UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

April 22, 2015

Date of report (Date of earliest event reported)

Valmont Industries, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

1-31429

|

47-0351813

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

One Valmont Plaza

|

|

|

Omaha, NE

|

68154

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(402) 963-1000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition.

The information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Valmont Industries, Inc. (the “Company”) issued a press release on April 22, 2015 announcing its financial results for the Company’s quarter ended March 28, 2015. The press release is furnished for purposes of this Item 2.02 with this Form 8-K as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

99.1

|

Press Release dated April 22, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Valmont Industries, Inc.

|

|

Date: April 22, 2015

|

|

| |

|

| |

By: _/s/ Mark Jaksich___________________

|

| |

Name: Mark Jaksich

|

| |

Title: Chief Financial Officer

|

| |

|

EXHIBITS

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release dated April 22, 2015.

|

Valmont Announces First Quarter 2015 Results

and a Restructuring Plan

Highlights:

|

·

|

Irrigation Segment’s operating income was a healthy 15.7% of sales despite reduced market demand.

|

|

·

|

Weak industrial and mining markets negatively affected our Australian businesses.

|

|

·

|

Utility Support Structures Segment continued to face market challenges in North America.

|

|

·

|

Foreign currency translation adversely impacted sales and operating income by $31 million and $2.3 million, respectively, in the first quarter.

|

|

·

|

Board of Directors approves a restructuring plan.

|

Omaha, NE - Valmont Industries, Inc. (NYSE: VMI), a leading global provider of engineered products and services for infrastructure and mechanized irrigation equipment for agriculture, reported first quarter sales of $670.4 million compared with $751.7 million for the same period of 2014. First quarter 2015 operating income was $57.7 million versus $98.8 million in 2014. First quarter reported diluted earnings per share were $1.28 compared with $2.08 in 2014. Included in 2015 and 2014 first quarter earnings were certain items affecting comparability. Without these items, diluted earnings per share were $1.28 in 2015 and $2.20 in 2014. (See Regulation G reconciliation on last page.)

First Quarter Review:

“As expected, compared to the historically strong first quarter results of last year, lower sales and operating income in our Irrigation and Utility Support Structures Segments drove unfavorable quarterly comparisons,” said Mogens C. Bay, Valmont’s Chairman and Chief Executive Officer. “In the Utility Support Structures Segment, lower volumes, competitive pricing and a less favorable mix led to decreased sales and significantly lower operating income compared with last year. Farmers cut back investment in irrigation equipment in response to weaker crop prices and lower projected farm income. Higher Engineered Infrastructure Products Segment sales were the result of acquisitions made last year and project sales, which more than offset the negative impacts of the softer industrial and mining economy in Australia and currency translation. Coatings Segment sales were also negatively impacted by the Australian economy as well as reduced internal North American demand.

-more-

“First quarter operating income as a percent of sales when compared to a relatively strong first quarter last year, was 8.6% compared to 13.1% in 2014, as a result of lower volumes and pricing in the Utility Support Structures Segment and volume reductions in the Irrigation Segment.

“A significantly stronger U.S. dollar contributed to lower U.S. dollar translated sales and operating income from international operations. This adversely impacted first quarter 2015 sales and operating income by approximately $31.0 million and $2.3 million respectively.

“At this time, we do not expect a meaningful improvement in the external environment. Consequently, we are undertaking certain restructuring actions described in more detail below.”

First Quarter Segment Review:

Engineered Infrastructure Products Segment (34% of 1st Quarter Sales)

Engineered structures and components for global lighting and traffic, wireless communication, roadway safety, offshore structures and access systems applications.

First quarter sales were $238.2 million, a 4% increase over 2014. The increase was due to the revenue contribution from acquisitions made during 2014, better results in Europe and Asia, partly offset by foreign exchange translation effects.

In North America, sales increased as a result of the addition of revenue from the Shakespeare acquisition completed in October 2014. Improved activity in the commercial lighting market was offset by reduced wireless communication and intercompany utility sales.

In Europe, sales increased due to the Valmont SM acquisition and a large lighting project supplied to the Middle East. Overall market conditions in Europe were comparable with 2014.

In the Asia-Pacific region, positive sales comparisons in China were more than offset by weaker sales in Australia.

Operating income decreased 13% to $11.9 million, or 5.0% of segment sales compared to 6.0% in 2014, mostly due to reduced profitability in Australia and foreign currency translation.

