UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, DC 20549

________________________________________

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 1, 2016

VULCAN MATERIALS COMPANY

(Exact name of registrant as specified in

its charter)

| New Jersey |

|

001-33841 |

|

20-8579133 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification

No.) |

1200 Urban Center Drive

Birmingham, Alabama 35242

(Address of principal executive offices) (zip

code)

(205) 298-3000

Registrant’s telephone number, including

area code:

Not Applicable

(Former name or former address if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. | Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective as of January

1, 2016, Vulcan Materials Company (“Vulcan”) entered into Change of Control Employment Agreements (the “Employment

Agreements”) with each of: (a) J. Thomas Hill, President and Chief Executive Officer; (b) John R. McPherson, Executive Vice

President and Chief Financial and Strategy Officer; (c) Michael R. Mills, Senior Vice President and General Counsel; and (d) Stanley

G. Bass, Senior Vice President – Western and Mountain West Divisions.

Each of the Employment

Agreements covers a term of three years and will be automatically extended annually for subsequent three-year terms unless Vulcan

gives prior notice of non-extension. In the event of a change of control, each Employment Agreement entitles the executive to continued

employment with Vulcan for two years following the change of control, during which time period the executive will continue to hold

a position and duties, and receive compensation and benefits, commensurate with the practices in effect during the four-month period

prior to the change of control. Severance benefits under each Employment Agreement will be payable following a qualifying termination

(termination by the executive for good reason or by Vulcan without cause) that occurs within two years following (or prior to,

but in connection with) a change of control. A change of control is defined to include: (a) the acquisition of 30% or more of the

outstanding Vulcan stock or voting power by an individual, entity or group; (b) a change in the majority of the board of directors

of Vulcan that is not endorsed by the incumbent board of directors; and (c) consummation of a reorganization, merger, consolidation

or similar corporate transaction that results in a new group holding at least 50% of the beneficial ownership of the outstanding

Vulcan stock or voting power. Following a qualifying termination in connection with a change of control, each Employment Agreement

entitles the executive to receive:

| (a) | accrued obligations through the date of termination for all base salary, prior period annual incentive

payments, accrued vacation, and business expenses, in each case to the extent earned and not previously paid; |

| (b) | a pro rata annual bonus for the fiscal year during which termination occurs; |

| (c) | payment equal to a multiplier of 3 times the sum of (1) the executive’s annual base salary

and (2) the higher of the current full year annual bonus amount or the average bonus amount for the three prior fiscal years; |

| (d) | an amount equal to Vulcan contributions that would have been made on the executive’s behalf

under the Vulcan 401(k) Plan or Unfunded Supplemental Benefit Plan for 3 years following termination; |

| (e) | healthcare benefits for 3 years following termination; and |

| (f) | outplacement services in an amount not to exceed $50,000. |

The foregoing description

of the Employment Agreements is qualified in its entirety by reference to the full text of the form of Employment Agreement, which

is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Effective January 1,

2016, Vulcan terminated the previous Form Change of Control Agreement (Double Trigger) with senior executives previously filed

on a Current Report on Form 8-K on October 2, 2008, and Vulcan also terminated the previous Change of Control and Noncompetition

Agreement with Mr. McPherson dated October 7, 2011 previously filed on a Current Report on Form 8-K on October 11, 2011.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Form Change of Control Employment Agreement Dated January 1, 2016. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Vulcan Materials Company |

| |

|

|

| |

By: |

/s/ Michael R. Mills |

| |

|

Name: Michael R. Mills |

| |

|

Title: Sr. Vice President and General Counsel |

Date: January 7, 2016

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Form Change of Control Employment Agreement Dated January 1, 2016. |

EXHIBIT 10.1

FORM

CHANGE OF CONTROL EMPLOYMENT AGREEMENT FOR TOM HILL, JOHN McPHERSON, MICHAEL MILLS AND STAN BASS

CHANGE OF CONTROL EMPLOYMENT

AGREEMENT, dated as of the 1st day of January, 2016, (this “Agreement”), by

and between, Vulcan Materials Company, a New Jersey corporation (the “Company”), and [Name of Executive]

(the “Executive”).

WHEREAS, the Company

has previously entered into a Change of Control and non-Competition Agreement with the Executive dated as of [Date of Previous

Agreement] (the “Prior Agreement”);

WHEREAS, the Board of

Directors of the Company (the “Board”) continues to believe that it is in the best interests of the Company

and its shareholders to assure that the Company will have the continued dedication of the Executive, notwithstanding the possibility,

threat or occurrence of a Change of Control (as defined herein) and that it is imperative to diminish the inevitable distraction

of the Executive by virtue of the personal uncertainties and risks created by a pending or threatened Change of Control, to encourage

the Executive’s full attention and dedication to the Company in the event of any threatened or pending Change of Control,

to provide the Executive with compensation and benefits arrangements upon a Change of Control that ensure that the compensation

and benefits expectations of the Executive will be satisfied and provide the Executive with compensation and benefits arrangements

that are competitive with those of other corporations

WHEREAS, in order to

accomplish these objectives, the Board has determined to enter into this Agreement, which shall supersede and replace the Prior

Agreement effective as of the day first written above.

NOW, THEREFORE, IT IS HEREBY AGREED AS FOLLOWS:

Section 1. Certain

Definitions.

(a) “Effective

Date” means the first date during the Change of Control Period (as defined herein) on which a Change of Control occurs.

Notwithstanding anything in this Agreement to the contrary, if (A) the Executive’s employment with the Company is terminated

by the Company, (B) the Date of Termination is prior to the date on which a Change of Control occurs, and (C) it is reasonably

demonstrated by the Executive that such termination of employment (i) was at the request of a third party that has taken steps

reasonably calculated to effect a Change of Control or (ii) otherwise arose in connection with or anticipation of a Change of Control,

then for all purposes of this Agreement, the “Effective Date” means the date immediately prior to such Date of Termination.

(b) “Change

of Control Period” means the period commencing on the date hereof and ending on the third anniversary of the date hereof;

provided, however, that, commencing on the date one year after the date hereof, and on each annual anniversary of

such date (such date and each annual anniversary thereof, the “Renewal Date”), unless previously terminated,

the Change of Control Period shall be automatically extended so as to terminate three years from such Renewal Date, unless, at

least 60 days prior to the Renewal Date, the Company shall give notice to the Executive that the Change of Control Period shall

not be so extended.

