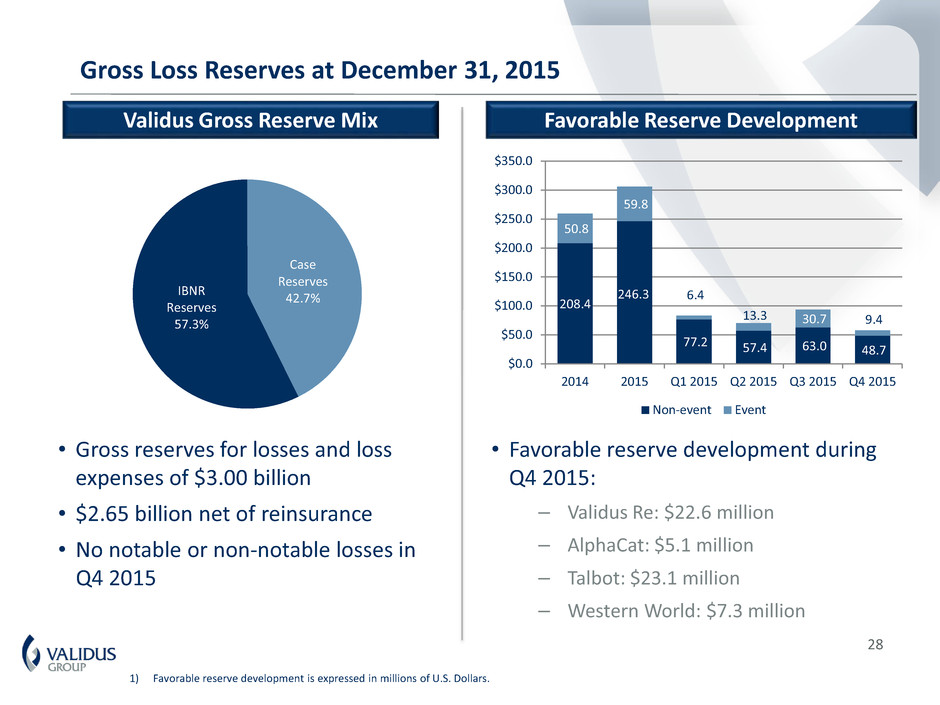

28 Gross Loss Reserves at December 31, 2015 • Gross reserves for losses and loss expenses of $3.00 billion • $2.65 billion net of reinsurance • No notable or non-notable losses in Q4 2015 • Favorable reserve development during Q4 2015: – Validus Re: $22.6 million – AlphaCat: $5.1 million – Talbot: $23.1 million – Western World: $7.3 million Favorable Reserve Development Validus Gross Reserve Mix 1) Favorable reserve development is expressed in millions of U.S. Dollars. Case Reserves 42.7%IBNR Reserves 57.3% 208.4 246.3 77.2 57.4 63.0 48.7 50.8 59.8 6.4 13.3 30.7 9.4 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2014 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Non-event Event

29 • International insurance and reinsurance business • Size and scale to compete effectively in targeted markets • Four distinct yet complementary operating segments • Focused on short-tail classes of reinsurance and insurance • Profitable in all ten years of operation • Short duration, highly liquid, conservative balance sheet • Transparent risk disclosure Conclusion – Continue to be Well Positioned for 2016 and Beyond

APPENDIX Investor Presentation

31 8.4% year over year increase in gross premiums written (Increases of 0.7% at Validus Re, 38.9% at AlphaCat and a decrease of 7.5% at Talbot) 10.3% ROAE and 11.3% net operating ROAE 1) Validus diluted book value per share, operating income, operating EPS and operating ROAE are non-GAAP financial measures. Please refer to notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 79.7% combined ratio (72.0% at Validus Re, 83.8% at Talbot and 98.2% at Western World) Net income available to Validus of $374.9 million and diluted EPS of $4.34 Book value per diluted share of $42.33 10.0% growth (including dividends) in 2015 Full Year 2015 Financial Results Net operating income available to Validus of $409.7 million and diluted operating EPS of $4.74

32 Selected Market Information at December 31, 2015 Exchange / Ticker: Share Price: Primary Shares Outstanding: Primary Market Capitalization: Annual Dividend/Yield: NYSE / “VR” $46.29 82,900,617 $3.84 billion $1.28 per share (2.77%) 1) Validus increased its quarterly common share dividend to $0.35 from $0.32 on February 2, 2016. The forward annual dividend/yield is $1.40 per share (3.02%).