Utility Support Structures Segment (25% of 1st Quarter Sales)

Steel and concrete structures for the global electric utility industry.

Sales of $176.3 million were 18% lower than 2014 mostly due to continued competitive pricing, significantly lower steel costs and a modest reduction in volume. Last year’s first quarter results reflected a favorable backlog carried forward from 2013. Operating income declined 53% to $15.4 million, which represents 8.7% of segment sales compared to 15.3% in 2014.

-more-

Valmont Industries, Inc. w One Valmont Plaza w Omaha, Nebraska 68154 U.S.A. w www.valmont.com

Coatings Segment (11% of 1st Quarter Sales)

Global galvanizing, painting and anodizing services.

Sales of $74.4 million were 10% lower than last year due to weaker markets in Australia, currency translation and reduced internal demand in North America. Operating income declined 21% to $11.0 million or 14.8% of segment sales compared to 16.9% in 2014.

Irrigation Segment (22% of 1st Quarter Sales)

Agricultural irrigation equipment and related parts and services worldwide.

Sales of $154.5 million declined 27% from 2014, due to lower volumes in both North American and International markets, compared to last year’s relatively strong first quarter.

North American farm incomes are forecast to be substantially lower in 2015, which has caused farmers to curb capital investments. Lower crop commodity prices and political conflicts have led to reduced demand in certain international markets. Sales in Brazil were lower than 2014, due to the effect of a severe drought that limited irrigation permits, a weaker currency and economic uncertainty.

Operating income at $24.3 million was 44% lower than last year, yet still a solid 15.7% of segment sales compared to 20.3% in 2014. The decline in operating income was due to the impact of lower volumes and associated deleverage on fixed operating costs.

Restructuring Plan:

Given that market conditions in a number of our businesses are not expected to improve over the near-term, our Board of Directors has authorized a broad restructuring plan of up to $60 million. The initial restructuring actions will involve the consolidation of operations and other cost reduction activities, resulting in pre-tax charges of approximately $30 million. The charges will include $19 million of cash expenses and $11million of non-cash charges. These actions will take place over the remainder of 2015. Most of the restructuring activities will take place in our Infrastructure businesses where an improvement in the Australian industrial and mining economies is not expected near term and public spending for infrastructure in Europe and North America continues to be constrained. The cash expenses are expected to be recovered through lower operating costs within 12 to 18 months. Of the above costs, approximately $0.8 million of pre-tax cash expenses were incurred during the first quarter related to the restructuring.

We are also evaluating other actions that could result in as much as $30 million of additional charges, most of which would be non-cash impairment charges.

-more-

Outlook:

“None of the long term positive drivers of our businesses have changed,” said Mr. Bay. “Current market conditions remain challenging, but what we can control is our cost structure and organization to be as competitive as we can. Our focus on lean activities and operational excellence should better position us to be prepared for when our markets recover. Our planned restructuring will consolidate operations and lower costs without affecting our ability to serve our customers and maintain our leadership positions in the markets we serve.”

An audio discussion of Valmont’s first quarter results by Mogens C. Bay, Chairman and Chief Executive Officer and Mark C. Jaksich, Executive Vice President and Chief Financial Officer, will be available live by telephone by dialing 1-877-493-2981 and entering Conference ID#: 66205079 or via the Internet at 8:00 a.m. CDT April 23, 2015, by pointing browsers to: https://engage.vevent.com/rt/valmontindustries_ao~042315. After the event you may listen by accessing the above link or by telephone. Dial 1-855-859-2056 or 404-537-3406, and enter the Conference ID#: 66205079 beginning April 23, 2015 at 10:00 a.m. CDT through 12:00 p.m. CDT on April 30, 2015.

Valmont is a global leader, designing and manufacturing highly engineered products that support global infrastructure development and agricultural productivity. Its products for infrastructure serve highway, transportation, wireless communication, electric transmission, and industrial construction and energy markets. Its mechanized irrigation equipment for large scale agriculture improves farm productivity while conserving fresh water resources. In addition, Valmont provides coatings services that protect against corrosion and improve the service lives of steel and other metal products.

This release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on assumptions that management has made in light of experience in the industries in which Valmont operates, as well as management’s perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances. As you read and consider this release, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (some of which are beyond Valmont’s control) and assumptions. Although management believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect Valmont’s actual financial results and cause them to differ materially from those anticipated in the forward-looking statements. These factors include among other things, risk factors described from time to time in Valmont’s reports to the Securities and Exchange Commission, as well as future economic and market circumstances, industry conditions, company performance and financial results, operating efficiencies, availability and price of raw material, availability and market acceptance of new products, product pricing, domestic and international competitive environments, and actions and policy changes of domestic and foreign governments. The Company cautions that any forward-looking statement included in this press release is made as of the date of this press release and the Company does not undertake to update any forward-looking statement.