(c) “Affiliated

Entity” means any entity controlled by, controlling or under common control with the Company.

(d) “Change

of Control” means the first to occur of the following:

(1) The

acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”)) (a “Person”) of beneficial ownership (within

the meaning of Rule 13d-3 promulgated under the Exchange Act) of 30% or more of either (i) the then-outstanding shares

of common stock of the Company (the “Outstanding Company Common Stock”) or (ii) the combined voting power

of the then-outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding

Company Voting Securities”); provided, however, that for purposes of this Section 1(d)(1), the

following acquisitions shall not constitute a Change of Control: (i) any acquisition directly from the Company; (ii) any

acquisition by the Company; (iii) any acquisition by any employee benefit plan (or related trust) sponsored or maintained

by the Company or any Affiliated Entity; or (iv) any acquisition by any entity pursuant to a transaction which complies with

clauses (i), (ii) and (iii) of Section 1(d)(3); or

(2) Individuals

who, as of the date hereof, constitute the Board (the “Incumbent Board”) cease for any reason to constitute

at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the date

hereof whose election, or nomination for election by the Company’s shareholders, was approved by a vote of at least a majority

of the directors then comprising the Incumbent Board shall be considered as though such individual was a member of the Incumbent

Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual

or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation

of proxies or consents by or on behalf of a Person other than the Board; or

(3) Consummation

of a reorganization, merger or consolidation or similar corporate transaction involving the Company or any of its subsidiaries,

a sale or other disposition of all or substantially all of the assets of the Company, or the acquisition of assets or stock of

another entity by the Company or any of its subsidiaries (each, a “Business Combination”), in each case, unless,

following such Business Combination, (i) all or substantially all of the individuals and entities that were the beneficial

owners, respectively, of the Outstanding Company Common Stock and the Outstanding Company Voting Securities immediately prior to

such Business Combination beneficially own, directly or indirectly, more than 50% of, respectively, the then-outstanding shares

of common stock (or, for a noncorporate entity, equivalent securities) and the combined voting power of the then-outstanding voting

securities entitled to vote generally in the election of directors (or, for a noncorporate entity, equivalent governing body),

as the case may be, of the entity resulting from such Business Combination (including, without limitation, an entity that, as a

result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through

one or more subsidiaries) in substantially the same proportions as their ownership, immediately prior to such Business Combination,

of the Outstanding Company Common Stock and the Outstanding Company Voting Securities, as the case may be, (ii) no Person

(excluding any entity resulting from such Business Combination or any employee benefit plan (or related trust) of the Company or

such entity resulting from such Business Combination) beneficially owns, directly or indirectly, 30% or more of, respectively,

the then-outstanding shares of common stock (or, for a noncorporate entity, equivalent securities) of the entity resulting from

such Business Combination or the combined voting power of the then-outstanding voting securities of such entity except to the extent

that such ownership existed prior to the Business Combination, and (iii) at least a majority of the members of the board of

directors (or, for a noncorporate entity, equivalent governing body) of the entity resulting from such Business Combination were

members of the Incumbent Board at the time of the execution of the initial agreement, or of the action of the Board, providing

for such Business Combination; or

(4) Approval

by the shareholders of the Company of a complete liquidation or dissolution of the Company.

Section 2. Employment

Period. The Company hereby agrees to continue the Executive in its employ, subject to the terms and conditions of this

Agreement, for the period commencing on the Effective Date and ending on the second anniversary of the Effective Date (the “Employment

Period”). The Employment Period shall terminate upon the Executive’s termination of employment for any reason.

Section

3. Terms of Employment. (a) Position and

Duties. (1) During the Employment Period, (A) the Executive’s position (including status, offices, titles and

reporting requirements), authority, duties and responsibilities shall be at least commensurate in all respects with the most

significant of those held, exercised and assigned at any time during the 120-day period immediately preceding the Effective

Date, (B) the Executive’s services shall be performed at the office where the Executive was employed immediately

preceding the Effective Date or at any other location less than 35 miles from such office, and (C) the Executive shall

not be required to travel on Company business to a substantially greater extent than required during the 120-day

period immediately prior to the Effective Date. During the Employment Period, and excluding any periods of vacation and sick

leave to which the Executive is entitled, the Executive agrees to devote reasonable attention and time during normal business

hours to the business and affairs of the Company and, to the extent necessary to discharge the responsibilities assigned to

the Executive hereunder, to use the Executive’s reasonable best efforts to perform faithfully and efficiently such

responsibilities. During the Employment Period, it shall not be a violation of this Agreement for the Executive to (A) serve

on corporate, civic or charitable boards or committees, (B) deliver lectures, fulfill speaking engagements or teach at

educational institutions, and (C) manage personal investments, so long as such activities do not significantly interfere with

the performance of the Executive’s responsibilities as an employee of the Company in accordance with this Agreement. It

is expressly understood and agreed that, to the extent that any such activities have been conducted by the Executive prior to

the Effective Date, the continued conduct of such activities (or the conduct of activities similar in nature and scope

thereto) subsequent to the Effective Date shall not thereafter be deemed to interfere with the performance of the

Executive’s responsibilities to the Company.

(b) Compensation.

(1) Base Salary. During the Employment Period, the Executive shall receive an annual base salary (the “Annual

Base Salary”) at an annual rate at least equal to 12 times the highest monthly base salary paid or payable, including

any base salary that has been earned but deferred, to the Executive by the Company and the Affiliated Entities in respect of the

one-year period immediately preceding the month in which the Effective Date occurs. The Annual Base Salary shall be paid at such

intervals as the Company pays executive salaries generally. During the Employment Period, the Annual Base Salary shall be reviewed

at least annually, beginning no more than 12 months after the last salary increase awarded to the Executive prior to the Effective

Date. Any increase in the Annual Base Salary shall not serve to limit or reduce any other obligation to the Executive under this

Agreement. The Annual Base Salary shall not be reduced after any such increase and the term “Annual Base Salary” shall

refer to the Annual Base Salary as so increased.