33 111 136 2007 2015 40 66 55 15 2007 2015 Dubai New York Asia LATAM 157 364 2007 2015 473 888 2007 2015 688 1,019 2007 2015 508 955 2007 2015 Talbot Growth Since Acquisition 1) Converted at rate of exchange £1.00 = $1.53, the average rate for 2015. 2) 2007 GPW & Net Underwriting Income are full year amounts, including pre-acquisition results. 3) 2015 Shareholders’ Equity includes capital supporting Funds at Lloyd’s. Employees 2.3x Shareholders’ Equity(3) $ in millions 1.9x Net Underwriting Income(2) $ in millions 1.2x Gross Premium Written(2) $ in millions 1.5x Syndicate Capacity (1) 1.9x $ in millions GPW in Overseas Offices $ in millions 186

34 Talbot Composite Rate Index – The Benefits of Cycle Management 1) Rate index reflects the whole account rate change, as adjusted for changes in exposure, inflation, attachment point and terms and conditions. 2) All data points are as of December 31. 100% 126% 187% 208% 206% 204% 217% 207% 197% 209% 208% 215% 221% 220% 211% 197% 75% 100% 125% 150% 175% 200% 225% 250% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

35 Abbreviated Balance Sheets 1) A full explanation and disclaimer is contained in the note on non-GAAP financial and other measures found in the Appendix hereto. (Expressed in thousands of U.S. Dollars) December 31, 2015 December 31, 2014 December 31, 2013 Assets Fixed maturities $ 5,510,331 $ 5,545,231 $ 5,542,258 Short-term investments 1,941,635 1,501,212 1,002,396 Other investments 336,856 334,685 160,307 Cash and cash equivalents 723,109 550,401 729,333 Restricted cash 73,270 173,003 200,492 Total investments and cash 8,585,201 8,104,532 7,634,786 Goodwill and Intangible assets 318,016 322,821 126,800 Other assets 1,612,595 1,685,211 1,695,460 Total assets $ 10,515,812 $ 10,112,564 $ 9,457,046 Liabilities Reserve for losses and loss expenses $ 2,996,567 $ 3,243,147 $ 3,047,933 Unearned premiums 966,210 989,229 822,280 Other liabilities 789,362 599,300 420,603 Notes payable to AlphaCat investors 75,493 - - Senior notes payable 245,161 244,960 244,758 Debentures payable 537,668 539,277 541,416 Total liabilities $ 5,610,461 $ 5,615,913 $ 5,076,990 Redeemable noncontrolling interest 1,111,714 617,791 300,936 Shareholders' equity Capital $ 1,004,919 $ 1,213,614 $ 1,694,085 Retained earnings 2,634,056 2,372,972 2,010,009 Total shareholders' equity available to Validus 3,638,975 3,586,586 3,704,094 Noncontrolling interest 154,662 292,274 375,026 Total shareholders' equity 3,793,637 3,878,860 4,079,120 Total liabilities, noncontrolling interests and shareholders' equity $ 10,515,812 $ 10,112,564 $ 9,457,046 Debt to capital ratio 4.3% 4.6% 4.7% Debt and hybrid to capital ratio 13.8% 14.9% 15.2% Investments and cash to equity 226.3% 208.9% 187.2%