-more-

|

VALMONT INDUSTRIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

|

|

(Dollars in thousands, except per share amounts)

|

|

(unaudited)

|

| |

|

|

|

|

| |

|

First Quarter

|

| |

|

13 Weeks Ended

|

| |

|

28-Mar-15

|

|

29-Mar-14

|

|

Net sales

|

|

$ 670,398

|

|

$ 751,740

|

|

Cost of sales

|

|

504,944

|

|

544,758

|

|

Gross profit

|

|

165,454

|

|

206,982

|

|

Selling, general and administrative expenses

|

|

107,771

|

|

108,134

|

|

Operating income

|

|

57,683

|

|

98,848

|

|

Other income (expense):

|

|

|

|

|

|

Interest expense

|

|

(11,128)

|

|

(8,197)

|

|

Interest income

|

|

874

|

|

1,739

|

|

Other

|

|

1,016

|

|

(5,812)

|

| |

|

(9,238)

|

|

(12,270)

|

| |

|

|

|

|

|

Earnings before income taxes

|

|

48,445

|

|

86,578

|

|

Income tax expense

|

|

16,938

|

|

30,015

|

|

Net earnings

|

|

31,507

|

|

56,563

|

|

Less: Earnings attributable to non-controlling interests

|

|

(768)

|

|

(583)

|

|

Net earnings attributable to Valmont Industries, Inc.

|

|

$ 30,739

|

|

$ 55,980

|

| |

|

|

|

|

| |

|

|

|

|

|

Average shares outstanding (000's) - Basic

|

|

23,868

|

|

26,715

|

|

Earnings per share - Basic

|

|

$ 1.29

|

|

$ 2.09

|

| |

|

|

|

|

|

Average shares outstanding (000's) - Diluted

|

|

23,982

|

|

26,950

|

|

Earnings per share - Diluted

|

|

$ 1.28

|

|

$ 2.08

|

| |

|

|

|

|

|

Cash dividends per share

|

|

$ 0.375

|

|

$ 0.250

|

| |

|

|

|

|

-more-

|

VALMONT INDUSTRIES, INC. AND SUBSIDIARIES

|

|

SUMMARY OPERATING RESULTS

|

|

(Dollars in thousands)

|

|

(unaudited)

|

| |

|

|

|

|

| |

|

First Quarter

|

| |

|

13 Weeks Ended

|

| |

|

28-Mar-15

|

|

29-Mar-14

|

|

Sales

|

|

|

|

|

|

Engineered Infrastructure Products

|

|

$ 238,393

|

|

$ 228,462

|

|

Utility Support Structures

|

|

176,341

|

|

214,727

|

|

Coatings

|

|

74,360

|

|

82,171

|

|

Infrastructure products

|

|

489,094

|

|

525,360

|

| |

|

|

|

|

|

Irrigation

|

|

154,476

|

|

212,733

|

|

Other

|

|

53,858

|

|

58,602

|

|

Less: Intersegment sales

|

|

(27,030)

|

|

(44,955)

|

|

Total

|

|

$ 670,398

|

|

$ 751,740

|

| |

|

|

|

|

|

Operating Income

|

|

|

|

|

|

Engineered Infrastructure Products

|

|

$ 11,982

|

|

$ 13,709

|

|

Utility Support Structures

|

|

15,357

|

|

32,757

|

|

Coatings

|

|

11,000

|

|

13,886

|

|

Infrastructure products

|

|

38,339

|

|

60,352

|

| |

|

|

|

|

|

Irrigation

|

|

24,302

|

|

43,146

|

|

Other

|

|

6,598

|

|

8,550

|

|

Corporate

|

|

(11,556)

|

|

(13,200)

|

|

Total

|

|

$ 57,683

|

|

$ 98,848

|

| |

|

|

|

|

Valmont has aggregated its business segments into four reportable segments as follows:

Engineered Infrastructure Products: This segment consists of the manufacture of engineered structures and components for global lighting and traffic, wireless communication, offshore, roadway safety, and access systems applications.

Utility Support Structures: This segment consists of the manufacture of engineered steel and concrete structures for the global utility industry.