(2) Annual

Bonus. In addition to Annual Base Salary, the Executive shall be awarded, for each fiscal year ending during the Employment

Period, an annual bonus (the “Annual Bonus”) in cash at least equal to the greater of (A) the average of

the Executive’s bonuses under the Company’s Management Incentive Plan, or any comparable bonus under any predecessor

or successor plan (the “Bonus Plan”), for the last three full fiscal years prior to the Effective Date (or such

shorter period of employment of the Executive) and (B) the Executive’s annual bonus under the Bonus Plan, determined

based on the target annual bonus percentage in effect with respect to the Executive immediately prior to the Change of Control

for the fiscal year in which the Change of Control occurs or, if no such target annual bonus percentage has been established for

such year, the target annual bonus percentage established for the fiscal year ending immediately prior to the Effective Date (such

higher amount, the “Recent Annual Bonus”). For purposes of any determinations hereunder, any bonus amounts shall

be annualized in the event that the Executive was not employed by the Company for the whole of any such fiscal year and, to the

extent relevant to such determination, shall be based on the Executive’s Annual Base Salary. Each such Annual Bonus shall

be paid no later than two and a half months after the end of the fiscal year for which the Annual Bonus is awarded, unless the

Executive shall elect to defer the receipt of such Annual Bonus pursuant to an arrangement that meets the requirements of Section

409A of the Internal Revenue Code of 1986, as amended (the “Code”).

(3) Long-Term

Cash and Equity Incentives, Savings and Retirement Plans. During the Employment Period, the Executive shall be entitled

to participate in all long-term cash incentive, equity incentive, savings and retirement plans, practices, policies and programs

applicable generally to other peer executives of the Company and the Affiliated Entities, but in no event shall such plans, practices,

policies and programs provide the Executive with incentive opportunities (measured with respect to both regular and special incentive

opportunities, to the extent, if any, that such distinction is applicable), savings opportunities and retirement benefit opportunities,

in each case, less favorable, in the aggregate, than the most favorable of those provided by the Company and the Affiliated Entities

for the Executive under such plans, practices, policies and programs as in effect at any time during the 120-day period immediately

preceding the Effective Date or, if more favorable to the Executive, those provided generally at any time after the Effective Date

to other peer executives of the Company and the Affiliated Entities.

(4) Welfare

Benefit Plans. During the Employment Period, the Executive and/or the Executive’s family, as the case may be, shall

be eligible for participation in and shall receive all benefits under welfare benefit plans, practices, policies and programs provided

by the Company and the Affiliated Entities (including, without limitation, medical, prescription, dental, disability, employee

life, group life, accidental death and travel accident insurance plans and programs) to the extent applicable generally to other

peer executives of the Company and the Affiliated Entities, but in no event shall such plans, practices, policies and programs

provide the Executive with benefits that are less favorable, in the aggregate, than the most favorable of such plans, practices,

policies and programs in effect for the Executive at any time during the 120-day period immediately preceding the Effective Date

or, if more favorable to the Executive, those provided generally at any time after the Effective Date to other peer executives

of the Company and the Affiliated Entities.

(5) Expenses.

During the Employment Period, the Executive shall be entitled to receive prompt reimbursement for all reasonable expenses incurred

by the Executive in accordance with the most favorable policies, practices and procedures of the Company and the Affiliated Entities

in effect for the Executive at any time during the 120-day period immediately preceding the Effective Date or, if more favorable

to the Executive, as in effect generally at any time thereafter with respect to other peer executives of the Company and the Affiliated

Entities.

(6) Fringe

Benefits. During the Employment Period, the Executive shall be entitled to fringe benefits, including, without limitation,

tax and financial planning services, payment of club dues and, if applicable, use of an automobile and payment of related expenses,

in accordance with the most favorable plans, practices, programs and policies of the Company and the Affiliated Entities in effect

for the Executive at any time during the 120-day period immediately preceding the Effective Date or, if more favorable to the Executive,

as in effect generally at any time thereafter with respect to other peer executives of the Company and the Affiliated Entities.

(7) Office

and Support Staff. During the Employment Period, the Executive shall be entitled to an office or offices of a size and

with furnishings and other appointments, and to personal secretarial and other assistance, at least equal to the most favorable

of the foregoing provided to the Executive by the Company and the Affiliated Entities at any time during the 120-day period immediately

preceding the Effective Date or, if more favorable to the Executive, as provided generally at any time thereafter with respect

to other peer executives of the Company and the Affiliated Entities.

(8) Vacation.

During the Employment Period, the Executive shall be entitled to paid vacation in accordance with the most favorable plans, policies,

programs and practices of the Company and the Affiliated Entities as in effect for the Executive at any time during the 120-day

period immediately preceding the Effective Date or, if more favorable to the Executive, as in effect generally at any time thereafter

with respect to other peer executives of the Company and the Affiliated Entities.

Section 4. Termination

of Employment. (a) Death or Disability. The Executive’s employment shall terminate automatically if

the Executive dies during the Employment Period. If the Company determines in good faith that the Disability (as defined herein)

of the Executive has occurred during the Employment Period (pursuant to the definition of “Disability”), it may give

to the Executive written notice, in accordance with Section 11(b), of its intention to terminate the Executive’s employment.

In such event, the Executive’s employment with the Company shall terminate effective on the 30th day after receipt of such

notice by the Executive (the “Disability Effective Date”); provided that, within the 30 days after such

receipt, the Executive shall not have returned to full-time performance of the Executive’s duties. “Disability”

means the absence of the Executive from the Executive’s duties with the Company on a full-time basis for 180 consecutive

business days as a result of incapacity due to mental or physical illness that is determined to be total and permanent by a physician

selected by the Company or its insurers and acceptable to the Executive or the Executive’s legal representative.

(b) Cause.

The Company may terminate the Executive’s employment during the Employment Period with or without Cause. “Cause”

means:

(1) the

willful and continued failure of the Executive to perform substantially the Executive’s duties (as contemplated by Section

3(a)(1)(A)) with the Company or any Affiliated Entity (other than any such failure resulting from incapacity due to physical or

mental illness or following the Executive’s delivery of a Notice of Termination for Good Reason), after a written demand

for substantial performance is delivered to the Executive by the Board, or if the Company is not the ultimate parent corporation

of the Affiliated Entities and is not publicly traded, the board of directors of the ultimate parent of the Company (the “Applicable

Board”), which specifically identifies the manner in which the Board believes that the Executive has not substantially

performed the Executive’s duties; or

(2) the

willful engaging by the Executive in illegal conduct which is materially and demonstrably injurious to the Company.