36 Net Operating Income Reconciliation 1) The transaction expenses relate to costs incurred in connection with the acquisition of Western World Insurance Group, Inc. (“Western World”), which was completed on October 2, 2014. Western World results have been included in the Company's consolidated results from October 2, 2014. Transaction expenses are primarily comprised of legal, financial advisory and audit related services. Validus Holdings, Ltd. Non-GAAP Financial Measure Reconciliation Net Operating Income available to Validus, Net Operating Income per share available to Validus and Annualized Net Operating Return on Average Equity (Expressed in thousands of U.S. Dollars, except share and per share information) Three Months Ended Year Ended Dec 31, 2015 Dec 31, 2014 Dec 31, 2015 Dec 31, 2014 Net income available to Validus $ 69,042 $ 125,908 $ 374,893 $ 479,963 Adjustments for: Net realized losses (gains) on investments 2,928 (6,902) (2,298) (14,917) Change in net unrealized losses on investments 34,862 2,040 32,395 2,842 Loss (income) from investment affiliate 1,261 (530) (4,281) (8,411) Foreign exchange (gains) losses (797) (3,674) 8,731 12,181 Other (income) loss (1,576) 770 1,002 2,243 Transaction expenses (a) - 4,695 - 8,096 Net (loss) attributable to noncontrolling interest (325) (433) (693) (1,235) Net operating income available to Validus 105,395 121,874 409,749 480,762 Less: Dividends and distributions declared on outstanding warrants - (1,552) (3,566) (6,208) Net operating income available to Validus, adjusted $ 105,395 $ 120,322 $ 406,183 $ 474,554 Net income per share available to Validus - diluted $ 0.81 $ 1.38 $ 4.34 $ 5.07 Adjustments for: Net realized losses (gains) on investments 0.03 (0.08) (0.03) (0.16) Change in net unrealized losses on investments 0.42 0.02 0.38 0.03 Loss (income) from investment affiliate 0.01 - (0.05) (0.09) Foreign exchange (gains) losses (0.01) (0.04) 0.10 0.13 Other (income) loss (0.02) 0.01 0.01 0.02 Transaction expenses (a) - 0.05 - 0.09 Net (loss) attributable to noncontrolling interest - - (0.01) (0.01) Net operating income per share available to Validus - diluted $ 1.24 $ 1.34 $ 4.74 $ 5.08 Weighted average number of common shares and common share equivalents 85,181,258 90,948,156 86,426,760 94,690,271 Average shareholders' equity available to Validus 3,641,970 3,643,812 3,641,920 3,683,029 Annualized net operating return on average equity 11.6% 13.4% 11.3% 13.1%

37 1) Weighted average exercise price for those warrants and stock options that have an exercise price lower than book value per share. 2) Using the "as-if-converted" method, assuming all proceeds received upon exercise of warrants and stock options will be retained by the Company and the resulting common shares from exercise remain outstanding. Diluted Book Value Per Share Reconciliation (Expressed in thousands of U.S. Dollars, except share and per share information) December 31, 2015 Equity amount Shares Exercise Price (1) Book value per share Total shareholders' equity available to Validus Book value per common share Total shareholders' equity available to Validus $ 3,638,975 82,900,617 $ 43.90 Tangible book value per common share $ 40.06 Book value per diluted common share Total shareholders' equity available to Validus $ 3,638,975 82,900,617 Assumed exercise of outstanding warrants (2) - - $ - Assumed exercise of outstanding stock options (2) 1,319 65,401 $ 20.17 Unvested restricted shares - 3,026,376 Book value per diluted common share $ 3,640,294 85,992,394 $ 42.33 Adjustment for accumulated dividends 10.16 Diluted book value per common share plus accumulated dividends $ 52.49 Tangible book value per diluted common share $ 38.63

38 In presenting the Company’s results herein, management has included and discussed certain schedules containing underwriting income (loss), net operating income (loss) available (attributable) to Validus, annualized return on average equity and diluted book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non-GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. The AlphaCat segment information is presented as an asset manager view and therefore is considered non-GAAP. Underwriting income indicates the performance of the Company's core underwriting segments, excluding revenues and expenses such as net investment income (loss), finance expenses, net realized and change in unrealized gains (losses) on investments, foreign exchange gains (losses), other income (loss) and transaction expenses. The Company believes the reporting of underwriting income enhances the understanding of our results by highlighting the underlying profitability of the Company's core insurance and reinsurance business. Underwriting profitability is influenced significantly by earned premium growth, adequacy of the Company's pricing and loss frequency and severity. Net operating income (loss) available (attributable) to Validus is calculated based on net income (loss) available (attributable) to Validus excluding net realized gains (losses), change in net unrealized gains (losses) on investments, income (loss) from investment affiliates, gains (losses) arising from translation of non-US$ denominated balances, other income (loss) and non-recurring items. Net income is the most directly comparable GAAP measure. Net operating income focuses on the underlying fundamentals of our operations without the influence of realized gains (losses) from the sale of investments, net unrealized gains (losses) on investments, translation of non-US$ currencies and non-recurring items. Realized gains (losses) from the sale of investments are driven by the timing of the disposition of investments, not by our operating performance. Gains (losses) arising from translation of non-US$ denominated balances are unrelated to our underlying business. Diluted book value per share is calculated based on total shareholders’ equity plus the assumed proceeds from the exercise of outstanding stock options and warrants, divided by the sum of unvested restricted shares, stock options, warrants and share equivalents outstanding (assuming their exercise). Reconciliations to the most comparable GAAP measure for net operating income and diluted book value per share can be found on pages 36 and 37, respectively. Net loss estimates and zonal aggregates are before income tax, net of reinstatement premiums, and net of reinsurance and retrocessional recoveries. The estimates set forth herein are based on an Occurrence basis on assumptions that are inherently subject to significant uncertainties and contingencies. These uncertainties and contingencies can affect actual losses and could cause actual losses to differ materially from those expressed above. In particular, modeled loss estimates do not necessarily accurately predict actual losses, and may significantly mis-estimate actual losses. Such estimates, therefore, should not be considered as a representation of actual losses. Notes on Non-GAAP and Other Financial and Exposure Measures