Coatings: This segment consists of global galvanizing, painting and anodizing services.

Irrigation: This segment consists of the manufacture of agricultural irrigation equipment and related parts and services worldwide.

In addition to these four reportable segments, Valmont also has other businesses that individually are not more than 10% of consolidated net sales. These businesses, which include the manufacture of forged steel grinding media, tubular products, and industrial fasteners, are reported in the "Other" category.

-more-

|

VALMONT INDUSTRIES, INC. AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(Dollars in thousands)

|

|

(unaudited)

|

| |

|

|

|

|

|

|

| |

28-Mar-15

|

|

|

29-Mar-14

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$ 318,366

|

|

|

$ 488,195

|

|

|

|

Accounts receivable, net

|

503,649

|

|

|

529,693

|

|

|

|

Inventories

|

379,514

|

|

|

424,825

|

|

|

|

Prepaid expenses

|

48,344

|

|

|

57,913

|

|

|

|

Refundable and deferred income taxes

|

53,032

|

|

|

57,935

|

|

|

|

Total current assets

|

1,302,905

|

|

|

1,558,561

|

|

|

|

Property, plant and equipment, net

|

586,746

|

|

|

612,203

|

|

|

|

Goodwill and other assets

|

694,479

|

|

|

715,102

|

|

|

| |

$ 2,584,130

|

|

|

$ 2,885,866

|

|

|

| |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Current installments of long-term debt

|

$ 1,070

|

|

|

$ 188

|

|

|

|

Notes payable to banks

|

14,459

|

|

|

14,860

|

|

|

|

Accounts payable

|

189,349

|

|

|

234,218

|

|

|

|

Accrued expenses

|

169,824

|

|

|

177,437

|

|

|

|

Income taxes payable

|

-

|

|

|

9,967

|

|

|

|

Dividend payable

|

8,889

|

|

|

6,721

|

|

|

|

Total current liabilities

|

383,591

|

|

|

443,391

|

|

|

|

Long-term debt, excluding current installments

|

765,762

|

|

|

479,141

|

|

|

|

Other long-term liabilities

|

290,912

|

|

|

343,531

|

|

|

|

Shareholders' equity

|

1,143,865

|

|

|

1,619,803

|

|

|

| |

$ 2,584,130

|

|

|

$ 2,885,866

|

|

|

| |

|

|

|

|

|

|

|

VALMONT INDUSTRIES, INC. AND SUBSIDIARIES

|

|

SUMMARY OF EFFECT OF SIGNIFICANT NON-RECURRING ITEMS ON REPORTED RESULTS

|

|

REGULATION G RECONCILIATION

|

|

(Dollars in thousands)

|

|

(unaudited)

|

|

The schedule below details the fair value adjustments of the Company's Delta EMD Pty. Ltd (Delta EMD) shares to its quoted market price at each quarter-end and the restructuring expense incurred in 2015. Earnings per share for each item are calculated separately. Therefore the sum of earnings per share amounts for each item below may not agree with the total. We believe it is useful for the non-GAAP adjusted net earnings to be taken into consideration with the reported GAAP measure which is net earnings.

|

| |

Quarter ended March 28, 2015

|

Diluted earnings per share

|

|

Quarter ended March 29, 2014

|

|

Diluted earnings per share

|

|

Net earnings attributable to Valmont Industries, Inc. - as reported

|

$ 30,739

|

$ 1.28

|

|

$ 55,980

|

|

$ 2.08

|

| |

|

|

|

|

|

|

|

Restructuring expenses (pre-tax $785 in 2015)

|

510

|

0.02

|

|

-

|

|

-

|

| |

|

|

|

|

|

|

|

Fair market value adjustment, Delta EMD - after-tax and net of received dividends ($5,000 in 2015 and $0 in 2014)

|

(600)

|

(0.02)

|

|

3,386

|

|

0.13

|

| |

|

|

|

|

|

|

|

Net earnings attributable to Valmont Industries, Inc. - Adjusted

|

$ 30,649

|

$ 1.28

|

|

$ 59,366

|

|

$ 2.20

|

| |

|

|

|

|

|

|

| |

-end-

|

|

|

|

|

|

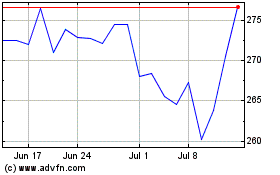

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valmont Industries (NYSE:VMI)

Historical Stock Chart

From Apr 2023 to Apr 2024