For purposes of this provision, no act

or failure to act, on the part of the Executive, shall be considered “willful” unless it is done, or omitted to be

done, by the Executive in bad faith or without reasonable belief that the Executive’s action or omission was in the best

interests of the Company. Any act, or failure to act, based upon (A) authority given pursuant to a resolution duly adopted

by the Applicable Board, (B) the instructions of the Chief Executive Officer or another executive officer of the Company or

(C) the advice of counsel for the Company, shall be conclusively presumed to be done, or omitted to be done, by the Executive

in good faith and in the best interests of the Company. The cessation of employment of the Executive shall not be deemed to be

for Cause unless and until there shall have been delivered to the Executive a copy of a resolution duly adopted by the affirmative

vote of not less than three-quarters of the entire membership of the Applicable Board (excluding the Executive, if the Executive

is a member of the Applicable Board) at a meeting of the Applicable Board called and held for such purpose (after reasonable notice

is provided to the Executive and the Executive is given an opportunity, together with counsel for the Executive, to be heard before

the Applicable Board), finding that, in the good faith opinion of the Applicable Board, the Executive is guilty of the conduct

described in Section 4(b)(1) or 4(b)(2), and specifying the particulars thereof in detail.

(c) Good

Reason. The Executive’s employment may be terminated during the Employment Period by the Executive for Good Reason

or by the Executive voluntarily without Good Reason. “Good Reason” means actions taken by the Company resulting

in a material negative change in the employment relationship. For these purposes, a “material negative change in the employment

relationship” shall include, without limitation:

(1) a

reduction of the Executive’s Annual Base Salary;

(2) a

material breach of Section 3(b) of this Agreement, which shall include, without limitation, a material reduction in the Executive’s

(i) Annual Bonus from the Recent Annual Bonus, (ii) target or maximum Annual Bonus opportunity, (iii) annual long-term incentive

compensation (cash and equity awards), including target or maximum incentive opportunity, or (iv) retirement, welfare, fringe

and other benefits provided or made available to the Executive, in the case of each of clauses (ii) through (iv), from those

contemplated by Section 3(b) of this Agreement;

(3) a

material diminution in the Executive’s authority, duties or responsibilities from those contemplated by Section 3(a) of this

Agreement or a material diminution in the authority, duties, or responsibilities of the supervisor to whom the Executive is required

to report from those in effect immediately prior to the Effective Date, including, without limitation, and where relevant, a requirement

that the Executive report to an officer or employee instead of reporting directly to the Board of the Company (or if the Company

is a subsidiary of another entity, its ultimate parent);

(4) a

change in the geographic location at which the Executive must perform services of more than 35 miles from the location the Executive

was required to perform services immediately prior to the Effective Date;

(5) a

material diminution in the budget over which the Executive retains authority from that in effect immediately prior to the Effective

Date; or

(6) any

other action or inaction that constitutes a material breach by the Company of this Agreement, including any failure by the Company

to comply with and satisfy Section 10(c).

In order to invoke a

termination for Good Reason, the Executive shall provide written notice to the Company of the existence of one or more of the conditions

described in clauses (1) through (6) within 90 days following the Executive’s knowledge of the initial existence of

such condition or conditions, specifying in reasonable detail the conditions constituting Good Reason, and the Company shall have

30 days following receipt of such written notice (the “Cure Period”) during which it may remedy the condition.

In the event that the Company fails to remedy the condition constituting Good Reason during the applicable Cure Period, the Executive’s

“separation from service” (within the meaning of Section 409A of the Code) must occur, if at all, within 180 days following

such Cure Period in order for such termination as a result of such condition to constitute a termination for Good Reason. The Executive’s

mental or physical incapacity following the occurrence of an event described above in clauses (1) through (6) shall not affect

the Executive’s ability to terminate employment for Good Reason and the Executive’s death following delivery of a Notice

of Termination for Good Reason shall not affect the Executive’s estate’s entitlement to severance payments benefits

provided hereunder upon a termination of employment for Good Reason.

(d) Notice

of Termination. Any termination of employment by the Company for Cause, or by the Executive for Good Reason, shall be communicated

by a Notice of Termination to the other party hereto given in accordance with Section 11(b). “Notice of Termination”

means a written notice that (1) indicates the specific termination provision in this Agreement relied upon, (2) to the extent applicable,

sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s

employment under the provision so indicated, and (3) if the Date of Termination (as defined herein) is other than the date of receipt

of such notice, specifies the Date of Termination (which Date of Termination shall be not more than 30 days after the giving of

such notice except in the case of a termination for Good Reason, notice shall be not more than 90 days before the termination date)

(subject to the Company’s right to cure in the case of a resignation for Good Reason). The failure by the Executive or the

Company to set forth in the Notice of Termination any fact or circumstance that contributes to a showing of Good Reason or Cause

shall not waive any right of the Executive or the Company, respectively, hereunder or preclude the Executive or the Company, respectively,

from asserting such fact or circumstance in enforcing the Executive’s or the Company’s respective rights hereunder.

(e) Date

of Termination. “Date of Termination” means (1) if the Executive’s employment is terminated by

the Company for Cause, or by the Executive for Good Reason, the date of receipt of the Notice of Termination or such later date

specified in the Notice of Termination, as the case may be, (2) if the Executive’s employment is terminated by the Company

other than for Cause or Disability, the date on which the Company notifies the Executive of such termination, (3) if the Executive

resigns without Good Reason, the date on which the Executive notifies the Company of such termination, and (4) if the Executive’s

employment is terminated by reason of death or Disability, the date of death of the Executive or the Disability Effective Date,

as the case may be. In no event shall the Date of Termination occur until the Executive experiences a “separation from service”

within the meaning of Section 409A of the Code, and the date on which such separation from service takes place shall be the “Date

of Termination.”