39 The Company has developed the estimates of losses expected from certain catastrophes for its portfolio of property, marine, workers’ compensation, and personal accident contracts using commercially available catastrophe models such as RMS, AIR and EQECAT, which are applied and adjusted by the Company. These estimates include assumptions regarding the location, size and magnitude of an event, the frequency of events, the construction type and damageability of property in a zone, policy terms and conditions and the cost of rebuilding property in a zone, among other assumptions. These assumptions will evolve following any actual event. Accordingly, if the estimates and assumptions that are entered into the risk model are incorrect, or if the risk model proves to be an inaccurate forecasting tool, the losses the Company might incur from an actual catastrophe could be materially higher than its expectation of losses generated from modeled catastrophe scenarios. In addition, many risks such as second-event covers, aggregate excess of loss, or attritional loss components cannot be fully evaluated using the vendor models. Further, there can be no assurance that such third party models are free of defects in the modeling logic or in the software code. Commencing in January 2012, the Company incorporated RMS version 11 as part of its vendor models. The Company has presented the Company Realistic Disaster Scenarios for non-natural catastrophe events. Twice yearly, Lloyds' syndicates, including the Company's Talbot Syndicate 1183, are required to provide details of their potential exposures to specific disaster scenarios. Lloyds' makes its updated Realistic Disaster Scenarios (RDS) guidance available to the market annually. The RDS scenario specification document for 2012 can be accessed at the RDS part of the Lloyd's public website: http://www.lloyds.com/The-Market/Tools-and-Resources/Research/Exposure-Management/Realistic-Disaster-Scenarios The Consolidated Net Premiums Earned used in the calculation represent the latest 12 months of net premiums earned up to December 31, 2015. Modeling catastrophe threat scenarios is a complex exercise involving numerous variables and is inherently subject to significant uncertainties and contingencies. These uncertainties and contingencies can affect actual losses and could cause actual losses incurred by the Company to differ materially from those expressed above. Should an event occur, the modeled outcomes may prove inadequate, possibly materially so. This may occur for a number of reasons including, legal requirements, model deficiency, non-modeled risks or data inaccuracies. A modeled outcome of net loss from a single event also relies in significant part on the reinsurance and retrocession arrangements in place, or expected to be in place at the time of the analysis, and may change during the year. Modeled outcomes assume that the reinsurance and retrocession in place responds as expected with minimal reinsurance failure or dispute. Reinsurance is purchased to match the original exposure as far as possible, but it is possible for there to be a mismatch or gap in cover which could result in higher than modeled losses to the Company. In addition, many parts of the reinsurance program are purchased with limited reinstatements and, therefore, the number of claims or events which may be recovered from second or subsequent events is limited. It should also be noted that renewal dates of the reinsurance program do not necessarily coincide with those of the inwards business written. Where original business is not protected by risks attaching reinsurance or retrocession programs, the programs could expire resulting in an increase in the possible net loss retained by the Company. Investors should not rely on the information set forth in this presentation when considering an investment in the Company. The information contained in this presentation has not been audited nor has it been subject to independent verification. The estimates set forth herein speak only as of the date of this presentation and the Company undertakes no obligation to update or revise such information to reflect the occurrence of future events. The events presented reflect a specific set of prescribed calculations and do not necessarily reflect all events that may impact the Company. Notes on Non-GAAP and Other Financial and Exposure Measures – Continued

Street Address: 29 Richmond Road Pembroke, Bermuda Mailing Address: Suite 1790 48 Par-la-Ville Road Hamilton, Bermuda HM 11 Telephone: +1-441-278-9000 Email: investor.relations@validusholdings.com For more information on our company, products and management team please visit our website at: www.validusholdings.com