Current Report Filing (8-k)

April 23 2015 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

April 20, 2015

Date of report (Date of earliest event reported)

Valmont Industries, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

1-31429

|

47-0351813

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

One Valmont Plaza

|

|

|

Omaha, NE

|

68154

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(402) 963-1000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.05 Costs Associated with Exit or Disposal Activities.

On April 20, 2015, the Board of Directors of Valmont Industries, Inc. (the “Company”) authorized a broad restructuring plan (the “Plan”) of up to $60 million to respond to the market environment in certain of its businesses. As a result of the Plan, the Company expects to incur material charges for exit and disposal activities under generally accepted accounting principles.

The initial restructuring activities primarily involve consolidation of Asia Pacific operations within the Engineered Infrastructure Products and Coatings segments and in the North American part of the Utility segment. Accordingly, the Company expects to incur pre-tax cash and non-cash charges of approximately $30 million, including approximately $19 million of cash charges. These charges are expected to be incurred over the remainder of 2015. The asset impairments are primarily write-downs of property, plant, and equipment in the Engineered Infrastructure Products, Utility, and Coatings segments. The Company’s current estimate of accounting charges is as follows:

Type of Cost:

|

·

|

Severance and related costs: $15 million

|

|

·

|

Asset impairment: $11 million

|

|

·

|

Property relocation and other site closure costs: $4 million

|

|

·

|

Total: Approximately $30 million

|

The Company is still evaluating other potential restructuring activities estimated up to $25 million of non-cash asset impairment and $5 million of cash expenses. The asset impairments under further assessment are primarily a write-down of goodwill in the Coatings segment and write-downs of property, plant, and equipment in the Engineered Infrastructure Products segment.

Item 2.06. Material Impairments.

As described in Item 2.05 above, which is incorporated into this Item 2.06 by reference, the Company estimates that it will incur asset impairment charges of approximately $11 million for the initial restructuring activities. Approximately $13 million of the $19 million of estimated cash expenditures in Item 2.05 above arise from initial restructuring activities that result in asset impairments. The asset impairments are primarily write-downs of property, plant and equipment in the Utility, Engineered Infrastructure Products, and Coatings segments associated with the operations consolidations.

Material impairments estimated for activities under further assessment are up to $25 million of asset impairment charges and $5 million of cash expenditures. The asset impairments under further assessment are primarily a write-down of goodwill in the Coatings segment and write-downs of property, plant, and equipment in the Engineered Infrastructure Products segment.

Forward-Looking Statements

This Form 8-K contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on assumptions that management has made in light of experience in the industries in which Valmont operates, as well as management’s perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances. As you read and consider this Form 8-K, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond Valmont’s control) and assumptions. Although management believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect Valmont’s actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. These factors include among other things, risk factors described from time to time in Valmont’s reports to the Securities and Exchange Commission, as well as future economic and market circumstances, industry conditions, Company performance and financial results, operating efficiencies, availability and price of raw material, availability and market acceptance of new products, product pricing, domestic and international competitive environments, and actions and policy changes of domestic and foreign governments. The Company cautions that any forward-looking statement included in this Form 8-K is made as of the date of the filing of this Form 8-K and the Company does not undertake to update any forward-looking statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Valmont Industries, Inc.

|

|

Date: April 23, 2015

|

|

| |

|

| |

By: /s/ Mark Jaksich

|

| |

Name: Mark Jaksich

|

| |

Title: Chief Financial Officer

|

| |

|

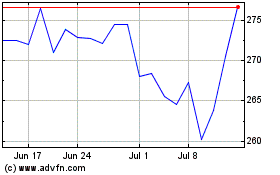

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Apr 2023 to Apr 2024