Section 5. Obligations

of the Company upon Termination. (a) By the Executive for Good Reason; By the Company Other Than for Cause, Death

or Disability. If, during the Employment Period, the Company terminates the Executive’s employment other than for

Cause, Death or Disability or the Executive terminates employment for Good Reason:

(1) the

Company shall pay to the Executive, in a lump sum payment in cash within 30 days after the Date of Termination equal to the aggregate

of the following amounts:

(A) the

sum of (i) the Executive’s Annual Base Salary through the Date of Termination, (ii) any Annual Bonus earned by

the Executive for a prior award period, (iii) any accrued and unused vacation pay or other paid time off, and (iv) any

business expenses incurred by the Executive that are unreimbursed as of the Date of Termination, in each case to the extent not

theretofore paid (the sum of the amounts described in clauses (i), (ii), (iii) and (iv) shall be hereinafter referred to as

the “Accrued Obligations”); provided that, notwithstanding the foregoing, in the case of clauses (i)

and (ii), if the Executive has made an irrevocable election under any deferred compensation arrangement subject to Section 409A

of the Code to defer any portion of the Annual Base Salary or Annual Bonus described in clause (i) or (ii) above, then for all

purposes of this Section 5 (including, without limitation, Sections 5(b) through 5(d)), such deferral election, and the terms of

the applicable arrangement shall apply to the same portion of the amount described in such clauses (i) or (ii), and such portion

shall not be considered as part of the “Accrued Obligations” but shall instead be an “Other Benefit” (as

defined below);

(B) the

product of (i) the higher of (a) the Annual Bonus under the Bonus Plan for the full fiscal year in which the Date of

Termination occurs, determined based on actual individual and corporate performance through the Date of Termination, and (b) the

Recent Annual Bonus and (ii) a fraction, the numerator of which is the number of days in the current fiscal year through the

Date of Termination, and the denominator of which is the total number of days in the applicable fiscal year in which the Date of

Termination occurs (the “Pro Rata Bonus”), subject to any applicable deferral election on the same basis as

set forth in the proviso to Section 5(a)(1)(A);

(C) the

amount equal to the product of (i) three (3) and (ii) the sum of (a) the Executive’s Annual Base Salary and

(b) the higher of (x) the annual bonus under the Bonus Plan for the full fiscal year in which the Date of Termination

occurs, determined based on actual individual and corporate performance through the Date of Termination, and (y) the Recent

Annual Bonus; and

(D) an

amount equal to the additional Company contributions, including matching contributions, profit sharing and discretionary contributions,

that would have been made on the Executive’s behalf to the Company’s 401(k) Plan or any successor plan (the “401(k)

Plan”) (assuming continued participation on the same basis as immediately prior to the Effective Date), plus the additional

amount of any contributions the Executive would have received under the Unfunded Supplemental Benefit Plan or its successor plan

or any other excess or supplemental retirement plan in which the Executive participates (together, the “SERP”)

as a result of contribution limitations in the 401(k) Plan, if the Executive’s employment continued for three (3) years after

the Date of Termination (the “Benefit Continuation Period”), assuming for this purpose that the Executive’s

compensation during the Benefit Continuation Period is the Executive’s Annual Base Salary and Recent Annual Bonus and that

the Company’s matching contributions are determined pursuant to the applicable provisions of the 401(k) Plan and the SERP,

as in effect during the 12-month period immediately prior to the Effective Date.

(2) Healthcare

Benefits. For the Benefit Continuation Period, or such longer period as may be provided by the terms of the appropriate

plan, program, practice or policy, the Company shall continue to provide to the Executive and/or the Executive’s eligible

dependents healthcare benefits at least equal to those that would have been provided to them if the Executive’s employment

had not been terminated, under and in accordance with the healthcare plans provided by the Company and the Affiliated Entities

prior to the Effective Date (including, without limitation, medical, prescription, dental, vision plans and programs) or, if more

favorable to the Executive, as in effect generally at any time thereafter with respect to other peer executives of the Company

and the Affiliated Entities and their eligible dependents; provided, however, that if the Executive becomes reemployed

with another employer and is eligible to receive healthcare benefits under another employer-provided plan, the healthcare benefits

provided hereunder shall be secondary to those provided under such other plan during such applicable period of eligibility. The

Benefit Continuation Period shall run concurrently with the period for providing continuation coverage under the group health plans

of the Company and the Affiliated Entities, as described in Section 4980B of the Code. For purposes of determining eligibility

(but not the time of commencement of benefits) of the Executive for retiree benefits pursuant to such plans, practices, programs

and policies, the Executive shall be considered to have remained employed during the Benefit Continuation Period and to have retired

on the last day of such period.

(3) Automobile.

Upon the Date of Termination, the Executive shall have the right and option to purchase the automobile which the Company was providing

to the Executive immediately prior to the Date of Termination in accordance with the Company’s practice for retiring employees

as in effect immediately prior to the Effective Date (provided that, to the extent such option results in a benefit that

is includable in the Executive’s gross income for federal income tax purposes, such purchase must occur no later than the

15th day of the third month following the end of the Executive’s taxable year in which the Date of Termination occurs).

(4) Outplacement

Services. The Company shall, at its sole expense as incurred, provide the Executive with outplacement services, the scope

and provider of which shall be selected by the Executive in the Executive’s sole discretion; provided that the aggregate

cost of such services shall not exceed $50,000.

(5) Other

Benefits. Except as otherwise set forth in the last sentence of Section 6, to the extent not theretofore paid or provided,

the Company shall timely pay or provide to the Executive any Other Benefits (as defined in Section 6) in accordance with the terms

of the underlying plans or agreements.

(b) Death.

If the Executive’s employment is terminated by reason of the Executive’s death during the Employment Period, the Company

shall provide the Executive’s estate or beneficiaries with the Accrued Obligations, the Pro Rata Bonus and the timely payment

or delivery of the Other Benefits, and shall have no other severance obligations under this Agreement. The Accrued Obligations

and the Pro Rata Bonus shall be paid to the Executive’s estate or beneficiary, as applicable, in a lump sum in cash within

30 days of the Date of Termination, subject to any applicable deferral election as contemplated by Sections 5(a)(1)(A) and (B).

With respect to the provision of the Other Benefits, the term “Other Benefits” as utilized in this Section 5(b) shall

include, without limitation, and the Executive’s estate and/or beneficiaries shall be entitled to receive, benefits at least

equal to the most favorable benefits provided by the Company and the Affiliated Entities to the estates and beneficiaries of peer

executives of the Company and the Affiliated Entities under such plans, programs, practices and policies relating to death benefits,

if any, as in effect with respect to other peer executives and their beneficiaries at any time during the 120-day period immediately

preceding the Effective Date or, if more favorable to the Executive’s estate and/or the Executive’s beneficiaries,

as in effect on the date of the Executive’s death with respect to other peer executives of the Company and the Affiliated

Entities and their beneficiaries.

(c) Disability.

If the Executive’s employment is terminated by reason of the Executive’s Disability during the Employment Period, the

Company shall provide the Executive with the Accrued Obligations, the Pro Rata Bonus and the timely payment or delivery of the

Other Benefits in accordance with the terms of the underlying plans or agreements, and shall have no other severance obligations

under this Agreement. The Accrued Obligations and the Pro Rata Bonus shall be paid to the Executive in a lump sum in cash within

30 days of the Date of Termination, subject to any applicable deferral election as contemplated by Sections 5(a)(1)(A) and (B).

With respect to the provision of the Other Benefits, the term “Other Benefits” as utilized in this Section 5(c) shall

include, and the Executive shall be entitled after the Disability Effective Date to receive, disability and other benefits at least

equal to the most favorable of those generally provided by the Company and the Affiliated Entities to disabled executives and/or

their families in accordance with such plans, programs, practices and policies relating to disability, if any, as in effect generally

with respect to other peer executives and their families at any time during the 120-day period immediately preceding the Effective

Date or, if more favorable to the Executive and/or the Executive’s family, as in effect at any time thereafter generally

with respect to other peer executives of the Company and the Affiliated Entities and their families.

(d) Cause;

Other Than for Good Reason. If the Executive’s employment is terminated for Cause during the Employment Period, the

Company shall provide the Executive with the Accrued Obligations and the timely payment or delivery of the Other Benefits and shall

have no other severance obligations under this Agreement. If the Executive voluntarily terminates employment during the Employment

Period, excluding a termination for Good Reason, the Company shall provide to the Executive the Accrued Obligations, the Pro Rata

Bonus and the timely payment or delivery of the Other Benefits and shall have no other severance obligations under this Agreement.

In such case, all the Accrued Obligations and, if applicable, the Pro Rata Bonus shall be paid to the Executive in a lump sum in

cash within 30 days of the Date of Termination, subject to any applicable deferral election as contemplated by Sections 5(a)(1)(A)

and (B).

Section 6. Non-exclusivity

of Rights. Nothing in this Agreement shall prevent or limit the Executive’s continuing or future participation in

any plan, program, policy or practice provided by the Company or the Affiliated Entities and for which the Executive may qualify,

or, subject to Section 11(f), shall anything herein limit or otherwise affect such rights as the Executive may have under any other

contract or agreement with the Company or the Affiliated Entities. Amounts that are vested benefits or that the Executive is otherwise

entitled to receive under any plan, policy, practice or program of or any other contract or agreement with the Company or the Affiliated

Entities at or subsequent to the Date of Termination, including amounts credited to the Executive’s account under the Executive

Deferred Compensation Plan or any successor plan (“Other Benefits”), shall be payable in accordance with such

plan, policy, practice or program or contract or agreement, except as explicitly modified by this Agreement. Without limiting the

generality of the foregoing, the Executive’s resignation under this Agreement with or without Good Reason, shall in no way

affect the Executive’s ability to terminate employment by reason of the Executive’s “retirement” under,

or to be eligible to receive benefits under, any compensation and benefits plans, programs or arrangements of the Company or the

Affiliated Entities, including, without limitation, any retirement or pension plans or arrangements or substitute plans adopted

by the Company, the Affiliated Entities or their respective successors, and any termination which otherwise qualifies as Good Reason

shall be treated as such even if it is also a “retirement” for purposes of any such plan. Notwithstanding the foregoing,

if the Executive receives payments and benefits pursuant to Section 5(a) of this Agreement, the Executive shall not be entitled

to any severance pay or benefits under any severance plan, program or policy of the Company and the Affiliated Entities, unless

otherwise specifically provided therein in a specific reference to this Agreement.

Section 7. Full

Settlement; Legal Fees. The Company’s obligation to make the payments provided for in this Agreement and otherwise

to perform its obligations hereunder shall not be affected by any set-off, counterclaim, recoupment, defense or other claim, right

or action that the Company may have against the Executive or others. In no event shall the Executive be obligated to seek other

employment or take any other action by way of mitigation of the amounts payable to the Executive under any of the provisions of

this Agreement, and except as specifically provided in Section 5(a)(2), such amounts shall not be reduced whether or not the Executive

obtains other employment. The Company agrees to pay as incurred (within 10 days following the Company’s receipt of an invoice

from the Executive), at any time from the Change of Control through the Executive’s remaining lifetime (or, if longer, through

the 20th anniversary of the Change of Control) to the full extent permitted by law, all legal fees and expenses that the Executive

may reasonably incur as a result of any contest (regardless of the outcome thereof) by the Company, the Executive or others of

the validity or enforceability of, or liability under, any provision of this Agreement or any guarantee of performance thereof

(including as a result of any contest by the Executive about the amount of any payment pursuant to this Agreement), plus, in each

case, interest on any delayed payment at the applicable federal rate provided for in Section 7872(f)(2)(A) of the Code (“Interest”)

based on the rate in effect for the month in which such legal fees and expenses were incurred.

Section 8. Certain

Reduction of Payments.

(a) Anything

in this Agreement to the contrary notwithstanding, in the event the Accounting Firm (as defined below) shall determine that receipt

of all Payments (as defined below) would subject the Executive to the excise tax under Section 4999 of the Code, the Accounting

Firm shall determine whether to reduce any of the Payments paid or payable pursuant to this Agreement (the “Agreement

Payments”) so that the Parachute Value (as defined below) of all Payments, in the aggregate, equals the Safe Harbor Amount

(as defined below). The Agreement Payments shall be so reduced only if the Accounting Firm determines that the Executive would

have a greater Net After-Tax Receipt (as defined below) of aggregate Payments if the Agreement Payments were so reduced. If the

Accounting Firm determines that the Executive would not have a greater Net After-Tax Receipt of aggregate Payments if the Agreement

Payments were so reduced, the Executive shall receive all Agreement Payments to which the Executive is entitled hereunder.

(b) If

the Accounting Firm determines that aggregate Agreement Payments should be reduced so that the Parachute Value of all Payments,

in the aggregate, equals the Safe Harbor Amount, the Company shall promptly give the Executive notice to that effect and a copy

of the detailed calculation thereof. All determinations made by the Accounting Firm under this Section 8 shall be binding

upon the Company and the Executive and shall be made as soon as reasonably practicable and in no event later than 15 days following

the Date of Termination. For purposes of reducing the Agreement Payments so that the Parachute Value of all Payments, in the aggregate,

equals the Safe Harbor Amount, only amounts payable under this Agreement (and no other Payments) shall be reduced. The reduction

of the amounts payable hereunder, if applicable, shall be made by reducing the Agreement Payments and benefits that have a Parachute

Value as follows: Section 5(a)(4); Section 5(a)(1)(D); and Section 5(a)(1)(C), in each case, beginning with payments or benefits

that constitute deferred compensation and reducing first those that are to be paid or provided the farthest in time, based on the

Accounting Firm’s determination. All reasonable fees and expenses of the Accounting Firm shall be borne solely by the Company.

(c) To

the extent requested by the Executive, the Company shall cooperate with the Executive in good faith in valuing, and the Accounting

Firm shall take into account the value of, services provided or to be provided by the Executive (including, without limitation,

the Executive’s agreeing to refrain from performing services pursuant to a covenant not to compete or similar covenant, before,

on or after the date of a change in ownership or control of the Company (within the meaning of Q&A-2(b) of the final regulations

under Section 280G of the Code), such that payments in respect of such services may be considered reasonable compensation

within the meaning of Q&A-9 and Q&A-40 to Q&A-44 of the final regulations under Section 280G of the Code and/or

exempt from the definition of the term “parachute payment” within the meaning of Q&A-2(a) of the final regulations

under Section 280G of the Code in accordance with Q&A-5(a) of the final regulations under Section 280G of the Code.

(d) The

following terms shall have the following meanings for purposes of this Section 8:

(i) “Accounting

Firm” shall mean a nationally recognized certified public accounting firm or other professional organization that is

a certified public accounting firm recognized as an expert in determinations and calculations for purposes of Section 280G

of the Code that is selected by the Company prior to a Change of Control for purposes of making the applicable determinations hereunder

and is reasonably acceptable to the Executive, which firm shall not, without the Executive’s consent, be a firm serving as

accountant or auditor for the individual, entity or group effecting the Change of Control.

(ii) “Net

After-Tax Receipt” shall mean the present value (as determined in accordance with Sections 280G(b)(2)(A)(ii) and 280G(d)(4)

of the Code) of a Payment net of all taxes imposed on the Executive with respect thereto under Sections 1 and 4999 of the Code

and under applicable state and local laws, determined by applying the highest marginal rate under Section 1 of the Code and

under state and local laws which applied to the Executive’s taxable income for the immediately preceding taxable year, or

such other rate(s) as the Accounting Firm determines to be likely to apply to the Executive in the relevant tax year(s).

(iii) “Parachute

Value” of a Payment shall mean the present value as of the date of the change of control for purposes of Section 280G

of the Code of the portion of such Payment that constitutes a “parachute payment” under Section 280G(b)(2) of

the Code, as determined by the Accounting Firm for purposes of determining whether and to what extent the excise tax under Section 4999

of the Code will apply to such Payment.

(iv) “Payment”

shall mean any payment, benefit or distribution in the nature of compensation (within the meaning of Section 280G(b)(2) of

the Code) to or for the benefit of the Executive, whether paid, payable or provided pursuant to this Agreement or otherwise.

(v) “Safe

Harbor Amount” shall mean 2.99 times the Executive’s “base amount,” within the meaning of Section 280G(b)(3)

of the Code.

Section 9. Confidential

Information. The Executive shall hold in a fiduciary capacity for the benefit of the Company all secret or confidential

information, knowledge or data relating to the Company or the Affiliated Entities, and their respective businesses, which information,

knowledge or data shall have been obtained by the Executive during the Executive’s employment by the Company or the Affiliated

Entities and which information, knowledge or data shall not be or become public knowledge (other than by acts by the Executive

or representatives of the Executive in violation of this Agreement). After termination of the Executive’s employment with

the Company, the Executive shall not, without the prior written consent of the Company or as may otherwise be required by law or

legal process (including in connection with any government investigation), communicate or divulge any such information, knowledge

or data to anyone other than the Company and those persons designated by the Company. In no event shall an asserted violation of

the provisions of this Section 9 constitute a basis for deferring or withholding any amounts otherwise payable to the Executive

under this Agreement.

Section 10. Successors.

(a) This

Agreement is personal to the Executive, and, without the prior written consent of the Company, shall not be assignable by the Executive

other than by will or the laws of descent and distribution. This Agreement shall inure to the benefit of and be enforceable by

the Executive’s legal representatives.

(b) This

Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns. Except as provided in Section

10(c), without the prior written consent of the Executive, this Agreement shall not be assignable by the Company.

(c) The

Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially

all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and

to the same extent that the Company would be required to perform it if no such succession had taken place. “Company”

means the Company as hereinbefore defined and any successor to its business and/or assets as aforesaid that assumes and agrees

to perform this Agreement by operation of law or otherwise.

Section 11. Miscellaneous.

(a) This

Agreement shall be governed by and construed in accordance with the laws of the State of New Jersey, without reference to principles

of conflict of laws. The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This

Agreement may not be amended or modified other than by a written agreement executed by the parties hereto or their respective successors

and legal representatives.

(b) All

notices and other communications hereunder shall be in writing and shall be given by hand delivery to the other party or by registered

or certified mail, return receipt requested, postage prepaid, addressed as follows:

if to the

Executive:

At the most recent address on

file at the Company.

if to the

Company:

Vulcan Materials Company

P.O. Box 385014

Birmingham, Alabama 35238-5014

Attention: General Counsel

or to such other address as either party

shall have furnished to the other in writing in accordance herewith. Notice and communications shall be effective when actually

received by the addressee.

(c) The

invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other

provision of this Agreement.

(d) The

Company may withhold from any amounts payable under this Agreement such United States federal, state or local or foreign taxes

as shall be required to be withheld pursuant to any applicable law or regulation.

(e) The

Executive’s or the Company’s failure to insist upon strict compliance with any provision of this Agreement or the failure

to assert any right the Executive or the Company may have hereunder, including, without limitation, the right of the Executive

to terminate employment for Good Reason pursuant to Sections 4(c)(1) through 4(c)(6), shall not be deemed to be a waiver of such

provision or right or any other provision or right of this Agreement.

(f) The

Executive and the Company acknowledge that, except as may otherwise be provided under any other written agreement between the Executive

and the Company, the employment of the Executive by the Company is “at will” and, subject to Section 1(a), the Executive’s

employment may be terminated by either the Executive or the Company at any time prior to the Effective Date, in which case the

Executive shall have no further rights under this Agreement. From and after the Effective Date, this Agreement shall supersede

the Prior Agreement.

(g) Grantor

Trust. The Company may establish a trust with a bank trustee, for the purpose of paying benefits under this Agreement.

If so established, the trust shall be a grantor trust subject to the claims of the Company’s creditors and may, immediately

prior to a Change of Control, be funded in cash, common stock of the Company or such other assets as the Company deems appropriate

with an amount equal to 100 percent of the aggregate benefits payable under this Agreement, assuming that the Executive incurred

a termination of employment entitling such Executive to the benefits under Section 5, or such lesser amount as the Company

shall determine prior to the Change of Control; provided, however, that the trust shall not be funded with respect

to the Executive if the funding thereof would result in taxable income to the Executive by reason of Section 409A(b) of the

Code; and provided, further, that in no event shall any trust assets at any time be located or transferred outside

of the United States, within the meaning of Section 409A(b) of the Code. Notwithstanding the establishment of any such trust,

the Executive’s rights hereunder will be solely those of a general unsecured creditor.

Section 12. Section

409A of the Code.

(a) General.

The obligations under this Agreement are intended to comply with the requirements of Section 409A of the Code or an exemption or

exclusion therefrom and shall in all respects be administered in accordance with Section 409A of the Code. Any payments that qualify

for the “short-term deferral” exception, the separation pay exception or another exception under Section 409A of the

Code shall be paid under the applicable exception to the maximum extent permissible. For purposes of the limitations on nonqualified

deferred compensation under Section 409A of the Code, each payment of compensation under this Agreement shall be treated as a separate

payment of compensation for purposes of applying the exclusion under Section 409A of the Code for short-term deferral amounts,

the separation pay exception or any other exception or exclusion under Section 409A of the Code. In no event may the Executive,

directly or indirectly, designate the calendar year of any payment under this Agreement. All payments to be made upon a termination

of employment under this Agreement may only be made upon a “separation from service” under Section 409A of the Code

to the extent necessary in order to avoid the imposition of penalty taxes on the Executive pursuant to Section 409A of the Code.

(b) Reimbursements

and In-Kind Benefits. Notwithstanding anything to the contrary in this Agreement, all reimbursements and in-kind benefits

provided under this Agreement that constitute nonqualified deferred compensation subject to Section 409A of the Code shall be made

in accordance with the requirements of Section 409A of the Code, including, without limitation, where applicable, the requirement

that (i) in no event shall the Company’s obligations to make such reimbursements or to provide such in-kind benefits apply

later than the Executive’s remaining lifetime (or if longer, through the 20th anniversary of the date hereof; (ii) the amount

of expenses eligible for reimbursement, or in-kind benefits provided, during a calendar year may not affect the expenses eligible

for reimbursement, or in-kind benefits to be provided, in any other calendar year; (iii) the reimbursement of an eligible fees

and expenses shall be made no later than the last day of the calendar year following the year in which the applicable fees and

expenses were incurred; provided that the Executive shall have submitted an invoice for such fees and expenses at least

10 days before the end of the calendar year next following the calendar year in which such fees and expenses were incurred; and

(iv) the right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

(c) Delay

of Payments. Notwithstanding anything herein to the contrary, if the Executive is considered a “specified employee”

for purposes of Section 409A of the Code (as determined in accordance with the methodology established by the Company as in effect

on the Date of Termination), any payment or benefit that constitutes nonqualified deferred compensation within the meaning of Section

409A of the Code that is otherwise due to the Executive under this Agreement during the six-month period immediately following

such Executive’s separation from service (as determined in accordance with Section 409A of the Code) on account of such Executive’s

separation from service shall be accumulated and paid to such Executive with Interest (based on the rate in effect for the month

in which the Executive’s separation from service occurs) on the first business day of the seventh month following the Executive’s

separation from service (the “Delayed Payment Date”), to the extent necessary to avoid penalty taxes or accelerated

taxation pursuant to Section 409A of the Code. If the Executive dies during the postponement period, the amounts and entitlements

delayed on account of Section 409A of the Code shall be paid to the personal representative of the Executive’s estate on

the first to occur of the Delayed Payment Date or 30 calendar days after the date of the Executive’s death.

Section 13. Survivorship.

Upon the expiration or other termination of this Agreement or the Executive’s employment, the respective rights and obligations

of the parties hereto shall survive to the extent necessary to carry out the intentions of the parties under this Agreement.

IN WITNESS WHEREOF, the

Executive has hereunto set the Executive’s hand and, pursuant to the authorization from the Board, the Company has caused

these presents to be executed in its name on its behalf, all as of the day and year first above written.

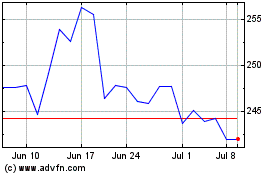

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

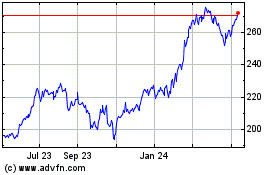

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Apr 2023 to Apr 2024